How to Download Golden Hen EA MT5: 9-Strategy Gold Robot Review + 47% Off (2026)

Last updated: February 2026

📑 Table of Contents

- 30 Second Overview

- What Is Golden Hen EA?

- The Developer — Taner Altinsoy

- Live Performance (Verified Signal)

- The Nine Strategies Explained

- The Volatility Filter

- Backtest Sanity Check

- What Real Buyers Are Saying

- Prop Firm Compatibility

- Step-by-Step Setup Guide

- Pros and Cons

- Who Should Buy This EA?

- How to Get Golden Hen EA MT5

- Frequently Asked Questions

- Our Assessment + How to Download

30 Second Overview of Golden Hen EA

Golden Hen EA is a multi-strategy Gold trading system that does what most gold EAs refuse to do: put a fixed stop loss and take profit on every single trade. No grid. No martingale. No averaging. Nine independent strategies across seven timeframes — and every trade has defined risk.

The numbers: 48% growth in 5 weeks with just 5.5% max drawdown. A 76% win rate across 17 trades with a 3.99 profit factor. The 2025 backtest adds depth: 84.4% win rate, 5.59 profit factor, and only 1.28% balance drawdown across 77 trades. These are clean metrics from a system that doesn’t rely on dangerous recovery techniques to look good.

The trust factor: 19 five-star reviews on MQL5 in under 5 months. The developer, Taner Altinsoy, is actively engaged — responding to every review, pushing regular updates (now on v2.52), and keeping the live signal public. He’s also released a Golden Hen Basic version, suggesting long-term commitment to the product line rather than a one-off cash grab.

Our call: Golden Hen is the anti-grid Gold EA. It won’t deliver the eye-popping returns that martingale systems show before they blow up. Instead, it offers something rarer: defined risk, diversified strategies, and steady performance. For traders who’ve been burned by aggressive Gold EAs, this is the grown-up alternative.

Rating: 4/5 ⭐⭐⭐⭐ — Strong Foundation, Growing Track Record

What Is Golden Hen EA?

Golden Hen EA is an Expert Advisor built exclusively for XAUUSD (Gold) on MetaTrader 5. It was published on MQL5 in September 2025 and has rapidly grown to 19 reviews, 1,171 demo downloads, and a current price of $799.

The core philosophy is straightforward: combine nine independent trading strategies across multiple timeframes (M5 through W1), each with its own entry logic and fixed stop loss/take profit. Instead of relying on one approach that works in one market condition, Golden Hen deploys different strategies for different scenarios — reversals, breakouts, trend-following, and bottom-fishing — all running simultaneously.

What makes it genuinely different from most Gold EAs is what it doesn’t do. No grid structures that stack positions during drawdowns. No martingale lot multiplication after losses. No averaging techniques that hide risk until the account blows. Every trade opens with known maximum risk and known profit target.

The EA attaches to an H1 chart but handles multi-timeframe analysis internally. It includes a dynamic volatility filter, prop firm daily loss protection, balance protection, and an auto-lot system with three risk levels.

The Developer — Taner Altinsoy

Taner Altinsoy is a Turkish developer who has built a focused presence on MQL5 around Golden Hen. While he doesn’t have the massive product catalog of developers like Bogdan Ion Puscasu, what he does have is a transparent and engaged approach that buyers consistently praise.

His MQL5 comment history tells the story. When a user reported their first stop loss, Taner responded within minutes explaining it was normal. When the October 2025 volatility spike caused losses, he immediately pushed an update with an enhanced volatility filter — and posted publicly about it. When Strategy 6 hit a massive 1:6 risk-reward trade on the live signal, he told users not to worry about unfamiliar trades because it was a new strategy being tested live before official release.

That’s the pattern: develop, test on live signal, release to users, iterate. He’s now on version 2.52 with nine strategies, up from six at launch. He also recently released Golden Hen Basic ($349) — a stripped-down version with five strategies for traders who want a simpler package.

The 19 five-star reviews consistently highlight two things: the trading results and the developer support. Multiple reviewers specifically mention his responsiveness and willingness to help with setup.

Live Performance (Verified Signal)

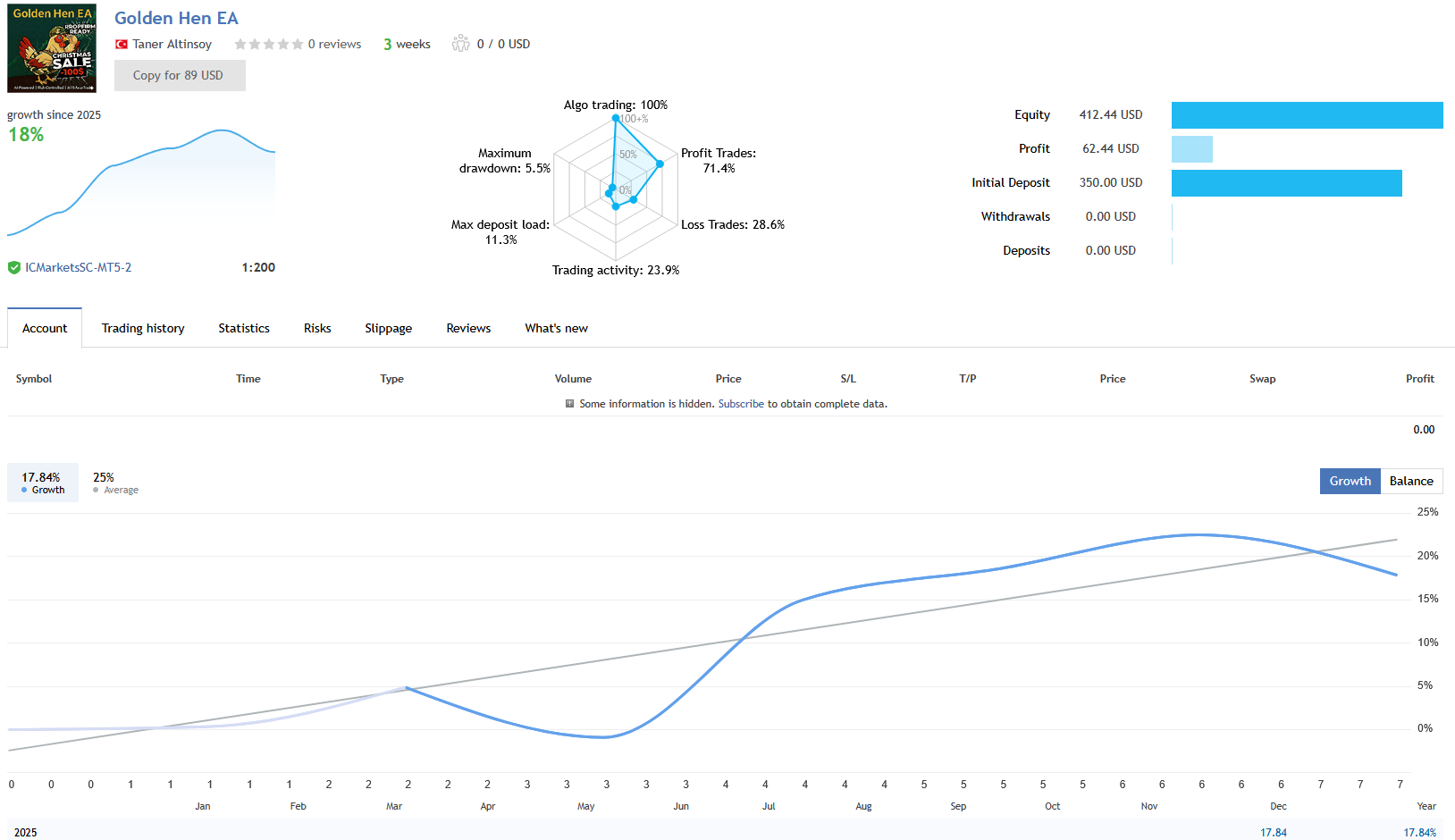

📊 Verified Live Signal (5 Weeks)

| Metric | Value |

| Growth | 47.67% |

| Initial Deposit | $350 |

| Current Equity | $516.83 |

| Profit | $166.83 |

| Win Rate | 76.47% (13 wins / 4 losses) |

| Profit Factor | 3.99 |

| Recovery Factor | 8.23 |

| Max Drawdown (Balance) | 5.52% |

| Max Drawdown (Equity) | 5.03% |

| Max Deposit Load | 11.28% |

| Total Trades | 17 |

| Trades per Week | 4 |

| Avg Holding Time | 8 hours |

| Best Trade | +$55.57 |

| Worst Trade | -$20.22 |

| Max Consecutive Wins | 5 ($80.85) |

| Max Consecutive Losses | 2 (-$18.58) |

| Algo Trading | 100% |

| Broker | ICMarketsSC-MT5-2 (1:200) |

| Subscribers | 2 |

| Signal Started | December 16, 2025 |

Signal Link: MQL5 Verified Signal

What These Numbers Actually Mean

The 5.5% drawdown is the standout number. Most Gold EAs show 20-50% drawdowns because they use grid or martingale recovery. Golden Hen’s fixed SL/TP approach means drawdown stays bounded — you always know your worst case before a trade opens.

The 3.99 profit factor means winning trades are generating roughly 4x more than losing trades cost. This isn’t brute-force profitability from lot multiplication — it’s genuine edge from selective entries across nine different strategy types.

All 17 trades are long-only (buy). The EA focuses exclusively on identifying bullish setups in gold. This is by design — the strategies are engineered around reversal patterns, momentum exhaustion, and breakout entries that favor the long side.

The 8-hour average holding time puts Golden Hen in the swing/intraday camp. It’s not scalping for pennies or holding for weeks. Trades open, hit their target or stop, and close within a working day.

⚠️ Reality Check: 5 Weeks, 17 Trades

Five weeks and 17 trades is a very small sample. The signal started December 16, 2025, and while the results are impressive, they represent a single market regime. We haven’t seen how the EA handles extended ranging markets, flash crashes, or FOMC-driven volatility spikes.

Why we’re cautiously optimistic: The 2025 backtest covers 77 trades across a full year with similar metrics (84.4% win rate, 5.59 PF). The developer has been transparent about the October 2025 drawdown period and responded with an improved volatility filter. And the 19 five-star reviews from live users add independent validation.

Our recommendation: Start with conservative lot sizing. The EA includes Low/Medium/High risk presets — use Low until you’ve seen at least 3 months of live performance on your own account.

Ready to Get Started?

Get Golden Hen EA MT5 for $419.95 (47% off MQL5’s $799)

Same official MQL5 product • Lifetime license • Free updates • Free installation

The Nine Strategies Explained

This is Golden Hen’s core differentiator: instead of relying on one setup that works in one market condition, it deploys nine independent strategies across seven timeframes. Each can be toggled on or off individually.

Strategy 1 (M30) — Bullish Reversal Pattern: Analyzes specific candlestick sequences to identify bullish reversal signals following a defined bearish pattern. Short-term reversal plays.

Strategy 2 (H4) — Momentum After Downtrend: Identifies strong bullish momentum after a sustained decline. Uses the previous H4 bar’s low as a reference. Catches trend exhaustion.

Strategy 3 (M30) — Session-Based Entry: Monitors price action relative to earlier session lows. Session-aware trading that respects market structure.

Strategy 4 (H6/H2) — Trend Following: Uses a higher-timeframe trend filter (H6) with lower-timeframe entries (H2). This strategy tracks conditions step-by-step — which is why VPS is critical. Restarting MT5 resets its internal memory.

Strategy 5 (M5) — Tokyo-London Breakout: Identifies the Tokyo session range and monitors for breakouts during London open. Captures early session volatility with defined range boundaries.

Strategy 6 (H12/H4) — Major Bottom Identification: Monitors extreme oversold conditions on the H12 timeframe. Waits for severely overextended markets, then enters on bullish confirmation. Structured with a 1:6 risk/reward ratio — the home run strategy.

Strategy 7 (H3/H2) — Bottom-Fishing Reversal: Monitors for consolidation patterns at potential market lows. Targets early stages of new upward trends with a 1:4 risk/reward ratio.

Strategy 8 (H6/H2) — Trend Continuation: Identifies significant breakouts, then waits for a corrective pullback (retracement) before entering. Validates momentum before committing.

Strategy 9 (W1) — Weekly Breakout: Long-term strategy based on weekly price structures. Identifies critical resistance zones from recent market behavior and enters only when price validates a breakout above key structural levels.

The combination means Golden Hen can capture short-term reversals (M5-M30), medium-term swings (H2-H6), and long-term structural moves (H12-W1) simultaneously. When one strategy type is inactive due to market conditions, others may be firing.

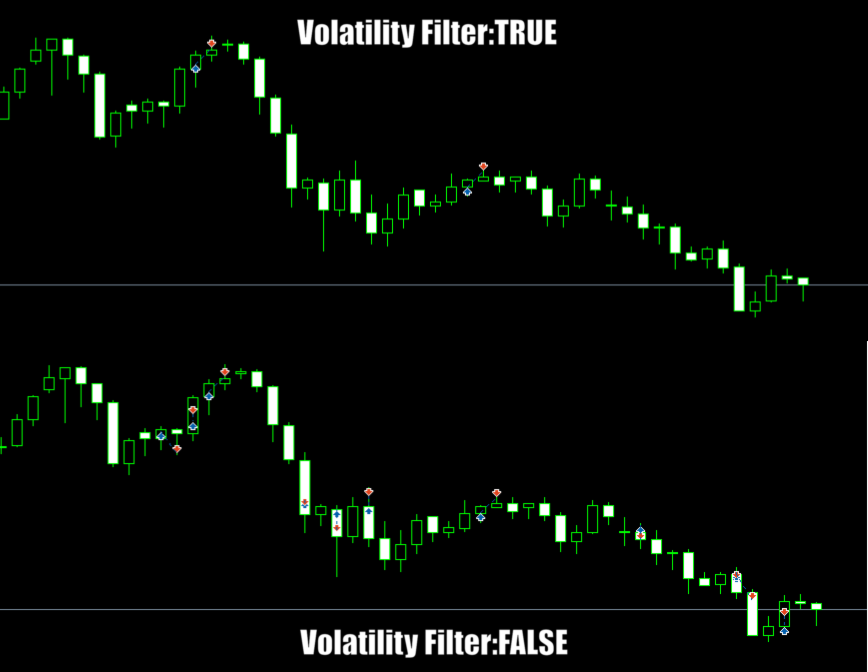

The Volatility Filter

The Dynamic Volatility Filter is one of Golden Hen’s most important safety features, and it has a real-world origin story. During the October 2025 volatility spike, the live signal experienced consecutive losses. Taner responded by implementing an enhanced filter that automatically pauses trading during extreme market conditions.

The result: fewer trades, but higher-quality entries. The filter prevents the EA from trading during conditions where slippage, spread widening, and erratic price action would degrade execution quality.

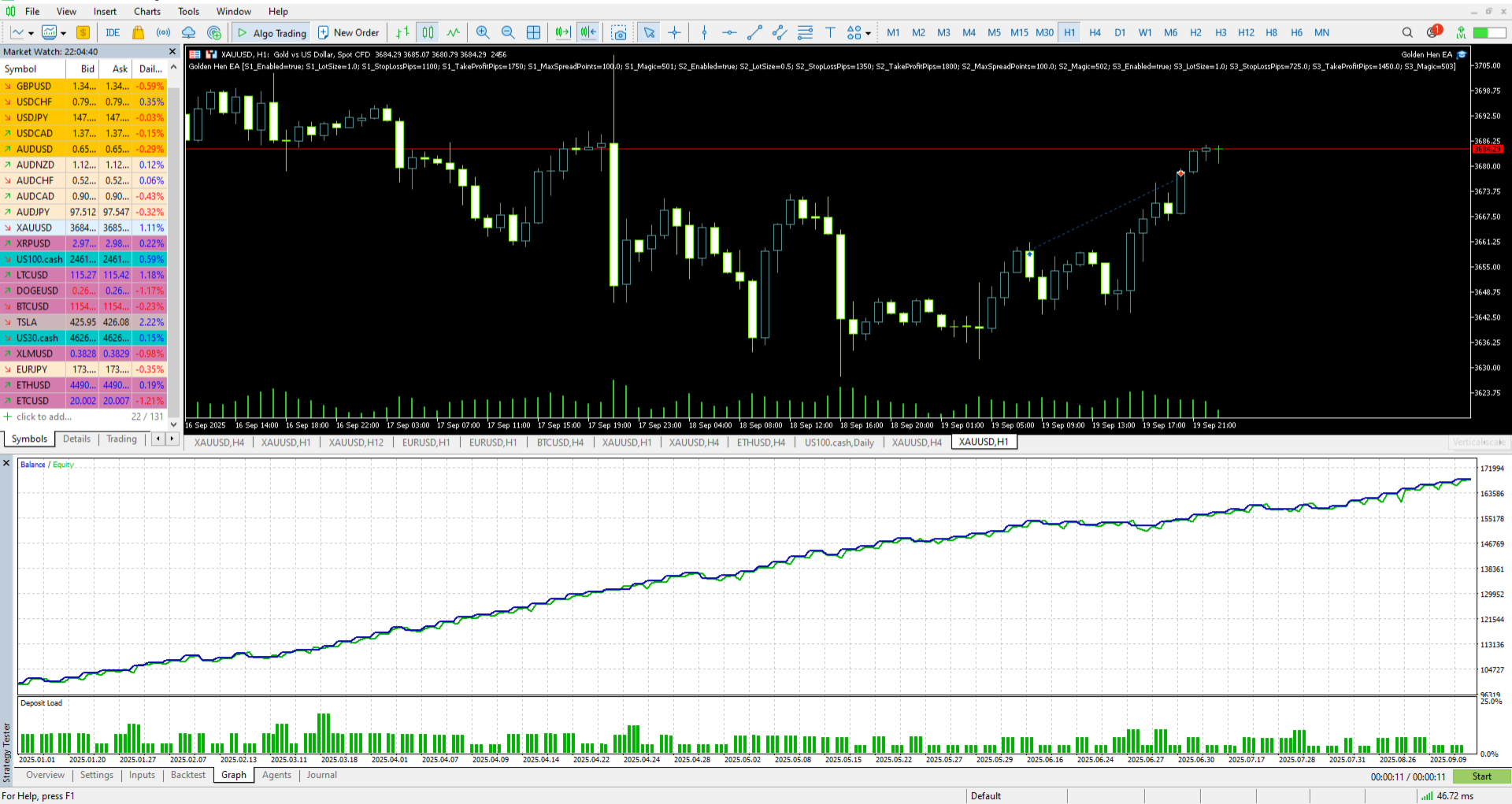

Backtest Sanity Check

The 2025 backtest provides a larger sample to contextualize the live signal:

Key backtest metrics: $100K initial deposit grew to $168K (68% return). 5.59 profit factor. 84.4% win rate (65 wins / 12 losses). 18.20 recovery factor. 18.46 Sharpe ratio. Maximum balance drawdown of just 1.28%.

How live compares to backtest: The live signal shows 76.47% win rate vs 84.4% backtest. Profit factor is 3.99 live vs 5.59 backtest. Live is slightly below backtest — which is actually a good sign. EAs that outperform their backtests often indicate overfitting. The fact that live performance is in the same ballpark without exceeding it suggests the strategy logic is robust rather than curve-fitted.

The meaningful takeaway: 77 trades over a full year with an 84.4% win rate and sub-2% drawdown is genuinely impressive for a non-grid, non-martingale system. The equity curve shows steady upward progression without the sharp recoveries that characterize grid trading. This is what clean, strategy-driven growth looks like.

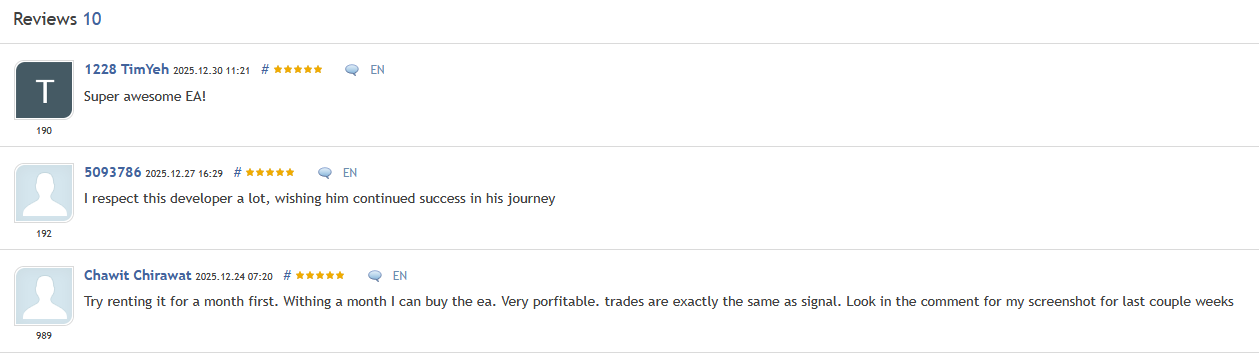

What Real Buyers Are Saying

Golden Hen has 19 five-star reviews on MQL5 — a perfect 5.0 rating. Here’s what verified buyers are reporting:

JonLaing (5 stars): Bought the EA based on backtests, activated it overnight, and woke up to 1% profit the next morning on Low risk. Called Strategy 8 “absolutely perfect” in timing.

Cristocarl (5 stars): Earned significant profit without losses in the first month. Highlighted how precise the entries are and the clean risk-reward structure. Called the developer’s support “unmatched” — responsive until the customer’s criteria are fully met.

Andrew Lee (5 stars): After testing and reviewing results, confirmed that trades are clean, risk management is well thought out, and the EA doesn’t rely on dangerous techniques. Noted the multiple strategies make it “a powerfully diverse tool for trading Gold.”

rafael carassa (5 stars): Initially rented to test — performance matched the backtests exactly. Praised the evolution from 6 to 8 strategies and emphasized the safety of fixed SL/TP on every trade. Called the risk-reward ratios on some strategies (5:1 and 4:1) exceptional.

Kalinskie Gilliam (5 stars): Running live with lower risk settings. Called the developer “very responsive, considerate, and talented.” The developer’s reply is worth reading — he explained that combining multiple excellent strategies into one EA wasn’t a commercial decision but a passion for delivering real value.

A consistent theme across reviews: trades match the signal exactly, and the developer actively supports buyers. That second point matters — many MQL5 developers disappear after launch.

Prop Firm Compatibility

Golden Hen includes a built-in Prop Firm Daily Protection mechanism that makes it specifically designed for funded accounts:

How it works: You set a maximum daily loss threshold. If the account hits that limit during the day, the EA instantly closes all open trades and blocks new entries until the next trading day. This prevents the cascading drawdown that fails prop firm challenges.

Recommended prop firm sizing: 0.01 lots per $5,000 balance. This conservative approach keeps individual trade risk well within typical challenge parameters.

Why Golden Hen suits prop firms better than grid EAs: The 5.52% max drawdown is well under most firms’ 5-10% daily limits. Fixed SL/TP means predictable worst-case scenarios on every trade. No position stacking means no surprise margin calls during adverse moves. The volatility filter adds another safety layer by pausing during dangerous conditions.

Step-by-Step Setup Guide

Step 1 — Broker Preparation: Open an ECN/Raw spread account with a recommended broker (IC Markets, Pepperstone, FP Markets, Eightcap, Tickmill, FXOpen, FxPro). Minimum 1:30 leverage required. Fund with minimum $200, recommended $500+.

Step 2 — Add XAUUSD: Ensure XAUUSD (Gold) is visible in your Market Watch. Right-click in Market Watch → Show All or search for XAUUSD.

Step 3 — Attach to H1 Chart: Open an H1 chart for XAUUSD. The EA handles multi-timeframe analysis internally — do not change the timeframe while the EA is running.

Step 4 — Load the SET File: Download the official v2.5 set file from the product page. In the EA settings, click “Load” and select the file. No complex configuration needed.

Step 5 — Configure Risk Level: Choose Low, Medium, or High risk in the auto-lot settings. For new users, always start with Low. For prop firms, disable auto-lot and use 0.01 lots per $5,000.

Step 6 — VPS (Strongly Recommended): Strategy 4 tracks market conditions step-by-step. Restarting MT5 resets this internal memory. Use a reliable VPS for uninterrupted 24/7 operation. The EA includes a Live Uptime Counter on the chart to monitor continuous runtime.

Pros and Cons

✅ Pros

- 48% growth in 5 weeks with 5.5% max drawdown

- No grid, no martingale, no averaging — fixed SL/TP every trade

- Nine independent strategies across seven timeframes

- 19 five-star reviews (perfect 5.0 rating on MQL5)

- 2025 backtest: 5.59 profit factor, 84.4% win rate

- Built-in prop firm daily loss protection

- Dynamic volatility filter pauses during high-risk periods

- Active developer — v2.52 with regular updates

- Pre-configured SET file — no complex setup required

- Each strategy togglable on/off individually

❌ Cons

- Signal only 5 weeks old — very limited live track record

- Small sample: 17 trades on signal, 77 on backtest

- XAUUSD only — no multi-pair diversification

- Long-only: all 17 signal trades are buys (no sell strategies)

- VPS required for optimal performance (Strategy 4 loses memory on restart)

- $799 MQL5 price is steep for a 5-month-old product

- Only 7 activations on MQL5 despite 1,171 demo downloads

- Price increases $100 every 10 purchases (currently rising)

Who Should Buy This EA?

Golden Hen is ideal if you: Want Gold exposure without grid/martingale risk. Value defined SL/TP on every trade. Trust the backtest metrics and developer track record enough to be an early adopter. Run a prop firm account and need daily loss protection. Want strategy diversification within a single EA. Prefer conservative, steady growth over aggressive, volatile returns.

Golden Hen is NOT for you if: You need 6+ months of proven live results before committing. You want multi-pair diversification (XAUUSD only). You expect aggressive daily returns from leveraged position stacking. You can’t run a VPS for 24/7 operation. You evaluate EAs primarily by backtest equity curves. You want sell-side exposure to Gold (all strategies are buy-only).

How to Get Golden Hen EA MT5

Looking to download Golden Hen EA for MT5? Here are the two legitimate ways to get this EA installed on your trading platform.

Option 1: Buy Direct from MQL5 Marketplace

- Visit the official MQL5 product page

- Click “Buy for $799”

- Complete payment through MQL5’s checkout

- Open MetaTrader 5 and go to Market tab

- Find Golden Hen EA in “Purchased” section

- Click “Install” — EA appears in your Navigator panel

Option 2: Get It Through CheaperForex (47% Off)

- Visit our Golden Hen EA product page

- Add to cart and checkout ($419.95 vs $799 on MQL5)

- We remotely activate the official MQL5 license on your MT5

- EA appears in your Navigator — ready to trade

- All future updates download automatically from MQL5

MQL5 vs CheaperForex: Quick Comparison

| Feature | MQL5 Direct | CheaperForex |

|---|---|---|

| Price | $799 | $419.95 |

| Official MQL5 License | ✓ Yes | ✓ Yes |

| Lifetime Updates | ✓ Yes | ✓ Yes |

| Crypto Discount | None | Extra 20% off |

| Installation Support | Self-install | We install for you |

| Refund Policy | Store credit only | Full refund before activation |

| Payment Options | Cards only | Cards, Apple Pay, Crypto |

| Activations | 7 activations | 1 activation (up to 10 MT5s) |

⚠️ Warning About “Free Downloads”

Multiple pirate sites (YoForex and others) offer “Golden Hen EA V2.52 free download” pages. These are scams. MQL5 marketplace products cannot be cracked — they require server-side license validation. What you’ll actually get from these sites: malware disguised as an EA file, outdated code that won’t execute, fake EAs that look similar but aren’t the real product, or account credential theft.

The only legitimate ways to get Golden Hen EA are through MQL5 directly or authorized resellers like CheaperForex.

Frequently Asked Questions

Can I download Golden Hen EA MT5 for free?

No. Golden Hen is an official MQL5 marketplace product ($799) that requires server-side license activation. Sites offering “free downloads” or “cracked versions” distribute malware or fake files. The only way to get the real product is through MQL5 or an authorized reseller like CheaperForex at $419.95.

Is CheaperForex a legitimate seller?

Yes. CheaperForex has served 28,000+ customers since 2019 with a 4.5-star Trustpilot rating from 116+ verified reviews. The EA is activated via the official MQL5 marketplace — the same product, same updates, same license.

Does Golden Hen use grid or martingale?

No. Golden Hen explicitly does NOT use grid, martingale, or averaging techniques. Every trade has a predefined fixed stop loss and take profit. You always know your maximum risk before a trade opens. This is the EA’s core differentiator from most Gold trading systems.

Why does Golden Hen only trade buy positions?

All nine strategies are designed around bullish setups: reversal patterns, momentum exhaustion, breakout entries, and bottom-fishing. The developer has optimized each strategy for the long side of gold. This is a deliberate design choice rather than a limitation.

Can I use Golden Hen on a prop firm account?

Yes — it’s specifically designed for prop firms. The built-in Prop Firm Daily Protection closes all trades and blocks new entries if your daily loss limit is reached. The 5.52% max drawdown is well under most prop firm thresholds. Use 0.01 lots per $5,000 balance for challenges.

Do I need a VPS?

Strongly recommended. Strategy 4 tracks market conditions step-by-step. Restarting MT5 or the EA resets this internal memory, causing missed signals. A Windows VPS running 24/7 ensures the EA operates without interruption. The EA includes a Live Uptime Counter to monitor runtime.

What broker should I use?

The developer recommends IC Markets, Pepperstone, FP Markets, Eightcap, Tickmill, FXOpen, or FxPro. The key requirement is ECN/Raw spread pricing on XAUUSD. Standard accounts with marked-up spreads will reduce the EA’s edge, especially on shorter-timeframe strategies.

Our Assessment + How to Download

Verdict: The Anti-Grid Gold EA — Clean, Defined, Growing

What Golden Hen gets right:

- Clean architecture: Fixed SL/TP on every trade — no dangerous recovery techniques

- Strategy diversity: Nine independent strategies across seven timeframes

- Risk control: 5.5% max drawdown is exceptional for any Gold EA

- Backtest alignment: Live metrics are in the same ballpark without exceeding backtest — no overfitting

- Developer engagement: 19 five-star reviews consistently praise both results and support

- Prop firm ready: Built-in daily loss protection with conservative sizing guidelines

What concerns us:

- Track record: 5 weeks, 17 trades on live signal — statistically insufficient

- Long-only: All strategies are buy-side — no downside coverage

- Conversion gap: 1,171 demo downloads but only 7 MQL5 activations

- Untested scenarios: How does it handle flash crashes, extended ranges, major news events?

Rating: 4/5 — Golden Hen is doing something rare in the Gold EA space: delivering consistent results without relying on dangerous position management. The 19 five-star reviews and active developer provide confidence that this isn’t a pump-and-dump product. The lower rating reflects the limited live track record — check back in 3 months for an updated assessment with more data.

Get Golden Hen EA — Save 47% Off MQL5 Price

Nine Strategies. Fixed Risk. Zero Grid.

MQL5 Price: $799

CheaperForex: $419.95

Extra 20% off with crypto payment

Official MQL5 license • Lifetime updates • Installation support included

Disclaimer: Forex trading carries substantial risk. Golden Hen EA has only 5 weeks of live signal data at the time of writing. Past performance does not guarantee future results. The 48% growth and 5.5% drawdown are real but may not continue. Only trade with capital you can afford to lose. We receive compensation for sales made through our links.

Review methodology: This assessment is based on verified MQL5 signal data, 2025 backtest analysis, 19 MQL5 user reviews, developer comment history, and competitor landscape evaluation. We have not received payment from the developer for this review.

Next review update: May 2026 (after 3+ months of additional live data)