How to Download AI Prop Firms EA MT5 — Save 62% (2026 Guide)

Last updated: February 2026 • Launch analysis (released January 2026)

🚀 Ready to Buy AI Prop Firms EA? Save 62% vs MQL5

Available from $499.95 at CheaperForex (MQL5 price: $1,299).

✅ Built specifically for FTMO, FundedNext, The5ers & more

✅ Daily Drawdown Guard + News Filter included

✅ Extra 20% off with crypto payment

- 30 Second Overview

- The Prop Firm EA Problem

- The Developer: MQL TOOLS SL

- Backtest Results: 78% Win Rate, 5.37 Profit Factor

- Prop Firm Protection Features

- The AI Engine Explained

- Settings & Configuration

- Who Should Consider This EA

- How to Download AI Prop Firms EA MT5

- Frequently Asked Questions

- Our Assessment

30 Second Overview of AI Prop Firms EA

AI Prop Firms EA is a fully automated trading system built from the ground up for prop firm environments. Developed by MQL TOOLS SL — a Spanish company with 17 years of forex programming experience — this EA is designed to pass challenges and trade funded accounts on FTMO, The5ers, FundedNext, FundingPips, and other prop firms without ever breaching their rules.

What we’re working with: An AI-powered USD/CAD trader that uses real-time market analysis, dynamic risk adjustment, and built-in prop firm compliance tools. Every trade uses a single position with controlled risk — no martingale, no grid, no averaging down, no high-risk recovery. The EA includes a Daily Drawdown Guard that automatically prevents breaching daily loss limits, an Economic News Filter that avoids trading during high-impact announcements, and an Entry Time Offset that prevents synchronized trading detection across accounts.

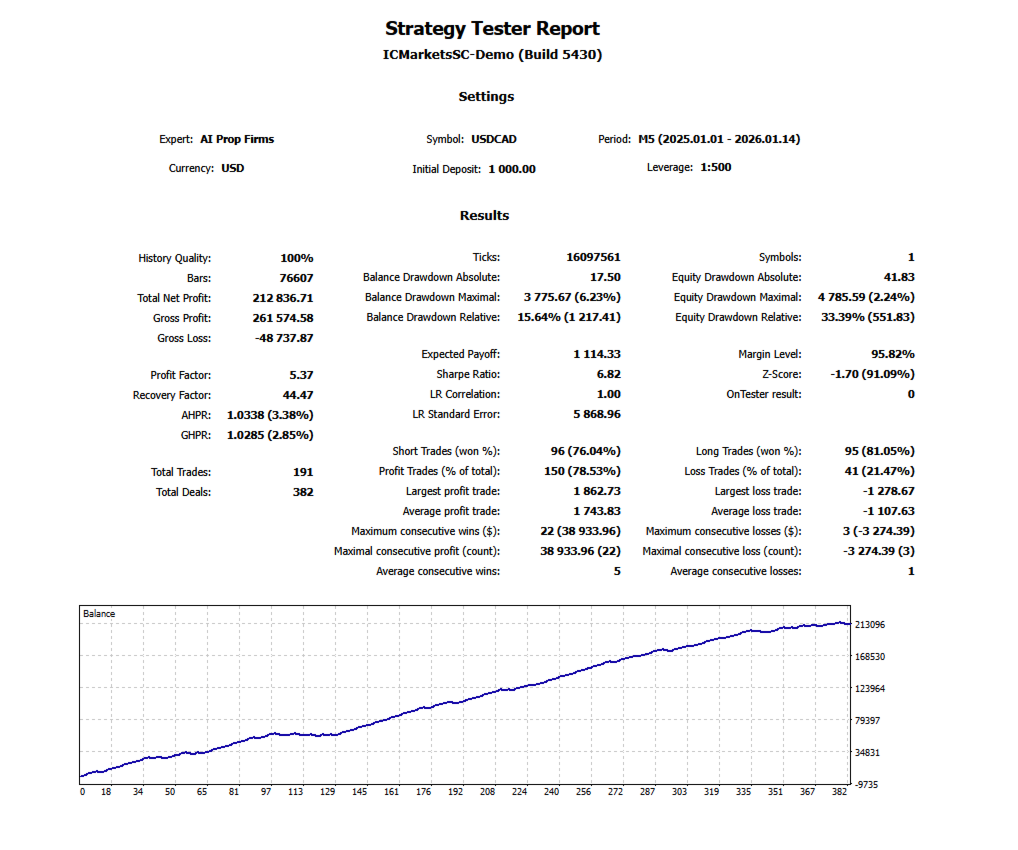

The headline numbers: Backtested over 12 months (Jan 2025 – Jan 2026) on USD/CAD M5, the EA delivered a 78.53% win rate with a 5.37 profit factor across 191 trades. Maximum consecutive losses: 3. Average consecutive wins: 5. These are exceptional metrics for any EA, and particularly strong for one designed around prop firm risk constraints.

The trust factor: MQL TOOLS SL rates 5.0 stars across 8 early reviews on MQL5. The same developer also creates AI Forex Robot — one of the most visible AI-powered EAs on the marketplace. They have 3,500+ MQL5 followers and 17 years of development history. This is not an anonymous fly-by-night operation.

Our call: AI Prop Firms EA is the most purpose-built prop firm solution we’ve seen. Every feature — from the Daily Drawdown Guard to the Entry Time Offset — directly addresses real reasons prop firm accounts get terminated. The backtest numbers are excellent, and the developer’s track record adds credibility. The main limitation is that it currently trades only USD/CAD (GBP/USD is coming), and it launched in January 2026, so there’s no extended live signal history yet. For prop firm traders who need a compliant, hands-off EA, this is the most thoughtful option on the market right now.

Rating: 4.0/5 ⭐⭐⭐⭐ — Best-in-Class Prop Firm Design, Awaiting Live Track Record

The Prop Firm EA Problem

Here’s the uncomfortable truth: most EAs marketed as “prop firm ready” are standard trading robots with a drawdown setting bolted on. They weren’t designed for prop firm environments — they were retrofitted with a checkbox. That’s why so many traders pass challenges with an EA, then get their funded accounts terminated within weeks.

Why standard EAs fail prop firms:

| Prop Firm Rule | How Standard EAs Fail | How AI Prop Firms Handles It |

|---|---|---|

| Daily loss limit | No awareness of daily P&L — keeps trading into losses | Daily Drawdown Guard monitors and pauses trading automatically |

| News trading ban | No news awareness — opens trades during NFP, FOMC | Economic News Filter restricts activity around announcements |

| Copy trading detection | Identical entries across all users — flagged as copy trading | Entry Time Offset randomises execution to avoid detection |

| Consistency rules | Erratic results — big wins followed by big losses | Dynamic risk mode switching maintains steady performance |

| Dangerous strategies | Grid/martingale works until it doesn’t — instant blowout | Single position logic — one trade at a time, always |

AI Prop Firms EA doesn’t treat compliance as an afterthought. The entire architecture — from signal generation to trade management to risk control — was engineered around prop firm requirements from day one.

The Developer: MQL TOOLS SL

MQL TOOLS SL is a Spanish company led by Marzena Maria Szmit, with 17 years of forex programming experience. Their MQL5 profile boasts 3,500+ followers, 34 products, and over 2,750 demo downloads across their product range. They’re one of the more established development teams on the marketplace.

Their flagship product, AI Forex Robot, is one of the highest-visibility AI-powered EAs on MQL5, rated 4.37 stars across 71 reviews. It uses a hybrid LSTM Transformer neural network for XAUUSD and EURUSD trading. AI Prop Firms EA benefits from this same AI development expertise, but applied to a completely different challenge: prop firm compliance.

What stands out about MQL TOOLS SL’s approach:

📧 Dedicated Support

Telegram @mqlblue and email support Monday–Friday. Active presence answering MQL5 comments.

🔄 Active Development

GBP/USD pair addition already announced. Regular version updates across all their products.

📺 YouTube Channel

Public channel at youtube.com/@mqlblue with tutorials and product demonstrations.

Backtest Results: 78% Win Rate, 5.37 Profit Factor

AI Prop Firms EA was backtested on USD/CAD M5 from January 2025 to January 2026 — a full year of data with 100% history quality. Here are the headline metrics:

| Metric | Value | Why It Matters for Prop Firms |

|---|---|---|

| Win Rate | 78.53% | High consistency — fewer losing streaks to threaten DD limits |

| Profit Factor | 5.37 | $5.37 earned for every $1 lost — exceptional risk/reward |

| Total Trades | 191 (in 12 months) | ~16 trades/month — selective, quality entries only |

| Max Consecutive Losses | 3 | Minimal losing streaks — critical for DD management |

| Avg Consecutive Wins | 5 | Steady positive momentum between losses |

| Sharpe Ratio | 6.82 | Outstanding risk-adjusted returns |

| Recovery Factor | 44.47 | Recovers from drawdowns rapidly |

| Balance DD | 15.64% | Within prop firm max DD limits |

| Long Trades Won | 81.05% | Strong performance in both directions |

| Short Trades Won | 76.04% | No directional bias — works in any market |

| History Quality | 100% | Full tick data — most reliable backtest type |

⚠️ Important Context: Backtests vs Live Trading

AI Prop Firms EA launched on January 16, 2026 — approximately one month ago. There is no live signal yet to independently verify these backtest results in real market conditions. The 78.53% win rate and 5.37 profit factor are backtest metrics only.

We always recommend waiting for at least 3-6 months of live signal data before committing significant capital. However, the developer’s track record with AI Forex Robot (71 MQL5 reviews, 4.37 stars) provides some confidence that their backtesting methodology translates to real-world performance. The backtest was run with 100% history quality tick data, which is the most reliable backtesting method available in MT5.

Ready to Get Started?

AI Prop Firms EA — $499.95 at CheaperForex (MQL5 price: $1,299)

✅ Purpose-built for prop firms | ✅ 78% win rate | ✅ No grid/martingale

Prop Firm Protection Features

This is where AI Prop Firms EA separates itself from every other “prop firm compatible” EA on the market. Each of these features directly addresses a specific reason prop firm accounts get breached or terminated:

🛡️ Daily Drawdown Guard

The number one reason funded accounts get terminated: breaching the daily loss limit. Most prop firms set this at 5% of the starting equity for the day. The Daily Drawdown Guard monitors your account’s daily P&L in real time and automatically reduces exposure or pauses trading entirely when approaching the limit. This happens without any manual intervention — the EA protects your account even if you’re asleep.

📰 Economic News Filter

Many prop firms either prohibit trading during major news events or impose additional restrictions. The built-in news filter automatically restricts trading activity before and after high-impact economic announcements like NFP, FOMC, and CPI releases. This prevents slippage-related losses and keeps you compliant with news trading restrictions — a common overlooked rule that catches many traders off guard.

⏱️ Entry Time Offset

This is the feature most prop firm EAs completely miss. When thousands of people use the same EA, entries become synchronized — identical open times, identical prices, identical stop losses. Prop firms detect this pattern and terminate accounts for copy trading, even though each user purchased independently. The Entry Time Offset introduces controlled randomisation to execution timing, making each user’s trades appear unique while maintaining strategy effectiveness.

🔄 Dynamic Risk Mode Switching

The AI continuously monitors market behaviour and automatically adapts its risk profile between conservative, balanced, and higher-activity modes. During volatile or uncertain conditions, the system dials back. During clear trends, it trades with more confidence. This dynamic adjustment maintains the kind of consistent equity curve prop firms look for during evaluation periods.

The AI Engine Explained

The term “AI” gets thrown around loosely in the EA market. Here’s what AI Prop Firms actually does with its intelligence layer:

Market Environment Recognition. The AI continuously classifies the current market into categories: trending, ranging, elevated volatility, or event-driven risk. Rather than applying the same strategy regardless of conditions, the system adapts its approach based on what the market is actually doing. In ranging conditions, it may reduce activity or tighten parameters. In trending conditions, it trades with more conviction.

Precision Entry Filtering. Not every potential setup gets executed. The AI evaluates each opportunity against strict quality criteria before allowing a trade. The chart interface displays a “Signal Quality” score (0-100) that reflects the system’s confidence in current conditions. This filtering is why the EA averages only ~16 trades per month — it’s selective by design, not by accident.

Adaptive TP, SL, and Trailing. Take profit, stop loss, and trailing stop levels aren’t fixed numbers. They’re dynamically calculated based on current volatility and liquidity conditions. In low-volatility environments, the parameters tighten. In high-volatility conditions, they widen to avoid premature stop-outs. All of this is managed automatically by the AI — no manual adjustment required.

AI Performance Reports. The system generates weekly performance summaries with key statistics and insights. This gives you data to evaluate the EA’s behaviour over time and make informed decisions about risk settings.

Settings & Configuration

AI Prop Firms EA comes preconfigured for prop firm use. Attach it to a USD/CAD M5 chart, enable Algo Trading, and the AI handles everything. That said, here are the key parameters you can adjust:

| Parameter | Purpose |

|---|---|

| Daily Drawdown Guard | Set your prop firm’s daily loss limit — EA stops trading when approaching it |

| Economic News Filter | Toggle on/off and set buffer time before/after news events |

| Entry Time Offset | Enable to randomise execution timing and avoid copy trading detection |

| Risk per trade | Control position sizing — keep low (0.5-2%) for prop firm challenges |

| Max open positions | Limit total exposure — set to 1 for maximum prop firm safety |

| Lot size | Auto or fixed — auto adjusts based on account balance and risk % |

Recommended prop firm configurations:

🎯 Challenge Phase

Risk: 1-2% per trade

Daily DD Guard: ON (set to firm’s limit)

News Filter: ON

Entry Offset: ON

Target: Pass challenge safely

💰 Funded Account

Risk: 0.5-1% per trade

Daily DD Guard: ON (conservative)

News Filter: ON

Entry Offset: ON

Target: Protect funded status

📈 Personal Account

Risk: 2-5% per trade

Daily DD Guard: Optional

News Filter: Optional

Entry Offset: OFF

Target: Growth without prop firm limits

Who Should Consider AI Prop Firms EA

✅ Good Fit

• Prop firm challenge traders (FTMO, FundedNext, The5ers, etc.)

• Funded account holders needing compliant automation

• Traders tired of EAs that breach daily DD limits

• Anyone who values controlled, consistent performance over explosive gains

• Traders comfortable with USD/CAD as a primary pair

• Early adopters who want to establish the EA before it becomes widely used

⚠️ Not Right For

• Traders who require a verified live signal before buying

• Multi-pair diversification seekers (USD/CAD only for now)

• Aggressive traders wanting high-risk, high-reward strategies

• Gold-only or XAUUSD traders

• Anyone without a VPS for 24/5 operation

• Traders on prop firms that ban EAs entirely

How to Download AI Prop Firms EA MT5

AI Prop Firms EA is an MQL5 marketplace product. There are two ways to get it:

Option 1: Buy Direct from MQL5 Marketplace

Go to the official AI Prop Firms EA product page on MQL5 and purchase at full price ($1,299). You’ll get 10 activations and direct developer support. This is the premium option if budget isn’t a concern.

Option 2: Get It Through CheaperForex (62% Off)

Purchase at CheaperForex for $499.95 and receive the same official EA via MQL5 activation. CheaperForex purchases full-price licenses and activates them on your MT5 terminal through a 2-minute remote session. Same product, same updates, same functionality — just 62% less.

MQL5 vs CheaperForex: Quick Comparison

| Feature | MQL5 Direct | CheaperForex |

|---|---|---|

| Price | $1,299 | $499.95 (extra 20% off with crypto) |

| Product | Official MQL5 activation | Same official MQL5 activation |

| Updates | Automatic via MT5 | Same automatic updates via MT5 |

| Activations | 10 activations | 1 activation (1 VPS/computer) |

| Installation | Self-install | Free installation support included |

| VPS | Not included | Optional free 1-month VPS setup |

| Broker accounts | Unlimited | Unlimited (within same MT5 terminal) |

| Refund | MQL5 policy | 7-day money-back before activation |

| Payment | MQL5 payment methods | Cards, Apple Pay, Google Pay, Amazon Pay, Crypto |

How CheaperForex activation works: After purchase, the CheaperForex team schedules a brief remote session (AnyDesk or UltraViewer) to activate the EA on your MT5 terminal. The process takes approximately 2 minutes. You stay in full control throughout and can disconnect at any time. Alternatively, you can provide VPS credentials and they’ll handle it for you. Once activated, the EA is yours — no further involvement from CheaperForex required.

Minimum requirements:

• MetaTrader 5 terminal (any broker)

• Minimum $100 account balance (recommended: $500+ for prop firm challenges)

• VPS recommended for 24/5 uptime

• Any account type: Raw, Hedging, Zero, Standard, Premium, ECN

Frequently Asked Questions

Can I download AI Prop Firms EA for free?

No. AI Prop Firms EA is an MQL5 marketplace product with built-in DRM protection. It cannot be cracked or pirated — the .ex5 format used by MQL5 marketplace products doesn’t allow it. You can download a free demo version from MQL5 for strategy tester evaluation, but the live trading version requires purchase. CheaperForex offers the same genuine product at 62% off through official MQL5 activation.

Will this EA actually pass my prop firm challenge?

The EA is specifically designed for prop firm environments with features like Daily Drawdown Guard, News Filter, and Entry Time Offset that directly address the most common reasons challenges fail. The 12-month backtest shows a 78.53% win rate with maximum 3 consecutive losses. However, no EA can guarantee challenge success — market conditions, risk settings, and broker execution all play a role. Start with conservative settings and test on a demo prop firm account first.

Why only USD/CAD?

The developer optimised the AI specifically for USD/CAD, where the strategy is designed to capitalise on that pair’s particular market behaviour. Rather than creating a generic system that trades everything adequately, they focused on one pair and made it exceptional. GBP/USD support has already been announced as the next addition. Single-pair focus also simplifies prop firm risk management — you always know your exposure.

Is CheaperForex legitimate?

Yes. CheaperForex has operated since 2019, served over 28,000 customers, and maintains a 4.5-star “Excellent” rating on Trustpilot with verified reviews. They activate the same official MQL5 product — not a cracked or modified version. If you change your mind before activation, they offer a full cash refund within 7 days.

Is there a live signal I can verify?

Not yet. AI Prop Firms EA launched on January 16, 2026. As of this writing, there is no public MQL5 live signal to independently verify performance. The backtest data is the primary performance reference. We recommend monitoring for a live signal in the coming months and will update this guide when one becomes available. The developer’s other product, AI Forex Robot, does have live trading history on MQL5.

What makes this different from other prop firm EAs?

Most “prop firm ready” EAs are standard trading robots with a drawdown setting added. AI Prop Firms was architected from the ground up around prop firm requirements. The Daily Drawdown Guard, Economic News Filter, Entry Time Offset, and Dynamic Risk Mode Switching are all core features — not bolt-on afterthoughts. The single-position logic and controlled risk approach align with how prop firms actually evaluate traders.

What broker should I use?

AI Prop Firms EA works with any MT5 broker and is compatible with all account types including Raw, Hedging, Zero, Standard, Premium, and ECN. For prop firm challenges, use whatever broker your prop firm provides. For personal accounts, any reputable ECN broker with competitive USD/CAD spreads will work. A VPS is recommended for reliable 24/5 connection — the developer suggests using MQL5 VPS or any Windows VPS from $13/month.

Our Assessment

Verdict: The Most Purpose-Built Prop Firm EA Available

What AI Prop Firms gets right:

- Purpose-built compliance: Daily DD Guard, News Filter, Entry Time Offset — every feature serves prop firm requirements

- Clean risk architecture: No martingale, no grid, single position logic with controlled sizing

- Strong backtest: 78.53% win rate, 5.37 profit factor, max 3 consecutive losses across 191 trades

- Established developer: MQL TOOLS SL has 17 years of experience and 34 MQL5 products

- AI adaptability: Dynamic risk modes, market regime recognition, and adaptive TP/SL/trailing

- Active development: GBP/USD pair addition already announced

What to be aware of:

- No live signal yet: Launched January 2026 — all performance data is backtest-only

- Single pair: USD/CAD only (GBP/USD coming soon, but no timeline confirmed)

- Very new product: Only ~1 month of market availability and 8 reviews

- Backtest ≠ live: 5.37 profit factor in backtesting may not fully replicate in live conditions

Rating: 4.0/5 — AI Prop Firms EA is the most thoughtfully designed prop firm EA we’ve reviewed. Every feature directly addresses a real reason funded accounts get terminated. The backtest metrics are exceptional and the developer has a proven track record. The 4.0 rating (rather than higher) reflects the lack of live signal verification — once a verified live signal shows results consistent with the backtest, this could easily become a 4.5. For prop firm traders who understand the early-adopter tradeoff, this is the strongest option available at 62% off MQL5 pricing.

Get AI Prop Firms EA — 62% Off MQL5 Price

Built for FTMO, FundedNext, The5ers — No Grid, No Martingale

MQL5 Price: $1,299

CheaperForex: $499.95

Extra 20% off with crypto payment

Official MQL5 license • Lifetime updates • Installation support included

Looking for More Options?

- AI Forex Robot EA MT5 — Same developer, LSTM neural network for XAUUSD & EURUSD

- All Prop Firm EAs — Browse our complete prop firm EA collection

- Our Vetted EA Recommendations — Products with extended live validation

Disclaimer: Forex trading carries substantial risk. AI Prop Firms EA has produced strong backtest results but past performance doesn’t guarantee future results. No EA can guarantee passing a prop firm challenge or maintaining a funded account. Prop firm rules and conditions vary — always verify your specific firm’s requirements before using any EA. Only trade with capital you can afford to lose. We receive compensation for sales made through our links.

Review methodology: This assessment is based on 12-month backtest analysis (100% history quality tick data), developer track record evaluation across 34 MQL5 products, 8 verified customer reviews, and prop firm compliance feature analysis. No live signal data was available at time of writing. We have not received payment from the developer for this review.

Last verified: February 2026 | Product age: ~1 month (launched January 16, 2026) | Developer: MQL TOOLS SL