Mad Turtle EA Settings Guide – Optimal Configuration MT5

📚 What You’ll Learn: This step-by-step configuration guide shows you exactly how to set up and optimize Mad Turtle EA for maximum performance. You’ll discover which AI model to choose based on your account size, the optimal risk settings for your trading style, and how to avoid the common mistakes that kill profitability. Perfect for traders who already own Mad Turtle EA or are ready to purchase it.

🚀 Ready to Buy Mad Turtle EA with 65% off?

Available now, only $295.

✅ Same official EA with lifetime updates

✅ Full installation support included

✅ 4.88★ rating on MQL5

Quick Start: Mad Turtle EA Configuration Guide

Last Updated: October 2025 | Version 6.2

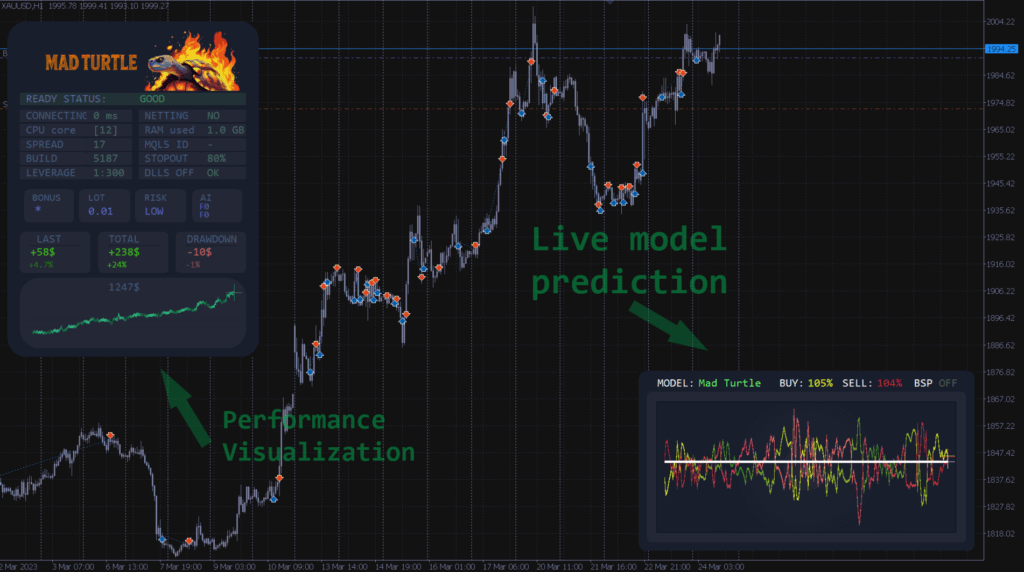

Mad Turtle EA is an AI-powered gold trading system that requires proper configuration to achieve optimal results. Unlike simple plug-and-play EAs, Mad Turtle offers multiple AI models, customizable risk settings, and advanced features. This guide shows you exactly how to configure it based on real testing data and verified live results.

Understanding Mad Turtle’s AI Models

The most important configuration decision is choosing the right AI model. Mad Turtle includes multiple pre-trained models optimized for different trading approaches:

Primary Models (Recommended)

XAUUSD H1 Mad Turtle (Performance Mode)

- Best for: Conservative traders, small accounts ($50-$500), prop firm challenges

- Trade frequency: 2-5 trades per week

- Recommended risk: 0.5-1% per trade

- VPS required: Optional (recommended for best results)

XAUUSD M15 Mad Turtle

- Best for: Moderate traders wanting more action ($500+)

- Trade frequency: 5-12 trades per week

- Recommended risk: 1-2% per trade

- VPS required: Highly recommended

XAUUSD M5 Mad Turtle

- Best for: Active traders with larger accounts ($1,000+)

- Trade frequency: 10-20+ trades per week

- Recommended risk: 0.5-1.5% per trade

- VPS required: Mandatory

Step-by-Step Setup Process

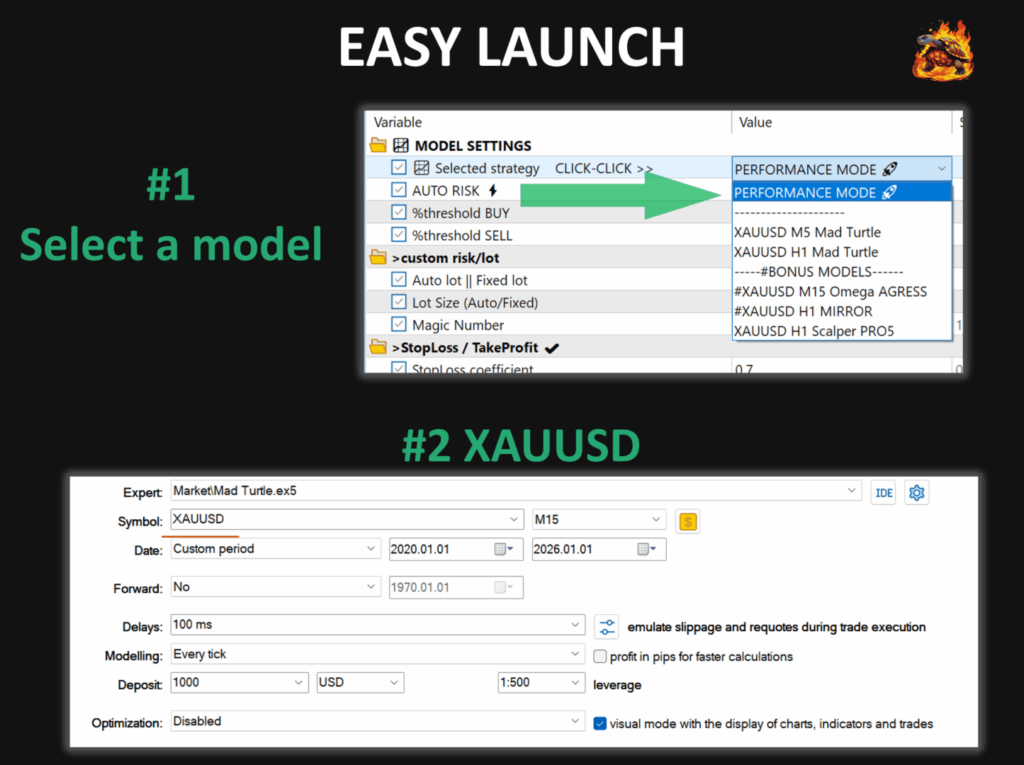

Step 1: Choose Your Model & Timeframe

- Open MT5 and create an XAUUSD chart

- Set timeframe to match your chosen model (H1, M15, or M5)

- Note: Chart timeframe should match EA model for proper dashboard display

Step 2: Configure EA Settings

- Drag Mad Turtle EA from Navigator onto your XAUUSD chart

- In the settings panel:

- Select your model from “Selected strategy” dropdown

- Enable “AUTO RISK” checkbox (recommended for 95% of traders)

- Set risk percentage: Start conservative at 0.5-1% per trade

- Set unique Magic Number if running multiple instances

- Leave other settings at default initially

- Click “OK” to apply settings

Step 3: Enable Auto-Trading

- Click “Auto Trading” button in MT5 toolbar (turns green when active)

- Verify EA shows smiley face icon in chart corner

- Check that dashboard panel appears showing EA status

Step 4: Verify Setup

Dashboard should display:

- READY STATUS: GOOD (green indicator)

- Model name matching your selection

- Account information showing correctly

- BUY/SELL prediction percentages updating in real-time

Optimized Risk Management Settings

Risk Per Trade (Auto Risk Enabled)

Conservative Profile ($50-$500):

- Start: 0.5% per trade

- Maximum: 1.5% per trade

- Why: Protects small accounts from single losing trades

Moderate Profile ($500-$2,000):

- Start: 1% per trade

- Maximum: 2% per trade

- Why: Balanced growth without excessive risk

Aggressive Profile ($2,000+):

- Start: 1.5% per trade

- Maximum: 3% per trade

- Why: Faster compounding for experienced traders

Critical rule: Never exceed 5% risk per trade. This is the #1 cause of account blow-ups.

Advanced Settings

Spread Filter: Set to 30-40 points (prevents trading during unusual spread spikes)

News Filter: Enable for H1/M15 models (provides extra protection during major news events like NFP, FOMC)

Time Filters: Leave at default unless your broker has unusual spread patterns during specific hours

Common Configuration Mistakes to Avoid

Mistake #1: Judging Performance Too Quickly

The AI deliberately pauses trading when market conditions are unclear. No trades for 2-3 days is protective behavior, not a malfunction. Evaluate performance over minimum 2-4 weeks, not days.

Mistake #2: Constantly Changing Settings

The developer spent months optimizing through machine learning. Set your configuration once and leave it alone for at least one month. Traders who constantly tweak settings perform worse than those who trust the optimization.

Mistake #3: Wrong Broker Choice

Using a broker with spreads over 30 points on XAUUSD kills profitability. Choose brokers with consistent spreads under 20-25 points. This is non-negotiable for optimal results.

Mistake #4: Running Fast Models Without VPS

M15 and M5 models require stable 24/7 connection. Running on home PC with intermittent internet causes missed trades and poor performance. VPS is mandatory for these models.

What Results to Expect

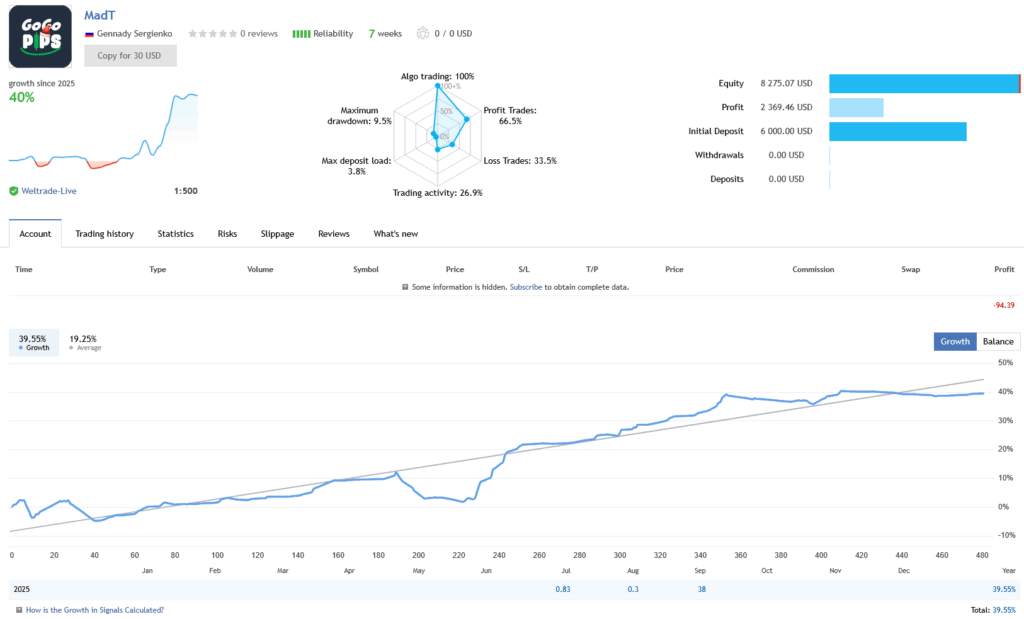

Based on verified live trading data (as of October 2025):

- Monthly average: 15-30% account growth with moderate risk settings

- Win rate: Approximately 65-70%

- Maximum drawdown: 10-15% during difficult periods

- Winning months: 85-90% of months are profitable

- Recovery time: 1-2 weeks typical recovery from normal drawdown

Important: Your results will vary based on broker spread/execution quality, VPS usage, risk settings, and market conditions during your trading period.

Broker Requirements

Essential Requirements

- XAUUSD symbol available

- Minimum deposit: $50 (but $100-$200 recommended)

- Average spread: Under 20-25 points

- Any account currency (USD, EUR, GBP all work)

- Standard or ECN account types both supported

Prop Firm Compatibility

Mad Turtle is fully compatible with prop firm challenges because:

- Uses strict stop loss on every trade

- No grid, martingale, or dangerous strategies

- Single-order logic (no averaging in standard models)

- Transparent operation with controllable risk

Works with: FTMO, MyForexFunds, The5ers, FundedNext, and similar prop firms

VPS Setup

H1 Model: Optional (can work on home PC with stable 24/7 internet)

M15 Model: Highly recommended (missing entries impacts performance)

M5 Model: Mandatory (requires continuous low-latency connection)

Minimum VPS specs: 1GB RAM, single core CPU, 20GB storage, Windows Server 2016+

Recommended providers: ForexVPS.net ($10-20/month), Vultr ($5-10/month), or your broker’s free VPS

Frequently Asked Questions

Q: Which model should I start with?

A: XAUUSD H1 Mad Turtle (Performance Mode) for 90% of traders. It’s stable, works from $50, and has the best verified results.

Q: Why hasn’t the EA traded in 3 days?

A: The AI pauses when market structure is unclear. This is protective behavior that prioritizes account safety over constant activity.

Q: The EA took a stop loss – is something wrong?

A: No. Stop losses are normal and expected. Even with 65-70% win rate, 30-35% of trades will stop out. This is proper risk management.

Q: Can I run multiple models simultaneously?

A: Yes, but use different magic numbers for each. Not recommended until you understand individual model behavior.

Q: What’s a realistic monthly return?

A: 15-30% monthly with moderate risk settings based on verified results. Anyone promising 50-100% monthly returns is unrealistic.

Ready to Get Started?

Mad Turtle EA is available at CheaperForex. You get the same official EA with lifetime updates and full installation support.

→ View Full Product Details & Purchase Mad Turtle EA

What’s Included:

- Official Mad Turtle EA (latest version)

- Lifetime updates included free

- Full installation support from CheaperForex

- Access to developer support and community

- Complete setup documentation

Support Resources:

- Developer: Gennady Sergienko (8+ years MQL5 experience)

- MQL5 Rating: 4.88/5.00 stars

- Live verified signal: View Performance

- Official MQL5 page: Product Details

Disclaimer: Trading forex and CFDs involves significant risk of loss. Past performance does not guarantee future results. Configuration strategies are based on verified testing but individual results vary based on broker, execution quality, risk settings, and market conditions. Always trade with risk capital you can afford to lose.

Last updated: October 24, 2025 | Version: 6.2 | Configuration Guide by CheaperForex