- Official Product

- Instant Download

- 7-Day Refund Policy*

- Instant Download

- 7-Day Refund Policy*

Sale!

Your money matters. Buy from a trusted Forex source.

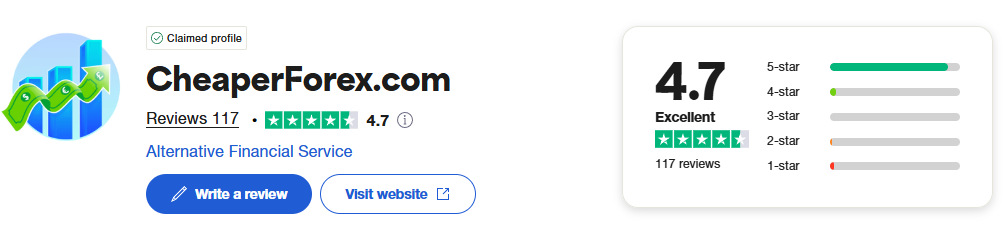

- ✔️ 117 reviews

- ✔️ Verified real customers

- ✔️ Founded 2019

- ✔️ 28,000+ orders delivered

Review Summary from Trustpilot

Review Summary from Trustpilot

Reviewers overwhelmingly had a great experience with this company. Customers appreciate the company's products and services, highlighting the fast delivery and seamless process. Consumers are satisfied with the customer service, noting the attentiveness, honesty, and helpfulness of the support team.

They also value the quick response times and professionalism in addressing their queries. The website is easy to navigate and pricing is fair. Overall, reviewers trust the company and appreciate the smooth resolution of any issues encountered.

Verified Customer Testimonials

Excellent product quality.

The latest updated versions of EAs are sent as soon as they are available.

I can highly recommend this site

Have gotten a lot from them in the past and never been disappointed.

After reaching out, I was refunded right away. 5/5 stars in my book.

I received immediate attention to a credit card payment error and they organised a refund within minutes ( late on a Sunday evening ) plus a great saving on a quality Forex EA.

But you need to do your homework on any product before buying.

They give a lot of commitment from themselves. I highly recommend it to everyone!

I recommend it 100%

The products work as advertised and the customer support is topnotch.

Great support. Recommended, 5 STARS.

You can trust them completely.

All issues have been resolved. , If the problem cannot be resolved, a refund will be given.

Prima che intervenissi, si erano accorti dell'anomalia. Per me, piena fiducia all'operatore.

Best in the industry. Thank you for what you do

They also have an outstanding customer care services .

It makes a change from most of the scam forex websites!

Why Traders Trust Us

- ⭐ We are rated excellent on Trustpilot

- 🏆 In business since 2019

- ⚡ Free and fast product updates

- 🚫 Instant access – no 'group buys' hassle

- 🔄 7-day refund policy for product errors

- 🖥️ We can install it for you using UltraViewer

- 💬 Responsive support team

- 🔒 Pay with cards, Apple Pay, GPay, or crypto

Live Chat

Click to message us on Telegram @CheaperForex

Join Channel

Stay updated by joining our free Telegram channel.

Apex Daytrader EA MT4 V3 with Setfiles

The Apex Daytrader EA is a culmination of extensive research, backtesting, and live testing over a year. Botond Ratonyi, the creator, developed this EA to be more than just another automated trading bot—it’s a complete system that incorporates a 12-step entry process.

This entry process includes trend identification across multiple timeframes and uses a combination of candle formations and indicators to make informed decisions.

The Download Package Includes:

+ Expert: Apex EA (.ex4 file) V3.0

+ Presets

+ How to Install files.pdf

+ Pairs and Timeframes.txt

More Information:

+ https://www.mql5.com/en/market/product/123177

Live Signal Performance:

+ https://www.myfxbook.com/RobotTraderKing/apex-ea/

Download Now

$700.00 Original price was: $700.00.$49.95Current price is: $49.95.

🛒 What Happens After Purchase?

- Instant download shown on-screen right after you pay

- You also receive it by email within seconds

- Includes setup guide, presets, and instructions

- Free lifetime updates included

- Start trading in under 5 minutes – no activation delays

- Contact us for support if you need help

🔍 Your Questions, Answered.

After successful payment, your product will be available for download instantly in the following ways:

- Displayed on the screen immediately after checkout.

- Emailed to the address you provided during purchase.

- Stored in your account if you created one at checkout, where you can access it anytime.

Please note, in rare cases (about 1% of high-value premium products), orders may be held for manual review to prevent fraud. If you don’t see a download link, contact us for assistance.

Yes, absolutely. We do not sell fake products, and our customer reviews, along with our pricing, reflect the quality and authenticity of what we offer.

We provide original, fully supported expert advisors with free lifetime updates, guaranteed to work and backed by a 7-day refund or exchange policy in the rare event something is broken.

Unlike many sites selling outdated or fake versions, we offer real quality, peace of mind, and ongoing improvements from a store trusted since 2019.

This is the latest version as of the date we published it. There may be newer updates available since then.

Please check the version number before purchasing.

Yes, product updates are always free and they are provided as soon as possible.

More popular products are updated more frequently, and we typically upload a free update if a significant improvement has been made.

All product updates are stored in your account for easy access.

Please review the content under 'The download package includes' section at the top of this page.

If set files are not listed and you need them, please contact us to confirm. We can usually create specific sets tailored to your requirements.

However, we cannot guarantee profitability. Forex markets are unpredictable and the ability to lose money is possible if you don't follow a solid risk strategy.

If this product is for MT4, it will work on all terminal builds.

In the rare event that you experience issues attaching this product to your chart and can provide error codes that we are able to replicate, we will issue a full refund.

However, we do NOT offer refunds if the product does not meet your profit expectations. Forex markets are unpredictable, and performance may vary across different brokers.

At our discretion, we may offer you store credit to be used toward another product if the product is not what you expected.

Yes, we'd be happy to assist you!

We can advise you on the best settings for your account or create custom presets tailored to your needs. Additionally, we offer a one-time free installation service using AnyDesk for remote setup.

Please note, however, that we cannot provide advice on how to make money with any of our products. That service is exclusively reserved for our VIP customers.

Your money matters.

Buy from a trusted Forex source.

Rated Excellent

Rated Excellent

Review Summary

Review Summary

Reviewers overwhelmingly had a great experience with this company. Customers appreciate the fast delivery, seamless process, and support responsiveness. They highlight honesty, attentiveness, and professionalism from the team.

The site is easy to navigate and prices are considered fair. Most users express strong trust in the company and satisfaction with issue resolution.

🗨️ Customer Testimonials

Excellent product quality.

The latest updated versions of EAs are sent as soon as they are available.

I can highly recommend this site

Have gotten a lot from them in the past and never been disappointed.

After reaching out, I was refunded right away. 5/5 stars in my book.

I received immediate attention to a credit card payment error and they organised a refund within minutes ( late on a Sunday evening ) plus a great saving on a quality Forex EA.

But you need to do your homework on any product before buying.

They give a lot of commitment from themselves. I highly recommend it to everyone!

I recommend it 100%

The products work as advertised and the customer support is topnotch.

Great support. Recommended, 5 STARS.

You can trust them completely.

All issues have been resolved. , If the problem cannot be resolved, a refund will be given.

Prima che intervenissi, si erano accorti dell'anomalia. Per me, piena fiducia all'operatore.

Best in the industry. Thank you for what you do

They also have an outstanding customer care services .

It makes a change from most of the scam forex websites!

⚙️ How Our Store Works

1. Purchase

Purchase the product securely.

2. Download

Get access to your EA package immediately after purchase.

3. Easy Installation

Use the included guide to install & configure in minutes.

4. Start Trading

Activate the product & begin using it with no restrictions.

5. Free Updates

New versions we receive are added to your account.

Congratulations — you’ve saved up to 85%!

Apex Daytrader EA for MT4 by Botond Ratonyi

Introduction

The Apex Daytrader EA is a cutting-edge trading solution, crafted meticulously for traders seeking stable, consistent, and secure results in the forex market. This expert advisor has been designed to bypass high-risk strategies and to provide a systematic and controlled approach to trading.

If you’re looking for an EA that blends sophisticated price action techniques, dynamic exit strategies, and robust money management, then the Apex Daytrader EA might be the tool that elevates your trading to the next level. Available exclusively on CheaperForex.com, this EA stands out as a unique and powerful tool to achieve your trading goals.

Product Overview: How Apex Daytrader EA Works

The Apex Daytrader EA is a culmination of extensive research, backtesting, and live testing over a year. Botond Ratonyi, the creator, developed this EA to be more than just another automated trading bot—it’s a complete system that incorporates a 12-step entry process. This entry process includes trend identification across multiple timeframes and uses a combination of candle formations and indicators to make informed decisions.

Unlike other EAs that rely on grid or martingale trading, which are often high-risk, the Apex Daytrader EA uses a price action-based strategy. By analyzing candle patterns, the EA makes calculated entries and exits, ensuring that every trade follows a logic grounded in technical analysis.

The strategy emphasizes controlled risk and capital protection. The built-in stop-loss and take-profit mechanisms ensure that no trade ever falls outside a pre-defined risk profile. With advanced money management settings, you can adjust volume sizes and take advantage of the EA’s dynamic exit strategies, maximizing profitability while maintaining peace of mind.

Trading Specifications: Recommended Pair, Timeframe, and Minimum Balance

The Apex Daytrader EA is designed to be versatile and adaptable. While its default set is optimized for the EURUSD H1 timeframe, the EA package also includes set files for other popular currency pairs:

- EURUSD H1

- USDJPY H1

- USDCAD H1

- NZDUSD H1

- GBPUSD H1

For optimal performance, the recommended trading environment includes a VPS (Virtual Private Server) for faster execution, an ECN Broker to ensure competitive spreads, and a minimum balance of $500 for 0.01 lot trading. If you intend to trade across all five pairs simultaneously, it’s crucial to use a 0.01 lot size per $500 in your account to maintain an appropriate risk level.

Key Features of Apex Daytrader EA

- Sophisticated Price Action Strategy

The core of the EA is its price action strategy. By analyzing candle formations across multiple timeframes, the EA ensures that trades are made based on solid technical evidence rather than market noise or random movements. - Safe and Controlled Trading

Unlike many trading robots that deploy high-risk strategies, the Apex Daytrader EA is grounded in safety and predictability. It does not use methods like martingale or grid trading. Instead, trades are entered with clearly defined stop losses and take profits, giving you control over your exposure. - Dynamic Money Management

The EA’s money management tools are tailored to maximize profit while managing risk effectively. You can set adjustable trade volumes and configure stop-loss levels to align with your trading preferences. The dynamic exit strategies are adaptable to changing market conditions, allowing for optimal profit-taking opportunities. - Indicator-Based Confirmation

The EA employs several technical indicators like the RSI (Relative Strength Index) and Moving Averages for confirming trade entries. These indicators provide another layer of validation to ensure that each trade aligns with the prevailing market trend. - Comprehensive Trade Filtering

With features like time-based filters and specific day settings, the EA gives you full control over when trades can be opened. This helps you avoid periods of low liquidity or high volatility, such as major economic news releases. - Customizable Dynamic Exit Strategies

The EA’s dynamic exit strategies are designed to help you secure profits at the right moments. With customizable parameters such as trade duration and pip targets, the EA exits trades at optimal times, thereby reducing unnecessary drawdowns and maximizing returns. - Advanced Risk Management

With the built-in maximum drawdown settings, your account is protected from excessive losses. The MaxDD feature caps your losses at a comfortable level, ensuring that your capital is preserved even in volatile market conditions. - Input Parameters for Flexibility

The EA comes with a range of input parameters, allowing you to tweak settings such as:- Max Spread: Limits trading during unfavorable market conditions.

- Profit Check Mode: Monitors profits based on equity in real-time.

- Stop Loss & Take Profit: Predefined for controlled risk management.

- Candle Patterns & Confirmation Indicators: Tailor price action and indicator settings to match your trading strategy.

- Time Filters: Define specific trading hours for precise control over trade entries.

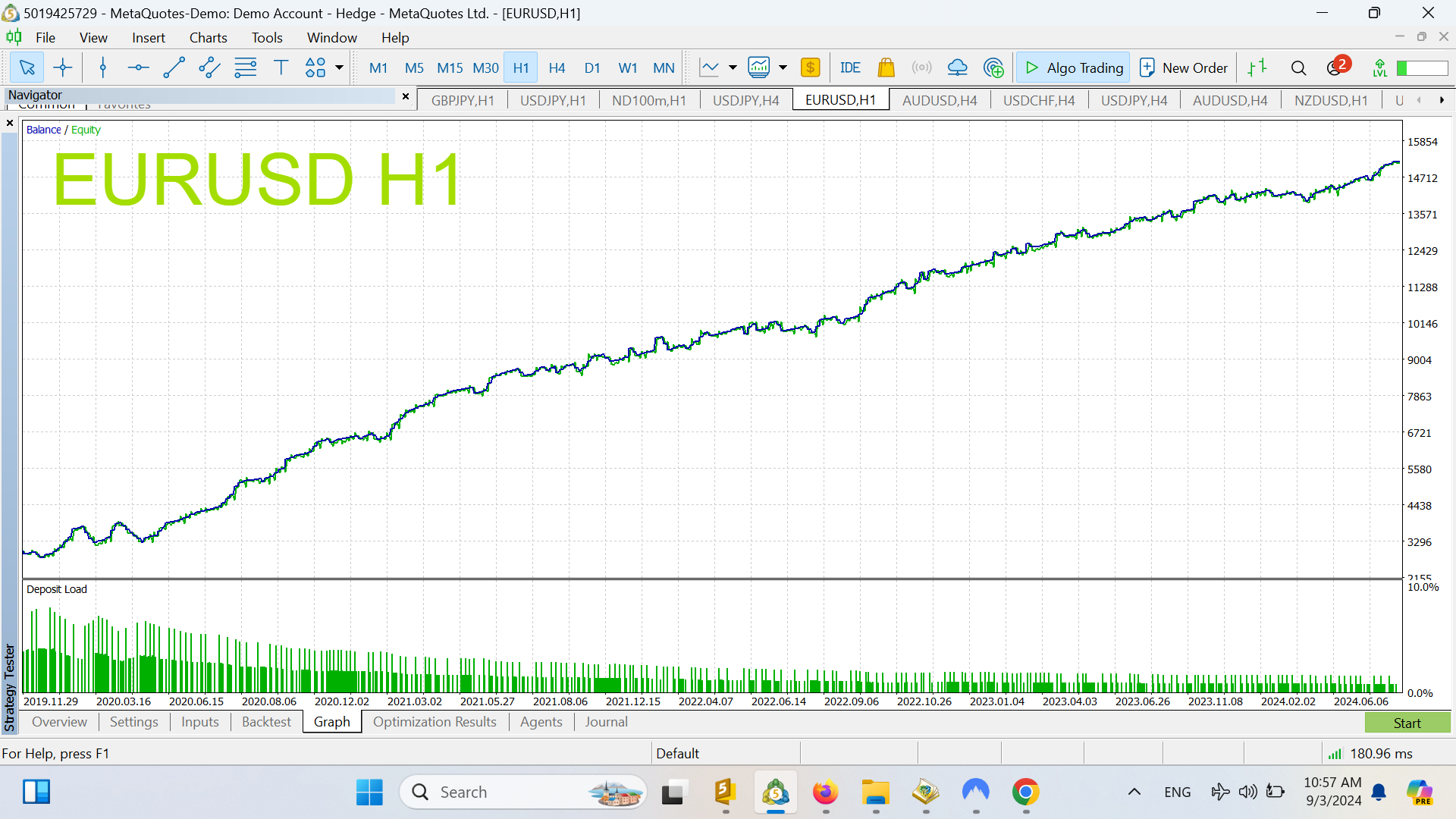

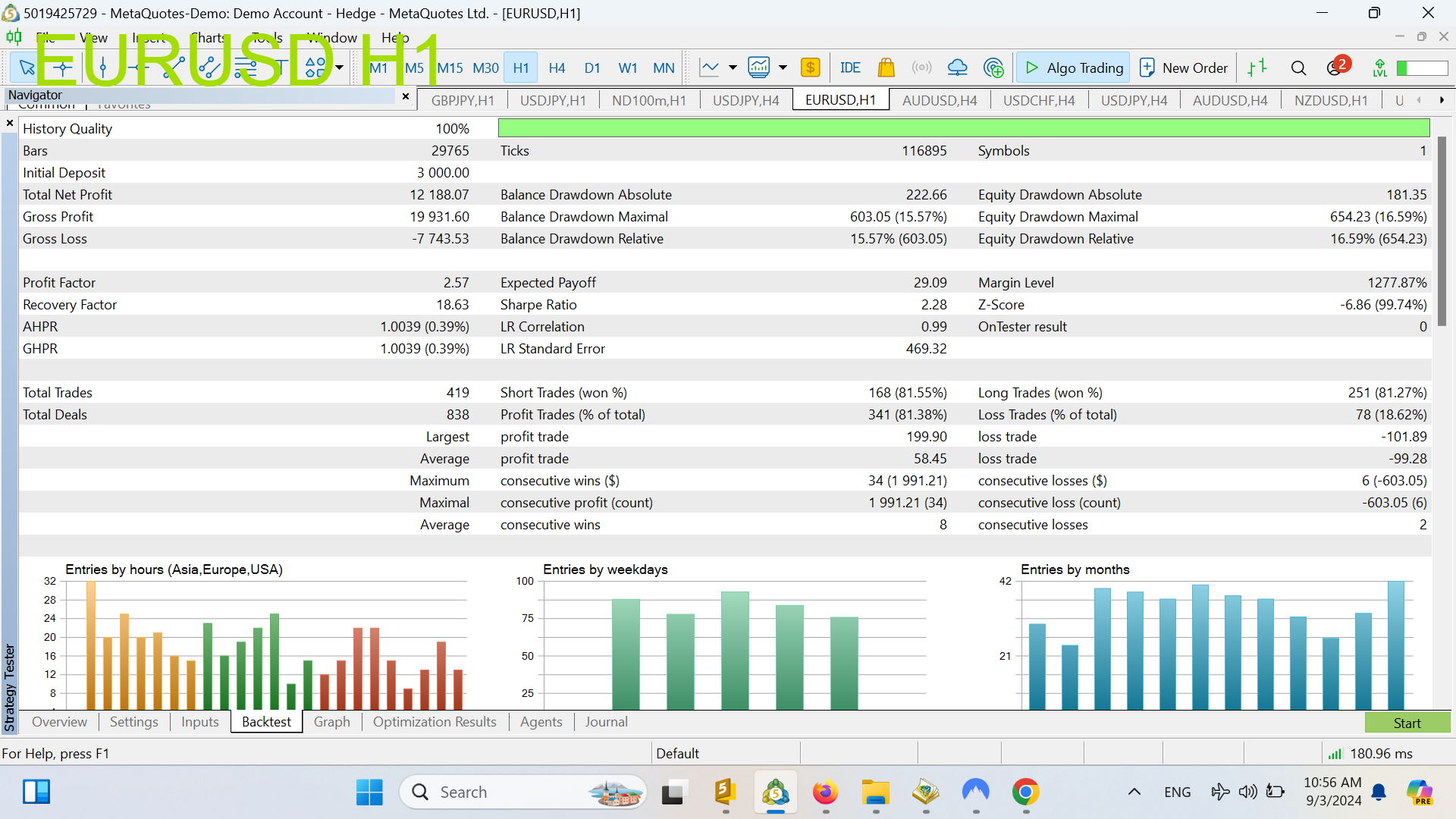

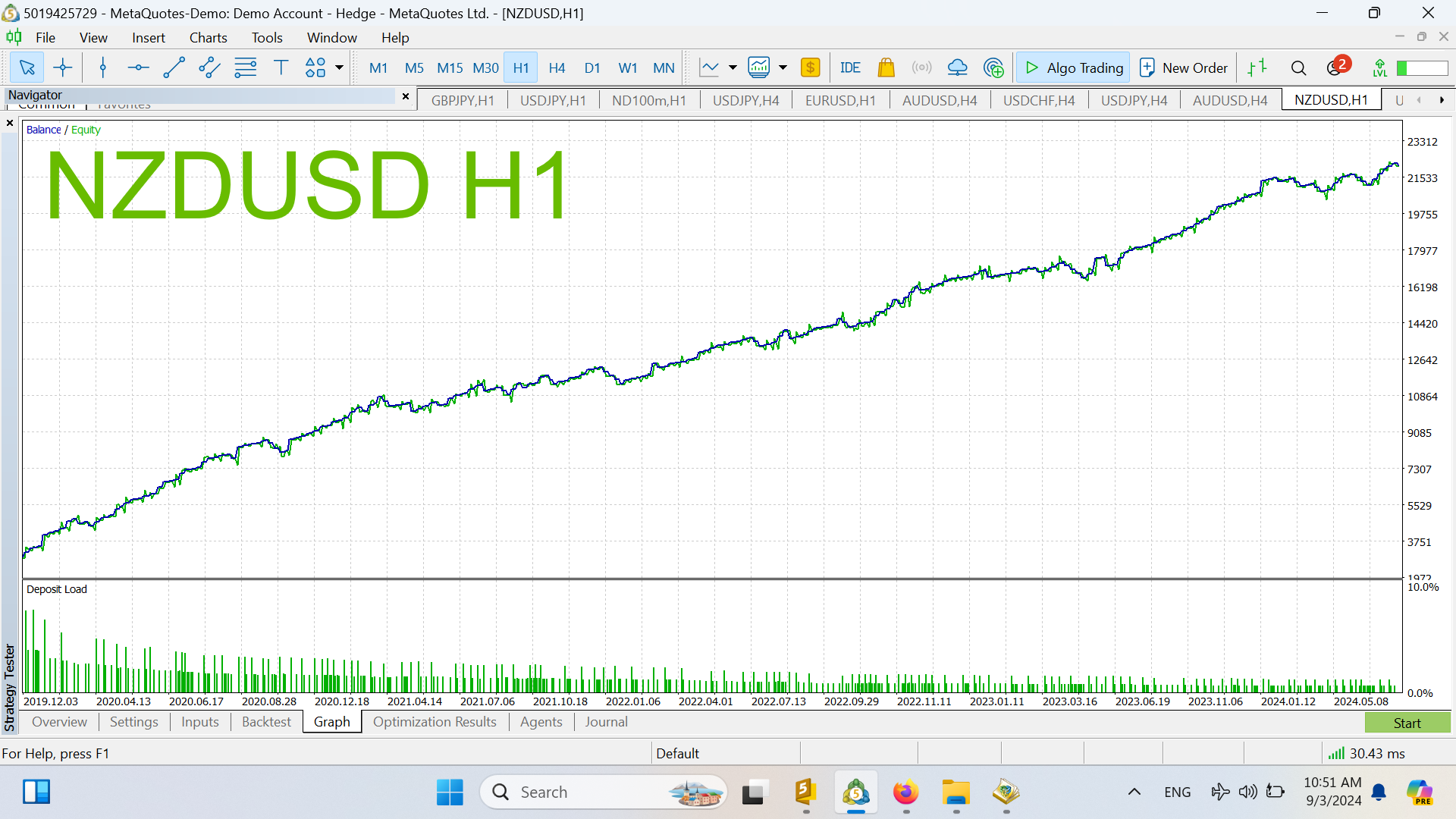

Backtest Performance

The backtest images provided for the EURUSD H1 and NZDUSD H1 set files demonstrate the EA’s consistent and reliable performance over a long period. The equity curves in the graphs show steady growth, indicating the robustness and profitability of the strategy.

- EURUSD H1 Backtest Results

The graph shows a smooth upward trend in balance and equity, reflecting the EA’s ability to navigate various market conditions while maintaining steady growth. Key statistics from the backtest results highlight a 100% history quality, 29765 bars, and a total net profit of over 12,188 units, with a profit factor of 2.57. With a winning rate of approximately 81.38%, this backtest reinforces the effectiveness of the strategy in terms of accuracy and profitability. - NZDUSD H1 Backtest Results

Similarly, the NZDUSD H1 backtest exhibits a strong and consistent equity curve. The EA’s performance across different market phases demonstrates its adaptability and resilience, making it a robust choice for diverse trading conditions.

The comprehensive data gathered from these backtests showcases the EA’s potential to yield positive results across various pairs and conditions.

Our Thoughts

The Apex Daytrader EA by Botond Ratonyi stands out as a reliable and meticulously crafted trading solution for both novice and experienced traders. With a clear emphasis on controlled risk and dynamic money management, this EA offers a balance between safety and profitability that is often hard to find. Whether you’re looking to trade on EURUSD or diversify across multiple pairs, the Apex Daytrader EA has been designed with versatility in mind.

Reviews

Early testers have already shared positive feedback, emphasizing the EA’s consistency and reliability on live accounts. The comprehensive 12-step entry strategy has proven to be effective, with testers confirming that real-world results align closely with backtesting outcomes. The strategy’s ability to avoid risky methods, combined with its advanced filtering and dynamic exit strategies, has made it a preferred choice for traders seeking stable returns.

Conclusion

The Apex Daytrader EA represents a strategic and safe approach to forex trading, tailored for those who value consistent performance without taking on undue risk. The attention to detail in its entry strategy, money management, and risk control mechanisms make it a standout choice for traders looking to automate their trading effectively. Available on CheaperForex.com, this EA is ready to help you achieve your trading goals with confidence.

By integrating cutting-edge price action techniques and advanced money management controls, the Apex Daytrader EA promises a safe yet profitable trading experience. Don’t miss the opportunity to make this robust trading solution a part of your trading arsenal.

Peter Jones

Featured Products

High-quality products exclusive to CheaperForex at the lowest prices.

-

Doctor Winston V4 EA MT4

Rated 0 out of 5$1,299.00Original price was: $1,299.00.$249.95Current price is: $249.95. -

Synapse Trader EA MT4 V1.2

Rated 0 out of 5$599.00Original price was: $599.00.$149.95Current price is: $149.95. -

Gold Dragon AI MT4 – 592% Profit

Rated 0 out of 5$699.00Original price was: $699.00.$149.95Current price is: $149.95. -

EvoTrade EA MT4 Version 1.5

Rated 0 out of 5$799.00Original price was: $799.00.$169.95Current price is: $169.95. -

News Scalps EA MT4 – High-speed Trading

Rated 0 out of 5$5,800.00Original price was: $5,800.00.$179.95Current price is: $179.95. -

Quantum Emperor EA MT5

Rated 0 out of 5$1,149.99Original price was: $1,149.99.$459.95Current price is: $459.95. -

PrizmaL Gold EA MT5

Rated 0 out of 5$1,199.00Original price was: $1,199.00.$199.95Current price is: $199.95. -

Sequoia EA MT4

Rated 0 out of 5$1,399.00Original price was: $1,399.00.$149.95Current price is: $149.95.

Why Traders Trust Us

- ⭐ We are rated excellent on Trustpilot

- 🏆 In business since 2019

- ⚡ Free and fast product updates

- 🚫 Instant access – no 'group buys' hassle

- 🔄 7-day refund policy for product errors

- 🖥️ We can install it for you using UltraViewer

- 💬 Responsive support team

- 🔒 Pay with cards, Apple Pay, GPay, or crypto