- Official Product

- Instant Download

- 7-Day Refund Policy*

- Instant Download

- 7-Day Refund Policy*

Sale!

Your money matters. Buy from a trusted Forex source.

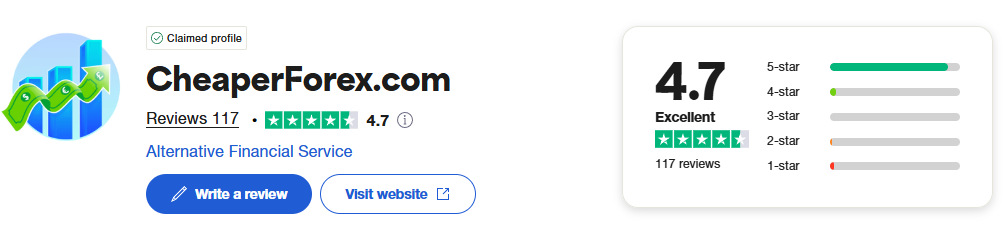

- ✔️ 117 reviews

- ✔️ Verified real customers

- ✔️ Founded 2019

- ✔️ 28,000+ orders delivered

Review Summary from Trustpilot

Review Summary from Trustpilot

Reviewers overwhelmingly had a great experience with this company. Customers appreciate the company's products and services, highlighting the fast delivery and seamless process. Consumers are satisfied with the customer service, noting the attentiveness, honesty, and helpfulness of the support team.

They also value the quick response times and professionalism in addressing their queries. The website is easy to navigate and pricing is fair. Overall, reviewers trust the company and appreciate the smooth resolution of any issues encountered.

Verified Customer Testimonials

Excellent product quality.

The latest updated versions of EAs are sent as soon as they are available.

I can highly recommend this site

Have gotten a lot from them in the past and never been disappointed.

After reaching out, I was refunded right away. 5/5 stars in my book.

I received immediate attention to a credit card payment error and they organised a refund within minutes ( late on a Sunday evening ) plus a great saving on a quality Forex EA.

But you need to do your homework on any product before buying.

They give a lot of commitment from themselves. I highly recommend it to everyone!

I recommend it 100%

The products work as advertised and the customer support is topnotch.

Great support. Recommended, 5 STARS.

You can trust them completely.

All issues have been resolved. , If the problem cannot be resolved, a refund will be given.

Prima che intervenissi, si erano accorti dell'anomalia. Per me, piena fiducia all'operatore.

Best in the industry. Thank you for what you do

They also have an outstanding customer care services .

It makes a change from most of the scam forex websites!

Why Traders Trust Us

- ⭐ We are rated excellent on Trustpilot

- 🏆 In business since 2019

- ⚡ Free and fast product updates

- 🚫 Instant access – no 'group buys' hassle

- 🔄 7-day refund policy for product errors

- 🖥️ We can install it for you using UltraViewer

- 💬 Responsive support team

- 🔒 Pay with cards, Apple Pay, GPay, or crypto

Live Chat

Click to message us on Telegram @CheaperForex

Join Channel

Stay updated by joining our free Telegram channel.

SMC NEW EA MT5 – Unrestricted

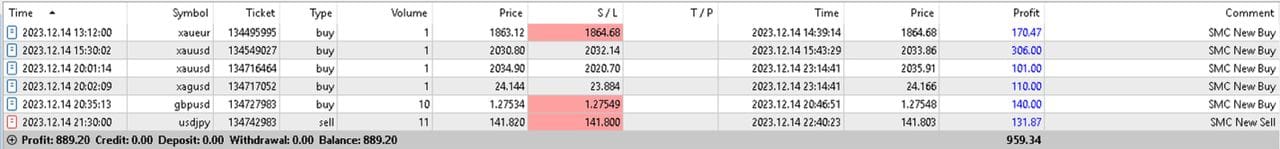

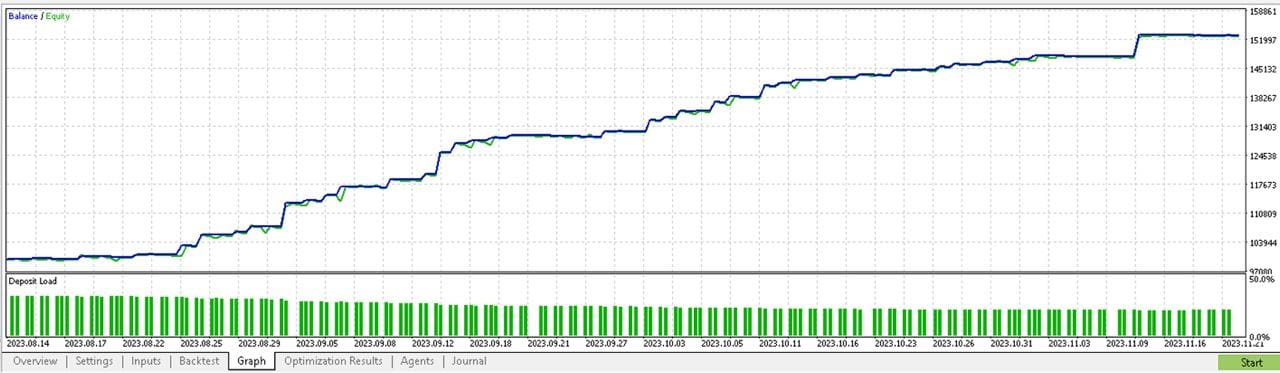

SMC NEW EA stands out as a cutting-edge forex robot and indicator package, specifically engineered to conquer prop firm challenges and thrive in live account trading.

The package includes:

+ Expert: SMC NEW EA (.ex5) – Version 1.1

+ Indicators

Website/Results:

+ https://t.me/cashcartelea

Note (Important):

This product utilizes a custom DLL named “msimg32.dll” and an MT5 terminal build 4000, which you must use, both are included.

Some antivirus software may block it and flag it as a virus. You’ll need to configure your antivirus settings to “allow it.”

This is a false alarm and the product is SAFE. The false alarm occurs due to this being a custom DLL not verified by a publisher, but unlocking this product is necessary.

If you do not wish to use the custom DLL or the supplied MT5 terminal.exe, please do not purchase.

Download Now

$500.00 Original price was: $500.00.$24.99Current price is: $24.99.

🛒 What Happens After Purchase?

- Instant download shown on-screen right after you pay

- You also receive it by email within seconds

- Includes setup guide, presets, and instructions

- Free lifetime updates included

- Start trading in under 5 minutes – no activation delays

- Contact us for support if you need help

🔍 Your Questions, Answered.

After successful payment, your product will be available for download instantly in the following ways:

- Displayed on the screen immediately after checkout.

- Emailed to the address you provided during purchase.

- Stored in your account if you created one at checkout, where you can access it anytime.

Please note, in rare cases (about 1% of high-value premium products), orders may be held for manual review to prevent fraud. If you don’t see a download link, contact us for assistance.

Yes, absolutely. We do not sell fake products, and our customer reviews, along with our pricing, reflect the quality and authenticity of what we offer.

We provide original, fully supported expert advisors with free lifetime updates, guaranteed to work and backed by a 7-day refund or exchange policy in the rare event something is broken.

Unlike many sites selling outdated or fake versions, we offer real quality, peace of mind, and ongoing improvements from a store trusted since 2019.

This is the latest version as of the date we published it. There may be newer updates available since then.

Please check the version number before purchasing.

Yes, product updates are always free and they are provided as soon as possible.

More popular products are updated more frequently, and we typically upload a free update if a significant improvement has been made.

All product updates are stored in your account for easy access.

Please review the content under 'The download package includes' section at the top of this page.

If set files are not listed and you need them, please contact us to confirm. We can usually create specific sets tailored to your requirements.

However, we cannot guarantee profitability. Forex markets are unpredictable and the ability to lose money is possible if you don't follow a solid risk strategy.

If this product is for MT4, it will work on all terminal builds.

In the rare event that you experience issues attaching this product to your chart and can provide error codes that we are able to replicate, we will issue a full refund.

However, we do NOT offer refunds if the product does not meet your profit expectations. Forex markets are unpredictable, and performance may vary across different brokers.

At our discretion, we may offer you store credit to be used toward another product if the product is not what you expected.

Yes, we'd be happy to assist you!

We can advise you on the best settings for your account or create custom presets tailored to your needs. Additionally, we offer a one-time free installation service using AnyDesk for remote setup.

Please note, however, that we cannot provide advice on how to make money with any of our products. That service is exclusively reserved for our VIP customers.

Your money matters.

Buy from a trusted Forex source.

Rated Excellent

Rated Excellent

Review Summary

Review Summary

Reviewers overwhelmingly had a great experience with this company. Customers appreciate the fast delivery, seamless process, and support responsiveness. They highlight honesty, attentiveness, and professionalism from the team.

The site is easy to navigate and prices are considered fair. Most users express strong trust in the company and satisfaction with issue resolution.

🗨️ Customer Testimonials

Excellent product quality.

The latest updated versions of EAs are sent as soon as they are available.

I can highly recommend this site

Have gotten a lot from them in the past and never been disappointed.

After reaching out, I was refunded right away. 5/5 stars in my book.

I received immediate attention to a credit card payment error and they organised a refund within minutes ( late on a Sunday evening ) plus a great saving on a quality Forex EA.

But you need to do your homework on any product before buying.

They give a lot of commitment from themselves. I highly recommend it to everyone!

I recommend it 100%

The products work as advertised and the customer support is topnotch.

Great support. Recommended, 5 STARS.

You can trust them completely.

All issues have been resolved. , If the problem cannot be resolved, a refund will be given.

Prima che intervenissi, si erano accorti dell'anomalia. Per me, piena fiducia all'operatore.

Best in the industry. Thank you for what you do

They also have an outstanding customer care services .

It makes a change from most of the scam forex websites!

⚙️ How Our Store Works

1. Purchase

Purchase the product securely.

2. Download

Get access to your EA package immediately after purchase.

3. Easy Installation

Use the included guide to install & configure in minutes.

4. Start Trading

Activate the product & begin using it with no restrictions.

5. Free Updates

New versions we receive are added to your account.

Congratulations — you’ve saved up to 85%!

SMC NEW EA, Smart Money Concepts (SMC) trading is a price action approach with a twist. It focuses on identifying the actions of “smart money” – big institutions and market makers – to inform your trading decisions. But does it live up to the hype? Let’s dive in.

Pros:

- Distinct Perspective: SMC renames classic concepts like support and resistance with terms like “order blocks” and “fair value gaps,” offering a fresh perspective on market dynamics.

- Emphasis on Market Structure: SMC stresses understanding the underlying structure of the market, going beyond simple trend lines and indicators.

- Focus on Order Flow: Analyzing how orders are placed and taken into the market is a valuable skill, and SMC emphasizes its importance.

- Active Community: A large online community supports SMC traders, offering mentorship and knowledge sharing.

Cons:

- Steep Learning Curve: SMC terminology and concepts can be complex and overwhelming for beginners.

- Over-Complication: Sometimes, SMC analysis can bog down in excessive detail, obscuring the bigger picture.

- Subjective Interpretation: Identifying “smart money” behavior isn’t always clear-cut, leading to potential confirmation bias and overfitting.

- Focus on Institutions: SMC primarily targets institutional behavior, which might not always be relevant for retail traders with smaller capital.

Overall Conclusion for SMC NEW EA:

SMC NEW EA offers valuable insights into market structure and order flow, but it’s not a magic bullet. Its complexity and subjective nature make it more suited for experienced traders who can critically analyze and adapt its principles. Beginners might find it overwhelming and benefit from simpler price action frameworks first.

Recommendation:

If you’re an experienced trader seeking a fresh perspective and willing to invest significant time in learning, SMC NEW EA can be a valuable addition to your toolbox. However, for beginners, simpler price action techniques might be a more accessible and effective starting point.

Final Note:

Remember, no trading strategy guarantees success. Consistent profitability requires proper risk management, discipline, and a deep understanding of the market, regardless of the chosen approach. Choose a method that aligns with your learning style and personality, and always practice proper risk management.

Peter Jones

Featured Products

High-quality products exclusive to CheaperForex at the lowest prices.

-

Nas100 Scalping EA MT4

Rated 0 out of 5$5,000.00Original price was: $5,000.00.$199.95Current price is: $199.95. -

Sonata EA MT4 – Scalping Perfection

Rated 0 out of 5$1,400.00Original price was: $1,400.00.$179.95Current price is: $179.95. -

Gold Dragon AI MT4 – 592% Profit

Rated 0 out of 5$699.00Original price was: $699.00.$149.95Current price is: $149.95. -

Gemini Trump EA MT4

Rated 0 out of 5$1,999.00Original price was: $1,999.00.$199.95Current price is: $199.95. -

Gold Isis EA MT4 with Presets

Rated 0 out of 5$398.00Original price was: $398.00.$39.95Current price is: $39.95. -

CoreX G EA MT4 V1.7 – Latest Version

Rated 0 out of 5$690.00Original price was: $690.00.$149.95Current price is: $149.95. -

Dax Killer EA MT5

Rated 0 out of 5$599.00Original price was: $599.00.$279.95Current price is: $279.95. -

Idol EA MT4 – Excellent Results

Rated 0 out of 5$1,999.00Original price was: $1,999.00.$149.95Current price is: $149.95.

Why Traders Trust Us

- ⭐ We are rated excellent on Trustpilot

- 🏆 In business since 2019

- ⚡ Free and fast product updates

- 🚫 Instant access – no 'group buys' hassle

- 🔄 7-day refund policy for product errors

- 🖥️ We can install it for you using UltraViewer

- 💬 Responsive support team

- 🔒 Pay with cards, Apple Pay, GPay, or crypto