- Official Product

- Instant Download

- 7-Day Refund Policy*

- Instant Download

- 7-Day Refund Policy*

Sale!

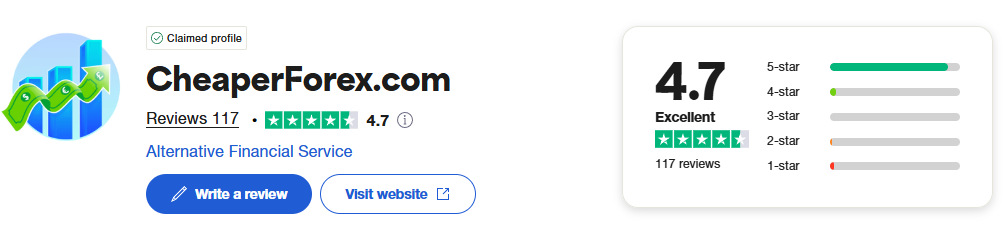

- ✔️ 117 reviews

- ✔️ Verified real customers

- ✔️ Founded 2019

Review Summary from Trustpilot

Review Summary from Trustpilot

Reviewers overwhelmingly had a great experience with this company. Customers appreciate the company's products and services, highlighting the fast delivery and seamless process. Consumers are satisfied with the customer service, noting the attentiveness, honesty, and helpfulness of the support team.

They also value the quick response times and professionalism in addressing their queries. The website is easy to navigate and pricing is fair. Overall, reviewers trust the company and appreciate the smooth resolution of any issues encountered.

Verified Customer Testimonials

Excellent product quality.

The latest updated versions of EAs are sent as soon as they are available.

I can highly recommend this site

Have gotten a lot from them in the past and never been disappointed.

After reaching out, I was refunded right away. 5/5 stars in my book.

I received immediate attention to a credit card payment error and they organised a refund within minutes ( late on a Sunday evening ) plus a great saving on a quality Forex EA.

But you need to do your homework on any product before buying.

They give a lot of commitment from themselves. I highly recommend it to everyone!

I recommend it 100%

The products work as advertised and the customer support is topnotch.

Great support. Recommended, 5 STARS.

You can trust them completely.

All issues have been resolved. , If the problem cannot be resolved, a refund will be given.

Prima che intervenissi, si erano accorti dell'anomalia. Per me, piena fiducia all'operatore.

Best in the industry. Thank you for what you do

They also have an outstanding customer care services .

It makes a change from most of the scam forex websites!

Why Traders Trust Us

- ⭐ We are rated excellent on Trustpilot

- 🏆 In business since 2019

- ⚡ Free and fast product updates

- 🚫 Instant access – no 'group buys' hassle

- 🔄 7-day refund policy for product errors

- 🖥️ We can install it for you using UltraViewer

- 💬 Responsive support team

- 🔒 Pay with cards, Apple Pay, GPay, or crypto

Live Chat

Click to message us on Telegram @CheaperForex

Join Channel

Stay updated by joining our free Telegram channel.

Royal Hedge Fund EA MT5

Royal Hedge Fund EA is a powerful MT5 trading robot designed to capitalize on market volatility.

With advanced order placement, tight stop-losses, and a trailing stop mechanism, it delivers rapid, consistent profits while maintaining exceptional risk control.

Perfect for short-term momentum trading.

The Download Package Includes:

+ The Royal Hedge Fund EA (.ex5 file) V3.0

+ How to Install files.pdf

+ Pairs and Timeframes.txt

More Information:

+ https://www.royalbotclub.com/

Live Signal Performance:

+ Unknown

Buy Now

$7,400.00 Original price was: $7,400.00.$49.95Current price is: $49.95.

🛒 What Happens After Purchase?

- Instant download shown on-screen right after you pay

- You also receive it by email within seconds

- Includes setup guide, presets, and instructions

- Free lifetime updates included

- Start trading in under 5 minutes – no activation delays

- Contact us for support if you need help

🔍 Your Questions, Answered.

After successful payment, your product will be available for download instantly in the following ways:

- Displayed on the screen immediately after checkout.

- Emailed to the address you provided during purchase.

- Stored in your account if you created one at checkout, where you can access it anytime.

Please note, in rare cases (about 1% of high-value premium products), orders may be held for manual review to prevent fraud. If you don’t see a download link, contact us for assistance.

Yes, absolutely. We do not sell fake products, and our customer reviews, along with our pricing, reflect the quality and authenticity of what we offer.

We provide original, fully supported expert advisors with free lifetime updates, guaranteed to work and backed by a 7-day refund or exchange policy in the rare event something is broken.

Unlike many sites selling outdated or fake versions, we offer real quality, peace of mind, and ongoing improvements from a store trusted since 2019.

This is the latest version as of the date we published it. There may be newer updates available since then.

Please check the version number before purchasing.

Yes, product updates are always free and they are provided as soon as possible.

More popular products are updated more frequently, and we typically upload a free update if a significant improvement has been made.

All product updates are stored in your account for easy access.

Please review the content under 'The download package includes' section at the top of this page.

If set files are not listed and you need them, please contact us to confirm. We can usually create specific sets tailored to your requirements.

However, we cannot guarantee profitability. Forex markets are unpredictable and the ability to lose money is possible if you don't follow a solid risk strategy.

If this product is for MT4, it will work on all terminal builds.

In the rare event that you experience issues attaching this product to your chart and can provide error codes that we are able to replicate, we will issue a full refund.

However, we do NOT offer refunds if the product does not meet your profit expectations. Forex markets are unpredictable, and performance may vary across different brokers.

At our discretion, we may offer you store credit to be used toward another product if the product is not what you expected.

Yes, we'd be happy to assist you!

We can advise you on the best settings for your account or create custom presets tailored to your needs. Additionally, we offer a one-time free installation service using AnyDesk for remote setup.

Please note, however, that we cannot provide advice on how to make money with any of our products. That service is exclusively reserved for our VIP customers.

Rated Excellent

Rated Excellent

Review Summary

Review Summary

Reviewers overwhelmingly had a great experience with this company. Customers appreciate the fast delivery, seamless process, and support responsiveness. They highlight honesty, attentiveness, and professionalism from the team.

The site is easy to navigate and prices are considered fair. Most users express strong trust in the company and satisfaction with issue resolution.

🗨️ Customer Testimonials

Excellent product quality.

The latest updated versions of EAs are sent as soon as they are available.

I can highly recommend this site

Have gotten a lot from them in the past and never been disappointed.

After reaching out, I was refunded right away. 5/5 stars in my book.

I received immediate attention to a credit card payment error and they organised a refund within minutes ( late on a Sunday evening ) plus a great saving on a quality Forex EA.

But you need to do your homework on any product before buying.

They give a lot of commitment from themselves. I highly recommend it to everyone!

I recommend it 100%

The products work as advertised and the customer support is topnotch.

Great support. Recommended, 5 STARS.

You can trust them completely.

All issues have been resolved. , If the problem cannot be resolved, a refund will be given.

Prima che intervenissi, si erano accorti dell'anomalia. Per me, piena fiducia all'operatore.

Best in the industry. Thank you for what you do

They also have an outstanding customer care services .

It makes a change from most of the scam forex websites!

⚙️ How Our Store Works

1. Purchase

Purchase the product securely.

2. Download

Get access to your EA package immediately after purchase.

3. Easy Installation

Use the included guide to install & configure in minutes.

4. Start Trading

Activate the product & begin using it with no restrictions.

5. Free Updates

New versions we receive are added to your account.

Congratulations — you’ve saved up to 85%!

Introduction to The Royal Hedge Fund EA for MT5 by The Royal Bot Club

The Royal Hedge Fund EA is a cutting-edge trading system designed to capitalize on market volatility and momentum, delivering rapid profits in highly volatile conditions. This EA operates by setting strategic buy and sell stops in both directions using advanced mathematical algorithms, ensuring precision and effectiveness. With tight stop-loss protection and a trailing stop mechanism, the EA minimizes risk while maximizing returns.

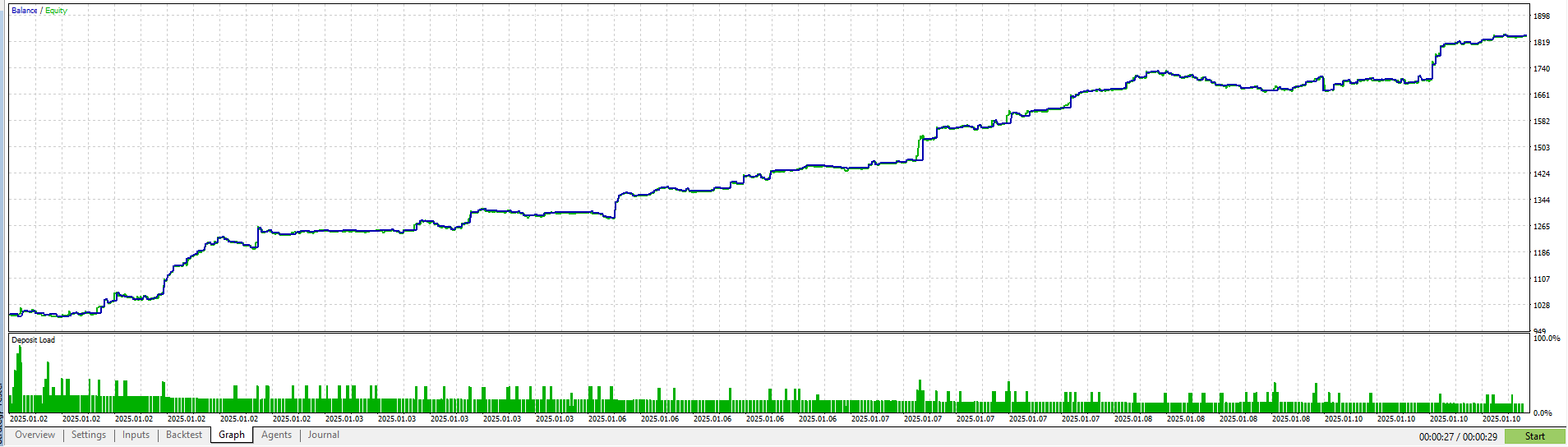

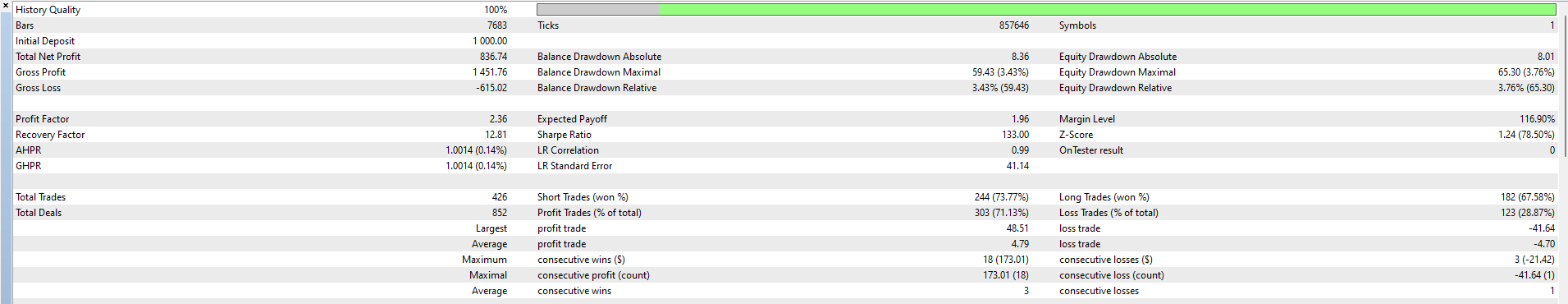

In just two weeks, a backtest on a $1,000 account demonstrated impressive results, proving its efficiency and profitability in short timeframes. Whether you’re a scalper or a momentum trader, this EA offers the tools to succeed in fast-moving markets.

Key Features of The Royal Hedge Fund EA

- Volatility-Driven Profits: Designed to harness the power of market momentum for rapid gains.

- Advanced Order Placement: Uses sophisticated mathematical calculations to strategically place buy and sell stops in both directions.

- Tight Risk Management: Employs a tight stop-loss strategy to limit potential losses.

- Trailing Stop Mechanism: Maximizes profits by locking in gains as momentum continues.

- Fully Automated Trading: Operates independently with minimal intervention required.

- Short-Term Performance: Demonstrated strong results in just two weeks of backtesting on a $1,000 deposit.

Backtest Results Analysis

Performance Highlights:

- Initial Deposit: $1,000

- Net Profit: $836.74

- Profit Factor: 2.36, indicating high profitability.

- Maximum Drawdown: 3.76% ($59.43), showcasing excellent risk control.

- Trades Executed: 426 total trades with a win rate of 73.77% for short trades and 71.13% for long trades.

The balance graph shows a consistent upward trajectory, with minimal drawdowns, confirming the EA’s stability and reliability in volatile conditions. Its ability to generate nearly 84% account growth in just two weeks highlights its exceptional performance.

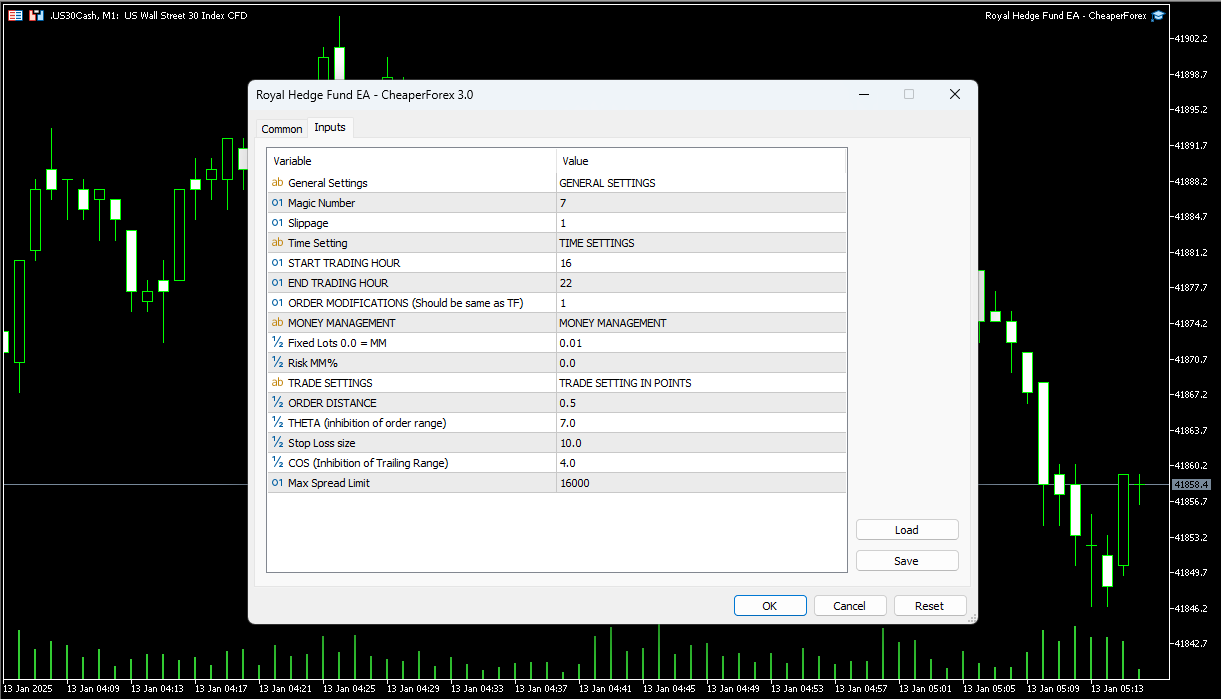

Inputs Explained

- Magic Number: Unique identifier for trades placed by the EA to avoid conflicts with other systems.

- Slippage: Defines the maximum allowed slippage for orders, ensuring precision in execution.

- Trading Hours:

- Start Trading Hour: The time when the EA begins placing trades.

- End Trading Hour: The cutoff time for new orders, ensuring trading within a controlled window.

- Money Management:

- Fixed Lot Size: Allows for a consistent lot size in trades.

- Risk MM%: Enables dynamic lot sizing based on account equity percentage.

- Trade Settings in Points:

- Order Distance: Distance between the current price and placed buy/sell stops.

- Theta: Restricts the order range to avoid excessive orders in volatile conditions.

- Stop Loss Size: Sets the maximum loss per trade.

- COS (Inhibition of Trailing Range): Restricts trailing stop activation until certain conditions are met.

- Max Spread Limit: Prevents trading during high-spread conditions to ensure optimal execution.

Recommendations for Optimal Use

- Timeframe: M1 for fast execution and responsiveness to volatility.

- Starting Deposit: $1,000 or more.

- Broker Type: Low-spread ECN accounts for efficient execution.

- Hosting: VPS for low-latency and uninterrupted operation.

- Best Markets: Volatile assets such as indices or currency pairs with high liquidity.

Why Choose The Royal Hedge Fund EA?

The Royal Hedge Fund EA is perfect for traders looking to exploit short-term market momentum with tight risk controls. Its advanced algorithms ensure precision, while its trailing stop mechanism secures profits in volatile markets. The backtest results highlight its ability to grow accounts quickly without excessive risk, making it a robust choice for traders of all experience levels.

Take your trading to the next level with the Royal Hedge Fund EA—a powerful tool for navigating fast-moving markets with confidence and consistency.

You must be logged in to post a review.

Peter Jones

Featured Products

High-quality products exclusive to CheaperForex at the lowest prices.

-

AlphaX Investment King EA MT4

Rated 0 out of 5$1,999.00Original price was: $1,999.00.$249.95Current price is: $249.95. -

Eve EA MT4 – 488% Profit with IC Markets

Rated 0 out of 5$1,499.00Original price was: $1,499.00.$249.95Current price is: $249.95. -

Goldbot One EA MT4 V1.3

Rated 0 out of 5$549.00Original price was: $549.00.$149.95Current price is: $149.95. -

Gemini Trump EA MT4

Rated 0 out of 5$1,999.00Original price was: $1,999.00.$199.95Current price is: $199.95. -

Synapse Trader EA MT4 V1.2

Rated 0 out of 5$599.00Original price was: $599.00.$149.95Current price is: $149.95. -

Beatrix Inventor MT5 EA

Rated 0 out of 5$1,499.00Original price was: $1,499.00.$199.95Current price is: $199.95. -

Red Star EA MT4 – Excellent Results

Rated 0 out of 5$3,467.00Original price was: $3,467.00.$249.95Current price is: $249.95. -

Nasdaq100 Algo Trading EA MT4 V1.1 – 210% Gain with IC Markets

Rated 0 out of 5$698.00Original price was: $698.00.$189.95Current price is: $189.95.

Why Traders Trust Us

- ⭐ We are rated excellent on Trustpilot

- 🏆 In business since 2019

- ⚡ Free and fast product updates

- 🚫 Instant access – no 'group buys' hassle

- 🔄 7-day refund policy for product errors

- 🖥️ We can install it for you using UltraViewer

- 💬 Responsive support team

- 🔒 Pay with cards, Apple Pay, GPay, or crypto

Reviews

There are no reviews yet.