Original Products • Free Lifetime Updates • Auto 20% Off on Orders Over $100

Sale!

• We can help you set up this product correctly or install it for you.

All of our MT4 products are fully compatible with build 1420.

Description & Download Package:

Arbitrage EA for MT4: Harnessing Price Deviations for Profitable Trades. In the dynamic realm of forex trading, the pursuit of arbitrage opportunities has long captivated traders seeking to exploit price discrepancies across different markets.

The Download Package Includes:

+ Expert: Arbitrage EA (.ex4)

More Information:

+ Unknown

Arbitrage AI EA MT4 Unlimited

$2,000.00 Original price was: $2,000.00.$39.95Current price is: $39.95. (Save $1,960.05)

• Only pay once. New updates are always available FREE.

• We can help you set up this product correctly.

This product is free for VIP members. Join today.

Download This Product Instantly:

Skip the checkout and Buy Now with PayPal.

BTC/ETH/USDT also accepted.

Added Peace of Mind:

- Free Lifetime Product Updates

- We Can Install It For You using AnyDesk

- 7-day Refund for Errors*

- 1 Free Product Swap If You Don't Like It*

- Presets on Request

- Instructions

- Unlimited Activations

- Free Lifetime Product Updates

- We Can Install It For You using AnyDesk

- 1 Free Product Swap If You Don't Like It*

- 7-day Refund for Errors*

- Presets on Request

- Instructions

- Unlimited Activations

All of our MT4 products are fully compatible with build 1420.

Buy With Confidence.

We're Rated Excellent.

Description & What's Included:

Arbitrage EA for MT4: Harnessing Price Deviations for Profitable Trades. In the dynamic realm of forex trading, the pursuit of arbitrage opportunities has long captivated traders seeking to exploit price discrepancies across different markets.

The Download Package Includes:

+ Expert: Arbitrage EA (.ex4)

More Information:

+ Unknown

Don’t get scammed by other websites selling broken software.

We stand by our products and are proud to provide excellent after-sales support in case you need assistance installing your purchase on your terminal, including a *7-day full refund in the rare event that something doesn’t work.

Arbitrage AI EA for MT4: Harnessing Price Deviations for Profitable Trades

In the dynamic realm of forex trading, the pursuit of arbitrage opportunities has long captivated traders seeking to exploit price discrepancies across different markets. While traditional arbitrage strategies often depend on latency and low transaction costs, the advent of expert advisors (EAs) has opened up new avenues for automated arbitrage trading.

Arbitrage expert advisors, such as those available on CheaperForex.com, employ sophisticated algorithms to identify and capitalize on price differences across multiple forex brokers. These EAs can significantly enhance the efficiency and profitability of arbitrage trading, allowing traders to exploit fleeting market inefficiencies and secure consistent gains.

Core Principles of Arbitrage EA Trading

Arbitrage trading revolves around the fundamental principle of buying an asset in one market and simultaneously selling it in another market at a higher price, thereby locking in a risk-free profit. This strategy relies on the assumption that prices across different markets will eventually converge, but for brief periods, they may diverge, offering arbitrage opportunities.

The Role of Expert Advisors in Arbitrage Trading

Traditionally, arbitrage trading required traders to manually monitor multiple markets, identify price discrepancies, and execute trades accordingly. This process was time-consuming, error-prone, and often inefficient. However, the emergence of forex EAs has revolutionized arbitrage trading by automating the entire process.

Arbitrage expert advisors continuously scan multiple forex brokers, analyzing real-time price data to identify and exploit arbitrage opportunities. Once a discrepancy is detected, the EA executes trades automatically, capitalizing on the price difference before the markets converge.

Benefits of Using Arbitrage Expert Advisors

The use of arbitrage expert advisors offers several compelling advantages for traders:

-

Automation: EAs handle the entire arbitrage process, eliminating the need for manual monitoring and trade execution, saving traders valuable time and reducing the risk of human error.

-

Efficiency: EAs can scan multiple markets simultaneously and identify arbitrage opportunities much faster than human traders, increasing the potential for profitable trades.

-

Precision: EAs are programmed with precise trading algorithms, ensuring accurate execution of arbitrage trades and maximizing profit potential.

-

Scalability: EAs can be easily scaled to manage larger trading volumes, allowing traders to increase their potential returns.

Choosing the Right Arbitrage Expert Advisor

When selecting an arbitrage expert advisor, traders should consider several factors:

-

Reputation: Choose an EA from a reputable developer with a proven track record of success and a strong reputation in the forex trading community.

-

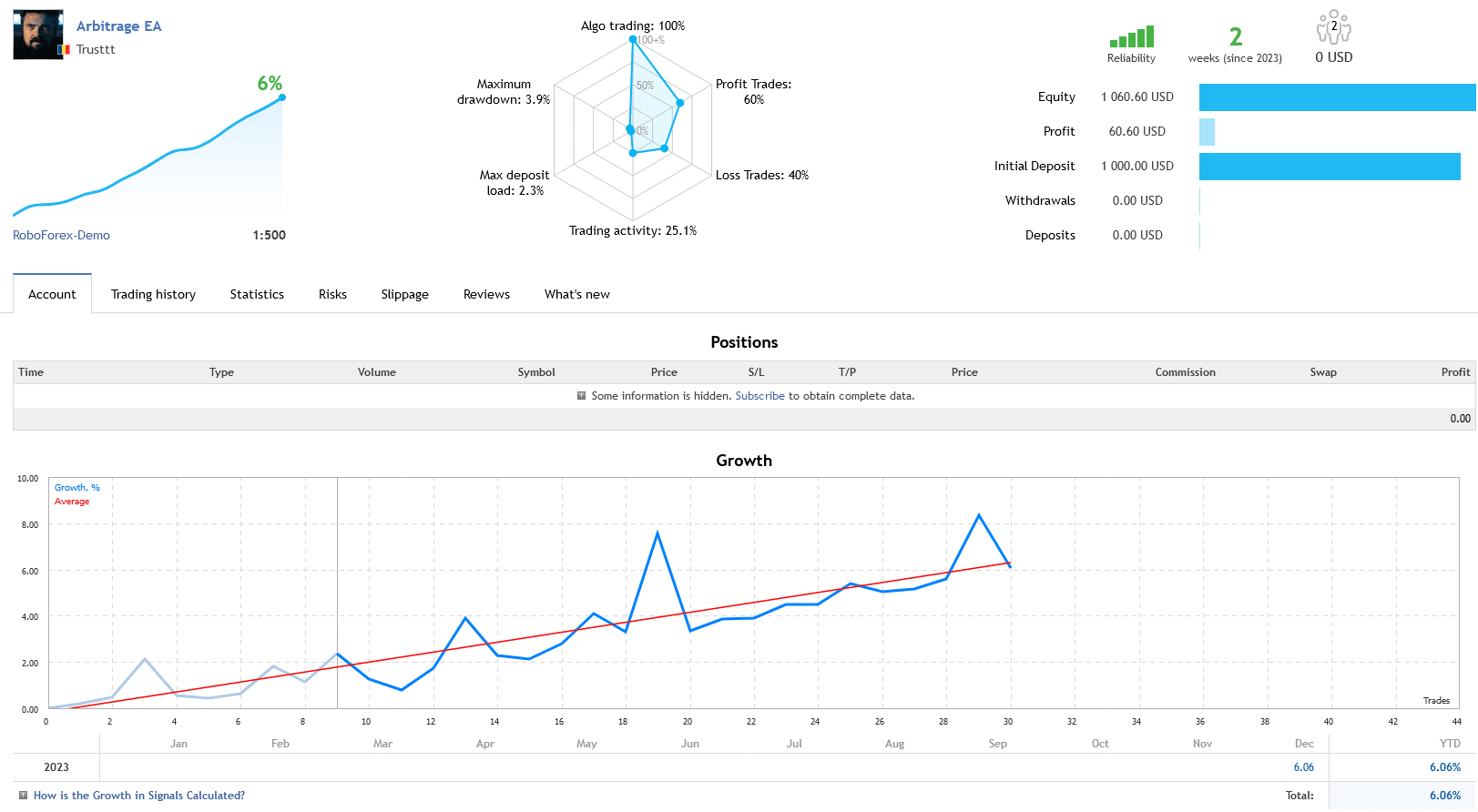

Performance: Evaluate the EA’s performance history and verify its profitability and consistency across different market conditions.

-

Customization: Ensure the EA offers sufficient customization options to align with your trading style and risk tolerance.

-

Ease of Use: Select an EA with an intuitive interface and easy-to-understand configuration settings.

Arbitrage EA Trading on CheaperForex.com

CheaperForex.com offers a comprehensive selection of forex EAs, including several dedicated arbitrage trading solutions. These EAs are developed by experienced programmers and have been rigorously tested to ensure their effectiveness and reliability.

Conclusion

Arbitrage trading, when implemented effectively, can be a highly profitable strategy for forex traders. The advent of arbitrage expert advisors has further enhanced the potential of this approach, automating the process and maximizing profitability.

Recommendations

For traders seeking to leverage arbitrage trading for consistent gains, utilizing an expert advisor like those available on CheaperForex.com can be a valuable asset. By automating the process, traders can reduce the risk of human error, increase their efficiency, and potentially secure significant profits.

However, it is crucial to approach arbitrage trading with caution and sound risk management practices. Traders should thoroughly research and select an EA from a reputable developer, carefully evaluate its performance history, and implement appropriate risk management strategies to minimize potential losses.

By combining a well-chosen arbitrage expert advisor with prudent risk management, traders can tap into the potential of arbitrage trading and potentially achieve consistent profitability in the dynamic forex market.

* 7-day money-back policy is only valid when you provide proof of any errors and allow us to try and fix it. If we can't fix it, we will refund you in full.

* 1 Free Product Swap If You Don't Like It - is for a product of similar value or you can pay the difference. You must inform us within 7-days of purchase.

Did you know you can use any of our MT4 Expert Advisors to execute trades on your MT5 terminal with a simple and free real-time copy trading tool?

Contact us after purchase if you'd like advice on how to do this.