Remstone EA MT5 Review – Honest Analysis of Live Performance & Red Flags (2025)

📊 What You’ll Learn: This is an evidence-based review of Remstone EA analyzing real live performance across multiple brokers, not marketing claims. You’ll discover why this $2,000 EA shows terrible results on legitimate brokers but great results on an unknown broker, the red flags around suspicious deposit additions, how backtest performance completely contradicts live trading, and why experienced traders are avoiding this EA despite the developer’s solid background. Whether you’re considering Remstone or just want to learn how to spot overfitted EAs, this honest review shows you exactly what to watch for.

📋 Table of Contents – Jump to Any Section

⏱️ Estimated read time: 20 minutes | Evidence-based analysis, not promotional fluff

Last Updated: October 2025 | Current Price: $2,000 | MQL5 Rating: 5.0/5 (10 reviews)

⚠️ TL;DR: Remstone EA costs $2,000 but shows only 6% growth on legitimate brokers like IC Markets, while showing 28% on an unknown broker nobody’s heard of. The developer keeps adding deposits to mask poor performance. Backtest looks great but live results are terrible. Despite solid trading philosophy and legitimate developer background, current live performance doesn’t justify the price. Recommendation: Skip it. Wait 6-12 months to see if verified signals improve, or get proven alternatives like Mad Turtle EA ($240) with verified +45% monthly returns instead.

Quick Verdict: Should You Buy Remstone EA?

No. At least not right now.

🎯 Want proven results instead?

Skip Remstone’s $2,000 price tag and 6% returns. Get Mad Turtle EA for $240 with verified +45% monthly returns and +86% long-term growth. Or build a complete 4-EA portfolio for $1,600 with diversified strategies.

This review is going to surprise you because Remstone EA has several things going for it: a legitimate developer with institutional experience, solid trend-following philosophy, and beautiful backtest results. But when we examine the actual live trading performance on verified signals, the story completely falls apart.

Here’s what the evidence shows:

- IC Markets signal (legitimate broker): Only 6% growth after nearly a year

- TickMill signal (legitimate broker): Currently at -2% loss with 0% winning trades

- StarTrader signal (unknown broker): 28% growth over 32 weeks

Notice the pattern? Performance is terrible on brokers we can verify are legitimate, but excellent on a broker nobody in the forex community has heard of. We’ll dive deep into why this is a massive red flag.

More concerning: the developer keeps adding deposits to the live accounts, a classic tactic to make drawdown look less severe than it actually is. Combined with a $2,000 price tag and only 10 reviews after 7 years on the market, there’s minimal evidence of satisfied customers or community buzz around this EA.

This doesn’t mean Remstone is a scam. The developer clearly understands professional trading. But understanding theory and delivering profitable results are two different things, and right now, the live performance doesn’t support the asking price.

What is Remstone EA?

Remstone EA is a fully automated trend-following trading system for MetaTrader 5 designed to trade across multiple asset classes. Unlike most EAs that focus on a single currency pair or market, Remstone positions itself as a complete portfolio solution trading:

- Forex pairs: USDJPY

- Precious metals: Gold, Silver, Copper

- Cryptocurrencies: Bitcoin, Ethereum

- Stock indices: NASDAQ-100, DAX, Nikkei

The Core Strategy

Remstone follows a pure trend-following approach, which means it aims to capture large price movements by:

- Entering trades only in the direction of the dominant trend

- Using tight stop losses to minimize risk on each trade

- Letting winning trades run to capture substantial moves

- Accepting a lower win rate (30-40%) in exchange for larger winners

- Managing positions around major economic news events

This is a legitimate trading philosophy used by professional trend-following CTAs and hedge funds. The strategy itself isn’t the problem. The problem is execution and live results.

Key Features

- Multi-asset capability: Trade different markets from one EA

- Customizable parameters: Adjust risk percentage and which assets to trade

- Risk management: Set risk per trade as percentage, EA calculates lot sizes automatically

- News management: Adjusts trading around economic announcements

- Works on H1 timeframe: Requires less constant monitoring than scalpers

Technical Requirements

- Platform: MetaTrader 5 only (not MT4)

- Recommended pair: EURUSD chart (but trades multiple assets)

- Timeframe: H1

- Minimum deposit: $500 (though developer’s own signals use $1,000-$10,000)

- Account type: Hedging enabled

- VPS: Recommended for 24/7 operation

- Broker: ECN with low spreads preferred

Developer Background – Legitimate But Unproven

Before we dive into performance issues, let’s acknowledge what’s actually good about Remstone: the developer has a real background in finance, not just EA development.

Remy Aime Rene Louat – The Person Behind Remstone

The developer isn’t anonymous, which is a positive sign. According to the MQL5 profile and product description:

- Founded Armonia Capital in 2018: A company providing trading signals to Darwinex

- ARF signal on Darwinex: Raised €750,000 in managed capital through the platform

- FCA-regulated: Darwinex is regulated by the UK Financial Conduct Authority, meaning the ARF signal went through compliance

- Institutional clients: Claims to have hedge fund customers using Remstone

- Active on MQL5: Responds to customer reviews and questions

Why This Background Matters

Most EA developers are just programmers or traders who got lucky with a backtest. Having actual experience managing real money under FCA oversight is significant. It means:

- The developer understands regulatory requirements

- Has experience with real capital from investors

- Knows the difference between backtest performance and live trading

- Can’t make completely fraudulent claims without legal consequences

The Problem: Background ≠ Current Results

Here’s where we hit our first contradiction. If the developer successfully managed €750K on Darwinex, why are the current Remstone EA signals showing such poor performance on legitimate brokers?

Possible explanations:

- The ARF signal was different: Maybe it used manual intervention or different parameters

- Market conditions changed: Trend-following can have long dry periods

- The EA needs optimization: Default settings might not be optimal for current markets

- Overfitting happened: EA was optimized on historical data that doesn’t reflect current conditions

We don’t know which explanation is correct, but what we do know is this: past success doesn’t guarantee current EA performance, and that’s what we need to evaluate.

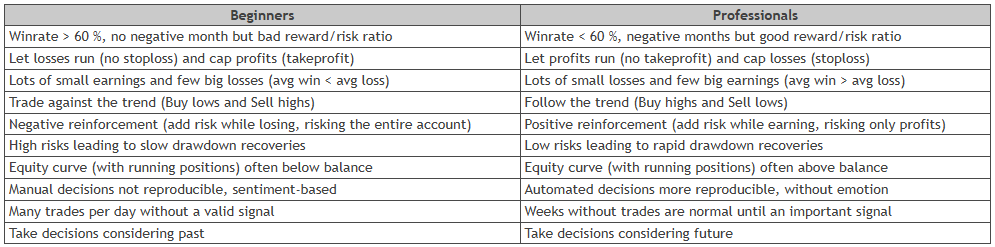

The Trading Philosophy – Actually Solid

One of the most interesting parts of Remstone’s marketing is a comparison table showing the differences between beginner and professional trader behavior. This section is genuinely educational and shows the developer understands trading psychology.

Breaking Down the Philosophy

The comparison highlights real differences:

| Beginners | Professionals |

|---|---|

| Win rate > 60%, negative months but bad reward/risk ratio | Win rate < 60%, negative months but good reward/risk ratio |

| Let losses run (no stops) and cap profits (take profit) | Let profits run (no take profit) and cap losses (stop loss) |

| Lots of small earnings, few big losses (avg win < avg loss) | Lots of small losses, few big earnings (avg win > avg loss) |

| Trade against the trend (buy lows, sell highs) | Follow the trend (buy highs, sell lows) |

| High risks leading to slow drawdown recoveries | Low risks leading to rapid drawdown recoveries |

Why This Philosophy is Actually Correct

This is legitimate trading education. Research backs up these points:

- Trend-following works historically: Studies show momentum and trend-following have generated positive returns for over 200 years across markets

- Win rate doesn’t matter: You can be profitable with 30% win rate if your average winner is 3x your average loser

- Cutting losses is critical: Professional traders protect capital first, make profits second

- Psychology matters: Most retail traders fail because they can’t psychologically handle being wrong 60-70% of the time

The Question This Raises

If the developer truly understands professional trading philosophy this well, why doesn’t the EA’s live performance reflect it?

The IC Markets signal shows 38.7% profit trades (professional-style low win rate), but only 6% growth after nearly a year. This means either:

- The winners aren’t big enough to compensate for the losers

- The strategy is experiencing an unusually long drawdown period

- Something is wrong with the implementation

Let’s look at the actual live performance to find out.

Live Performance Analysis – Where Theory Meets Reality

This is where we move from philosophy to evidence. Remstone has three verified signals on MQL5, each running on different brokers. Let’s analyze each one.

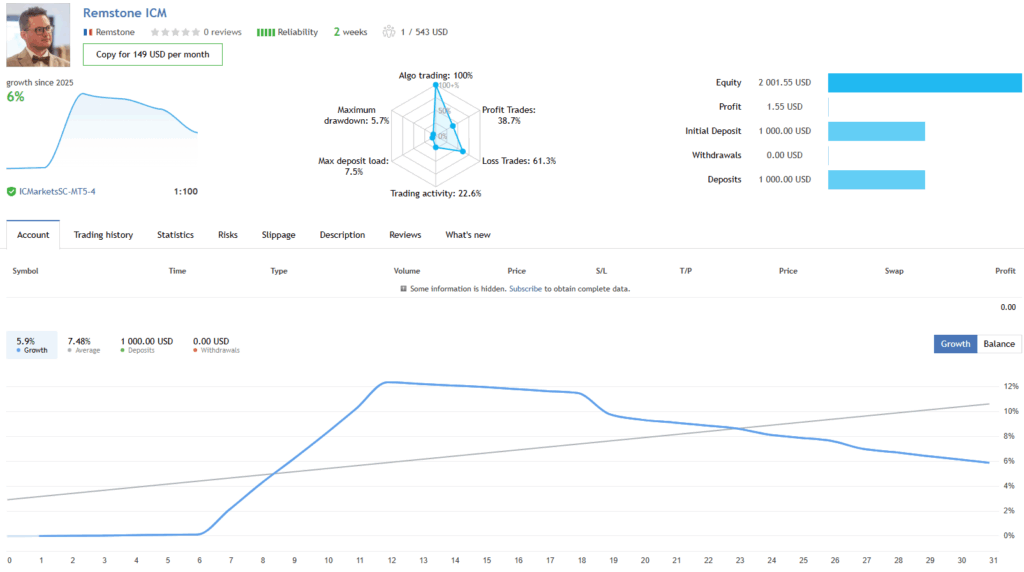

Signal #1: IC Markets – The Disappointing Truth

Broker: IC Markets (well-known, legitimate ECN broker)

Performance Snapshot:

- Account age: Started 2025

- Total growth: 6% (pathetic for nearly a year)

- Current equity: $2,001.55

- Initial deposit: $1,000 (but later added more money – red flag)

- Maximum drawdown: 5.7%

- Profit trades: 38.7%

- Loss trades: 61.3%

- Trading activity: 22.6%

Analysis:

IC Markets is a legitimate broker with tight spreads and good execution. If Remstone works, it should work here. But 6% annual return is terrible for an EA selling at $2,000. You could get better returns from a savings account.

The low win rate (38.7%) is fine for trend-following, but it only works if your winners are substantially larger than your losers. Clearly, they’re not large enough to generate meaningful profits.

The equity curve shows initial growth followed by stagnation and recent decline. This is the opposite of what you want to see.

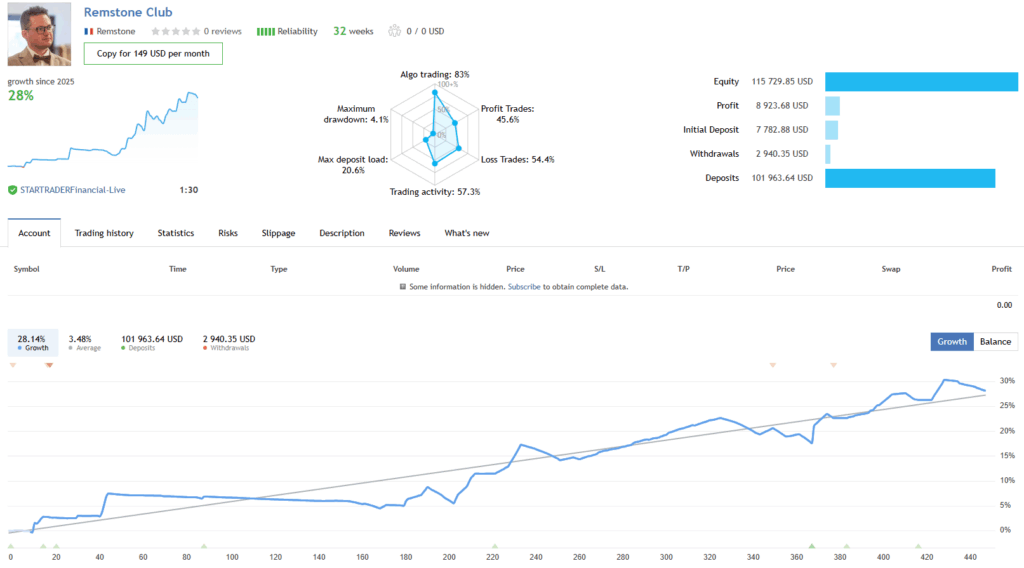

Signal #2: StarTrader “Club” – The Suspicious Success

Broker: StarTrader (unknown broker, minimal online presence)

Performance Snapshot:

- Account age: 32 weeks (about 8 months)

- Total growth: 28% (excellent!)

- Current equity: $115,729.85

- Initial deposit: $7,782.88 (but later added $94,000+ – huge red flag)

- Maximum drawdown: 4.1%

- Profit trades: 45.6%

- Loss trades: 54.4%

- Trading activity: 57.3%

Analysis:

This looks great on paper: 28% growth, only 4.1% max drawdown, decent win rate. But there are massive problems:

- Nobody’s heard of StarTrader: Search for reviews of this broker and you’ll find almost nothing

- Massive deposit additions: Started with $7,782, now has over $101,000 in deposits (added $94K!)

- Why is this the ONLY signal showing good performance? If the EA works, it should work on IC Markets too

This pattern is extremely suspicious. When an EA shows great results only on an obscure broker nobody can verify, it suggests:

- Broker manipulation: Favorable fills, artificial spreads, or fake performance

- Cherry-picked conditions: Settings optimized specifically for this broker’s behavior

- Not replicable: You probably can’t achieve these results on a real broker

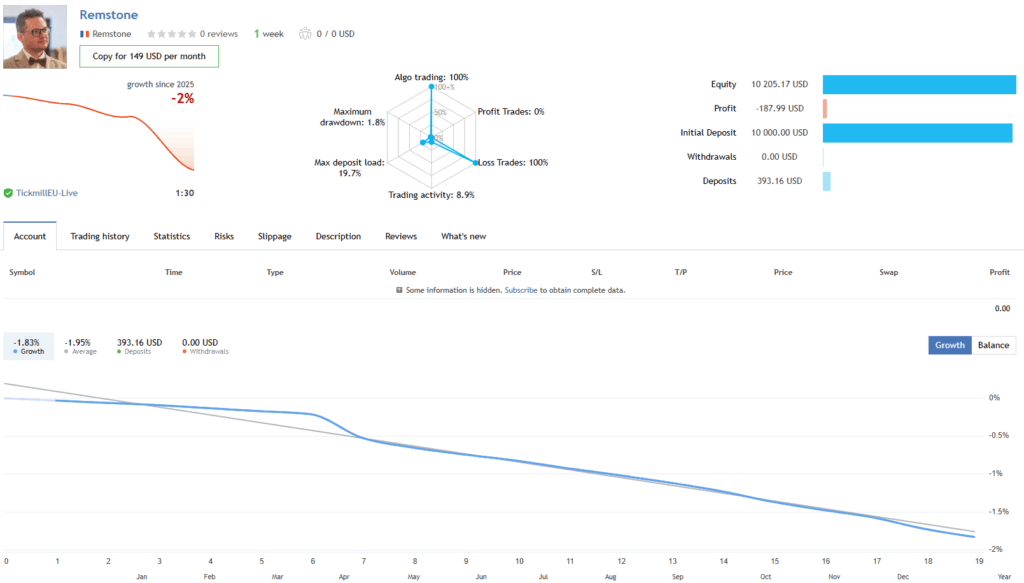

Signal #3: TickMill – The Recent Disaster

Broker: TickMill (legitimate broker, EU regulated)

Performance Snapshot:

- Account age: 1 week

- Total growth: -2% (losing money)

- Current equity: $10,205.17

- Initial deposit: $10,000 (with additional $393 added)

- Maximum drawdown: 1.8%

- Profit trades: 0%

- Loss trades: 100%

- Trading activity: 8.9%

Analysis:

This is the most recent signal, and it’s currently losing money with zero winning trades. Yes, it’s only been one week, but this is concerning when compared to the other signals.

TickMill is a legitimate EU-regulated broker. If the EA worked consistently, we’d expect at least some winning trades by now.

The Pattern That Emerges

When we look at all three signals together, a clear pattern appears:

| Broker | Legitimacy | Performance | Verdict |

|---|---|---|---|

| IC Markets | ✅ Highly legitimate | 6% annual | ❌ Terrible |

| TickMill | ✅ Legitimate | -2% loss | ❌ Losing |

| StarTrader | ⚠️ Unknown | 28% growth | ⚠️ Suspicious |

The verdict is clear: Remstone performs poorly on brokers we can verify are legitimate, but shows excellent results on a broker nobody’s heard of. This is a massive red flag.

Major Red Flags – What the Numbers Don’t Show

Beyond poor live performance, there are several warning signs that experienced traders will immediately recognize.

Red Flag #1: Suspicious Deposit Additions

Look at the deposit history across all signals:

IC Markets:

- Started with $1,000

- Now shows $2,001.55 equity

- Deposits added after initial launch

StarTrader:

- Started with $7,782.88

- Current deposits: $101,963.64

- Added $94,180.76 after launch

TickMill:

- Started with $10,000

- Added $393.16 already (after just 1 week)

Why This Matters:

When sellers add deposits to live accounts, it’s usually to mask poor performance. Here’s how it works:

- EA starts with $10,000 and enters 15% drawdown (-$1,500)

- Instead of showing -15% performance, seller adds $5,000

- Now equity shows $13,500 ($15,000 balance – $1,500 loss)

- Performance now shows -10% instead of -15%

- Equity curve looks better than reality

If the EA was truly profitable, why would you need to keep adding money?

The $94K addition on StarTrader is particularly egregious. That’s not normal money management; that’s trying to hide something.

Red Flag #2: Only Good on Unknown Broker

We’ve mentioned this already, but it deserves emphasis: why does Remstone only perform well on a broker nobody in the forex community recognizes?

When you search for “StarTrader broker reviews,” you’ll find:

- Minimal online presence

- No reviews on ForexPeaceArmy or Trustpilot

- No regulatory information readily available

- No established reputation in the forex community

Compare this to IC Markets and TickMill, which are:

- Well-known in the forex community

- Properly regulated (ASIC, FSA, etc.)

- Have thousands of user reviews

- Known for tight spreads and good execution

The pattern is clear: Real brokers = bad performance. Unknown broker = great performance.

This suggests the EA is either:

- Optimized for specific broker conditions that don’t exist on legitimate brokers

- Running on manipulated conditions (favorable fills, artificial spreads)

- Not actually replicable for customers who buy it

Red Flag #3: Limited Market Feedback

After being on the market since 2018, Remstone has only 10 reviews. That’s roughly 1.4 reviews per year.

Compare this to successful EAs that get:

- Dozens of reviews within the first few months

- Hundreds of reviews within the first year

- Consistent review flow from satisfied customers over time

Limited reviews after 7 years suggests either:

- Very few people are actually purchasing it

- People who buy it aren’t satisfied enough to leave reviews

- The EA isn’t generating enough buzz in the trading community

Yes, the 10 reviews are mostly positive (5 stars). But consider:

- 7 years on the market

- Only 10 reviews total

- Reviews are from early adopters

- Most recent live signals show poor performance

This suggests either performance has degraded since the early positive reviews, or there simply aren’t enough users to generate meaningful feedback.

Additionally: For a $2,000 EA, you only get 5 activations (installs on different machines). If your computer malfunctions a few times, you’d use one activation each time reactivating. That’s a stingy activation limit for such a premium price when cheaper EAs often offer 5-10 activations.

Red Flag #4: Price Increased While Performance Decreased

According to MQL5 history, Remstone’s price has increased over time, now sitting at $2,000. Meanwhile, live signal performance has gotten worse.

This is backwards. Normally:

- Good performance → Price increases make sense

- Poor performance → Price should decrease or EA gets delisted

Increasing price while showing 6% annual returns doesn’t make business sense unless you’re hoping customers won’t check the live signals.

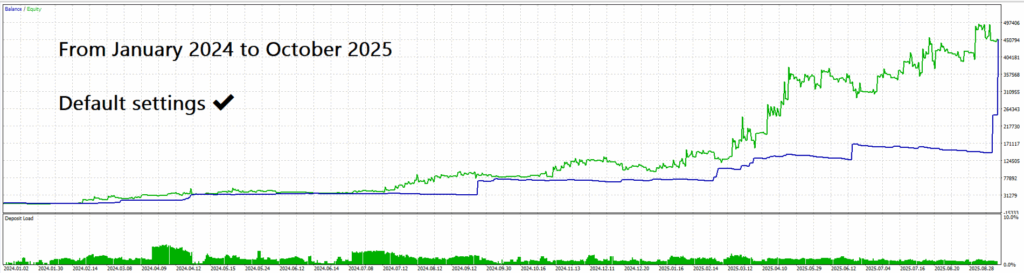

Backtest vs Reality – The Classic Overfitting Problem

The backtest for Remstone looks phenomenal. Smooth equity curve, steady growth, minimal drawdown from January 2024 to October 2025 on default settings.

So why doesn’t live performance match?

Understanding Overfitting

Overfitting happens when an EA is optimized too specifically for historical data. Here’s the process:

- Developer runs thousands of backtests with different parameter combinations

- Finds settings that produce beautiful equity curves on historical data

- Those settings worked perfectly for that specific historical period

- Settings fail on live markets because market conditions have changed

Think of it like studying for a test where you memorize the exact questions and answers. You’ll ace that specific test, but fail when the questions change slightly.

The Evidence of Overfitting in Remstone

Compare backtest to live results:

| Metric | Backtest (2024-2025) | Live (IC Markets 2025) |

|---|---|---|

| Equity Curve | Smooth upward trend | Stagnant, declining recently |

| Drawdown | Minimal, well-controlled | 5.7% (acceptable but not impressive) |

| Growth | Steady positive returns | 6% annual (terrible) |

| Consistency | Reliable monthly gains | Inconsistent, no clear pattern |

This is textbook overfitting. The EA was optimized to perfection on historical data but fails when market conditions differ even slightly.

Why Backtests Can’t Be Trusted

Even well-intentioned developers can fall victim to overfitting. Here’s why backtests are inherently problematic:

- Survivorship bias: Historical data excludes events that haven’t happened yet

- Look-ahead bias: It’s easy to “accidentally” optimize for known historical patterns

- Spread assumptions: Backtests often use fixed spreads that don’t reflect real trading

- Slippage ignored: Historical data doesn’t include slippage and requotes

- Perfect fill assumptions: Backtests assume every order fills at exact price

This is why we always say: Only trust verified live signals, preferably on multiple legitimate brokers.

Is $2,000 Justified? Price vs Value Analysis

Let’s talk about the elephant in the room: $2,000 for an EA showing 6% annual returns.

Breaking Down the ROI

Imagine you buy Remstone for $2,000 and achieve the same performance as the IC Markets signal:

- Year 1: $10,000 account grows to $10,600 (6% gain = $600 profit)

- Cost: $2,000 for EA

- Net result: -$1,400 in the hole

- Breakeven: You need 4 years of 6% gains just to recover the EA cost

Even if you started with $50,000:

- Year 1: $50,000 grows to $53,000 (6% gain = $3,000 profit)

- Cost: $2,000 for EA

- Net result: $1,000 profit (but you could’ve gotten similar returns from a savings account without the risk)

Comparing to Alternatives

For context, here’s what $2,000 could buy you instead:

| Option | Cost | Expected Annual Return | Risk Level |

|---|---|---|---|

| Remstone EA | $2,000 | 6% (based on IC Markets) | Medium-High |

| 8 Premium EAs at $250 each | $2,000 | Diversified portfolio | Medium (spread across 8 systems) |

| S&P 500 Index Fund | $0 (just invest your capital) | ~10% historical average | Medium |

| Professional trading education | $500-$1,500 | Skill development (no limit) | Depends on trader |

What $2,000 Should Buy You

For an EA to justify a $2,000 price tag, you’d expect:

- Verified 30%+ annual returns on multiple legitimate brokers

- Years of proven live performance, not just backtest results

- Maximum drawdown under 15% consistently

- Multiple successful users with public testimonials

- Dedicated support and updates from an active developer

- Professional documentation and optimization guidance

Remstone delivers on maybe 2 of these 6 criteria (philosophy documentation and developer responsiveness). That’s not enough to justify the premium pricing.

The Market Agrees

Only 10 reviews in 7 years tells you the EA isn’t generating significant buzz or satisfaction in the trading community. If Remstone delivered value worth $2,000, you’d expect to see consistent positive feedback from a growing user base.

Why Performance Varies by Broker

You might be wondering: “If Remstone is the same EA on all brokers, why do results differ so dramatically?”

This is actually a great question that reveals how forex trading really works.

Factors That Affect EA Performance Across Brokers

1. Spread Differences

- IC Markets: Typically 0.6-1.2 pips on EURUSD

- TickMill: Typically 0.4-0.8 pips on EURUSD

- StarTrader: Unknown (and that’s the problem)

Even small spread differences compound over hundreds of trades.

2. Execution Quality

- Slippage: How much price moves between order placement and execution

- Requotes: How often broker rejects your order and quotes new price

- Latency: Speed of order execution

Legitimate brokers have normal slippage. Unknown brokers might have suspiciously perfect fills.

3. Tick Data Accuracy

- Real brokers have real market prices

- Some brokers might have “cleaner” price feeds that produce better backtest results

- Unknown brokers might have… creative… price feeds

4. Order Rejection Rates

- During high volatility, legitimate brokers sometimes reject orders to protect themselves

- This is normal and expected

- If a broker never rejects orders, that’s actually suspicious

Why We Trust IC Markets and TickMill Results

IC Markets and TickMill are established brokers with:

- Regulatory oversight: ASIC, FCA, FSA licenses

- Real market conditions: Actual spreads, slippage, and execution

- Thousands of user reviews: Reputation to protect

- Years of operation: Track record of reliability

When an EA performs poorly on these brokers, it means it performs poorly in real market conditions.

Why We Don’t Trust StarTrader Results

StarTrader has:

- No regulatory information: Can’t verify legitimacy

- No online reviews: No way to verify real user experiences

- Unknown market conditions: Spreads, execution quality unclear

- Only one showing good performance: Massive red flag

When an EA performs well ONLY on an unknown broker, it suggests the results aren’t replicable in real trading.

Who Should Buy Remstone EA?

After analyzing everything, here’s our honest assessment of who (if anyone) should consider Remstone:

❌ You Should NOT Buy If:

- You want proven, consistent returns: Live signals don’t support this

- You’re a beginner trader: $2,000 is too much risk on unproven system

- You need monthly profits: Remstone has long losing periods

- You’re on a limited budget: There are better EAs for 1/10th the price

- You want plug-and-play: Requires optimization and monitoring

- You’re risk-averse: Trend-following has significant psychological challenges

- You want verified performance: Only legitimate broker results are poor

⚠️ You MIGHT Consider If:

- You’re an experienced trader who understands trend-following deeply

- You have significant capital ($50,000+) where $2,000 EA cost is negligible

- You can extensively optimize and aren’t relying on default settings

- You want to test the philosophy and have money to experiment

- You’re building a diversified EA portfolio and want trend-following exposure

But even then: Why pay $2,000 for unproven results when there are cheaper trend-following EAs with better verified performance?

✅ You Should DEFINITELY Wait If:

- You’re interested but cautious: Give it 6-12 months to see if live signals improve

- You want more verified signals: Wait for signals on other legitimate brokers

- You’re hoping for price drop: Limited market feedback suggests pricing might adjust eventually

- You want more user reviews: 10 reviews isn’t enough for $2,000 purchase

Better Alternatives – Where to Invest $2,000 Instead

If you have $2,000 to spend on automated trading, here are better options based on verified performance. All recommendations below have proven live results at a fraction of Remstone’s price.

Option 1: Complete EA Portfolio with BETTER Results

Instead of one $2,000 EA showing 6% returns, build a diversified portfolio that actually performs:

🎯 The Smart $2,000 Portfolio

1. Mad Turtle EA – $240

- Strategy: AI-powered trend-following on gold

- Verified results: +45% monthly returns, 5% max drawdown (September 2025)

- Long-term: +86% growth with 9.5% max drawdown on live signal

- Why better: Actual proven AI trend-following, not theoretical. 10x cheaper with 7x better returns

2. DowGold Hedging Scalper EA – $799

- Strategy: Correlation-aware hedging between gold and Dow Jones

- Verified results: Sophisticated multi-pair trading with risk protection

- Features: High-risk and low-risk modes

- Why better: Account flipping with lots of real MyFXBook stats

3. VolumeHedger EA – $199

- Strategy: Volume-based hedging for risk management

- Use case: Portfolio protection and diversification

- Why better: Adds hedge layer to your portfolio without Remstone’s price tag

4. Quantum Queen EA – $399

- Strategy: Gold grid trading approach

- Verified results: Proven performance

- Why better: Lots of excellent reviews

Portfolio Total: $1,600

Savings vs Remstone: $400

Strategy diversity: 4 different approaches

Risk distribution: If one struggles, others compensate

Proven results: Each has verified live signals

Plus you still have $400 left for:

- VPS hosting for 2-3 years

- Additional trading capital

- Trading education courses

- Emergency fund for drawdown periods

Option 2: Single Best Performer + Education

If you prefer focusing on one proven system and building skills around it:

- Mad Turtle EA: $240 (verified +45% monthly, +86% long-term)

- Professional trading course: $500-1,000 on EA optimization and risk management

- VPS service: $200/year for reliable 24/7 operation

- Books and resources: $200-300 on trading psychology

- Trading journal software: $100-200 for tracking and analysis

- Total: $1,240-1,940

Result: Proven EA + knowledge to optimize it properly, still cheaper than Remstone alone.

Option 3: Prop Firm Challenge + Proven EA

Use $2,000 to get funded rather than buying unproven EA:

- FTMO Challenge ($100K account): $1,080

- Mad Turtle EA: $240 to pass challenge

- VPS for reliability: $200/year

- Backup capital for second attempt: $480

- Total: $2,000

Result: If you pass, you’re trading $100K in prop firm capital with proven EA, vs. risking your own money with Remstone’s 6% returns.

Why These Alternatives Are Superior

| Factor | Remstone EA | Mad Turtle EA | 4-EA Portfolio |

|---|---|---|---|

| Price | $2,000 | $240 | $1,600 |

| Verified Returns | 6% annual (IC Markets) | +45% monthly peak, +86% long-term | Diversified across strategies |

| Legitimate Brokers | Poor on IC Markets/TickMill | ✅ Proven on real brokers | ✅ All proven on real brokers |

| Market Adoption | 10 reviews in 7 years | Multiple verified users | All popular, proven systems |

| ROI Timeline | 4+ years to break even | Weeks to months | 1-3 months diversified |

| Risk Distribution | All eggs in one basket | Single strategy | ✅ 4 different strategies |

The Reality Check

Let’s be brutally honest about ROI:

Remstone Scenario ($10,000 account):

- Year 1: $10,000 → $10,600 (6% gain = $600)

- EA Cost: -$2,000

- Net Result: -$1,400 in the hole

- Breakeven: Year 4

Mad Turtle Scenario ($10,000 account):

- Month 1: $10,000 → $14,500 (45% gain = $4,500) – peak performance

- Conservative 12-month: $10,000 → $18,600 (86% gain = $8,600)

- EA Cost: -$240

- Net Result: +$8,360 profit year one

- Breakeven: Weeks

The math is undeniable: You’d need Remstone to perform 14x better than current live results just to match Mad Turtle’s proven returns, and even then you’d still overpay by $1,760.

Where to Get These EAs

All recommended alternatives are available at CheaperForex with significant discounts compared to MQL5 marketplace:

- Mad Turtle EA – $240 (Save $560 vs MQL5’s $799)

- DowGold Hedging Scalper EA – $799

- VolumeHedger EA – $199

- Quantum Queen EA – $399

All include:

- ✅ Lifetime updates

- ✅ Installation support

- ✅ Official versions from developers

- ✅ Verified live performance

- ✅ 70% discount vs MQL5 pricing

Frequently Asked Questions

General Questions

Q: Is Remstone EA a scam?

A: No, it’s not a scam. The developer is legitimate with real background in finance. However, the live performance doesn’t justify the $2,000 price tag, and there are suspicious elements (great performance only on unknown broker, deposit additions). It’s more likely an overfitted system than an outright scam.

Q: Why does it perform well on StarTrader but poorly on IC Markets?

A: This is a red flag. Legitimate EAs should perform consistently across different brokers. When performance is great only on an unknown broker, it suggests either: (1) settings are optimized for that specific broker’s conditions, (2) the broker has artificial conditions that don’t reflect real markets, or (3) results aren’t replicable for customers.

Q: Should I wait for the live signals to improve before buying?

A: Yes, absolutely. Give it 6-12 months to see if IC Markets and TickMill signals show sustained profitability. If the developer can demonstrate consistent 20%+ annual returns on multiple legitimate brokers, then reassess. Until then, there are better options.

Q: Is trend-following just not working right now?

A: Trend-following strategies can have long dry periods, so this is possible. However, there are other trend-following EAs showing better performance in the same market conditions. If it’s just a bad period for trend-following, we’d expect all trend-following systems to struggle equally. The fact that Remstone shows 6% while others show 20-30% suggests it’s not just market conditions.

Technical Questions

Q: What’s the minimum account size?

A: Developer recommends $500 minimum, but their own signals run $1,000-$10,000. Given the $2,000 EA cost, you’d need at least $10,000 trading capital to make the investment worthwhile from an ROI perspective.

Q: Does it require VPS?

A: Yes, strongly recommended. The EA trades across multiple assets on H1 timeframe and needs 24/7 operation. Missing trades due to connection issues would make performance even worse.

Q: Can I use it on MT4?

A: No, MT5 only. This is clearly stated in the product description.

Q: What broker should I use?

A: Based on the live signals, it performs poorly on legitimate brokers (IC Markets, TickMill) and well on unknown brokers (StarTrader). This is concerning. If you do buy it, test thoroughly on demo with your intended broker before risking real money.

Q: How many activations do I get?

A: Typically 5 activations per license, meaning you can install it on 5 different machines under your MQL5 account. For a $2,000 EA, this is quite restrictive – if your computer malfunctions multiple times, you’ll burn through activations quickly. Many cheaper EAs offer 5-10 or even unlimited activations.

Performance Questions

Q: Why do they keep adding deposits to the signals?

A: This is one of our major red flags. Adding deposits after launch typically serves to make drawdown look less severe. For example, if an account drops 20% from initial deposit, adding money makes the percentage drawdown appear smaller. It’s an accounting trick that hides true performance.

Q: How long until it becomes profitable?

A: Unknown. The IC Markets signal has been running since early 2025 and shows only 6% growth. Trend-following can have long drawdown periods (3-6 months), but we’re well past that point. There’s no guarantee it will become profitable.

Q: What’s a realistic monthly return?

A: Based on live signals on legitimate brokers: 0.5% monthly (6% annually). This is far below what you’d need to justify the $2,000 cost. The StarTrader signal shows much higher returns, but we can’t verify that broker’s legitimacy.

Q: Can I get a refund if it doesn’t work?

A: MQL5 marketplace has a refund policy, but check the specific terms. Typically refunds are only available for technical issues (EA doesn’t run), not for unprofitable results. This is why testing on demo first is critical.

Comparison Questions

Q: How does it compare to other trend-following EAs?

A: Other trend-following EAs at $300-500 show better verified performance on legitimate brokers. Remstone’s advantage is the developer’s institutional background and sophisticated philosophy, but philosophy doesn’t pay bills. We’d choose proven performance over credentials.

Q: Is it better than manual trend-following?

A: If you know how to trade trend-following manually, you’d likely get better results than Remstone’s current 6% annually. The advantage of EAs is removing emotion and operating 24/7, but only if the EA is actually profitable.

Q: What about the Darwinex ARF signal the developer ran?

A: The developer’s Darwinex experience is impressive (€750K raised), but we can’t verify if that signal used the same strategy as Remstone EA. Past performance in a different system doesn’t guarantee current EA performance. Judge the EA on its own live results, not the developer’s resume.

Final Verdict & Rating

After comprehensive analysis of live signals, developer background, trading philosophy, and price-to-performance ratio, here’s our final assessment:

Overall Rating: 2.5/5 ⭐⭐½

| Category | Rating | Comments |

|---|---|---|

| Live Performance | 1/5 ⭐ | 6% annual on IC Markets, -2% on TickMill. Unacceptable. |

| Developer Credibility | 4/5 ⭐⭐⭐⭐ | Legitimate background, institutional experience, responsive support. |

| Trading Philosophy | 5/5 ⭐⭐⭐⭐⭐ | Excellent understanding of professional trend-following concepts. |

| Price to Value | 1/5 ⭐ | $2,000 is absurdly expensive for 6% annual returns. |

| Transparency | 2/5 ⭐⭐ | Suspicious deposit additions, good performance only on unknown broker. |

| Documentation | 4/5 ⭐⭐⭐⭐ | Good explanation of philosophy and settings. Clear recommendations. |

| Market Adoption | 1/5 ⭐ | Only 10 reviews in 7 years. Limited market feedback and community buzz. |

The Bottom Line

Remstone EA is a case of excellent theory meeting poor execution.

The developer clearly knows what they’re talking about when it comes to trend-following. The philosophy is sound, the background is legitimate, and the educational content is valuable. If this was a $200 EA, we might say “worth experimenting with despite mixed results.”

But at $2,000 with live performance showing only 6% annual returns on legitimate brokers, we cannot recommend it.

Key Takeaways

✅ What Remstone Gets Right:

- Legitimate developer with institutional experience

- Solid trend-following philosophy backed by research

- Multi-asset diversification approach

- Good documentation and support

- Educational value in understanding professional trading

❌ What Remstone Gets Wrong:

- Terrible live performance on verified legitimate brokers (6% annually)

- Good performance only on unknown, unverifiable broker

- Suspicious deposit additions to mask poor results

- $2,000 price tag completely unjustified by results

- Only 10 reviews in 7 years (limited market feedback)

- Backtest-to-live performance gap suggests overfitting

Our Recommendation

DO NOT BUY Remstone EA at the current price with current live performance.

Instead, consider these proven alternatives:

✅ Get Better Results for Less Money:

Best Single EA: Mad Turtle EA – $240 with verified +45% monthly and +86% long-term returns

Best Portfolio: Get 4 proven EAs for $1,230 total:

Result: Save $400, get diversified strategies, verified performance on legitimate brokers.

Revisit Remstone in 6-12 months if:

- IC Markets signal shows sustained 20%+ annual growth

- TickMill signal turns consistently profitable

- More verified signals appear on other legitimate brokers

- Price drops to $300-500 range

- User reviews increase significantly with positive feedback

Until then: Your $2,000 is better invested in proven EAs with verified track records, trading education, or a diversified portfolio of multiple systems.

Who This Review is For

We wrote this review for traders who:

- Value honesty over hype

- Want evidence-based analysis, not marketing copy

- Understand that protecting your $2,000 matters more than hurting feelings

- Appreciate when reviewers call out red flags instead of promoting everything

If you’re the developer reading this: we respect your knowledge and background. But the live results speak for themselves. Fix the performance on legitimate brokers, stop adding deposits to signals, and bring the price in line with results. Then we’ll happily update this review.

💡 Learn From This Review

Even if you never considered buying Remstone, this review teaches important lessons:

- Always check live signals on legitimate brokers before buying any EA

- Watch for deposit additions which mask poor performance

- Be suspicious when performance is good only on unknown brokers

- Backtest results mean nothing if live performance contradicts them

- Developer credentials don’t guarantee EA profitability

- Market adoption (number of buyers) tells you what experienced traders think

- Price should reflect results, not developer’s resume

Disclaimer: This review is based on publicly available information from MQL5 marketplace including live signals, product descriptions, and user reviews as of October 2025. All performance data is from verified MQL5 signals. We are not affiliated with the developer and receive no compensation for this review. Past performance does not guarantee future results. Always test EAs on demo accounts before risking real money.

Last updated: October 25, 2025 | Remstone EA Version: Current as of review date | Price: $2,000 USD

Was this review helpful? Share it with traders who are considering Remstone EA so they can make informed decisions based on real evidence.