Zenox EA MT5 Review – Proven Performance with +157% Profit

Last updated: February 2026 • 48-week performance analysis

🚀 Ready to Buy Zenox EA? Save 60% vs MQL5

Available from $599.95 at CheaperForex (MQL5 price: $1,499.99).

✅ Same official EA with lifetime updates

✅ Full installation support included

✅ Extra 20% off with crypto payment

30 Second Overview of Zenox EA

Zenox EA is a multi-pair swing trading robot with genuine machine learning training on 25 years of historical data — the longest training period we’ve seen in any retail EA. It trades 16 currency pairs plus gold from a single chart with trend-following logic, predefined stop losses, and no dangerous strategies.

What we’re working with: An AI-powered swing trader that uses reinforcement learning algorithms trained on data from the year 2000 to present. Every trade uses pending orders (buy/sell stops) with predefined stop loss and take profit. No martingale. No grid. No averaging down. The developer spent multiple weeks training the AI on a dedicated server — not hours clicking “optimize” in Strategy Tester.

The headline numbers: 141% growth over 48 weeks on IC Markets with an 82% win rate and 21.6% max equity drawdown. The account has nearly doubled in under a year of live trading. Meanwhile, the 25-year backtest from 2000-2025 demonstrates the algorithm maintained profitability through every major market event — from the dot-com crash to post-pandemic inflation.

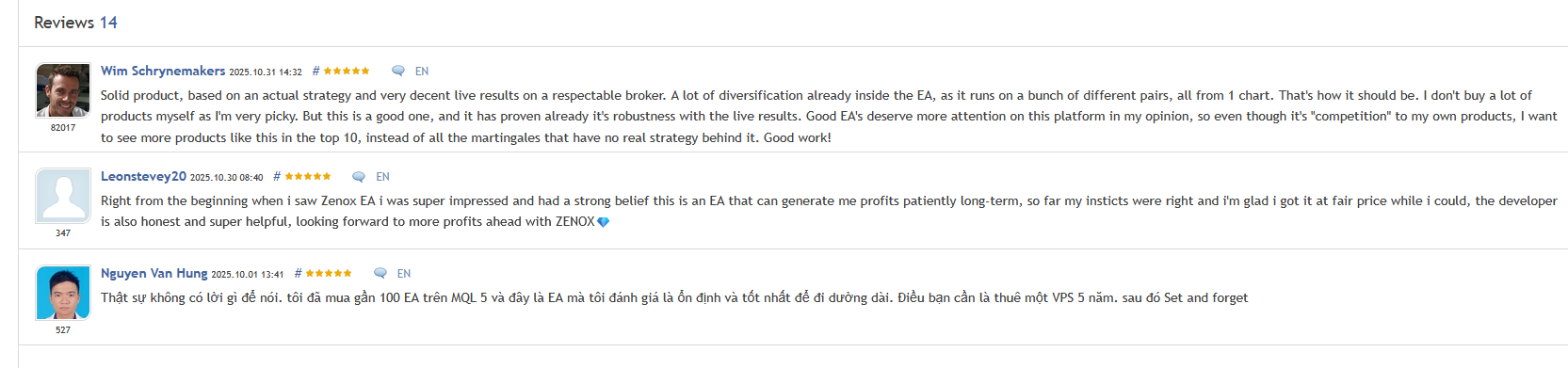

The trust factor: 25 verified MQL5 reviews at 4.63 stars, 35 purchases per month, and 3,153 demo downloads. The developer is transparent — the live signal runs 24/7 on IC Markets for anyone to verify in real time.

Our call: Zenox represents the gold standard for evidence-based trading. The 25-year backtest provides unprecedented historical validation, and the live signal has proven the strategy works with real money. Like any swing trading system, there are periods of drawdown — that’s the nature of holding positions for days or weeks. What matters is that after 48 weeks of live trading, the account is up 141%. The machine learning approach is genuine, the risk management is disciplined, and the 16-pair diversification gives it continuous opportunity.

Rating: 4.5/5 ⭐⭐⭐⭐½ — Exceptional Evidence Base, Proven ML Strategy

What Makes Zenox Different

The EA market is full of products claiming “AI” or “machine learning” in their descriptions. Most are using optimized indicator parameters and calling it intelligence. Zenox is fundamentally different — and the proof is in the training methodology.

25 years of training data. The developer trained Zenox’s AI on market data starting from the year 2000. That means the algorithm learned from the dot-com crash (2000-2002), the global financial crisis (2008-2009), the Brexit shock (2016), the COVID-19 crash (2020), post-pandemic inflation (2021-2022), and aggressive rate hiking cycles (2023-2025). An EA that maintains profitability across these wildly different market regimes demonstrates fundamental soundness — not curve-fitting to recent data.

Real reinforcement learning, not parameter optimization. The developer states that training took multiple weeks on a dedicated server using machine learning techniques followed by reinforcement learning. This is how professional quantitative firms validate strategies — exposing the algorithm to every possible market condition and letting it learn optimal behavior through trial and error. Critically, the developer notes that multiple parameter configurations worked well, which is a hallmark of genuine robustness. Curve-fitted EAs break when you change one setting. Robust EAs work across a range of settings.

The comparison tells the story:

| Typical “AI” EAs | Zenox (Real ML) |

|---|---|

| Hours of Strategy Tester optimization | Weeks of server-based reinforcement learning |

| Trained on 2-5 years of data | Trained on 25 years of data (2000-2025) |

| Finds one “best” parameter set | Multiple parameter sets work (robust) |

| Breaks when markets change | Profitable across 6 different market regimes |

| Live results often disappoint | 141% live growth in 48 weeks on IC Markets |

No dangerous strategies. Every Zenox trade uses a pending order (buy stop or sell stop) which means the market must confirm the direction before entry. Every position has a predefined stop loss and take profit — no trailing stop, which actually reduces slippage risk. The EA allows maximum one buy and one sell per pair at any time. This disciplined approach is why the strategy survived 25 years of backtesting without a catastrophic drawdown.

The Developer: Peter Deschepper

Peter Omer M Deschepper is a Belgian developer behind Zenox and GoldenTron X on MQL5. His approach to Zenox is notably methodical — rather than rushing to market with a quick optimization, he invested weeks of server time in proper machine learning training and validated across 25 years of data before publishing.

What stands out about Deschepper is his pricing strategy: the MQL5 price increases by 10% every time the live signal grows by 10%. This does two things — it rewards early adopters and it naturally limits the number of users to protect strategy effectiveness. The current price of $1,499.99 reflects the signal’s growth from its launch, with a final cap at $2,999.

He’s responsive in the MQL5 comments section (51+ comments) and provides a downloadable user manual. Multiple reviewers praise his helpfulness and prompt responses to questions. He also recommends specific risk settings for different account sizes and prop firm configurations — showing he understands that one-size-fits-all settings are a recipe for blown accounts.

💡 Developer Warning

The developer explicitly states: “Be aware: Zenox is only available via the MQL5 platform. If it is being sold on any other website, it is a scam.”

Important context: CheaperForex purchases official MQL5 activations at full price and resells them at a discount. The EA is activated directly through MQL5’s system — it’s not a cracked file. This is the same genuine product with the same automatic updates.

Live Performance: 48 Weeks on IC Markets

The developer runs a transparent live signal on IC Markets — one of the most trusted regulated brokers in the forex industry. Here’s what 48 weeks of real-money trading looks like:

| Metric | Value |

|---|---|

| Growth | 141% in 48 weeks |

| Win Rate | 82.2% profitable trades |

| Max Equity Drawdown | 21.6% |

| Profit Factor | 1.38 |

| Average Holding Time | 13 days (true swing trading) |

| Max Consecutive Wins | 16 trades in a row |

| Broker | IC Markets (regulated, trusted) |

| Trading Activity | 96.9% (near-continuous) |

| Algo Trading | 100% automated |

📊 What 48 Weeks Actually Proves

The account has nearly doubled in under a year. 141% growth means a $1,000 starting balance is now worth $2,410. An 82% win rate across almost a year of live trading proves the machine learning generalised well beyond the training data.

The 13-day average holding time confirms this is genuine swing trading — not scalping dressed up with a fancy name. Positions are held for days or weeks, targeting substantial moves. This means there will be periods where open positions are in drawdown before reaching their targets. That’s not a bug — it’s how swing trading works.

The critical insight: After 48 weeks through varying market conditions — including trending, ranging, and volatile periods — Zenox is still profitable. That’s a meaningful validation of the 25-year ML training.

⚠️ Understanding Swing Trading Drawdowns

Zenox holds positions for an average of 13 days. During that time, open positions will naturally fluctuate — sometimes significantly — before hitting their targets. The 21.6% equity drawdown reflects these open-position fluctuations, not realised losses.

This is fundamentally different from a scalper showing 20% drawdown. Swing traders accept temporary paper drawdowns as the cost of capturing larger moves. The key metric is that after 48 weeks, the strategy is up 141% net. If you can’t tolerate watching positions swing through temporary unrealised losses, swing trading isn’t for you — regardless of which EA you use.

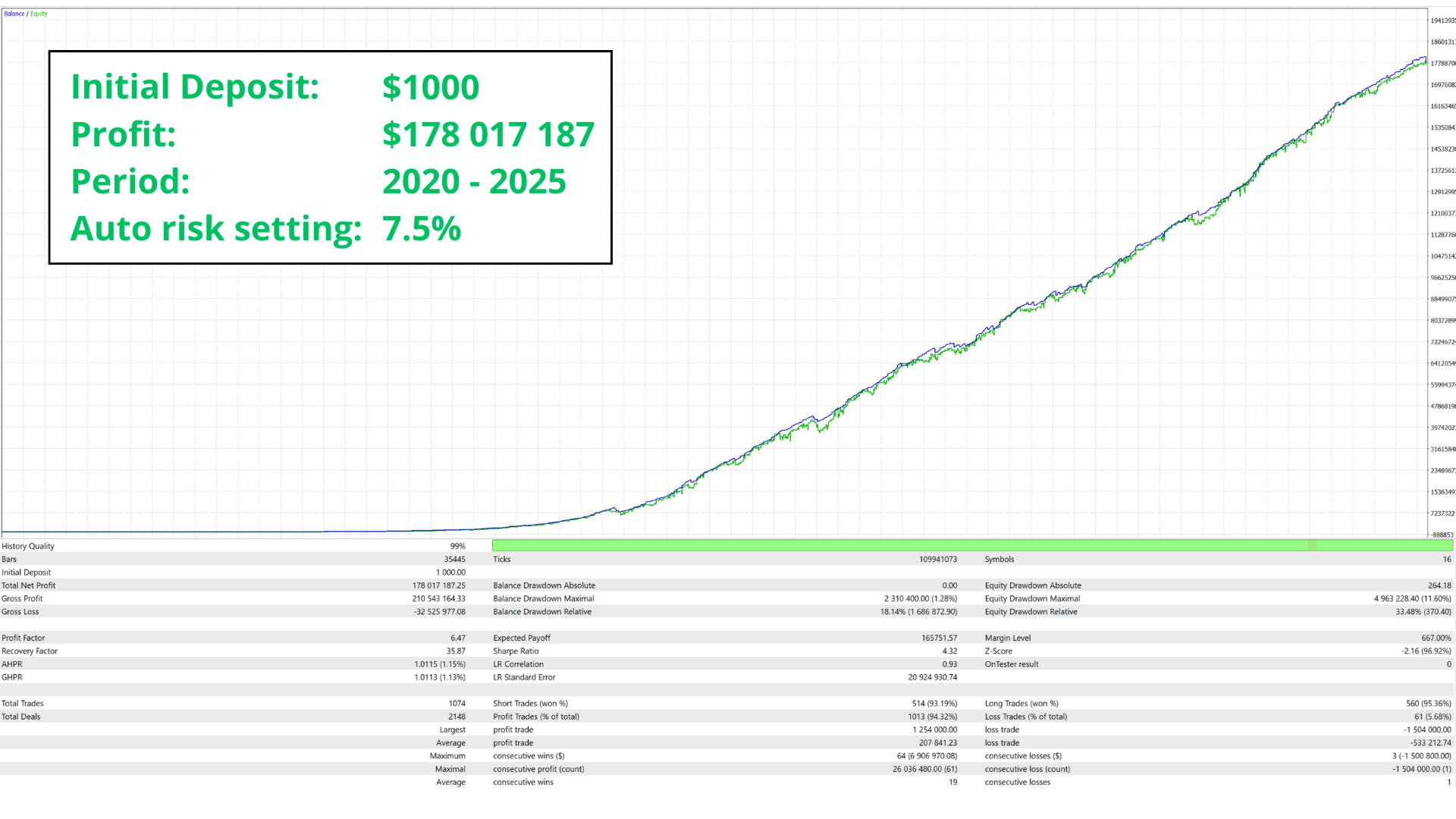

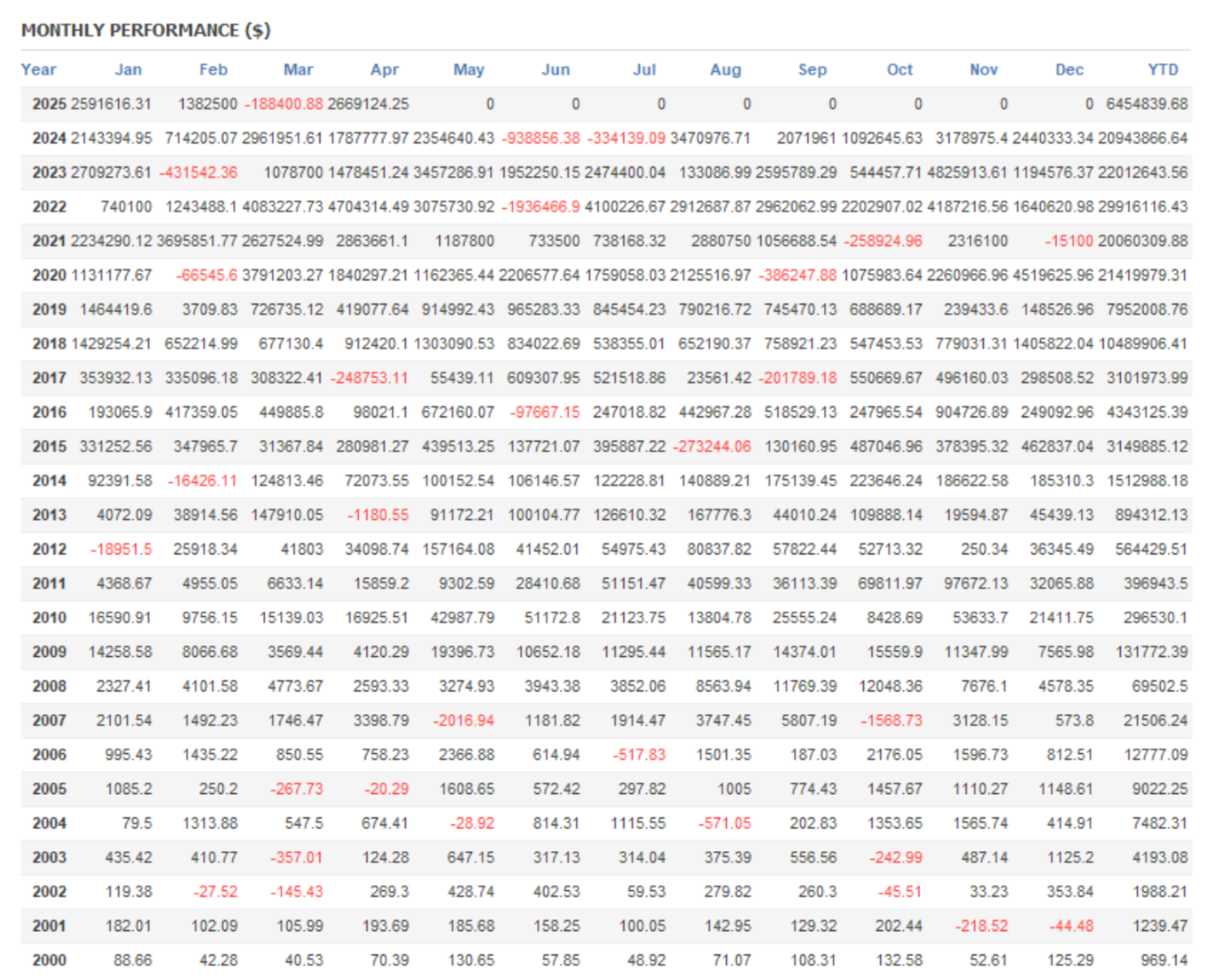

The 25-Year Backtest: Unprecedented Historical Proof

Yes, the backtest shows astronomical compound growth numbers. No, you won’t replicate them exactly. But here’s what 25 years of data actually validates:

The backtest runs from 2000 to 2025 using real tick data. During that period, the algorithm traded through every conceivable market environment: the tech bubble collapse, the 2008 financial crisis, European sovereign debt crises, Brexit, COVID-19, aggressive global rate hikes, and everything in between. The algorithm maintained profitability across all of them.

What the backtest proves and what it doesn’t:

✅ What It Proves

• Algorithm is profitable long-term

• Risk management prevents blowup

• Strategy works across different regimes

• Not curve-fitted to recent data

• ML training generalised successfully

⚠️ What It Doesn’t Prove

• You’ll make millions (compound math ≠ reality)

• Future markets will behave like past markets

• Every month will be profitable

• Drawdowns won’t happen

• Execution will match backtested conditions

The realistic takeaway: The backtest’s extraordinary compound numbers are theoretical. What matters is that the core algorithm demonstrated consistent profitability over 25 years across every major market regime — and the live signal’s 141% growth in 48 weeks confirms the backtest wasn’t fiction. Realistic expectations: 50-150%+ annual returns depending on risk settings and market conditions.

Ready to Get Started?

Zenox EA — $599.95 at CheaperForex (MQL5 price: $1,499.99)

✅ 25-year backtest | ✅ 141% live growth (48 weeks) | ✅ 82% win rate

The 16-Pair Portfolio Approach

Most EAs trade one or two pairs. Zenox trades 16 instruments simultaneously from a single chart — and this diversification is one of its greatest strengths.

The full portfolio:

USD Majors: EUR/USD, GBP/USD, AUD/USD, NZD/USD, USD/CAD, USD/CHF, USD/JPY

Crosses: EUR/GBP, EUR/JPY, GBP/AUD, GBP/JPY, AUD/CHF, AUD/NZD, NZD/CAD, NZD/JPY

Commodity: XAU/USD (Gold)

Why 16 pairs matters: When EUR/USD consolidates, GBP/JPY might be trending. When gold ranges, NZD/USD may offer opportunities. By spreading across 16 instruments, Zenox captures trends wherever they emerge while reducing dependency on any single pair. The live signal data shows trades distributed across all instruments — gold, majors, and crosses all contributing to the overall result.

The one-chart setup is also a practical advantage. You don’t need 16 separate charts, 16 separate EAs, or 16 different configurations. Attach Zenox to one chart (typically EUR/USD H1) and it manages everything internally. You can enable or disable individual pairs if you prefer a smaller portfolio.

Settings & Configuration Guide

| Parameter | Default | Purpose |

|---|---|---|

| Auto risk setting | 5% | Risk per trade as % of balance. Lower for conservative (1-3%), higher for aggressive (7.5%+) |

| Max open positions | 16 | Total exposure limit. Reduce to 8-10 for prop firms |

| Fixed lot size | 0.0 | If >0, disables auto risk. Use for precise position sizing |

| Use equity for risk | False | Calculates risk from equity instead of balance — useful with multiple EAs |

| Fixed balance amount | 0 | Useful for regular withdrawals — risk stays consistent |

| Use randomiser | False | Enable ONLY for prop firms to avoid identical trade detection |

| Enable/disable pairs | All enabled | Toggle individual pairs on/off per your preference |

| Symbol prefix/suffix | Empty | For brokers using non-standard symbol names (e.g., “mEURUSD”) |

Recommended configurations:

🛡️ Conservative (Prop Firms)

Auto risk: 1-2%

Max positions: 8-10

Pairs: Majors only

Randomiser: TRUE

Expected: 30-60% annually

⚖️ Balanced (Recommended)

Auto risk: 3-5%

Max positions: 16

Pairs: All 16

Randomiser: FALSE

Expected: 80-150% annually

🚀 Aggressive (Growth)

Auto risk: 7.5-10%

Max positions: 16

Pairs: All 16

Randomiser: FALSE

Expected: 150-250%+ annually

Who Should Consider Zenox

✅ Good Fit

• Swing trading enthusiasts who understand multi-day holds

• Evidence-based traders who value 25 years of backtested proof

• Set-and-forget investors comfortable with temporary drawdowns

• Portfolio diversifiers wanting multi-pair exposure

• ML/AI believers who appreciate genuine training methodology

• Prop firm traders (with conservative settings)

⚠️ Not Right For

• Scalpers and day traders expecting quick in-and-out trades

• Impatient traders who can’t watch positions held for 13+ days

• Very small accounts under $750

• Manual interventionists who close trades early

• Traders who can’t tolerate 20%+ equity swings

• Anyone without a VPS for 24/7 uptime

How to Download Zenox EA MT5

Zenox is an MQL5 marketplace product. There are two ways to get it:

Option 1: Buy Direct from MQL5 Marketplace

Go to the official Zenox EA product page on MQL5 and purchase at full price ($1,499.99). You’ll get 10 activations and direct support from the developer. This is the premium option if budget isn’t a concern.

Option 2: Get It Through CheaperForex (60% Off)

Purchase at CheaperForex for $599.95 and receive the same official EA via MQL5 activation. CheaperForex purchases full-price licenses and activates them on your MT5 terminal through a 2-minute remote session. Same product, same updates, same functionality — just 60% less.

MQL5 vs CheaperForex: Quick Comparison

| Feature | MQL5 Direct | CheaperForex |

|---|---|---|

| Price | $1,499.99 | $599.95 (extra 20% off with crypto) |

| Product | Official MQL5 activation | Same official MQL5 activation |

| Updates | Automatic via MT5 | Same automatic updates via MT5 |

| Activations | 10 activations | 1 activation (1 VPS/computer) |

| Installation | Self-install | Free installation support included |

| VPS | Not included | Optional free 1-month VPS setup |

| Broker accounts | Unlimited | Unlimited (within same MT5 terminal) |

| Refund | MQL5 policy | 7-day money-back before activation |

| Payment | MQL5 payment methods | Cards, Apple Pay, Google Pay, Amazon Pay, Crypto |

How CheaperForex activation works: After purchase, the CheaperForex team schedules a brief remote session (AnyDesk or UltraViewer) to activate the EA on your MT5 terminal. The process takes approximately 2 minutes. You stay in full control throughout and can disconnect at any time. Alternatively, you can provide VPS credentials and they’ll handle it for you. Once activated, the EA is yours — no further involvement from CheaperForex required.

Minimum requirements:

• MetaTrader 5 terminal (any broker)

• Minimum $750 account balance (at 5% default risk)

• VPS highly recommended for 24/7 uptime (swing positions need continuous connection)

• Hedge mode enabled on your account

Frequently Asked Questions

Can I download Zenox EA for free?

No. Zenox is an MQL5 marketplace product with built-in DRM protection. It cannot be cracked or pirated — the .ex5 format used by MQL5 marketplace products doesn’t allow it. Any site claiming to offer a free Zenox download is distributing fake files or malware. The developer has explicitly warned that Zenox is only available through MQL5. CheaperForex offers the same genuine product at 60% off through official MQL5 activation.

Is the machine learning real or just marketing?

It’s real. The developer trained Zenox using machine learning techniques followed by reinforcement learning on a dedicated server over multiple weeks. The 25-year training dataset (2000-2025) is unprecedented for a retail EA. Crucially, the developer notes that multiple parameter configurations worked well during training — a hallmark of genuine robustness that curve-fitted EAs cannot replicate. The 48-week live signal validates that the ML training generalised to real market conditions.

Why is there drawdown on a profitable EA?

Zenox is a swing trader that holds positions for an average of 13 days. During that time, open positions naturally fluctuate before reaching their targets. The equity drawdown reflects these temporary paper fluctuations — not realised losses. Think of it like buying a stock that dips 10% before rallying 30% to your target. The dip feels uncomfortable, but the outcome is profitable. After 48 weeks, the account is up 141% despite normal swing trading fluctuations along the way.

Is CheaperForex legitimate?

Yes. CheaperForex has operated since 2019, served over 28,000 customers, and maintains a 4.5-star “Excellent” rating on Trustpilot with verified reviews. They activate the same official MQL5 product — not a cracked or modified version. If you change your mind before activation, they offer a full cash refund within 7 days.

Can Zenox be used for prop firm challenges?

Yes, with proper configuration. Use 1-2% risk, enable the randomiser (to avoid identical trade detection), limit to 8-10 max positions, and consider restricting to majors only. The developer specifically includes prop firm guidance. With conservative settings, expect 30-60% annual returns with controlled drawdown — well within most prop firm rules.

What’s the minimum account balance?

The developer recommends $750 minimum with the default 5% auto risk setting. However, $1,000-$2,000 provides more flexibility and smoother equity curves. Larger accounts can use lower risk percentages (1-3%) for more conservative growth with reduced drawdown. Adjust the risk setting to match your account size and risk tolerance.

What broker should I use?

Zenox works with any broker and any account currency. The developer uses IC Markets for the live signal, which proves it works well on that platform. For optimal performance, use a VPS (the developer recommends MQL5 VPS). Zenox is not sensitive to high spreads or slippage, making it compatible with most brokers. Just make sure hedge mode is enabled on your MT5 account.

Our Assessment

Verdict: The Most Evidence-Based EA We’ve Reviewed

What Zenox gets right:

- Unmatched historical validation: 25-year backtest from 2000 is unprecedented in retail EAs

- Real ML training: Weeks of server-based reinforcement learning, not hours of optimisation

- Live proof: 141% growth in 48 weeks on IC Markets — the algorithm works with real money

- Portfolio diversification: 16 pairs from a single chart is genuinely innovative

- Disciplined risk: No martingale, no grid, predefined SL/TP on every trade

- Developer transparency: Public live signal, downloadable manual, responsive support

What to be aware of:

- Swing trading volatility: 13-day average holds mean positions will swing through drawdowns

- Patience required: This is not a daily-profit machine — some weeks/months may underperform

- Relatively new: Published March 2025; still building long-term live track record

- Price escalation: MQL5 price increases with signal growth — early adoption matters

Rating: 4.5/5 — Zenox delivers the strongest evidence base of any EA we’ve reviewed. The 25-year backtest provides unprecedented confidence, and the 141% live growth over 48 weeks confirms the strategy works in real conditions. The swing trading approach requires patience and tolerance for temporary drawdowns, but the long-term trajectory is clearly profitable. At 60% off MQL5 pricing, it represents strong value for serious traders who understand swing trading dynamics.

Get Zenox EA — 60% Off MQL5 Price

25 Years of ML Training — 16-Pair Swing Trading — No Grid, No Martingale

MQL5 Price: $1,499.99

CheaperForex: $599.95

Extra 20% off with crypto payment

Official MQL5 license • Lifetime updates • Installation support included

Looking for More Options?

- AI Gold Sniper EA — GPT-4o powered gold trading with 542% verified growth

- Our Vetted EA Recommendations — Products with extended live validation

- All MT5 Expert Advisors — Browse our complete premium EA collection

Disclaimer: Forex trading carries substantial risk. Zenox EA has produced exceptional backtest and live results but past performance doesn’t guarantee future results. Swing trading involves holding positions for days or weeks, during which time equity may fluctuate significantly. Only trade with capital you can afford to lose. We receive compensation for sales made through our links.

Review methodology: This assessment is based on 48 weeks of verified MQL5 signal data on IC Markets, 25 verified customer reviews, 25-year backtest analysis, and developer track record evaluation. We have not received payment from the developer for this review.

Last verified: February 2026 | Signal duration: 48 weeks | Developer: Peter Omer M Deschepper