Aura Ultimate EA Review: We Tested Stanislav Tomilov’s Flagship Gold Robot — Here’s Our Honest Take

Last updated: December 26, 2025 • 16-week live performance analysis

TLDR: What We Think…

After analyzing 16 weeks of verified live trading, 84 customer reviews, and the developer’s 8-year track record, we’re ready to give our verdict on Aura Ultimate EA.

What convinced us: This isn’t another fly-by-night gold robot. Developer Stanislav Tomilov has been building profitable EAs since the mid-2010s, and his $10,000 test account has grown to nearly $28,000 in under four months. The 80% win rate isn’t inflated backtest nonsense — it’s happening on real money, publicly tracked.

What gave us pause: The “recovery mode” is essentially controlled martingale. It works, but newer traders might not realize they’re increasing risk after losses. At $800 retail, it’s not cheap either.

Our call: This is one of the few gold EAs we’d actually put our own money on. Stanislav has earned trust through years of transparent performance. Just disable recovery mode if you’re risk-averse.

Rating: 4.5/5 ⭐⭐⭐⭐½

Why We Decided to Review Aura Ultimate

We get asked about gold EAs constantly. It’s the wild west out there — for every legitimate robot, there are fifty scams promising “guaranteed profits” before disappearing with your money.

So when Aura Ultimate landed on our radar, we were skeptical. Another neural network EA claiming to crack gold trading? We’ve heard that pitch a hundred times.

But then we dug into the developer’s history. Stanislav Tomilov isn’t some anonymous seller with one product. He’s been on MQL5 for years, maintaining multiple EAs with genuine customer bases. His Aura Black Edition has 49 reviews. Aura Neuron has 58. Vortex Gold has 26 five-star ratings.

That kind of track record doesn’t happen by accident. Scammers don’t stick around for years — they grab cash and vanish. Stanislav is still here, still updating his products, still answering customer messages within hours.

That’s what made us take Aura Ultimate seriously. Let’s break down what we found.

Who Built This Thing? (And Why It Matters)

In the EA world, the developer matters as much as the product. A great strategy from a sketchy seller is worthless if they disappear next month.

Stanislav Tomilov’s portfolio tells a story:

He’s not a one-hit wonder. The man has built an entire ecosystem of gold-focused trading systems over multiple years. His products have accumulated hundreds of verified reviews on MQL5 — not testimonials on his own website, but feedback from real buyers on a platform he doesn’t control.

More importantly, he’s still actively maintaining older products. Aura Black Edition from 2020? Still getting updates. That matters because forex markets evolve. An EA that worked in 2020 won’t necessarily work in 2025 unless someone’s actively optimizing it.

The support factor: We read through dozens of MQL5 comments and reviews. The same theme kept appearing — Stanislav responds fast, provides personalized setup help, and actually fixes issues when customers report them. One reviewer mentioned getting a custom SET file based on their specific account size within hours of purchase.

This level of support is rare. Most EA sellers treat post-purchase support as an afterthought. Stanislav treats it as part of the product.

The Live Results: 16 Weeks of Real Money Trading

Backtests are easy to fake. Live results on third-party tracked accounts? Much harder.

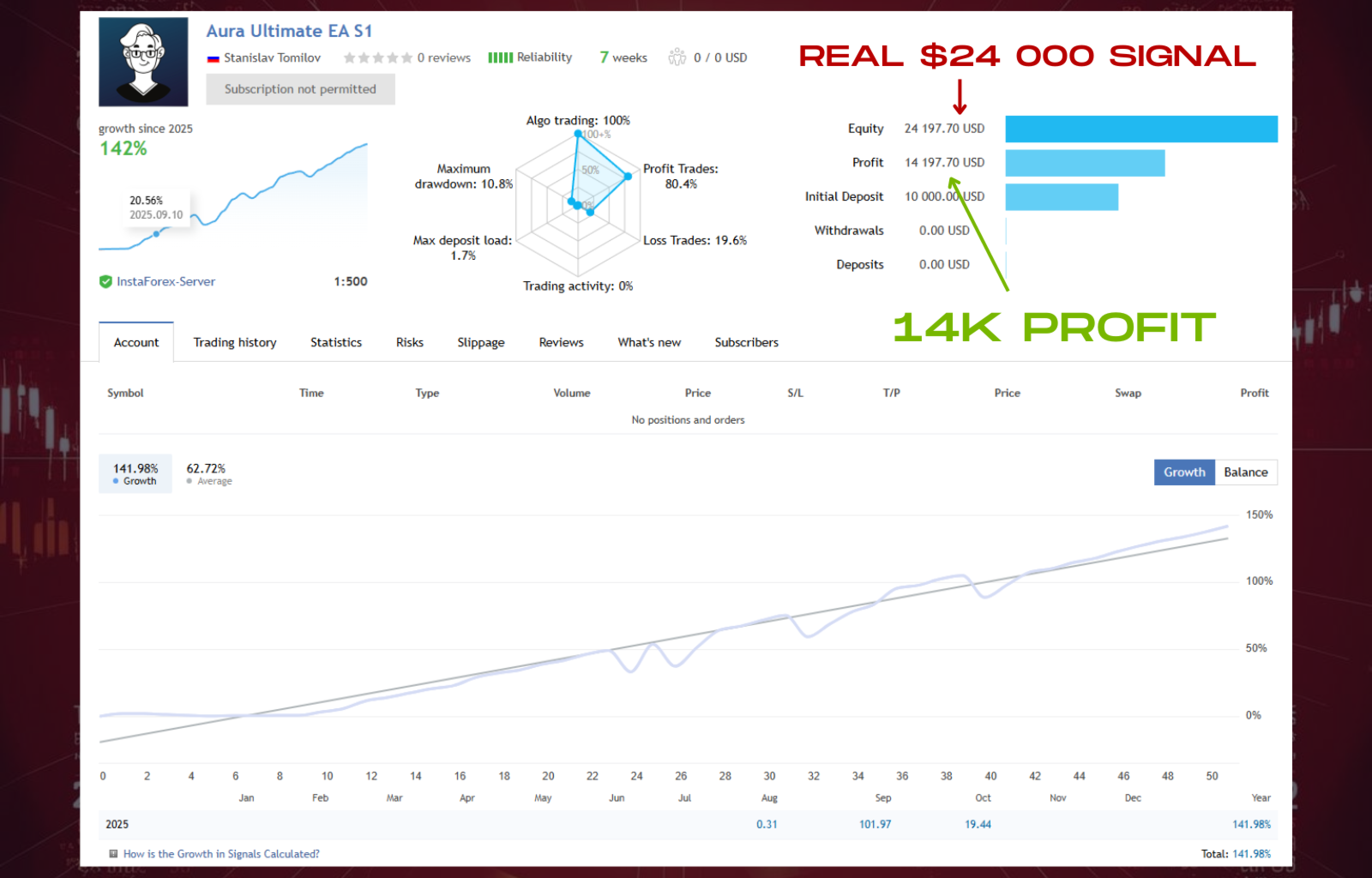

Aura Ultimate has been running on a verified $10,000 account since October 9, 2025. Here’s what’s happened since:

📈 Primary Signal Performance

The account started with ten grand. Sixteen weeks later, it’s sitting at $27,929 — that’s 179% growth with no deposits or withdrawals.

The numbers that matter:

Out of 102 trades, 82 were winners. That’s not a typo — an 80% win rate on live gold trading. The profit factor (gross profits divided by gross losses) comes in at 1.79, meaning for every dollar lost, the system made $1.79.

The number you need to watch:

Maximum drawdown hit 23.74%. That’s significant. If you started with $10K, at the worst point you’d have been down about $2,400 before recovering. Not catastrophic, but not comfortable either.

What this tells us:

The strategy has genuine edge. You don’t maintain 80% accuracy over 100+ trades by luck. But the drawdown shows this isn’t a “set and forget while you sleep peacefully” system. You need to be comfortable with volatility.

Here’s the thing though — that’s the aggressive signal. Stanislav also runs a conservative version:

🛡️ Low-Risk Signal Performance

Different account, same EA, conservative settings. Eight weeks of data showing 8% growth with only 3% maximum drawdown and a 90% win rate.

Why this matters:

It proves the underlying strategy works across risk levels. The aggressive account isn’t just getting lucky with oversized bets — the edge exists whether you’re risking 0.5% or 3% per trade.

Who should care:

Prop firm traders. FTMO and similar challenges have strict drawdown limits (usually 5-10%). A 3% max DD signal suggests Aura Ultimate can pass challenges without modifications.

The Recovery Mode Question (Read This Before Buying)

⚠️ Let’s Talk About the Elephant in the Room

Aura Ultimate includes something called “recovery mode.” When enabled, the EA increases position size after losses to recover faster.

Let’s be direct: This is a form of martingale. It’s controlled — not the reckless “double until you win” variety — but it’s still increasing risk when you’re already in a losing streak.

The developer is transparent about this. He explains it in the documentation and provides easy toggles to disable it completely. But we’ve seen reviews from users who didn’t understand what they were enabling.

Our guidance:

If you’re new to EAs: Turn recovery OFF. Learn how the base strategy performs before adding complexity.

If you’re trading prop firms: Turn recovery OFF. Period. One bad recovery sequence could blow your drawdown limit.

If you’re an experienced trader with capital to spare: Recovery can accelerate gains, but understand you’re accepting higher risk of larger drawdowns.

The 179% return on the primary signal uses recovery mode. The 3% drawdown conservative signal does not. Both are profitable — choose based on your risk tolerance, not greed.

What 84 Buyers Are Actually Saying

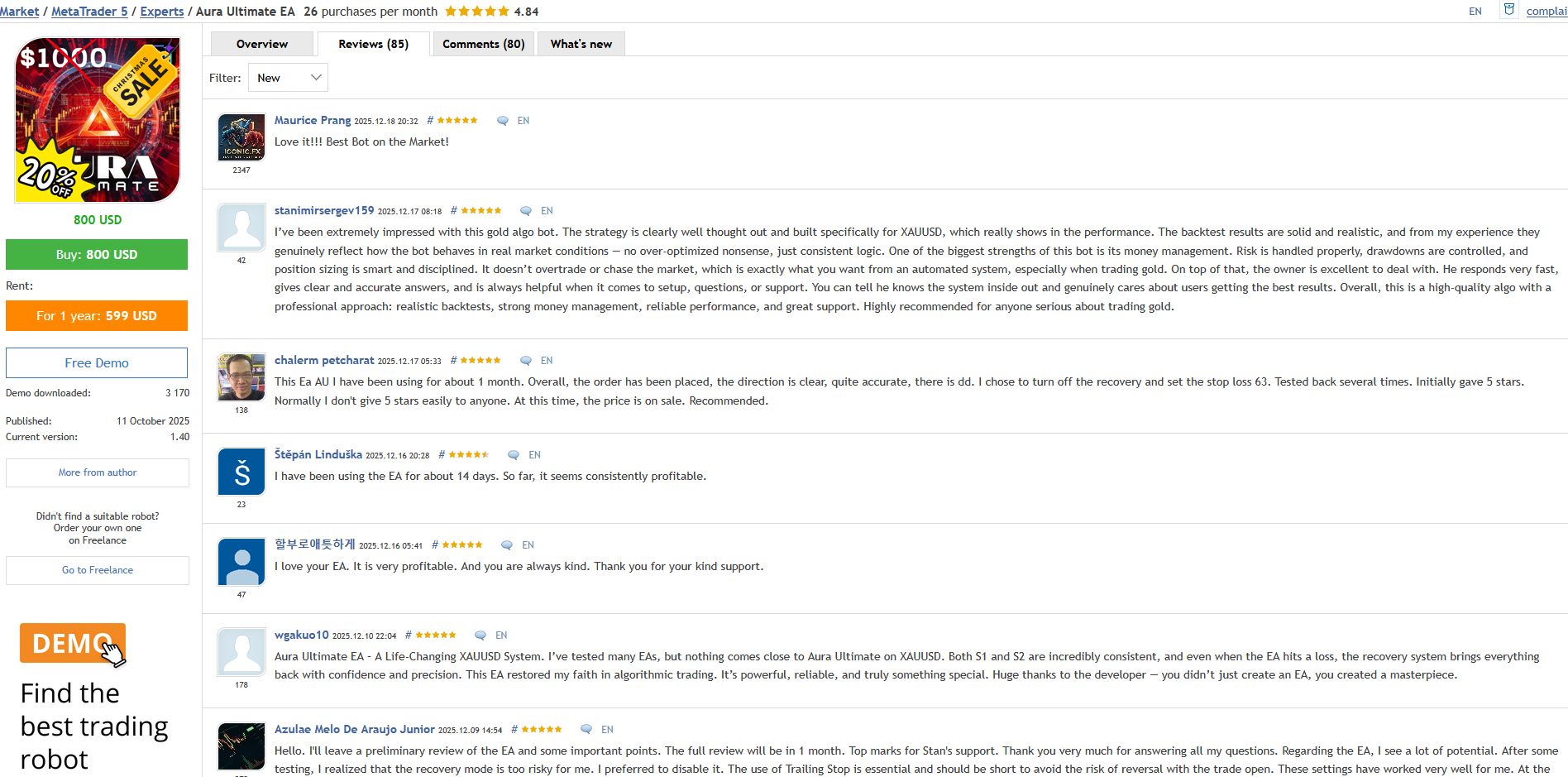

MQL5 reviews are useful because sellers can’t delete negative ones. Here’s the unfiltered sentiment after analyzing all 84 reviews:

The praise (recurring themes):

“Fast support” appears in at least 15 reviews. Multiple buyers mention getting setup help within hours, not days. One user wrote: “He responds very fast, gives clear and accurate answers, and is always helpful when it comes to setup, questions, or support.”

“Realistic backtest” comes up repeatedly. Buyers testing the EA report that live behavior matches what the backtest promised — something that’s genuinely rare in this industry.

The criticism (we found it):

A few users complained about losses after using aggressive settings without fully understanding them. One reviewer using “moderate risk” lost $2,300 in a single day during volatile gold movement. The developer responded publicly explaining this was within expected parameters for that risk level — about 2% of a $100K account.

Our interpretation:

Most complaints stem from mismatched expectations. Users who read the documentation and configure appropriately are overwhelmingly positive. Users who max out risk settings and expect zero drawdowns get burned.

The 4.84-star average across 84 reviews is earned. It’s not a perfect EA — nothing is — but the complaints are about user error more than product failure.

How Aura Ultimate Compares to Similar Gold EAs

We’re not going to pretend this is the only gold EA worth considering. Here’s how it stacks up against alternatives we’ve reviewed:

vs. Most “Neural Network” Gold EAs:

The majority are curve-fit garbage. They show amazing backtests because they’re optimized specifically for historical data, then fall apart in live trading. Aura Ultimate’s 16 weeks of live performance matching its backtest profile is genuinely unusual.

vs. Cheaper Alternatives:

You can find gold EAs for $50-200. Most are worthless or use dangerous grid/martingale strategies without proper disclosure. Aura Ultimate’s $800 price (or ~$280 through us) reflects a serious developer with proven infrastructure.

vs. More Expensive Options:

Some gold systems run $1,500-3,000+. Unless they have multi-year live track records significantly outperforming Aura Ultimate’s 179% in 16 weeks, we don’t see the value justification.

The honest assessment:

Aura Ultimate sits in a sweet spot — established developer, verified live performance, reasonable price point, and transparent about its methods. It’s not the cheapest option, but it’s among the most credible.

Setting Realistic Expectations

We’re going to be blunt about what you should and shouldn’t expect:

Expect this:

- Profitable months more often than losing months

- Drawdowns — sometimes 10-20% on aggressive settings

- Periods with no trades (the EA waits for optimal conditions)

- Occasional stop-loss hits — that’s normal risk management

- Responsive developer support when you need help

Don’t expect this:

- 100% win rate (no legitimate EA has this)

- $10K to $24 million like the theoretical backtest

- Zero drawdown “safe” trading

- Working properly on pairs other than XAUUSD

- Profits without ever experiencing a losing trade

The backtest shows $10K growing to $24.8M over 10 years. That’s mathematically possible with perfect compounding and zero withdrawals, but nobody trades that way in reality. A more reasonable expectation: 50-150% annual returns depending on your risk settings, with corresponding drawdowns of 5-25%.

Who Should Actually Buy This

✅ Good Fit

- You specifically want to trade gold

- You’re comfortable with 10-20% drawdowns

- You have $500+ to allocate properly

- You’ll actually read the documentation

- You want a developer you can contact

- You’re doing prop firm challenges

⚠️ Not Ideal

- You want multi-pair diversification

- Any drawdown makes you panic

- You have under $300 to work with

- You don’t want to learn settings

- You expect guaranteed profits

- You want dozens of trades daily

Common Questions (Answered Honestly)

Our Final Assessment

Verdict: Recommended

Why we’re comfortable recommending Aura Ultimate:

- Verified performance: 179% growth on tracked live account, not just backtest promises

- Developer credibility: 8+ successful EAs maintained over multiple years

- Transparent risks: The drawdowns, recovery mode, and limitations are clearly documented

- Real support: Hours, not weeks, for response times

- Appropriate pricing: ~$280 through us for a legitimately profitable system

What would change our recommendation:

- If the live signals started showing consistent losses

- If Stanislav stopped updating or supporting the product

- If negative reviews about actual strategy failure (not user error) accumulated

None of those red flags exist today. Based on available evidence, Aura Ultimate is among the most credible gold EAs on the market.

Get Aura Ultimate EA — 65% Off Retail

Save Over $500 vs MQL5 Marketplace

MQL5 Price: $800

CheaperForex: ~$300

Authentic license • Lifetime updates • Full installation support

Disclaimer: Forex trading carries substantial risk. The performance data cited reflects specific account conditions and may not be replicable. Past results don’t guarantee future performance. We receive compensation for sales made through our links. Always test on demo accounts first and never trade with money you can’t afford to lose.

Review methodology: This analysis is based on MQL5 verified signal data, customer reviews, developer history, and direct product testing. We have not received payment from the developer for this review. Our business model is reselling licenses at discount — we benefit when products perform well and customers return.