Nova Gold X EA Review: High-Frequency Gold Scalper With Unusual Transparency — But Is 3 Weeks Enough to Trust It? +60% Discount!

Last updated: December 28, 2025 • Early-stage assessment

The Bottom Line

Nova Gold X EA launched three weeks ago and is already generating buzz. The concept is compelling: AI-powered scalping that executes 100+ trades daily on gold and bitcoin, with the developer providing live investor account passwords so you can watch performance in real time.

What caught our attention: The transparency is unusual. Most EA sellers hide behind backtests — this developer hands you login credentials to monitor live accounts yourself. That’s rare and commendable.

What gives us pause: Three weeks isn’t enough time to judge any trading system. The developer is relatively new to MQL5 with only two products. And let’s be honest — the “$1,000 to $596 million” backtest claim is marketing theatre, not realistic expectation.

Our call: Promising early signs, but this is a calculated risk, not a proven system. We’re cautiously optimistic — the transparency earns trust, but we’d like to see 2-3 more months of live data before calling it a winner.

Rating: 3.5/5 ⭐⭐⭐½ — Promising, Monitor Closely

Why Nova Gold X Landed on Our Radar

We review dozens of gold EAs. Most follow the same pattern: big backtest claims, zero live proof, developer vanishes after a few months. The gold EA market is flooded with these.

Nova Gold X caught our attention for one reason: the developer did something almost nobody does.

Instead of just showing screenshots and expecting you to trust him, Hicham Chergui published the actual investor account passwords. You can log into MetaTrader yourself, connect to his Exness accounts, and watch the EA trade in real time. No manipulation possible — you’re seeing raw, live data.

That’s either extreme confidence or extreme transparency. Either way, it’s worth investigating.

The Developer: New But Transparent

⚠️ Let’s Be Upfront About the Risk

Hicham Chergui (username: infinitynetwork) is relatively new to MQL5. He has two products:

- Nova Gold X — launched December 8, 2025

- OptivexPro MT5 — his other scalping EA

What this means: There’s no multi-year track record to fall back on. No portfolio of proven products. No history of surviving market crashes, flash events, or extended drawdowns.

The counterpoint: Everyone starts somewhere. What matters is how a developer handles transparency and support — and on those fronts, early signs are positive. Reviews consistently mention responsive support, clear explanations, and willingness to help with settings.

Our position: We’re giving Hicham the benefit of the doubt based on his transparency approach, but we’re watching closely. New developers can become great ones. They can also disappear. Time will tell.

The Unique Selling Point: Investor Account Access

This is where Nova Gold X differentiates itself from 99% of EAs on the market.

Most developers show you backtests and maybe a MyFXBook screenshot. Hicham gives you the actual login credentials:

🔐 Live Investor Accounts You Can Monitor

Bitcoin Trading:

- Nova Gold X 1H — Exness, Account: 253171379

- Nova Gold X 5Min — Exness, Account: 253183735

Gold (XAUUSD) Trading:

- Nova Gold X 5Min — Exness, Account: 253198898

- Nova Gold X 1Min — Exness, Account: 253198896

Password for all: 111@Meta (investor access only — view trades, can’t execute)

Why this matters:

Investor passwords give read-only access. You can see every trade, every profit, every loss — in real time. The developer can’t manipulate what you’re seeing because it’s coming directly from the broker’s servers.

This is the gold standard for EA transparency. We wish more developers did this.

The developer’s claim: Within 5 days of launching, he withdrew all initial capital from these accounts. They’re now trading purely on profits — zero risk to the original deposit. If true (and you can verify via the account history), that’s impressive capital protection.

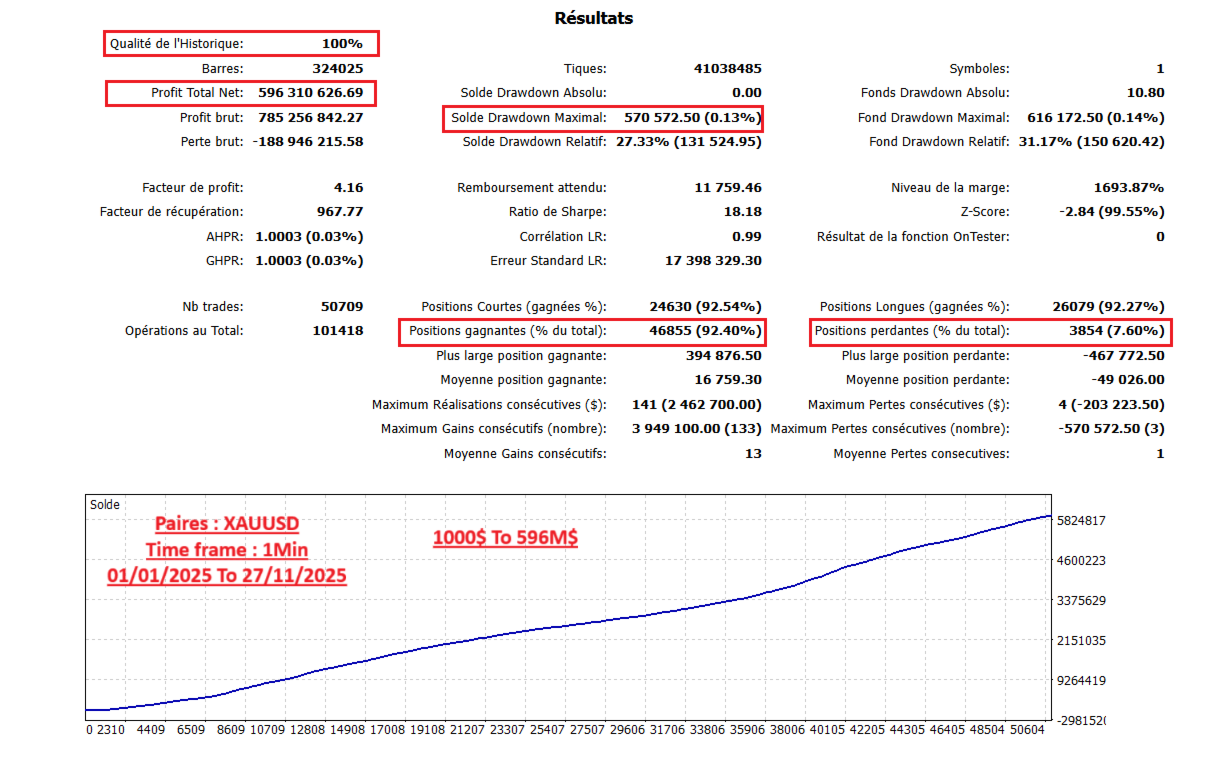

Let’s Talk About That Backtest

⚠️ The $596 Million Elephant in the Room

The marketing shows a backtest where $1,000 becomes $596 million in 11 months. Let’s be adults about this.

That’s not going to happen.

Here’s why:

- Backtests assume perfect execution with no slippage

- They don’t account for broker limitations on lot sizes

- Liquidity constraints make scaling impossible

- No broker would let you compound to $596M without intervention

- Real spreads during news events would crush high-frequency strategies

What the backtest actually shows: The underlying strategy has potential edge. A 92% win rate across 50,000+ trades with 0.13% drawdown suggests the logic is sound. But translating that to “you’ll make millions” is fantasy.

Realistic expectations: If the live accounts continue performing, 20-50% monthly returns on small accounts is plausible for high-frequency scalping. Maybe more, maybe less. Anyone promising hundreds of millions is selling dreams, not trading systems.

Our take: Ignore the headline number. Focus on the strategy mechanics and live performance. The backtest shows the system can be profitable — the magnitude is irrelevant because real-world constraints prevent it.

What We Know About the Strategy

Based on the product description and observed behavior:

Trading approach:

- AI-driven price action analysis (reads candles directly, no lagging indicators)

- High-frequency execution — 100+ trades per day is the claim

- Scalping with tight targets and quick exits

- Works on M1, M5, M15, M30, and H1 timeframes

Risk management:

- Hard stop loss on every trade (not grid, not martingale)

- Trailing stop that follows profitable trades

- Break-even system that moves stop to entry after reaching profit target

- Automatic lot sizing based on account balance

The recovery mode question:

Nova Gold X has an optional “recovery mode” that increases lot size once after a loss, then resets. The developer emphasizes this is NOT martingale — no exponential doubling.

Our advice: Disable recovery mode until you understand the system. One controlled lot increase is different from martingale, but it still adds risk. Start conservative.

What Early Buyers Are Saying

With only 5 reviews (all 5-star), sample size is tiny. But themes are emerging:

“By far the best trading robot I’ve ever had access to. Extremely consistent, with very low drawdown, and truly outstanding support.” — Ana Lucia

“Very good EA, and seller is helpful and responsive. Very less DD which is very impressive. Developer is trying to make it more better with best features.” — Ranjeet

“The expert patiently explained the settings of this EA. Finally mastered the correct operation.” — kungking168

Pattern we’re seeing: Support quality is mentioned repeatedly. The developer appears genuinely engaged with buyers, not just collecting payments and disappearing. That’s a positive signal for a new product.

What’s missing: Long-term reviews. Nobody has run this for 3+ months yet because it hasn’t existed that long. Check back in February 2025 for more meaningful feedback.

How Nova Gold X Compares

vs. Established Gold EAs (like our vetted recommendations):

The established players have months or years of verified live performance. Nova Gold X has weeks. If you want proven track record, look at EAs with 6+ months of live signals.

vs. Other High-Frequency Scalpers:

Most HF scalpers hide their live performance. Nova Gold X’s investor password approach is genuinely rare. For transparency alone, it stands out.

vs. The Price Point:

At $399 retail (or ~$160 through us), it’s mid-range for gold EAs. Not cheap enough to be suspicious, not expensive enough to suggest overconfidence. Reasonable for what’s being offered.

The honest comparison:

If you need certainty, Nova Gold X isn’t there yet. If you’re willing to take calculated risks on promising newcomers with good transparency practices, it’s worth consideration.

Who Should Consider Nova Gold X

✅ Potentially Good Fit

- You want to trade gold AND bitcoin

- You’re comfortable monitoring investor accounts yourself

- High-frequency trading appeals to you

- You have a low-spread broker with good execution

- You’re willing to take early-adopter risk

- $300-500 is capital you can afford to risk

⚠️ Probably Not Right For

- You need 6+ months of proven results

- Your broker has high spreads or slow execution

- You can’t monitor performance regularly

- You don’t have VPS for 24/5 operation

- You expect $596 million returns

- You want “set and forget” without checking

Critical Requirements for High-Frequency Trading

Nova Gold X trades 100+ times per day. That’s a different beast from EAs that trade a few times weekly. You need:

1. Low-Spread Broker (Essential)

Each trade targets small profits. If your spread is 3 pips and the target is 5 pips, you’ve lost 60% of potential profit to spread alone. ECN/Raw spread accounts are strongly recommended.

2. Fast Execution (Essential)

Slippage kills scalpers. If the EA sees an entry at 2650.00 but your broker fills at 2650.50, that’s immediate disadvantage. Choose brokers known for execution speed.

3. VPS (Highly Recommended)

100+ trades per day means opportunities around the clock. Your home internet dropping for 10 minutes could miss multiple trades. A $15-20/month VPS near your broker’s servers is worthwhile.

4. Regular Monitoring (Required)

This isn’t a “check once a month” EA. High-frequency systems need weekly attention minimum. Use those investor account credentials to verify your results match the developer’s accounts.

Questions You Should Be Asking

Our Assessment

Verdict: Promising — But Early Days

What Nova Gold X gets right:

- Transparency: Investor account access is genuinely rare and valuable

- Support: Early reviews consistently praise responsive developer

- Risk management: Hard stops, no grid, no martingale core strategy

- Multi-asset: Works on both gold and bitcoin

- Pricing: Reasonable for what’s offered

What concerns us:

- Track record: Three weeks is not enough validation

- Developer history: Only two products, no long-term reputation

- Backtest claims: $596M marketing is unrealistic and borders on irresponsible

- Broker dependency: High-frequency requires specific conditions

Rating: 3.5/5 — We’re cautiously optimistic. The transparency approach earns points that most EAs don’t get. But we can’t give higher rating until more live time proves consistency.

What Would Change Our Rating

To upgrade to 4+ stars:

- 3+ months of continued positive live performance

- Developer publishes MQL5 verified signal (not just investor passwords)

- More customer reviews showing consistent results across different brokers

- Backtest marketing toned down to realistic expectations

To downgrade:

- Investor accounts show significant losses or manipulation

- Developer becomes unresponsive

- Customer reviews turn negative

- Product abandoned without updates

We’ll update this review in March 2025 with fresh data.

Get Nova Gold X EA — 60% Off MQL5 Price

Early Adopter Pricing

MQL5 Price: $399

CheaperForex: ~$160

Extra 20% off with crypto payment

Authentic license • Lifetime updates • Installation support included

Looking for More Established Options?

If you prefer EAs with longer track records, check out:

- Our Vetted EA Recommendations — Products we’ve validated over months of live performance

- All Gold Trading EAs — Browse our complete collection of gold-focused robots

Disclaimer: Forex and cryptocurrency trading carry substantial risk. Nova Gold X EA is a new product with limited live track record. The backtest figures ($596M) are theoretical and not achievable in real trading conditions. Past performance doesn’t guarantee future results. Only trade with capital you can afford to lose. We receive compensation for sales made through our links.

Review methodology: This assessment is based on MQL5 product data, customer reviews, investor account access, and backtest analysis. We have not received payment from the developer. We will update this review as more live performance data becomes available.

Next review update: March 2025 (after 3+ months of live data)