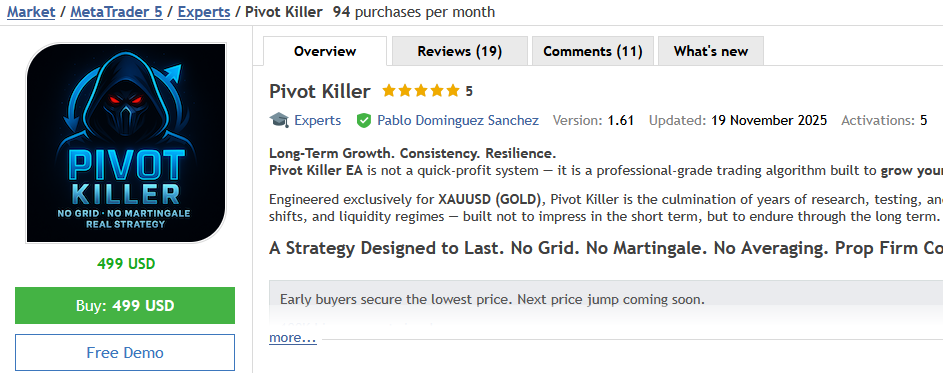

Pivot Killer EA Review – Why We Don’t Recommend This $499 Gold Trading Robot (Yet)

Serious Red Flags.. We Explain Why.

TL;DR: Is Pivot Killer EA Worth It? – No.

Pivot Killer EA is a gold-only (XAUUSD) breakout trading system using pivot point detection and volatility analysis. It claims no grid, no martingale, no averaging down—just clean single-shot trades with predefined stop losses.

The Good: Professional testing methodology (Monte Carlo, walk-forward), prop firm compatible, plug-and-play setup on H1 timeframe.

The Bad: Developer has deleted multiple failed EAs (Wall Street Killer, DAX Killer) after they blew up. Current live performance is weak (7% in 4 weeks on Darwinex, 24% in 4 weeks on small account). Charges $499 USD despite minimal track record.

Our Verdict: WAIT BEFORE BUYING. Give this EA at least 2-3 more months of live performance verification. The developer’s history of deleting failed products is a major red flag.

Rating: 2/5 ⭐⭐ – Cautious Approach Recommended

What is Pivot Killer EA?

Pivot Killer EA is a single-pair Expert Advisor focused exclusively on XAUUSD (Gold) trading on the H1 timeframe. Developed by Pablo Dominguez Sanchez, it uses breakout detection combined with volatility pivot analysis to identify high-probability entry points.

The core philosophy: Long-term growth through consistency and resilience, not quick profits. The developer emphasizes that this is a “professional-grade trading algorithm built to grow your account sustainably over the long term.”

Key differentiators:

- No grid, martingale, or averaging down strategies

- Single-shot trades with predefined stop losses

- Adaptive risk management based on volatility

- Prop firm compatible with strict drawdown control

- Plug-and-play setup (attach to XAUUSD H1, done)

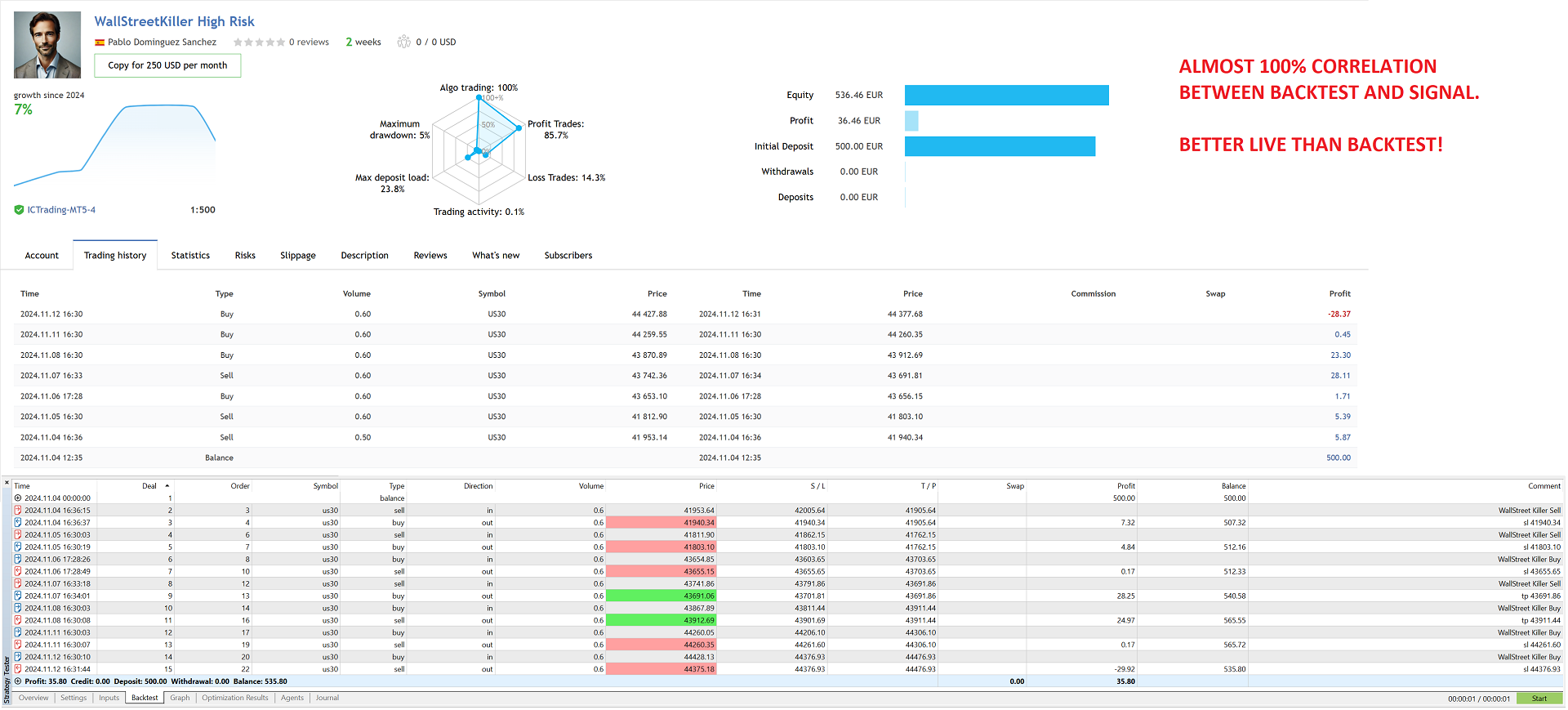

The Developer’s Track Record: Deleted EAs and Live Signals

⚠️ See the deleted signals for yourself below:

Before you buy, you MUST know this: Pablo Dominguez Sanchez has a troubling pattern of releasing EAs, seeing them fail, then deleting them from MQL5 once sales dry up.

Previously deleted EAs:

- Wall Street Killer EA – Released, failed, deleted from MQL5

- DAX Killer EA – Released, failed, deleted from MQL5

This raises serious questions:

- ❌ Why delete products instead of fixing them or being transparent about failures?

- ❌ Will Pivot Killer EA follow the same pattern?

- ❌ Is the developer committed to long-term support?

- ❌ Why charge $499 USD with only 4 weeks of live performance?

Our position: We believe in transparency. Developers who delete failed products and move on to the next one without accountability are a red flag in the forex EA industry. We’re giving Pivot Killer EA a fair review based on its current claims, but buyers should be aware of this history.

Current Live Performance: Unimpressive (So Far)

Pivot Killer EA has two live signals running, both started in early 2025:

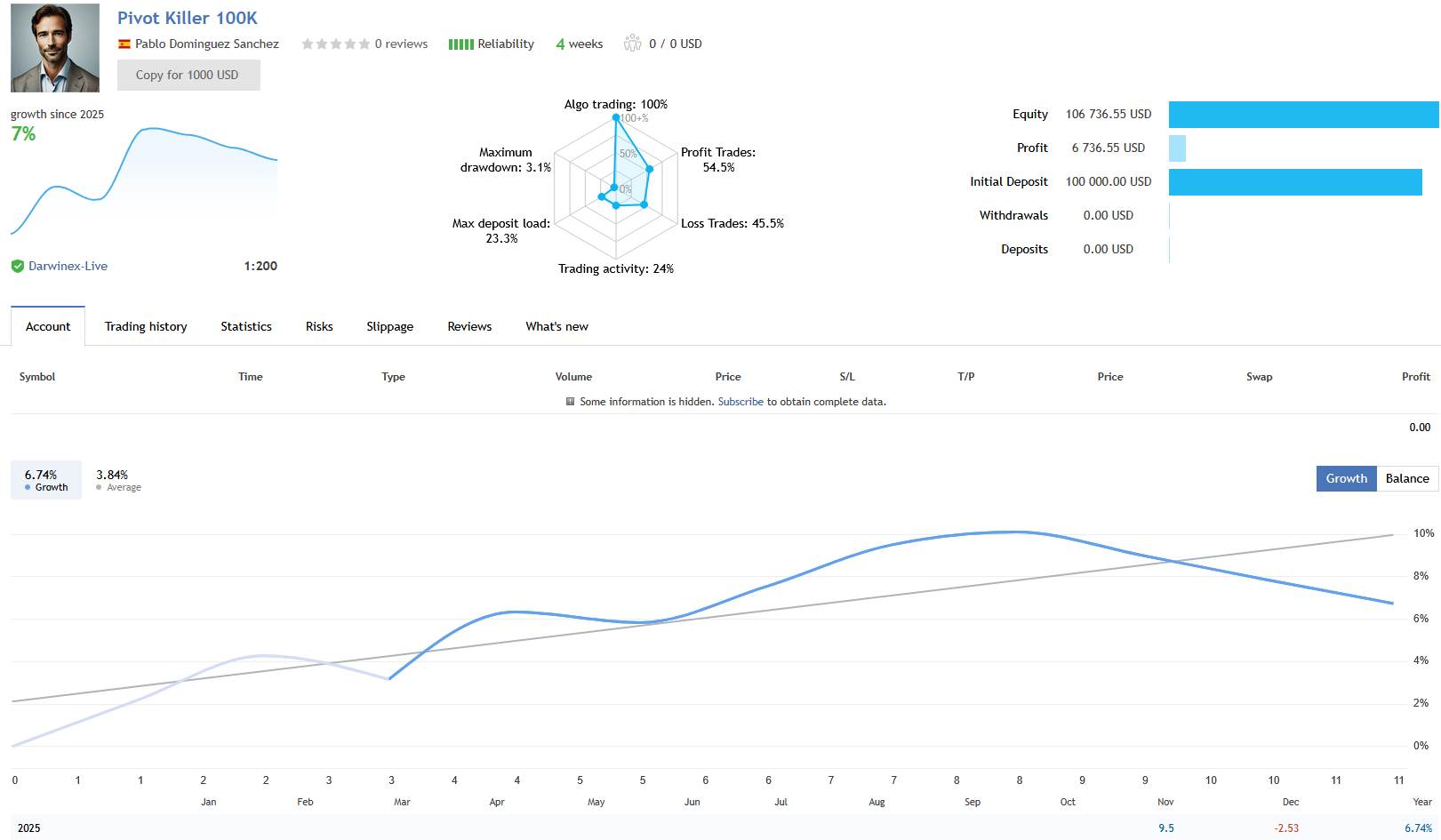

Signal 1: Darwinex 100K Account

Performance (4 weeks):

- Growth: 7% since January 2025

- Win Rate: 54.5%

- Max Drawdown: 3.1%

- Broker: Darwinex (regulated)

- Starting Balance: $100,000

Analysis: 7% in 4 weeks is modest—projects to ~90% annually if maintained, but it’s far too early to extrapolate. The 3.1% max drawdown is excellent, but with only 54.5% win rate, we need to see more data.

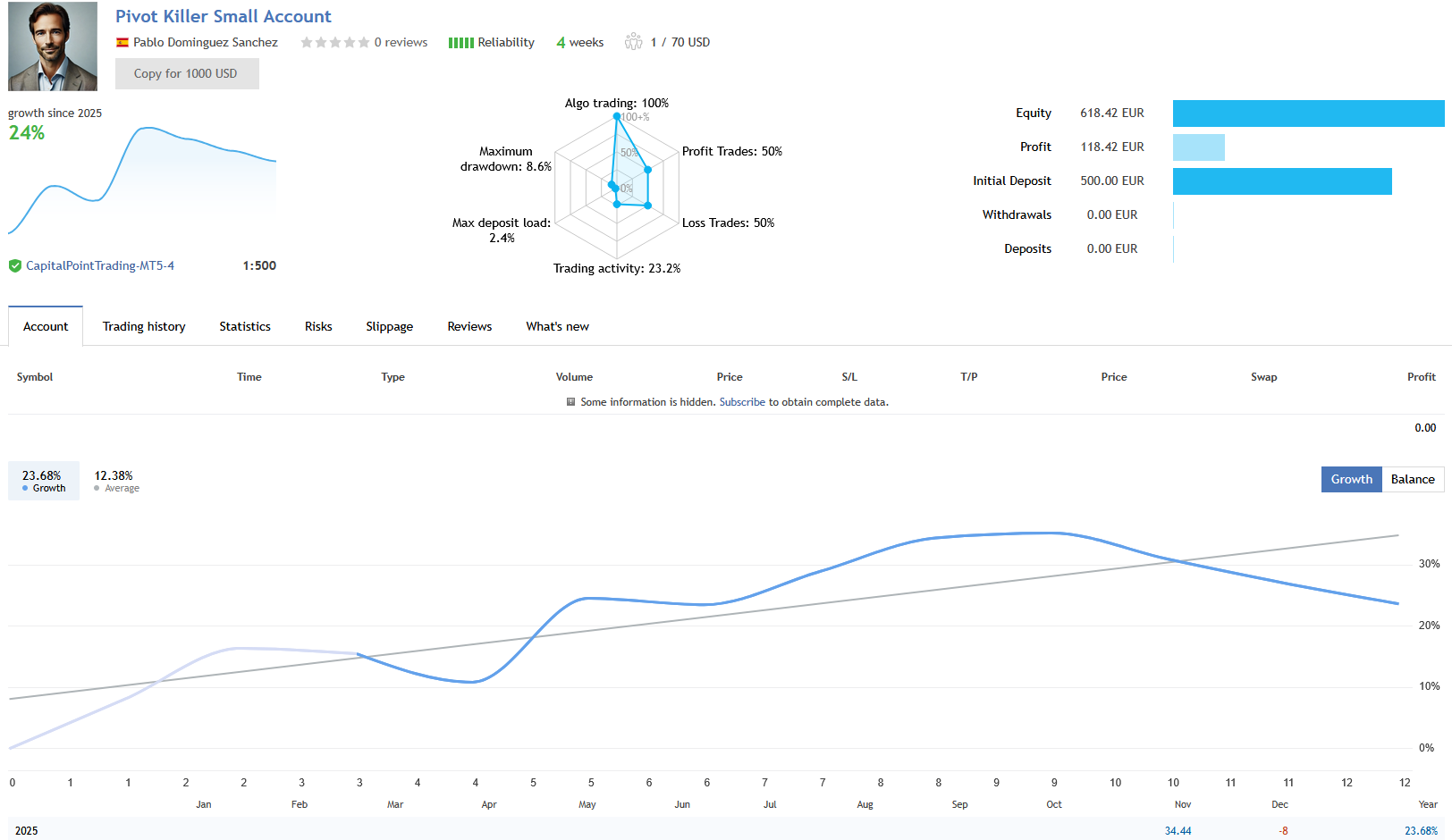

Signal 2: IC Markets Small Account (€500)

Performance (4 weeks):

- Growth: 24% since January 2025

- Win Rate: 50%

- Max Drawdown: 8.6%

- Broker: IC Markets (trusted)

- Starting Balance: €500

Analysis: 24% in 4 weeks is more impressive but comes with higher drawdown (8.6%). The 50% win rate is concerning—suggests wins are larger than losses (good), but consistency needs longer verification.

🤔 Why We’re Not Convinced Yet

4 weeks is simply not enough time to validate a $499 EA.

- The developer claims “years of research and testing,” yet launched with minimal live track record

- Both signals are very new. A lot can go wrong in the next 3-6 months.

- Win rates around 50% mean the EA relies heavily on reward-to-risk ratio—needs more trades to confirm

- No explanation for why previous EAs (Wall Street Killer, DAX Killer) were deleted

Our recommendation: Wait 2-3 months minimum. If both signals maintain positive growth with controlled drawdown, the EA may be worth considering. If either signal blows up or gets deleted, you’ll know the pattern continues.

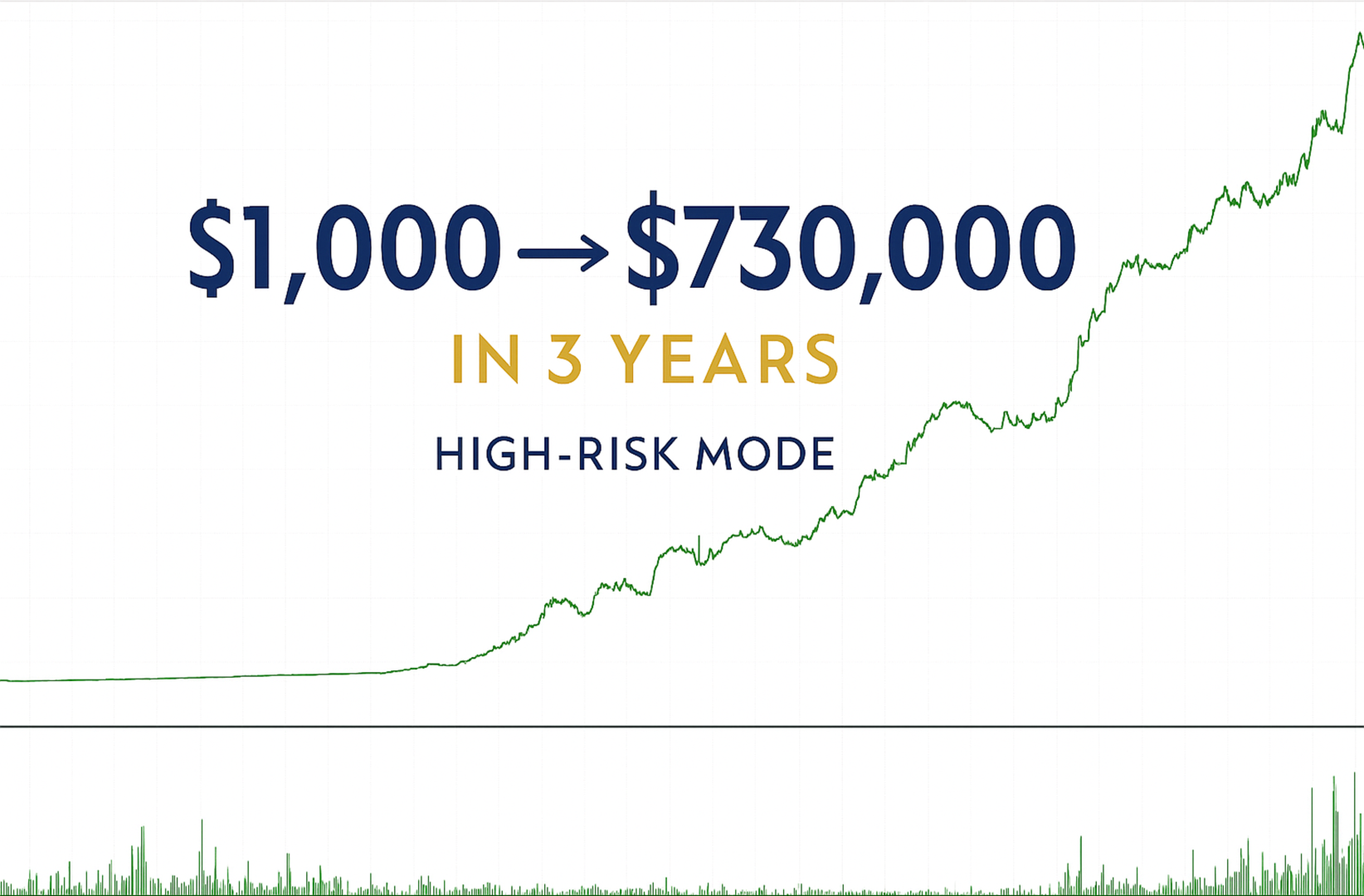

The Backtest: Impressive Claims

The developer claims backtest results of $1,000 to $730,000 in 3 years on high-risk mode. This is theoretical compound reinvestment with no withdrawals.

Why you should be skeptical:

- Every failed EA has impressive backtests—that’s how they sell

- “High-risk mode” is vague—what risk percentage? What drawdown did it experience?

- 730x return in 3 years is marketing fluff, not realistic expectation

- The developer provides no detailed backtest report (win rate, drawdown breakdown, monthly returns)

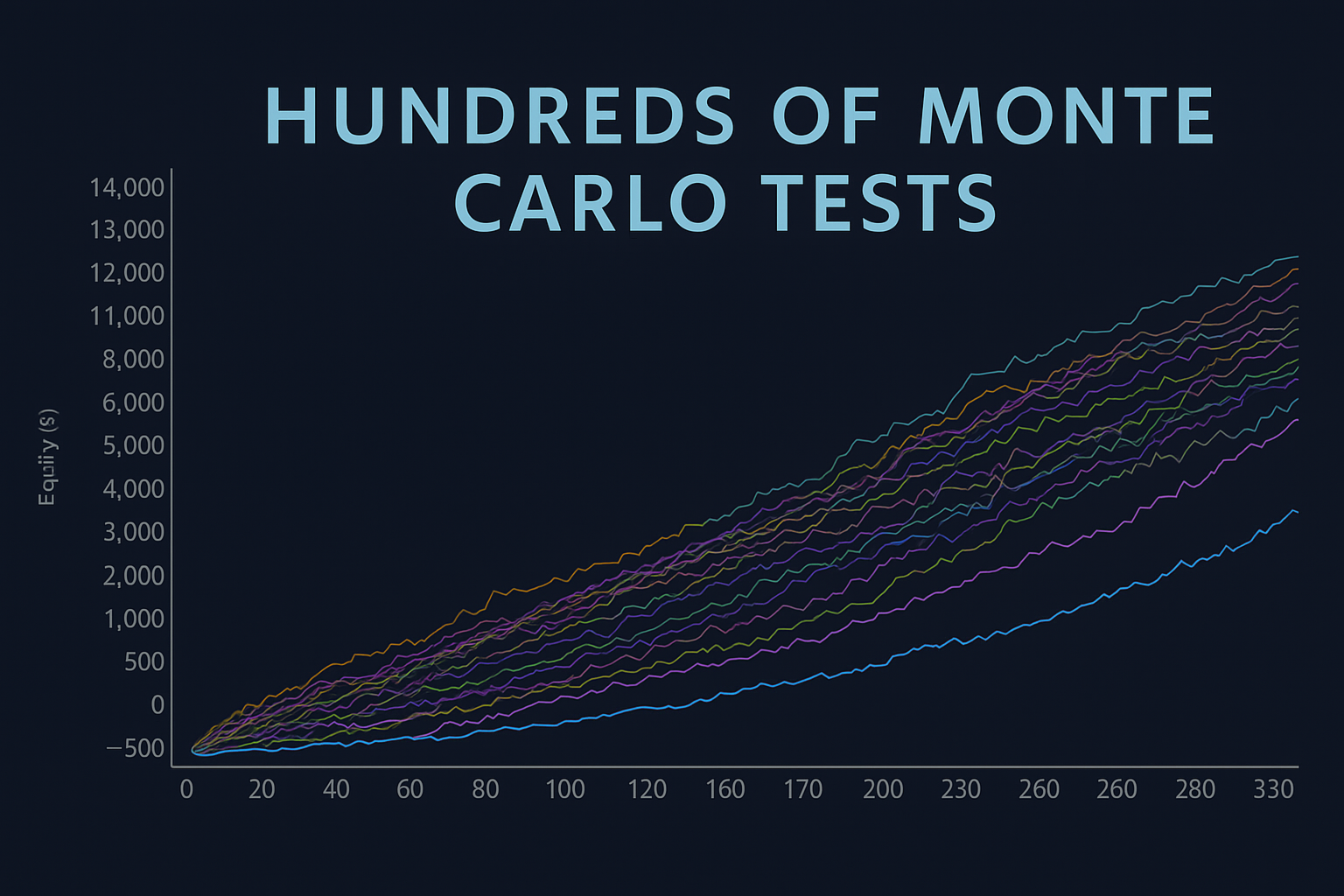

Monte Carlo Testing: A Positive Sign

One thing the developer did right: hundreds of Monte Carlo simulations to test robustness under randomized market conditions.

Monte Carlo testing randomizes trade sequences to ensure the strategy isn’t curve-fitted to historical order. The fact that most equity curves remain positive is encouraging—it suggests the strategy has statistical edge.

However: Monte Carlo testing on backtest data still doesn’t prove live performance. It’s a necessary validation step, but not sufficient proof on its own.

Strategy Breakdown

Based on the developer’s description and manual:

| Component | Details |

|---|---|

| Strategy Type | Breakout + Volatility Pivot Detection |

| Methodology | Non-grid, non-martingale, fully controlled risk |

| Philosophy | Long-term growth through stability and patience |

| Testing | Walk-forward, Monte Carlo, out-of-sample validation |

| Preset | XAUUSD H1 (default, plug & play) |

| Ease of Use | Attach to chart, set risk %, done |

| Prop Firm Safe | Yes (strict drawdown control, low max DD) |

What we like:

- ✅ No dangerous strategies (grid/martingale/averaging)

- ✅ Professional testing methodology described

- ✅ Prop firm compatible design

- ✅ Clean, simple setup process

What concerns us:

- ❌ Developer’s history of deleting failed EAs

- ❌ Only 4 weeks of live performance

- ❌ $499 USD pricing without established track record

- ❌ Vague backtest claims without detailed reports

Recommended Setup

| Parameter | Recommendation |

|---|---|

| Symbol | XAUUSD (Gold) |

| Timeframe | H1 |

| Minimum Balance | $250 |

| Recommended | $500+ |

| Broker Type | ECN / RAW Spread |

| Risk per Trade | 0.5-2% (conservative to moderate) |

| Prop Firm Compatible | Yes (strict drawdown control) |

Configuration Tips

🛡️ Conservative (Prop Firms)

- Risk per trade: 0.5-1%

- Expected drawdown: 3-5%

- Annual return: 30-60%

- Best for: Prop firm challenges

⚖️ Balanced (Personal)

- Risk per trade: 1-1.5%

- Expected drawdown: 5-10%

- Annual return: 60-100%

- Best for: Personal accounts

🚀 Aggressive (High Risk)

- Risk per trade: 2%+

- Expected drawdown: 10-20%

- Annual return: 100-200%+

- Best for: Risk-tolerant traders

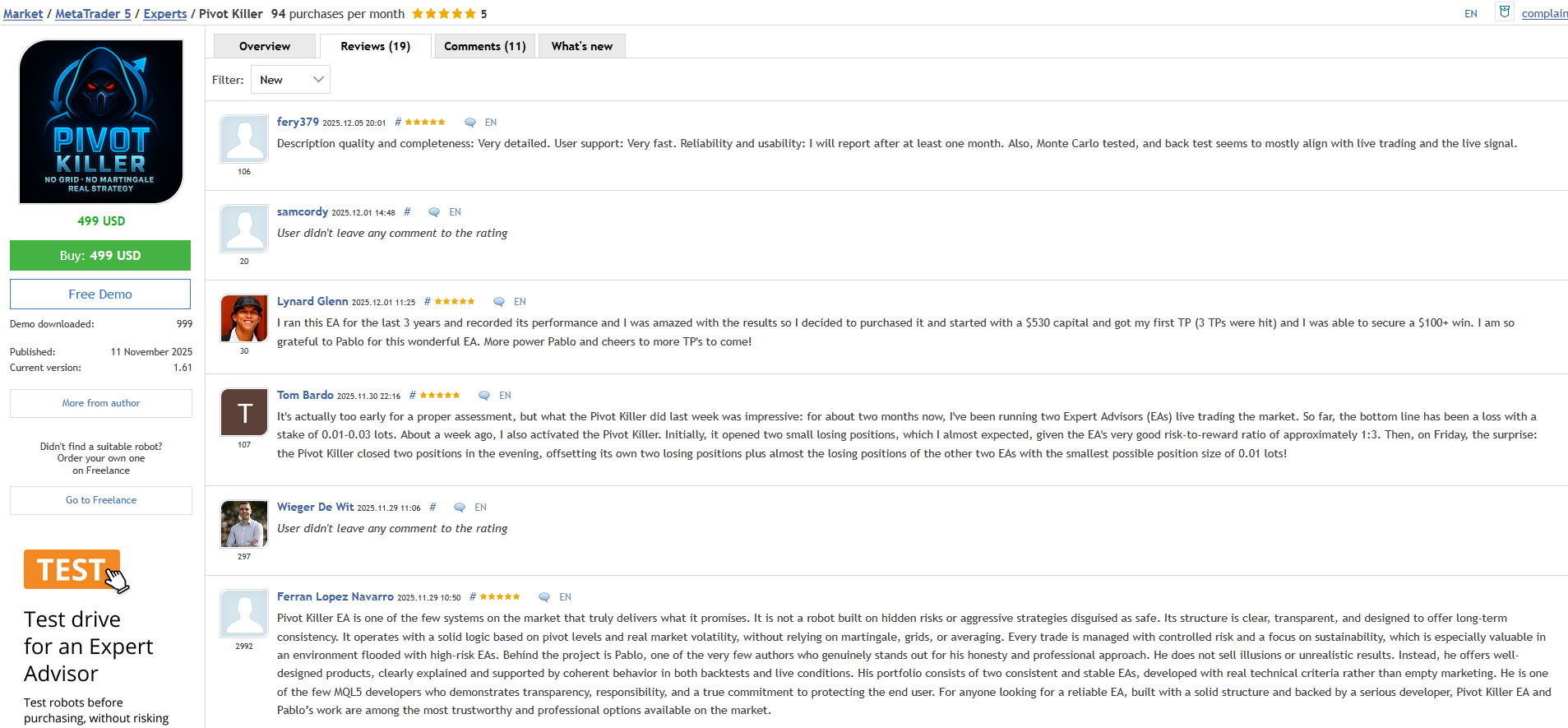

Customer Reviews on MQL5

Pivot Killer EA currently has 5-star rating from 19 reviews on MQL5, with 94 purchases per month. However, most reviews are from early adopters testing demo/short-term results.

Notable positive reviews:

- “Very detailed, user support is very fast” – Verified purchaser

- “I ran this EA for the last 3 years and recorded its performance… started with $530 capital and got my first TP” – Lynard Glenn (ran on demo for 3 years before buying)

- “Monte Carlo tested, back test aligns with live trading and live signal” – fery379

Our take on reviews: Mostly positive, but it’s still very early. The EA was published November 2025—we need 6-12 months of verified customer results to trust the reviews fully. Watch for negative reviews appearing as live performance develops.

Who Should Use Pivot Killer EA?

✅ Might Be Good For

- Gold/XAUUSD specialists

- Prop firm traders (strict DD control)

- Patient long-term traders

- Risk-averse EA users

- Those who want plug-and-play setup

- Traders willing to WAIT 2-3 months before buying

⚠️ Not Ideal For

- Traders wanting proven track record NOW

- Those uncomfortable with developer’s history

- Multi-pair diversification seekers

- High-frequency traders

- Budget-conscious buyers ($499 is steep)

- Anyone expecting $730K from $1K backtests

Common Mistakes to Avoid

- ❌ Buying immediately without waiting – Give it 2-3 months minimum to verify live performance

- ❌ Using on wrong pairs/timeframes – ONLY XAUUSD H1, do not experiment

- ❌ Expecting backtest results – $730K from $1K in 3 years is NOT realistic

- ❌ Ignoring developer history – Previous deleted EAs are a serious red flag

- ❌ Running without VPS – H1 timeframe needs 24/7 uptime

- ❌ Using excessive risk – Start conservative (0.5-1%) until proven

- ❌ No demo testing – Test 4-8 weeks on demo before live

Frequently Asked Questions

Final Verdict & Rating

Overall Rating: 2/5 ⭐⭐ – Wait Before Buying

Category Ratings:

- Strategy Design: 4.0/5 (solid breakout + pivot methodology)

- Testing Methodology: 4.0/5 (Monte Carlo + walk-forward is professional)

- Live Performance: 2.0/5 (only 4 weeks, unimpressive so far)

- Developer Trust: 1.5/5 (history of deleting failed EAs)

- Value for Money: 2.0/5 ($499 too expensive for unproven track record)

- Documentation: 4.5/5 (comprehensive manual and setup guide)

⚠️ OUR HONEST RECOMMENDATION

DO NOT BUY PIVOT KILLER EA RIGHT NOW.

Here’s why we’re giving it 2/5 stars instead of higher:

- Developer’s History: Deleting Wall Street Killer EA and DAX Killer EA after they failed is unacceptable. Reputable developers fix problems or provide transparency—they don’t delete and move on.

- Insufficient Live Proof: 4 weeks of live performance is nowhere near enough to justify $499 USD. We need at least 3-6 months of verified results before trusting this EA with real money.

- Weak Current Performance: 7% in 4 weeks (Darwinex) and 24% in 4 weeks (IC Markets) are modest results. Nothing here proves the backtest claims or justifies premium pricing.

- Pattern Risk: Given the developer’s history, there’s legitimate concern that if Pivot Killer EA underperforms, it will simply be deleted and replaced with “XYZ Killer EA” next year.

What would change our rating:

- ✅ 3-6 months of solid live performance (both signals maintaining positive growth)

- ✅ Developer addresses the deleted EA history transparently

- ✅ More customer reviews after extended live use (not just demo/early results)

- ✅ No signs of the EA being abandoned or deleted

Our advice: Bookmark the live signal pages (Darwinex and IC Markets) and check back in February/March 2025. If both signals are still running with positive results and no major drawdowns, we’ll update this review and potentially increase the rating.

If you absolutely must buy now: Test extensively on demo for 8+ weeks, use minimal risk (0.5-1%), and be prepared for the possibility that this EA may not deliver on its promises. Your risk tolerance should account for the developer’s questionable track record.

💡 Better Alternatives to Consider

Instead of risking $499 USD on an unproven EA with a questionable developer history, consider:

- Zenox EA – 157% live growth in 34 weeks with 24-year backtest validation

- Wait 2-3 months – Monitor Pivot Killer’s live signals, then reassess

- Multi-EA portfolio – Diversify with several proven EAs instead of one unproven expensive one

Your capital deserves better than “trust me, this time will be different” from a developer who deleted previous failures.

⚠️ We Do NOT Sell Pivot Killer EA

Why We’re Not Offering This EA:

❌ Developer’s history of deleting failed products

❌ Only 4 weeks of live performance data

❌ Insufficient proof to justify $499 USD price

❌ Risk of following same pattern as deleted EAs

If you want to purchase Pivot Killer EA, you can buy it directly from MQL5 marketplace at your own risk.

Our recommendation: Wait 2-3 months, monitor the live signals, and check back for our updated review before making any purchase decision.

We will update this review in February 2025 after more live performance data is available.

Disclaimer: Trading involves substantial risk. This review reflects our honest assessment based on available data as of December 2025. The developer’s history of deleting failed EAs (Wall Street Killer, DAX Killer) is a documented fact. Current live performance is only 4 weeks old—insufficient for confident recommendation. Always test on demo, never risk more than you can afford to lose, and consult a financial advisor. We will update this review as more data becomes available.

Last updated: December 7, 2025 | Live Signal Duration: 4 weeks | Our Rating: 2/5 – Wait Before Buying | Next Review Update: February 2025