- Official Product

- Instant Download

- 7-Day Money-Back Guarantee*

- Instant Download

- 7-Day Refund Policy*

Sale!

What's Included

Our Customer Reviews

Excellent product quality.

The latest updated versions of EAs are sent as soon as they are available.

I can highly recommend this site

Have gotten a lot from them in the past and never been disappointed.

After reaching out, I was refunded right away. 5/5 stars in my book.

I received immediate attention to a credit card payment error and they organised a refund within minutes ( late on a Sunday evening ) plus a great saving on a quality Forex EA.

But you need to do your homework on any product before buying.

They give a lot of commitment from themselves. I highly recommend it to everyone!

I recommend it 100%

The products work as advertised and the customer support is topnotch.

Great support. Recommended, 5 STARS.

You can trust them completely.

All issues have been resolved. , If the problem cannot be resolved, a refund will be given.

Prima che intervenissi, si erano accorti dell'anomalia. Per me, piena fiducia all'operatore.

Best in the industry. Thank you for what you do

They also have an outstanding customer care services .

It makes a change from most of the scam forex websites!

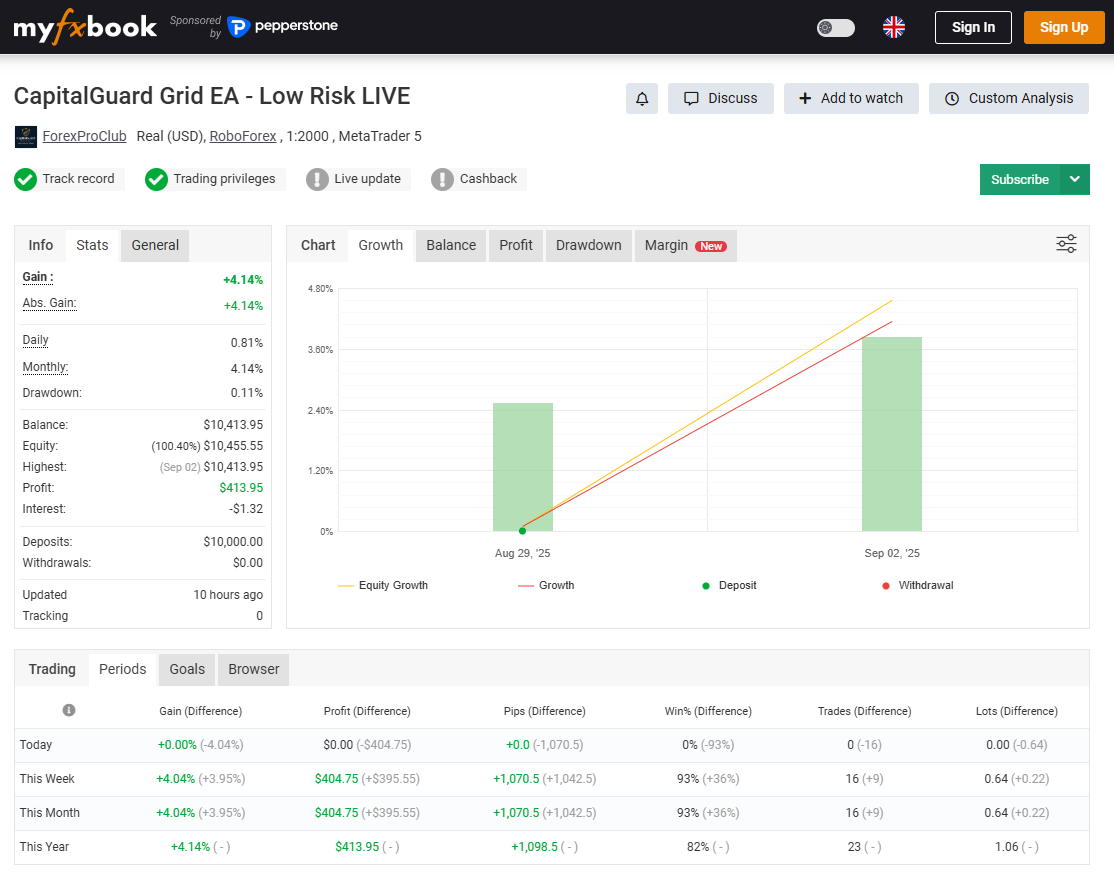

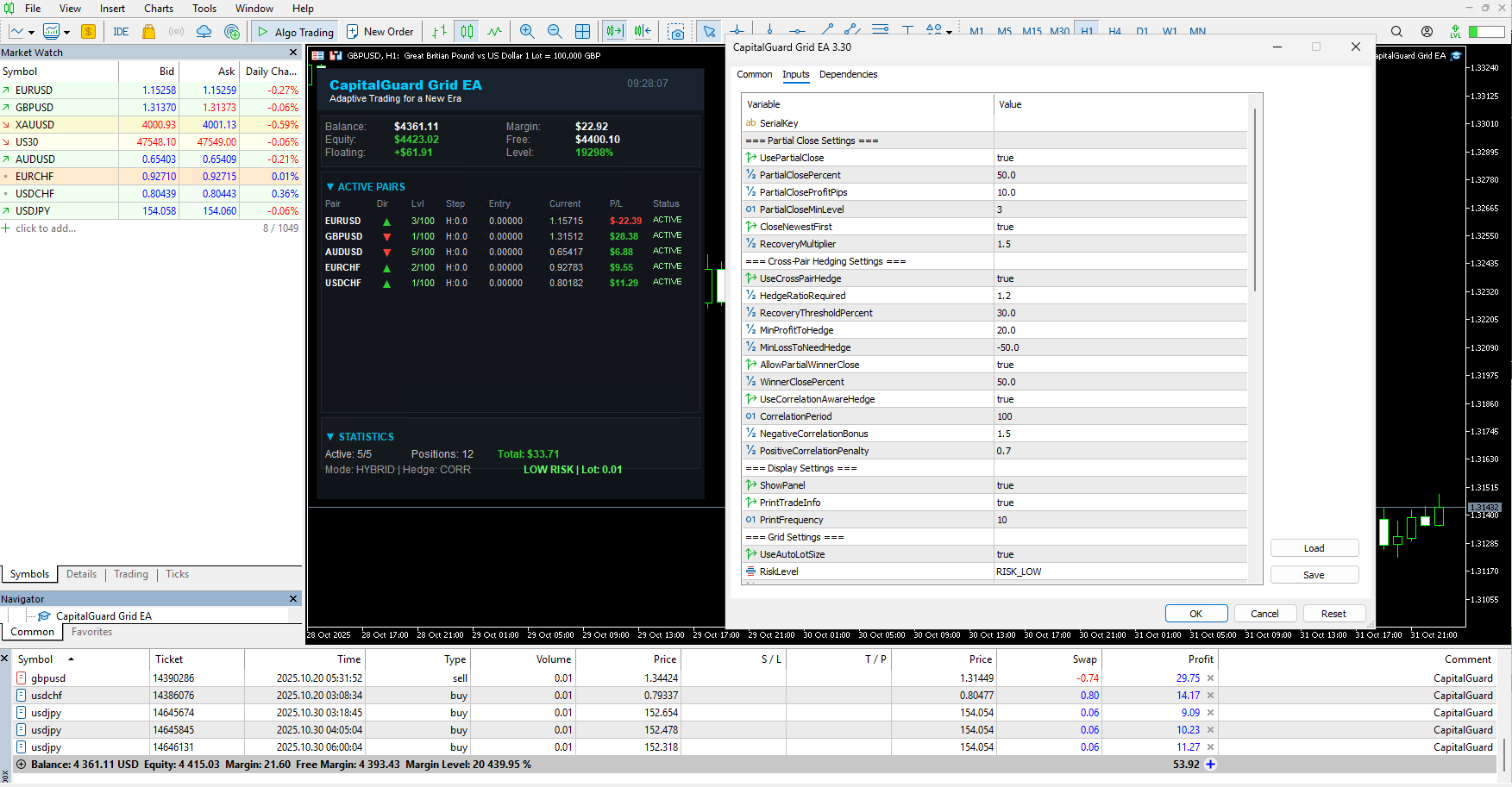

CapitalGuard Grid EA MT5 – $10K Live Signal

The only grid EA that actually thinks before it trades – analyzes all 28 pairs simultaneously using proprietary smart entry algorithms, with no martingale risk and adaptive grid spacing that adjusts to market conditions.

Drawdown is managed with pair correlation hedging, ensuring your capital is protected.

Choose low risk for steady 6-10% monthly returns or high risk to potentially double your account in a couple of months, with built-in protection systems and correlation filtering across 8 specialized currency pairs.

The Download Package Includes:

+ Expert: CapitalGuard Grid EA (.ex5) – Latest Version + All Updates

+ Unique license key

+ Detailed User Guide.pdf

Live Performance Signal:

+ https://www.myfxbook.com/capitalguard-grid-ea-live/

Pay £75/Month (Klarna • Revolut)

Pay €85/Month (Klarna • Revolut)

Don’t want to pay the full amount at once? Pay monthly for 10 months ($1,000). Choose your currency above.

Instant Download

The lowest legitimate price — anywhere.

7-day full refund in the rare event of problems.

Don't risk being scammed by fake resellers. We are the only EA reseller rated Excellent on Trustpilot — check it yourself.

$1,249.95 Original price was: $1,249.95.$999.95Current price is: $999.95.

The lowest genuine reseller price. · Price reflects current MQL5 listing and may change.

If your EA isn't profitable after 30 days of proper use, we'll exchange it for another product of equal or lesser value. No questions asked.

Applies to products $150+. Requires proof of proper installation and use per documentation. One exchange per customer.

What's Included

CapitalGuard EA — Adaptive Trading for a New Era

Institutional Logic • Intelligent & Adaptive Averaging • Capital Protection through Cross-Pair Hedging

Trade like the pros. CapitalGuard applies a portfolio-style, bank-inspired approach: it maps supply/demand zones, analyzes 28 pairs at once, aligns signals with our proprietary server data, and continuously updates logic as markets evolve.

The result? Safe compounding and balanced risk across multiple pairs with optional hedging — designed for long-term, set-and-forget performance.

🚀 Why Traders Choose CapitalGuard

- Set-and-Forget: VPS-ready — check in monthly, not hourly

- Low-Risk Mode: Targets ~10% per month with controlled drawdown

- Institutional Execution: Supply/demand levels + portfolio-style position management

- Market-Wide Intelligence: Analyses all 28 major forex pairs before committing entries

- Always Evolving: Secure server connection for licensing, live market data & continuous updates

- Multi-Pair from One Chart: Manage 8+ symbols you list in the inputs

- Hedging Enabled: Can hold buys & sells on the same pair for balanced exposure

- FIFO Compatible: Works with U.S. brokers using a special preset

🧠 How CapitalGuard Thinks

CapitalGuard isn’t a static EA. It uses proprietary entry filtering to evaluate all 28 major pairs, aligns with supply/demand zones, then executes with layered, risk-aware positioning and basket exits. A secure server link powers licensing, continuous optimization, and live market data, so the logic stays current with market conditions. Attach it to one chart, list the symbols you want, and it will trade them all from a single instance.

📈 Add CapitalGuard to Your Trading Portfolio

Think of CapitalGuard as the steady income engine in your trading portfolio. While you chase momentum plays, scalp sessions, or swing trade high-conviction setups, CapitalGuard quietly compounds in the background — targeting consistent monthly returns with disciplined risk management.

🎯 Consistent Monthly Targets — Built for Compounding

CapitalGuard is calibrated for sustainable compounding across three risk profiles. Not explosive gambles, not reckless martingale — just professional-grade position management across multiple pairs with controlled exposure.

The math: Even Low-Risk mode at 10% monthly compounds to ~214% annually. That’s institutional-level performance without the institutional-level stress.

Why This Works as a Portfolio Component

| Your Active Trading | CapitalGuard EA |

|---|---|

| High focus, time-intensive | Set-and-forget, VPS runs 24/7 |

| Variable returns (streaky) | Consistent monthly targets |

| Directional risk (stops matter) | Multi-pair hedging (balanced exposure) |

| Emotional decisions | Algorithmic discipline |

| Chart time = income potential | Works while you sleep, travel, or trade other markets |

⚙️ Three Risk Profiles — Choose Your Speed

Same intelligent framework, same institutional logic — you choose the intensity based on your goals and risk tolerance:

🛡️ Low Risk

✓ Annual projection: ~214%

✓ Best for: VPS set-and-forget

✓ Sleep-at-night comfort

⚡ Medium Risk

✓ Annual projection: ~435-790%

✓ Best for: Balanced growth

✓ More aggressive compounding

🚀 High Risk

✓ Annual projection: ~1,355-3,294%

✓ Best for: Experienced traders

✓ Accept higher volatility

Note: All modes use controlled lot sizing, hedging capability, basket targets and exposure caps. No martingale. Past performance doesn’t guarantee future results.

Low Drawdown by Design

CapitalGuard’s risk management isn’t just about smaller lot sizes. It’s about intelligent exposure management:

- ✓ Multi-pair diversification: Spreads risk across 8+ symbols from 28-pair analysis

- ✓ Basket exits: Takes profit across positions collectively, not piecemeal

- ✓ Exposure caps: Hard limits prevent overextension even in volatile markets

- ✓ Hedging capability: Can hold offsetting positions to neutralize directional risk

- ✓ No martingale: Controlled lot progression, never doubling down recklessly

- ✓ Supply/demand awareness: Entries align with institutional key levels

The result? Your equity curve stays smooth while compounding — even during volatile market conditions.

Click above to see verified trading stats on Myfxbook — every trade tracked and verified by third-party analytics.

🛡️ Correlation-Aware Cross-Pair Hedging

CapitalGuard doesn’t just trade multiple pairs — it understands the relationships between them. The correlation-aware hedging system analyzes how pairs move together in real-time, automatically protecting your portfolio by keeping winning inverse-correlation pairs open while strategically closing weaker hedges during recovery periods.

Real Example: How Hedging Protects You

Without Correlation Hedging:

- EURUSD: -$150 (losing)

- GBPUSD: -$120 (losing – moves with EUR)

- USDJPY: +$80 (winning but unrelated)

- Net Drawdown: -$190 😟

With Correlation Hedging:

- EURUSD: -$150 [PROT▼]

- GBPUSD: -$120 [PROT▼]

- USDJPY: +$80

- USDCHF: +$200 [HEDGE▲] (inverse to EUR, worth $320 effective hedge value due to -0.85 correlation × 1.6 bonus)

- Net Drawdown: -$30 ✅ (84% reduction!)

How Cross-Pair Hedging Works

1. Correlation Analysis

Calculates how pairs move together every hour (100-bar price analysis). Identifies inverse relationships automatically.

2. Weighted Hedge Values

Inverse pairs (like USDCHF vs EURUSD): Profit × 1.6 = stronger hedge value

Correlated pairs (like GBPUSD vs EURUSD): Profit × 0.7 = weaker hedge value

Why? Inverse pairs move opposite your losses — they’re TRUE hedges.

3. Smart Recovery Lock-In

When a losing pair recovers 25% from its worst point, system closes winning positions strategically: weak hedges first (correlated pairs), strong hedges last (inverse pairs). Locks in profits before market reverses.

4. Coverage Monitoring

System requires 130% hedge coverage by default. If you have -$100 in losses, system needs $130 in effective hedge value to mark portfolio as “COVERED” and continue trading confidently.

Massive Drawdown Reduction

| Risk Mode | Without Hedging | With Hedging | Improvement |

|---|---|---|---|

| Low Risk | 15-20% drawdown | 5-8% drawdown | 60-70% ↓ |

| Medium Risk | 20-30% drawdown | 8-12% drawdown | 40-60% ↓ |

| High Risk | 30-45% drawdown | 12-18% drawdown | 40-60% ↓ |

Managing Losing Positions

The hedging system doesn’t just reduce drawdowns — it actively manages losing positions through intelligent protection:

- Automatic Protection: When pairs lose money, system identifies and opens inverse correlation pairs

- Keeps Winners Active: Profitable hedges stay open even when other pairs are losing — they’re protecting you

- Recovery Detection: Tracks each pair’s worst loss point, triggers profit-taking at 25% recovery

- Priority Closing: Closes weakly-correlated winners first, keeps strong inverse hedges longer

- Portfolio Balance: Never lets one pair drag down the whole account — hedge coverage monitoring ensures protection

Visual Indicators

On the dashboard, you’ll see real-time hedge status:

- HEDGE▲ (Cyan) — Pair is protecting others with its profit

- PROT▼ (Orange) — Pair is being protected by winning hedges

- ACTIVE (Green) — Normal trading

Recommended Pairs: For maximum hedge effectiveness, include USDCHF (inverse to EUR pairs) and USDCAD (inverse to commodity currencies) in your pair selection. These provide the strongest correlation protection.

🛡️ The Safety Net You Didn’t Know You Needed

Bad trading month? CapitalGuard keeps churning. On vacation? It’s working. Market whipsaws killing your setups? CapitalGuard’s multi-pair basket smooths it out.

This isn’t about replacing your edge — it’s about amplifying your results with consistent, low-drawdown passive income.

🚀 Built for Long-Term Compounding

Set-and-Forget: Put it on a VPS, let it run, check in monthly.

Professional Compounding: Choose Low-Risk for steady ~10% monthly, or go Medium/High if you want more speed.

Portfolio Mindset: Multi-pair exposure + hedging to balance risk and smooth equity.

Continuously Updated: Server-connected logic that evolves with the market — not a “frozen” codebase.

⭐ Trader Reviews

- ★★★★★ “Feels like a bank’s playbook. I run Low-Risk on a VPS and check monthly — ~10% average so far with tiny heat.” – Daniel R.

- ★★★★★ “Multi-pair from one chart + hedging is the edge. Smooth curve, zero micromanaging.” – Elena S.

- ★★★★★ “The live stream is the clincher. Real entries, real drawdown, real money.” – Michael T.

❓ Frequently Asked Questions

Does it scan the whole market?

It analyses all 28 major forex pairs and trades the symbols you specify — all from a single chart.

Can it hedge?

Yes. It can hold buys and sells on the same pair, managing them as a balanced basket.

Is this a grid EA?

The engine uses layered entries and basket exits. Unlike typical grid bots, it is server-updated, supply/demand aware, and built to balance risk across pairs with exposure caps (no martingale).

Do I need a VPS?

Yes — CapitalGuard is designed for 24/7, set-and-forget operation. Most retail traders can’t leave their computer on permanently.

Is it FIFO compliant?

Yes — use the included settings for U.S. brokers.

What’s the difference between Low, Medium, and High Risk?

They use the same intelligent logic but with different lot sizes and exposure levels. Low Risk targets ~10% monthly with <15% drawdown. Medium targets 15-20% with moderate drawdown. High targets 25-35% with higher volatility. Choose based on your risk tolerance.

🚀 Start Compounding Like a Pro

Begin with Low-Risk ~10% monthly targeting, or choose a higher profile if you want more speed. You’re running the same logic you watch live on our $10K stream — with institutional discipline and server-driven updates.

- ✅ Choose your risk profile: Low (10%), Medium (15-20%), or High (25-35%) monthly targets

- ✅ Real $10K account — streamed live 24/7

- ✅ Supply/demand execution + hedging

- ✅ Analyses 28 pairs — portfolio-style exposure

- ✅ Server-connected — continuous updates & licensing

- ✅ VPS-ready set-and-forget

- ✅ FIFO compatible

💳 Prefer Installments? Pay Over Time

Pay £75/Month (Klarna • Revolut)

Pay €85/Month (Klarna • Revolut)

| Choose | Buy, Rent for 30 Days |

|---|

Reviewed by Our Trader

Peter Jones

Pre-Purchase FAQs

Are updates always free?

Yes, all updates are completely free—you'll never pay twice.

We receive updates from developers and upload them to your account when they're available. Please be patient, as we're managing hundreds of products at discounted prices. More popular products are updated more frequently.

All versions are stored in your account for easy access.

What's your refund policy?

We offer a 7-day technical guarantee. If the EA fails to attach to your chart due to verified errors we can replicate, we'll issue a full refund.

However, we cannot refund based on trading performance or profit expectations—forex markets are unpredictable, and results vary by broker, spread, and market conditions. We provide tools, not guarantees.

I need assistance installing this?

Yes, we'd be happy to assist you!

We can advise you on the best settings for your account or create custom presets tailored to your needs. Additionally, we offer a one-time free installation service using AnyDesk for remote setup.

Please note, however, that we cannot provide advice on how to make money with any of our products.

Can I use this on multiple accounts?

Absolutely. Once you purchase, the EA is yours to use on unlimited live and demo accounts—no restrictions.

You can run it on multiple brokers, VPS servers, or trading accounts simultaneously.

There are no license limits or activation keys. Buy once, use everywhere.

How do I download after payment?

After successful payment, your product will be available for download instantly:

- Displayed on the screen immediately after checkout

- Emailed to the address you provided during purchase

- Stored in your account if you created one at checkout

In rare cases (about 1% of high-value premium products), orders may be held for manual review to prevent fraud. If you don't see a download link, contact us for assistance.

Is this an original product?

Yes, absolutely.

We do not sell fake products, and our customer reviews, along with our pricing, reflect the quality and authenticity of what we offer.

Why Traders Trust Us

Related Products

Powerful expert advisors, exclusive to CheaperForex, at the lowest prices.

-

TrendAlgo AI EA MT4 V2.30 – Trend-Following Trading Bot

Rated 0 out of 5$1,500.00Original price was: $1,500.00.$199.95Current price is: $199.95. -

Magnat EA MT4 V1.5 – Official & Latest Version

Rated 0 out of 5$9,000.00Original price was: $9,000.00.$199.95Current price is: $199.95. -

Boring Pips EA MT4 Version 4.4

Rated 0 out of 5$399.00Original price was: $399.00.$149.95Current price is: $149.95. -

Sonata EA MT4 – Scalping Perfection

Rated 0 out of 5$1,400.00Original price was: $1,400.00.$179.95Current price is: $179.95.