Official MQL5 EA. Massive Discount. Zero Catch.

We paid full price, so you don't have to. Get the genuine EA activated directly from MQL5 into your MT5 — same product, same updates, fraction of the cost.

Our Customer Reviews

Excellent product quality.

The latest updated versions of EAs are sent as soon as they are available.

I can highly recommend this site

Have gotten a lot from them in the past and never been disappointed.

After reaching out, I was refunded right away. 5/5 stars in my book.

I received immediate attention to a credit card payment error and they organised a refund within minutes ( late on a Sunday evening ) plus a great saving on a quality Forex EA.

But you need to do your homework on any product before buying.

They give a lot of commitment from themselves. I highly recommend it to everyone!

I recommend it 100%

The products work as advertised and the customer support is topnotch.

Great support. Recommended, 5 STARS.

You can trust them completely.

All issues have been resolved. , If the problem cannot be resolved, a refund will be given.

Prima che intervenissi, si erano accorti dell'anomalia. Per me, piena fiducia all'operatore.

Best in the industry. Thank you for what you do

They also have an outstanding customer care services .

It makes a change from most of the scam forex websites!

How MQL5 Activation Works

Purchase

Save 50-80%

on the exact same official product

Install

We activate it for you

in 60 seconds, directly from MQL5

Start Trading

Full ownership, no restrictions

It's yours, permanently

Future Updates

Free & instant updates

delivered straight to your MT5

Gold Buster Sensitive EA MT5

This next-generation expert system combines neural network architectures with predictive analytics to exploit Gold volatility. The unique Signals Sensitivity parameter lets you control trade frequency vs. quality — from high-frequency trading to maximum precision entries.

- ✅ $1K → $91K backtest — 2.42 profit factor, 56.06 recovery factor

- ✅ 67.14% win rate — 3,332 trades over testing period

- ✅ Adjustable sensitivity (0.1-0.9) — control trade frequency and quality

- ✅ NO martingale / NO grid — fixed stop losses only

- ✅ Works M1 to H1 — validated across multiple timeframes

Customize both quantity AND quality of trades with one parameter.

Official MQL5 EA. Massive Discount. Zero Catch.

We paid full price, so you don't have to. Get the genuine EA activated directly from MQL5 into your MT5 — same product, same updates, fraction of the cost.

Buy Now

$250.00 Original price was: $250.00.$124.95Current price is: $124.95.

Yes! All products listed on our site are in stock and ready for immediate activation.

There are no waiting periods or group buys. Purchase today, get it activated today.

Updates are downloaded directly from within your MT5 terminal — no need to contact us.

Simply open the developer's product page in the MQL5 marketplace and click "Update" whenever a new version is released. It's fully self-service and takes seconds.

Yes. This is activated directly from the developer's official MQL5 marketplace listing—guaranteed authentic.

Unlike downloadable files (which can be fake or cracked), this EA is installed through MQL5's one-click activation system, ensuring you get the real product with full functionality and instant automatic updates.

When you buy from us, you're getting the exact same lifetime license as buying directly from MQL5—just at a fraction of the price.

If you change your mind before we activate the official product in your MT5 terminal, you are eligible for a full refund. Absolutely no questions asked.

Once it has been activated and is working correctly, refunds are no longer available and our regular 7-day refund policy does not apply.

Once we've activated it for you, we can't take it back and it's yours permanently.

Buying directly on MQL5 means paying full price upfront—often $500-$1,500—without knowing if the EA will work for you. If it doesn't perform or the developer abandons it, there's no refund.

At CheaperForex, you get the exact same official, lifetime-licensed copy for up to 70% less. Test it at a lower risk before committing full price elsewhere.

We've been trusted since 2019, and every EA is yours forever—no renewals, no expiry, no surprises. Smarter investing in trading tools.

Simple: Volume purchasing + lower overhead = better prices for you.

We purchase licenses in bulk, then pass the wholesale savings to you. MQL5 charges full retail because they're a marketplace with fees and overhead. We buy direct and operate lean.

You get the exact same product:

✅ Same official MQL5 license (not cracked or pirated)

✅ Same lifetime updates from the developer

✅ Same technical support

✅ We handle the activation for you (under 2 minutes)

The only difference? You pay 50-80% less.

28,000+ customers trust us. Rated "Excellent" on Trustpilot with 116+ reviews.

No. As this is an official marketplace product, we cannot send you a direct file. The product must be activated directly inside your MT5 terminal via the official MQL5 marketplace.

This is the only legitimate way to receive the product and ensures you'll get ALL future updates automatically, which you can download yourself directly from the marketplace.

If you're looking for a downloadable file instead of legitimate marketplace activation, please do not purchase.

Risk-free purchase. Full refund if not satisfied.

We're so confident you'll love this EA that we offer a full refund within 7 days if you're not satisfied—no questions asked.

- ✓ Full refund if you don't activate the EA

- ✓ No complicated forms or hoops to jump through

- ✓ Simply email us within 7 days of purchase

- ✓ Your satisfaction is our #1 priority

Important: Refunds are only available before activation. Once the EA is installed on any MT5 platform, the activation is permanently consumed and cannot be reclaimed. This is standard MQL5 policy across all vendors to protect limited license slots.

Installed directly from the MQL5 marketplace

We can install it for you—no technical skills needed

Not tech-savvy? No problem. We'll handle the entire installation process for you via remote desktop—completely free.

- ✓ We remotely connect to your computer (with your permission)

- ✓ Install and configure the EA on your MT5 platform

- ✓ Set up optimal settings for your broker and account

- ✓ Verify everything is working correctly before we disconnect

- ✓ Typically takes under 2 minutes start to finish

How it works:

After purchase, simply email us or use our live chat. We'll schedule a quick session at your convenience using secure remote desktop software (AnyDesk or TeamViewer). You stay in control the entire time and can disconnect at any moment.

Major advantage: MQL5 marketplace doesn't offer any installation help. We do, free of charge.

It's installed from the official marketplace, there's no difference

Quick Summary:

Gold Buster Sensitive EA for MT5 is a neural network-powered Gold trading system developed by Svetlana Cherepanova.

This next-generation expert system combines neural network architectures with predictive analytics to exploit Gold volatility. The unique Signals Sensitivity parameter lets you control trade frequency vs. quality — from high-frequency trading to maximum precision entries. No martingale, no grid, just fixed stop losses with positive mathematical expectation.

Official MQL5 Listing:

Gold Buster Sensitive EA MT5

Developer Profile:

Svetlana Cherepanova

The Unique Sensitivity Control

CONTROL TRADE FREQUENCY AND QUALITY

The Signals Sensitivity parameter (0.1 – 0.9) defines the system’s sensitivity threshold to market triggers:

- Low values (near 0.1): Maximum trade frequency with reduced signal selectivity

- Medium values (0.4-0.6): Good balance between number and quality of trades

- High values (near 0.9): Fewer trades but highest quality and precision

- Recommended: 0.6 — optimal balance between signal frequency and quality

This is what makes Gold Buster different from other EAs: you decide whether you want more trades with lower selectivity, or fewer trades with maximum precision.

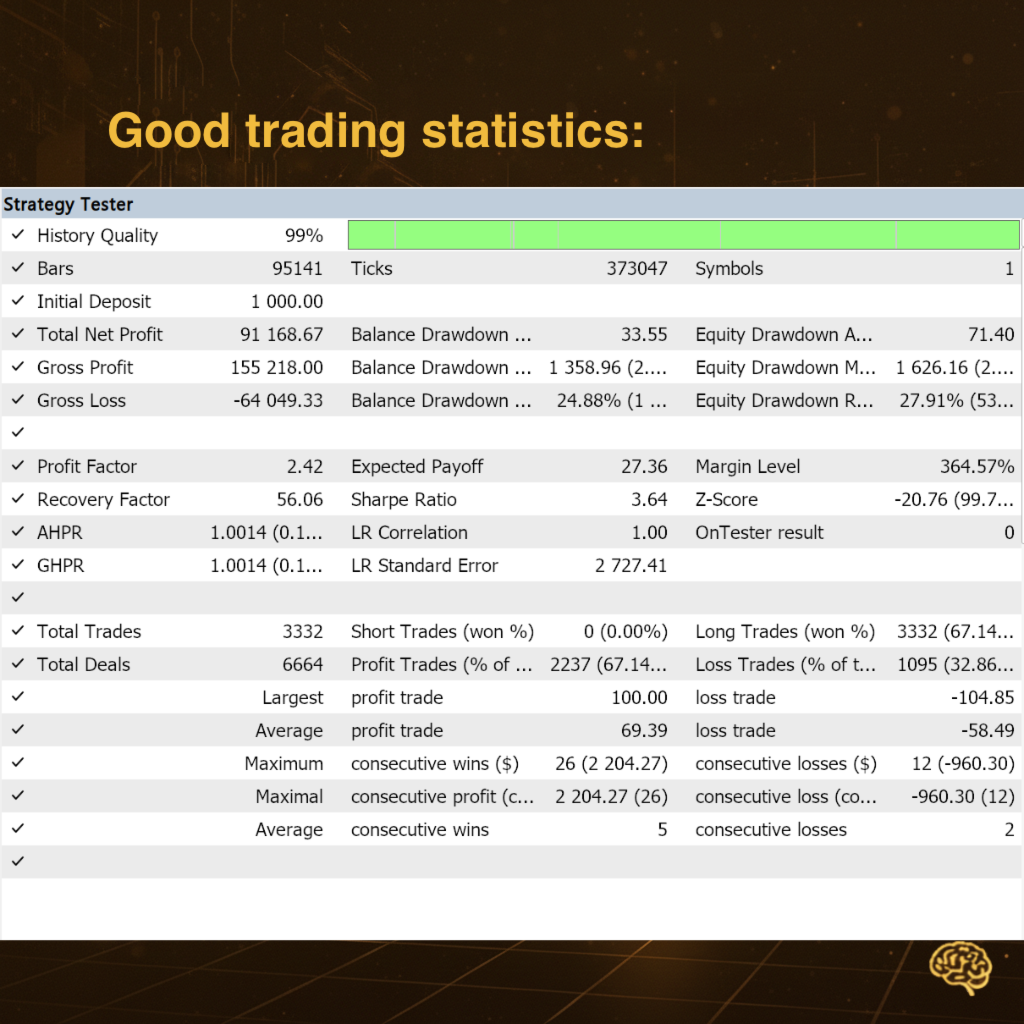

Backtest Results

Strategy tester results ($1,000 initial deposit, 99% history quality):

- Total Net Profit: $91,168.67

- Gross Profit: $155,218.00

- Gross Loss: -$64,049.33

- Profit Factor: 2.42

- Recovery Factor: 56.06

- Sharpe Ratio: 3.64

- Expected Payoff: $27.36

- Total Trades: 3,332

- Total Deals: 6,664

- Profit Trades: 2,237 (67.14%)

- Loss Trades: 1,095 (32.86%)

- Long Trades Won: 3,332 (67.14%)

- Balance Drawdown Relative: 24.88%

- Equity Drawdown Relative: 27.91%

- Largest Profit Trade: $100.00

- Average Profit Trade: $69.39

- Largest Loss Trade: -$104.85

- Average Loss Trade: -$58.49

- Max Consecutive Wins: 26 trades ($2,204.27)

- Max Consecutive Losses: 12 trades (-$960.30)

- Average Consecutive Wins: 5

- Average Consecutive Losses: 2

- Z-Score: -20.76 (99.7%)

- LR Correlation: 1.00

The 2.42 profit factor means the system generates $2.42 in gross profit for every $1 of loss. Combined with a 56.06 recovery factor and 3.64 Sharpe ratio, these are solid risk-adjusted metrics.

Technological Dominants

Adaptive AI Engine

Continuous strategy calibration to real-time market liquidity through advanced machine learning mechanisms. The system adapts to changing Gold conditions automatically.

Neural Network Filtering

Identification of latent patterns and non-linear correlations beyond the reach of classical technical analysis. The neural network detects opportunities that traditional indicators miss.

Execution Speed

Instantaneous trade signal derivation and precision order execution to minimize slippage. Fast execution is critical for Gold’s volatile price movements.

Risk Management

Rejection of toxic methods (Martingale, Grids) in favor of fixed Stop Losses and positive mathematical expectation. Every trade has defined risk from entry.

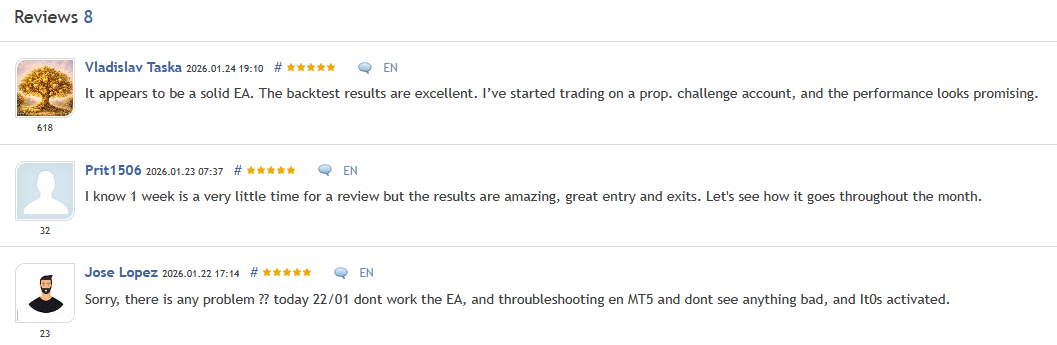

What Real Users Say

Vladislav Taska (5 stars):

“It appears to be a solid EA. The backtest results are excellent. I’ve started trading on a prop. challenge account, and the performance looks promising.”

Prit1506 (5 stars):

“I know 1 week is a very little time for a review but the results are amazing, great entry and exits. Let’s see how it goes throughout the month.”

Long-Only Strategy

Gold Buster specializes in identifying high-probability entry points for Buy positions only. This is a deliberate design choice:

- Gold has a historical upward bias over the long term

- Buy entries tend to have better reward profiles during volatility

- Simplifies the strategy for cleaner execution

- Reduces conflicting signals that could occur with bi-directional trading

The conservative approach to capital management means the EA focuses on quality buy entries rather than trying to catch every market move.

Timeframe Versatility

Gold Buster is validated for operation on any time interval from M1 to H1:

- M1: Most frequent signals, suited for scalping approach

- M5: Good balance for active traders

- M15: Medium-term opportunities

- M30: Less frequent but higher-quality signals

- H1: Least frequent, highest conviction entries

Combine timeframe selection with the Signals Sensitivity parameter to fine-tune exactly how the EA behaves.

Additional User Reviews

★★★★★ “The sensitivity control is genius.”

I run it at 0.3 for more trades on one account and 0.8 for quality-only on another. Completely different trading styles from the same EA. Love having this control.

— Marcus T., Frankfurt

★★★★★ “Neural network actually delivers.”

Skeptical of AI claims usually, but this one finds entries I wouldn’t spot manually. The pattern recognition is genuinely different from indicator-based systems.

— Elena S., Vienna

★★★★☆ “Good EA, needs patience.”

At sensitivity 0.7 it’s quite selective — only a few trades per week. But when it trades, the entries are excellent. Not for impatient traders.

— James R., London

★★★★★ “No martingale finally.”

So many Gold EAs hide martingale or grid logic. Gold Buster uses fixed stops — I always know my risk. The drawdown is real, not hidden in floating losses.

— Sophie L., Paris

★★★★★ “Works on M5 as advertised.”

Running on M5 with 0.6 sensitivity. Good trade frequency without sacrificing quality. The recovery factor is impressive for the drawdown level.

— David K., Singapore

Our Assessment

Transparent evaluation based on backtest performance and unique features:

What We Found:

- Backtest Performance: $1K→$91K, 2.42 profit factor, 56.06 recovery factor, 67.14% win rate

- Unique Feature: Signals Sensitivity (0.1-0.9) — control trade frequency vs. quality

- Technology: Neural network filtering with adaptive AI engine

- Risk Management: NO martingale, NO grid — fixed stop losses only

- Strategy: Long-only (Buy positions) — focused approach

- Timeframes: Validated M1 through H1 — versatile application

- Win Streaks: Max 26 consecutive wins, average 5

- Drawdown: 24.88% balance DD — moderate risk profile

- Best Suited For: Traders wanting customizable trade frequency/quality balance

- Overall: Gold Buster’s unique sensitivity control sets it apart from typical Gold EAs. The ability to adjust trade frequency vs. quality in one parameter provides genuine flexibility. Neural network filtering combined with no-martingale risk management creates a solid foundation for Gold trading.

Who Should Use This EA?

Gold Buster Sensitive is ideal for traders who:

- Want control over trade frequency — adjust sensitivity to match your style

- Prefer neural network technology — pattern recognition beyond indicators

- Require fixed stop losses — no martingale or grid risk

- Trade Gold (XAUUSD) — specialized for gold volatility

- Want timeframe flexibility — M1 to H1 validated

NOT for traders who:

- Want to trade short positions (this is long-only)

- Need very low drawdown (<10%)

- Want to trade pairs other than XAUUSD

Technical Requirements

- Platform: MetaTrader 5

- Instrument: XAUUSD (Gold)

- Timeframe: M1, M5, M15, M30, or H1

- Account Mode: Hedging

- Lot Sizing: Progressive or Fixed lot options

- Features: Max spread control, dynamic SL/TP

- VPS: Recommended for consistent operation

Key Parameters

- Signals Sensitivity (0.1-0.9): Critical parameter for trade frequency/quality balance

- Lot Size: Fixed or progressive calculation

- Max Spread: Filter entries during wide spread conditions

- Stop Loss: Dynamic, always active on every trade

- Take Profit: Dynamic based on market conditions

Conclusion

Gold Buster Sensitive EA for MT5 offers something genuinely different: control over your trading style through a single parameter.

The Signals Sensitivity setting (0.1-0.9) lets you choose between high-frequency trading with more signals or low-frequency precision with maximum entry quality. This flexibility is rare in EA design and allows the same system to serve different trading preferences.

The backtest demonstrates solid performance: $1,000 to $91,168 with a 2.42 profit factor and 56.06 recovery factor. The 67.14% win rate across 3,332 trades shows consistent performance, not a lucky streak on a few trades.

The neural network filtering identifies patterns beyond classical technical analysis, while the adaptive AI engine calibrates to real-time market liquidity. Most importantly, the system rejects martingale and grid strategies in favor of fixed stop losses — you always know your risk.

For Gold traders who want the ability to customize trade frequency and quality while maintaining solid risk management, Gold Buster Sensitive delivers genuine flexibility backed by neural network technology.

What Do You Receive?

– Gold Buster Sensitive EA for MT5 – Latest Official Version activated directly in your MT5

– Free lifetime updates (which you can download yourself)

– For use on unlimited brokers and trading accounts

FAQs

What are the backtest results?

$1,000 → $91,168 with 2.42 profit factor, 56.06 recovery factor, 3.64 Sharpe ratio. 67.14% win rate across 3,332 trades. Max consecutive wins: 26, max consecutive losses: 12.

What is the Signals Sensitivity parameter?

A unique control (0.1-0.9) that defines trade frequency vs. quality. Low values (0.1) = more trades, less selectivity. High values (0.9) = fewer trades, maximum precision. Recommended: 0.6 for optimal balance.

Does it use martingale or grid?

No. Gold Buster explicitly rejects toxic methods (martingale, grids) in favor of fixed Stop Losses and positive mathematical expectation. Every trade has defined risk from entry.

What technology powers it?

Three pillars: Adaptive AI Engine (continuous calibration to market liquidity), Neural Network Filtering (identifies patterns beyond classical analysis), Execution Speed (precision order execution).

Does it trade both long and short?

Long only (Buy positions). This is deliberate — Gold has historical upward bias, and focusing on buys simplifies execution while capturing the best opportunities.

What timeframes work?

Validated from M1 to H1. M1 for most frequent signals, H1 for highest conviction entries. Combine timeframe selection with sensitivity parameter for fine-tuned control.

What’s the recommended sensitivity setting?

0.6 is recommended as the optimal balance between signal frequency and quality. Lower for more trades, higher for maximum precision.

What’s the win rate?

67.14% across 3,332 backtested trades. Average consecutive wins: 5. Average consecutive losses: 2.

What’s the drawdown?

24.88% balance drawdown relative in backtesting. This is moderate risk — the system doesn’t hide drawdown in floating losses like martingale systems.

What is the recovery factor?

56.06 recovery factor — this measures how quickly the system recovers from drawdowns. Higher is better, and 56 is excellent.

What account type is needed?

Hedging account mode on MetaTrader 5. Compatible with most brokers that support MT5 hedging.

What lot sizing options exist?

Progressive or Fixed lot options available. Also includes max spread control to filter entries during wide spread conditions.

Is it prop firm compatible?

Users report using it on prop firm challenges. The fixed stop loss approach and no-martingale design align with prop firm requirements. Adjust sensitivity for your risk tolerance.

Does it work on other pairs?

XAUUSD (Gold) only. The system is specifically designed for Gold’s volatility characteristics and not optimized for other instruments.

How is this different from other Gold EAs?

The Signals Sensitivity control is unique — one parameter to adjust trade frequency vs. quality. Combined with neural network filtering and no martingale/grid, it offers genuine customization most Gold EAs lack.

Peter Jones

Us vs MQL5 Marketplace

See why 28,000+ customers choose us

|

CheaperForex

Best Value

|

MQL5 Direct | |

|---|---|---|

| Price | ✓ Save 50-80% | Full price |

| Crypto Discount | ✓ Extra 20% off | ✗ Not available |

| Refund Policy | ✓ Full refund before activation | ✗ Store credit only |

| Payment Options | ✓ Cards, Apple Pay, Crypto | ✓ Cards only |

| Activation Support | ✓ We install for you | ✓ Self-install |

| Ownership | ✓ Lifetime, no expiration | ✓ Lifetime, no expiration |

| Hardware Activations | ⚠ 1 (up to 10 MT5s) | ✓ 5 activations |

| Trustpilot | ✓ Rated "Excellent" | — Seller ratings vary |

Us vs MQL5 Marketplace

Tap to compare →

CheaperForex

MQL5 Direct

How We Deliver Your EA (2 Minutes)

Why Traders Trust Us

Frequently Asked Questions

Is this an official product?

Yes. This is activated directly from the developer's official MQL5 marketplace listing—guaranteed authentic.

Unlike downloadable files (which can be fake or cracked), this EA is installed through MQL5's one-click activation system, ensuring you get the real product with full functionality and instant automatic updates.

When you buy from us, you're getting the exact same lifetime license as buying directly from MQL5—just at a fraction of the price.

Are updates always free and instant?

Yes, product updates for this EA are always free and instant.

They can be downloaded from within the terminal from the marketplace.

Just go to the product listing and click "update" if there's one available.

How do I get this after paying?

Most activations are completed within 15-30 minutes of purchase.

Here's the simple process:

This is an official MQL5 product that must be activated directly from the marketplace—it cannot be downloaded as a standalone file.

Installation process:

1. After purchase, we'll schedule a quick activation session (usually within a few hours)

2. You grant us temporary access via UltraViewer or AnyDesk (takes ~2 minutes), OR provide temporary VPS credentials

3. We activate the EA on your MT5 terminal(s)

4. Done! The EA is permanently yours with instant updates from MQL5

The entire process is secure and takes about 2 minutes.

After activation, no further involvement from us is needed.

How does the 7-day refund policy work?

If you change your mind before we activate the official product in your MT5 terminal, you are eligible for a full refund. Absolutely no questions asked.

Once it has been activated and is working correctly, refunds are no longer available and our regular 7-day refund policy does not apply.

Once we've activated it for you, we can't take it back and it's yours permanently.

How long does activation take?

Usually within a few hours of purchase, but often much faster.

Immediately after purchase, you'll receive an instructional PDF explaining the simple activation process.

Don't worry—it's straightforward, and our refund policy applies anytime before we activate the EA on your terminal.

What if I reinstall MT5 or get a new computer?

Activations are tied to your hardware ID, not your MT5 installation.

Free reactivation if:

• You reinstall MT5 on the same computer

• You accidentally delete MT5

• Windows updates cause issues (this is rare)

• You reinstall Windows (sometimes this doesn't work, but we will always attempt it for you)

Reactivation NOT possible if:

• You get a new computer (different hardware)

• You upgrade major hardware components (motherboard, etc.)

Important: Treat your installation with care. If you're planning to reformat or upgrade hardware, contact us FIRST so we can assist you.

Contact [email protected] with your order number if you need help.

Why should I buy here?

Buying directly on MQL5 means paying full price upfront—often $500-$1,500—without knowing if the EA will work for you. If it doesn't perform or the developer abandons it, there's no refund.

At CheaperForex, you get the exact same official, lifetime-licensed copy for up to 70% less. Test it at a lower risk before committing full price elsewhere.

We've been trusted since 2019, and every EA is yours forever—no renewals, no expiry, no surprises. Smarter investing in trading tools.

Related Products

Official MT5 expert advisors, exclusive to CheaperForex, at the lowest prices.

-

AlphaCore X EA MT5

Rated 0 out of 5$790.00Original price was: $790.00.$219.95Current price is: $219.95. -

Quantum Bitcoin EA MT5

Rated 0 out of 5$999.00Original price was: $999.00.$395.95Current price is: $395.95. -

Synthara MT5 EA

Rated 0 out of 5$699.00Original price was: $699.00.$249.95Current price is: $249.95. -

Axonshift EA MT5

Rated 0 out of 5$799.00Original price was: $799.00.$319.95Current price is: $319.95.