Quantum Emperor EA Review (2025) – 8.3/10 Rating | See Why We Love It

Our opening thoughts regarding Quantum Emperor…

After running Quantum Emperor EA (MT4 & MT5) across GBPUSD H1 on low-spread accounts, my take is simple: this is one of the few EAs whose execution design (six-trade split + profit-recycling) genuinely reduces stress without leaning on martingale or a grid. It won’t “print money,” but it does smooth the ride. I’d call it a high-confidence, medium-aggression system — ideal for traders who want steady equity growth rather than fireworks.

Bottom line up front: Rating: 8.3/10. It earns that score for consistency, risk framing, and day-to-day usability. I’ve seen stronger raw returns elsewhere, but very few combine comparable win rate with controlled behaviour and beginner-friendly setup.

How It Trades (In Practice)

Six-Trade Split & “Profit-Recycling”

Each signal is broken into six smaller orders. Winners trail out; losers aren’t dumped in a panic — they’re retired gradually using realized profit from recent winners. The effect: fewer nasty equity cliffs, more “drift upwards.” Every position still carries a 250-pip protective SL, so you’re not naked in a trend shock.

Risk & Pace

On H1 GBPUSD, trade frequency is moderate (not a scalper). With sensible risk, the EA avoids the “death by overtrading” pattern. The Auto-Lot option scales exposure reliably with balance — I found this safer than fixed-lot tinkering for most users.

What Convinced Me

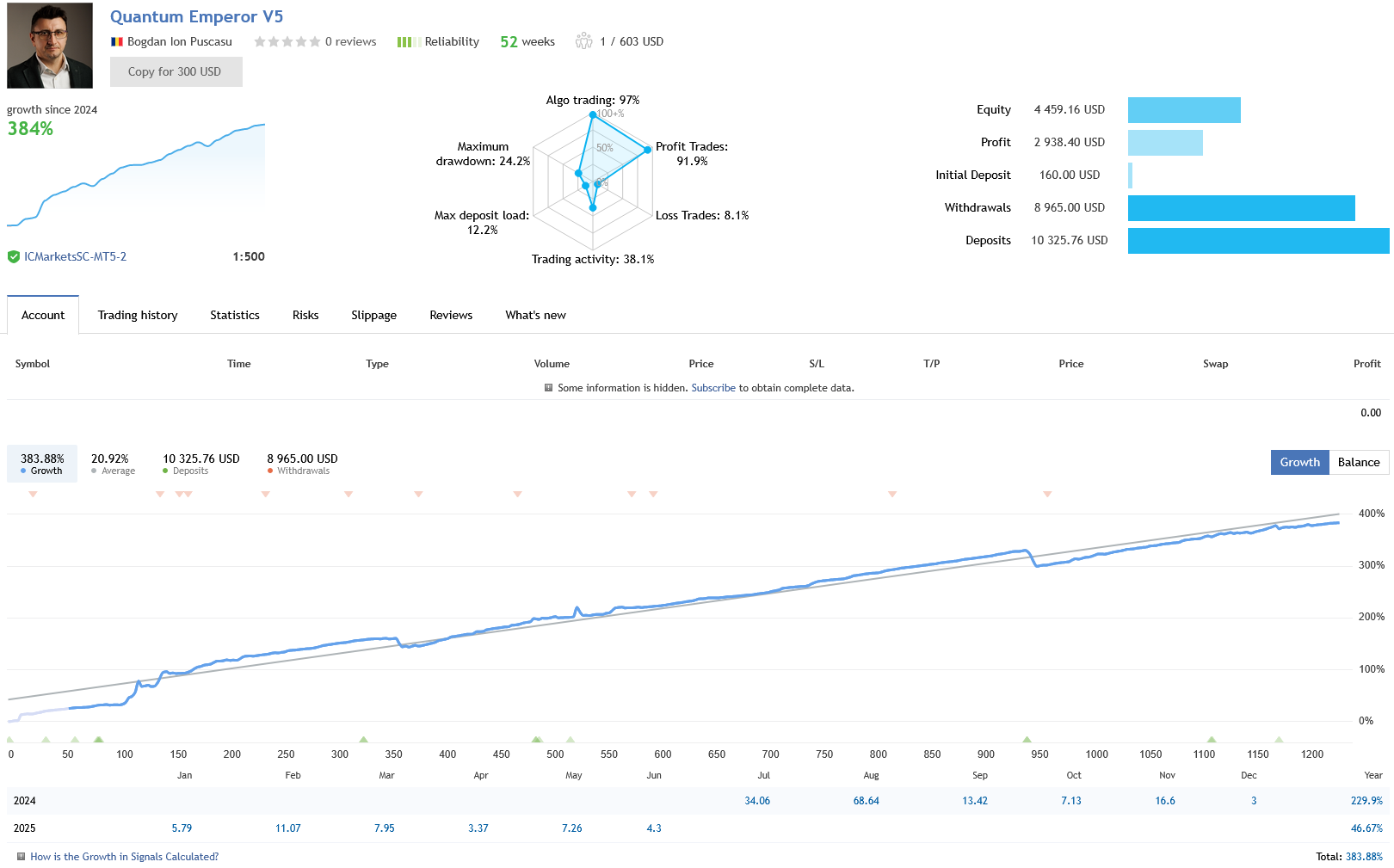

- Live performance tone: High win rate with controlled max DD is consistent with how the logic works. It behaves like a professional system rather than a hype bot.

- Design integrity: No martingale, no blind grid stacking. The recovery is methodical, not reckless.

- Broker realism: Works best on ECN/Raw/Razor. On a decent VPS it’s very “set and let it run.”

Caveat: like any recovery-aware model, it prefers rhythm over chaos. In prolonged one-way GBPUSD trends, expect slower cycles and more reliance on the SL and trailing logic — still controlled, but patience is required.

Strengths vs. Limitations

Where It Shines

- Equity smoothness from the six-trade structure — fewer equity shocks.

- Clear, disciplined exits: trailing + hard SL on every position.

- Beginner-friendly: default settings are genuinely usable.

- Prop-friendly profile if you keep risk modest.

What To Watch

- Pair locked to GBPUSD H1. If you want multi-symbol coverage, this isn’t it.

- Needs low spreads and decent execution to shine (IC Markets / Pepperstone level).

- Recovery logic still means some time in market during stubborn trends — don’t oversize.

Who Should Use It

- Prop-firm candidates who value steady curves and predictable behaviour.

- Hands-off retail traders who want automation without a parameter maze.

- Risk-aware users comfortable with “earn consistently, compound sensibly.”

Setup Notes (What I Recommend)

- Symbol/TF: GBPUSD, H1

- Capital: $1,000+ (more headroom = calmer cycles)

- Leverage: 1:100 minimum (1:500 ideal, but don’t oversize)

- Broker: ECN/Raw/Razor; hedge mode preferred

- VPS: Yes — 24/7 uptime and stable latency matter here

- Risk Mode: Start conservative with Auto-Lot, scale only after a few weeks of live behaviour

Editor’s Take vs Similar EAs

- Compared to grid/marti “grow fast” bots: Emperor is slower but far safer; fewer disasters, fewer resets.

- Compared to pure trend followers: Emperor is more forgiving in chop; a bit less explosive in clean trends.

- Compared to Quantum Queen / Bitcoin: Emperor feels more “institutional” on GBPUSD — calmer risk profile.

FAQs

Does it use martingale or a grid?

No. It splits orders, trails intelligently, and retires losers with realized profits from winners. Every position has a hard SL.

Can I run it on multiple pairs?

It’s built and tuned for GBPUSD on H1. That focus is part of why it’s stable.

Is it prop-firm compatible?

Yes, if you keep risk modest and respect daily/overall DD limits. VPS and ECN spreads are strongly recommended.

How “hands-off” is it?

Very. Attach to the chart, set risk, verify broker time alignment if needed (GMT+2/DST), and let it run.

Verdict: 8.3/10

Quantum Emperor EA earns a solid 8.3/10 from me. It’s a grown-up approach to GBPUSD automation: structured, protective, and realistic about risk. If you want an EA that composes a smooth equity line and keeps your heart rate down, this belongs on your shortlist.

💰 Where to Buy Quantum Emperor EA

Get Quantum Emperor EA for MT4 & MT5 at 60% OFF the MQL5 marketplace price!

- ✅ Lifetime License – No recurring fees

- ✅ Installation Support – We help you get started

- ✅ Instant Delivery – Activation immediately after purchase

- ✅ Authentic EA – Directly from MQL5, massive savings

Accepted: Cards, Apple Pay, Google Pay, Amazon Pay, Link and Crypto (extra discount available)