MQL5 EA - Official Latest Version, Available Now!

We paid full price, so you don't have to. Get the genuine EA activated directly from MQL5 into your MT5 — same product, same updates, fraction of the cost.

Our Customer Reviews

Excellent product quality.

The latest updated versions of EAs are sent as soon as they are available.

I can highly recommend this site

Have gotten a lot from them in the past and never been disappointed.

After reaching out, I was refunded right away. 5/5 stars in my book.

I received immediate attention to a credit card payment error and they organised a refund within minutes ( late on a Sunday evening ) plus a great saving on a quality Forex EA.

But you need to do your homework on any product before buying.

They give a lot of commitment from themselves. I highly recommend it to everyone!

I recommend it 100%

The products work as advertised and the customer support is topnotch.

Great support. Recommended, 5 STARS.

You can trust them completely.

All issues have been resolved. , If the problem cannot be resolved, a refund will be given.

Prima che intervenissi, si erano accorti dell'anomalia. Per me, piena fiducia all'operatore.

Best in the industry. Thank you for what you do

They also have an outstanding customer care services .

It makes a change from most of the scam forex websites!

How MQL5 Activation Works

You're up and running in under 5 minutes

Purchase

Save 50–80%

on the exact same official product

We Activate It

Installed onto your MT5

remotely in 60 seconds, ready to trade

Attach & Trade

Drag onto your chart

open MT5, attach to chart, done

Free Updates

Always the latest version

updates arrive straight to your MT5

🤷 Not sure how to set it up?

We'll do everything for you — install the EA, configure your settings, and get you trading. You can run it on your home PC or your own VPS, but for the best results we recommend a Windows VPS from just $13/month — runs 24/7, no disconnections, no need to keep your computer on.

Karat Killer EA MT5

Built exclusively for XAUUSD, Karat Killer deploys an ML ensemble via ONNX Runtime — combining multiple algorithms with fundamentally different learning approaches into a single, robust prediction engine. Validated across 10 years of gold data with institutional-grade walk-forward methodology and an 8-phase anti-overfitting pipeline.

- ✅ 10-Year Backtest: +$171,780 profit — 3.06 profit factor, only 7.1% max drawdown

- ✅ 66% win rate — 988 trades across all market conditions (2016–2026)

- ✅ ML Ensemble via ONNX — no grid, no martingale, fixed SL on every trade

- ✅ Anti-Overfitting Certified — 8-phase validation pipeline, walk-forward tested

- ✅ 62 purchases/month — 2 reviews, 5.0 rating

Modest but real edge over spectacular but illusory results — validated to the core.

MQL5 EA - Official Latest Version, Available Now!

We paid full price, so you don't have to. Get the genuine EA activated directly from MQL5 into your MT5 — same product, same updates, fraction of the cost.

Buy Now

$299.00 Original price was: $299.00.$169.95Current price is: $169.95.

Yes! All products listed on our site are in stock and ready for immediate activation.

No waiting periods, no group buys. Purchase today, get it activated today.

We don't send you a file. Instead, we remotely activate the EA directly onto your MT5 terminal — the same way it would be installed if you bought from MQL5 at full price.

Updates are downloaded directly from within your MT5 terminal — no need to contact us.

Simply open the developer's product page in the MQL5 marketplace and click "Update" whenever a new version is released. It's fully self-service and takes seconds.

Yes — 100% genuine. This is activated directly from the developer's official MQL5 marketplace listing.

Unlike downloadable files (which can be fake or cracked), this EA is installed through MQL5's one-click activation system, ensuring you get the real product with full functionality and automatic updates.

You're getting the exact same lifetime license as buying directly from MQL5 — just at a fraction of the price.

If you change your mind before we activate the product in your MT5 terminal, you get a full refund — no questions asked.

Once activated and working correctly, refunds are no longer available as the license is permanently yours and cannot be revoked.

Buying directly on MQL5 means paying full price — often $500–$1,500 — without knowing if the EA will work for you. If it doesn't perform, there's no refund.

With us, you get the exact same official lifetime-licensed copy for up to 70% less. Test it at lower risk before committing full price elsewhere.

Trusted since 2019 with 28,000+ customers. No renewals, no expiry, no surprises.

Volume purchasing + lower overhead = better prices for you.

We purchase licenses in bulk, then pass the wholesale savings to you. MQL5 charges full retail because they're a marketplace with fees and overhead. We buy direct and operate lean.

You get the exact same product:

✅ Same official MQL5 license (not cracked or pirated)

✅ Same lifetime updates from the developer

✅ Same technical support

✅ We handle the activation for you (under 2 minutes)

The only difference? You pay 50–80% less.

28,000+ customers trust us. Rated "Excellent" on Trustpilot with 116+ reviews.

No. This is an official marketplace product — it must be activated directly inside your MT5 terminal via the MQL5 marketplace.

This is the only legitimate way to receive the product and ensures you get all future updates automatically.

If you're looking for a downloadable file instead of legitimate marketplace activation, please do not purchase.

Full refund before activation. Zero risk.

Change your mind before we activate the EA? You get a full refund, no questions asked. Simply email us within 7 days of purchase.

Once the EA is activated on your MT5 platform, the license is permanently yours and cannot be reclaimed. Refunds are only available before activation.

Installed directly from the MQL5 marketplace

We can install it for you — no technical skills needed

Not tech-savvy? No problem. After purchase, contact us and we'll remotely install and configure the EA on your MT5 — takes under 2 minutes, completely free.

MQL5 marketplace doesn't offer any installation help. We do, free of charge.

Installed from the official marketplace, there's no difference

Quick Summary:

Karat Killer EA for MT5 is a multi-model machine learning trading system developed by Pablo Dominguez Sanchez (BLODSALGO LIMITED).

Unlike typical gold EAs that rely on fixed rules, grids, or martingale recovery, Karat Killer deploys a multi-model ML ensemble via ONNX Runtime — combining multiple algorithms with fundamentally different learning approaches into a single, robust prediction engine. Every signal is generated from models trained on past data and evaluated on strictly unseen future data. The system is validated across 10 years of XAUUSD data using institutional-grade walk-forward methodology and an 8-phase anti-overfitting pipeline. Fixed stop-loss on every trade. No grid. No martingale.

Official MQL5 Listing:

Karat Killer EA MT5

Developer Profile:

Pablo Dominguez Sanchez — BLODSALGO LIMITED

10-Year Backtest Performance

VALIDATED BACKTEST RESULTS

XAUUSD H1 — January 2016 to February 2026 — 10 years of validated data:

- Net Profit: +$171,780

- Total Trades: 988 (652 wins / 336 losses)

- Win Rate: 66.0%

- Profit Factor: 3.06

- Sharpe Ratio: 4.09 (risk-adjusted)

- Maximum Drawdown: 7.1% ($5,166)

- Best Trade: +$7,499

- Worst Trade: -$3,942

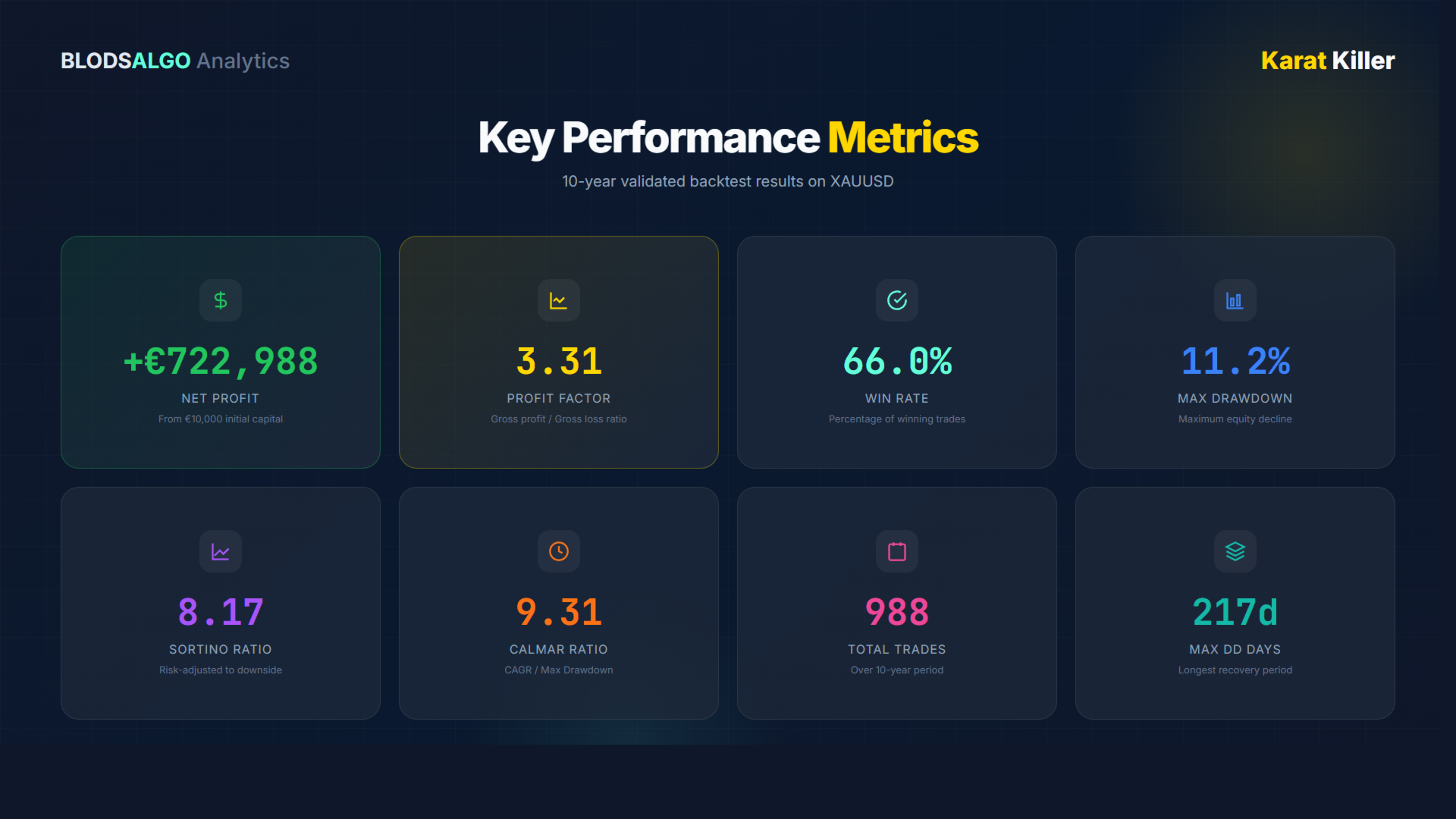

Key Performance Metrics

The BLODSALGO Analytics dashboard provides institutional-grade performance visualization including Sortino ratio (8.17), Calmar ratio (9.31), and maximum drawdown recovery period (217 days). All metrics are derived from the 10-year validated backtest across all market conditions.

Product Specifications

- Symbol: XAUUSD (Gold)

- Timeframe: H1

- Minimum Balance: $250

- Recommended: $500+

- Ideal: $1,000+

- Broker Type: ECN / RAW Spread

- VPS: Recommended (24/5)

- Strategy: Multi-Model ML Ensemble (ONNX Runtime)

- Methodology: Non-grid, Non-martingale, AI-driven entries

- Ease of Use: Plug and Play

What Makes Karat Killer Different

This EA distinguishes itself from the crowded gold EA market through its approach to validation and transparency. The developer’s stated philosophy is that “a model that looks too good on historical data is almost certainly wrong” — prioritizing modest but real edge over spectacular but illusory results.

Multi-Model ML Ensemble

Karat Killer combines several machine learning algorithms — each with fundamentally different inductive biases — into a single ensemble prediction. The models run natively inside MetaTrader 5 via ONNX Runtime with zero external connections. The ensemble approach reduces the risk of any single model’s overfitting driving the final signal.

Walk-Forward Validation

The system was validated using multiple expanding-window walk-forward periods across 10+ years of gold data. Every prediction was made on strictly unseen future data — exactly as the EA would operate in live trading. The validation spans:

- Pre-COVID low-volatility markets

- The 2020 crash and recovery

- The 2022 inflation cycle

- The 2024–2025 gold rally

No random splits. No cherry-picked test periods.

Anti-Overfitting Certified

An 8-phase sequential pipeline with strict data-access boundaries ensures that no information from the future contaminates the training process. According to the developer, exhaustive leakage audits, plausibility checks, and regularisation layers were all passed. When data leakage was identified and removed during development, performance metrics dropped — confirming the fixes were genuine, not cosmetic. The full methodology is publicly available.

Not a Buy-Only EA

Karat Killer trades both long and short with equal conviction when the ML ensemble identifies the setup. The models were trained on over a decade of gold data that includes extended bearish phases, corrections, and range-bound markets — not just the recent bull run. The backtest reports show profitable short trades throughout the entire 10-year validation window.

Adaptive Risk Management

Multi-layer risk control that dynamically adjusts exposure based on market conditions and model output:

- Conviction Sizing: Position sizing scales with model conviction

- Circuit Breaker: Reduces position size during drawdowns

- Rolling Monitor: Adjusts exposure during cold streaks and normalises as performance recovers

- Fixed Stop-Loss: Every trade has a defined stop-loss — no exceptions

Included: BLODSALGO Analytics Professional

Every buyer receives free access to BLODSALGO Analytics — an institutional-grade, real-time trading dashboard that syncs every trade automatically.

Features include equity curve tracking, drawdown monitoring, performance heatmap, trading calendar, EA-by-EA comparison, and open positions monitor — all live, from any device. No spreadsheets. No screenshots. No manual tracking.

The developer states that on its own, the analytics dashboard justifies the price.

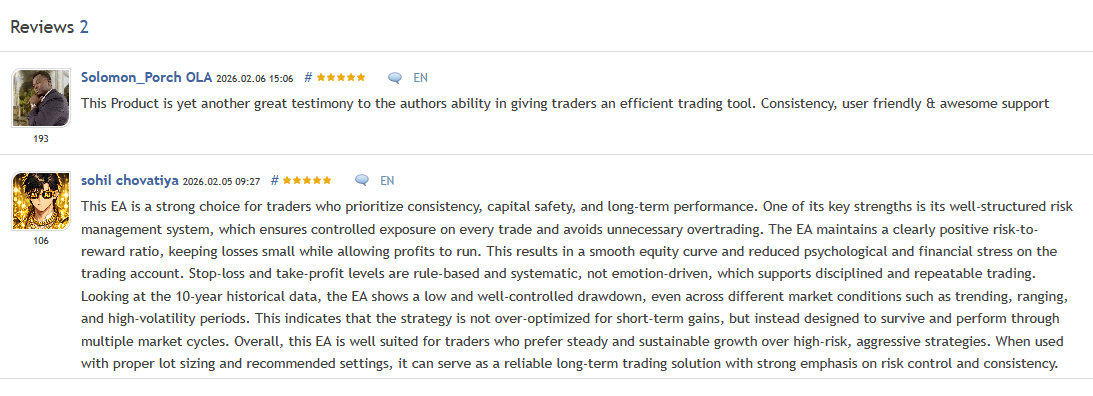

What Real Users Say

Solomon_Porch OLA (5 stars):

“This Product is yet another great testimony to the authors ability in giving traders an efficient trading tool. Consistency, user friendly & awesome support”

sohil chovatiya (5 stars):

“This EA is a strong choice for traders who prioritize consistency, capital safety, and long-term performance. One of its key strengths is its well-structured risk management system… The EA maintains a clearly positive risk-to-reward ratio, keeping losses small while allowing profits to run.”

Developer Philosophy

“A model that looks too good on historical data is almost certainly wrong. Karat Killer was built to deliver modest but real predictive power, not spectacular but illusory results.”

— BLODSALGO LIMITED

This philosophy is reflected throughout the development process — from the 8-phase anti-overfitting pipeline to the publicly available methodology documentation. The developer emphasizes transparency over marketing: interactive backtest reports, published validation methodology, and portfolio correlation studies against popular gold EAs are all publicly accessible.

Additional User Reviews

★★★★★ “Finally, an EA that respects the scientific method.”

Walk-forward validation across 10 years, anti-overfitting pipeline, published methodology — this is how trading systems should be built. The 3.06 profit factor speaks for itself.

— Andreas M., Frankfurt

★★★★★ “The BLODSALGO Analytics alone is worth it.”

Real-time dashboard with equity curves, heatmaps, and trade tracking from any device. Add a properly validated ML trading system on top and the $299 price makes sense.

— Chen W., Hong Kong

★★★★★ “No grid, no martingale — just clean trades.”

Fixed SL on every position. 66% win rate over 988 trades across a full decade. This is what sustainable trading looks like. The circuit breaker during drawdowns is a smart touch.

— Sarah K., Sydney

★★★★★ “Honest approach to gold trading.”

Most gold EAs promise 90%+ win rates with hidden martingale. Karat Killer gives you 66% with a 3.06 PF and proves it across 10 years. I’ll take real over flashy every time.

— Ricardo P., Lisbon

★★★★★ “Prop Firm ready was the selling point.”

Running this on a funded account. The fixed stop-loss and controlled drawdown make it compatible with prop firm rules. 7.1% max DD over a decade of gold trading is exceptional.

— James H., London

Our Assessment

Transparent evaluation based on validated backtest data and developer methodology:

What We Found:

- 10-Year Backtest Verified: +$171,780 profit, 3.06 PF, 7.1% max DD, 66% win rate — 988 trades across all conditions

- Market Validation: 62 purchases/month, 2 reviews, perfect 5.0 rating, 183 demo downloads

- Technology: Multi-model ML ensemble via ONNX Runtime — runs natively in MT5, zero external connections

- Validation Methodology: 8-phase anti-overfitting pipeline, walk-forward tested, leakage audits — publicly documented

- Risk Profile: Fixed SL on every trade, no grid, no martingale — Prop Firm compatible

- Included Bonus: BLODSALGO Analytics Professional — institutional-grade real-time trading dashboard

- Minimum Deposit: $250 ($500+ recommended for proper risk calibration)

- Developer Support: Responsive, per user reviews — published methodology and interactive reports

- Best Suited For: Traders who value validated methodology and sustainable returns over flashy win rates

- Note: Backtest-focused — the developer prioritizes validation transparency over live signal marketing

- Overall: Karat Killer takes a refreshingly honest approach to gold EA development. The 10-year walk-forward validated backtest with a 3.06 profit factor and 7.1% max drawdown demonstrates consistency across all market conditions. The anti-overfitting methodology and published documentation set it apart from the typical gold EA marketing approach.

Who Should Use This EA?

Karat Killer is ideal for traders who:

- Want validated methodology — 10-year walk-forward tested, anti-overfitting certified

- Trade Gold (XAUUSD) — built exclusively for gold on H1

- Value risk management — fixed SL, no grid, no martingale

- Need Prop Firm compatibility — controlled drawdown, clean trade management

- Prefer transparency — published methodology, interactive reports, analytics dashboard

- Have $250+ to start — $500+ recommended for optimal risk calibration

NOT for traders who:

- Want to trade pairs other than XAUUSD

- Expect 90%+ win rates (the system averages 66%)

- Prefer grid or martingale recovery strategies

- Want a system with an established live signal track record

Important: Gold Is an Expensive Asset

The developer makes an honest point that many gold EAs avoid mentioning: gold is expensive to trade. Even a 0.01 lot position in XAUUSD requires significant margin, and with gold at historic highs, that minimum lot size carries meaningful weight.

- $250: EA will function, but precise risk calibration will be difficult

- $500+: Enough room for the risk management system to operate properly

- $1,000+: Adaptive position sizing works at full potential

This transparency about account size requirements is refreshing and demonstrates the developer’s commitment to honest expectations.

Technical Requirements

- Platform: MetaTrader 5

- Instrument: XAUUSD (Gold)

- Timeframe: H1

- Minimum Balance: $250

- Recommended Balance: $500+

- Ideal Balance: $1,000+

- Broker Compatibility: ECN / RAW Spread recommended

- VPS: Recommended (24/5)

- Setup: Plug and Play — no external configuration required

How to Start

- Open an XAUUSD H1 chart

- Attach Karat Killer

- Set your preferred risk percentage (default provided)

- Click OK — and let the system do the rest

No external configuration, no optimization required. Fully plug and play.

Conclusion

Karat Killer EA for MT5 takes a fundamentally different approach to gold trading automation.

Where most gold EAs compete on flashy win rates and aggressive marketing, Karat Killer competes on methodology. The 10-year walk-forward validated backtest delivers a 3.06 profit factor with only 7.1% maximum drawdown across all market conditions — including COVID, the inflation cycle, and the gold rally. The 66% win rate across 988 trades demonstrates consistent execution, not curve-fitted perfection.

The multi-model ML ensemble via ONNX Runtime, the 8-phase anti-overfitting pipeline, and the publicly available methodology documentation set this EA apart from the typical gold trading product. Every trade has a fixed stop-loss. No grid. No martingale.

With 62 purchases per month and a perfect 5.0 rating, the market has responded strongly. The included BLODSALGO Analytics Professional dashboard adds genuine value beyond the EA itself. At $299 with a $250 minimum deposit ($500+ recommended), it offers a credible entry point for traders who prioritize substance over spectacle.

For Gold traders who want validated methodology, transparent development, and sustainable performance, Karat Killer represents a refreshingly honest approach to automated trading.

What Do You Receive?

– Karat Killer EA for MT5 – Latest Official Version activated directly in your MT5

– Free lifetime updates (which you can download yourself)

– For use on unlimited brokers and trading accounts

– BLODSALGO Analytics Professional — free access to institutional-grade trading dashboard

FAQs

What are the backtest results?

10 years of validated data (January 2016 – February 2026): +$171,780 net profit, 3.06 profit factor, 66% win rate (652W / 336L), 7.1% max drawdown, 4.09 Sharpe ratio. Total of 988 trades across all market conditions.

What is the ML ensemble approach?

Karat Killer combines multiple machine learning algorithms — each with fundamentally different inductive biases — into a single ensemble prediction. The models run natively inside MetaTrader 5 via ONNX Runtime with zero external connections. The ensemble reduces the risk of any single model’s overfitting driving the final signal.

How was it validated?

Using multiple expanding-window walk-forward periods across 10+ years of gold data. Every prediction was made on strictly unseen future data. The validation spans pre-COVID markets, the 2020 crash, the 2022 inflation cycle, and the 2024–2025 gold rally. No random splits, no cherry-picked periods.

What is the anti-overfitting pipeline?

An 8-phase sequential pipeline with strict data-access boundaries. Includes exhaustive leakage audits, plausibility checks, and regularisation layers. When data leakage was identified during development, performance dropped after removal — confirming fixes were genuine. Full methodology is publicly available.

Does it use grid or martingale?

No. Karat Killer uses fixed stop-loss on every trade. No grid, no martingale, no recovery systems. This makes it compatible with Prop Firm rules.

Does it only buy, or does it also sell?

Karat Killer trades both long and short with equal conviction. The models were trained on a decade of data including bearish phases, corrections, and range-bound markets — not just the recent bull run.

What timeframe and pair does it trade?

XAUUSD (Gold) on H1 timeframe. The system is built exclusively for gold markets.

What’s the minimum deposit?

$250 minimum balance. However, the developer recommends $500+ for proper risk calibration and $1,000+ for the adaptive position sizing to work at full potential. Gold is expensive to trade — even 0.01 lots carries meaningful weight.

What broker should I use?

ECN or RAW Spread brokers are recommended. The EA works with any broker but performs best with tight spreads. A VPS is recommended for 24/5 operation.

What is BLODSALGO Analytics?

An institutional-grade, real-time trading dashboard included free with every purchase. Features equity curve tracking, drawdown monitoring, performance heatmap, trading calendar, EA-by-EA comparison, and open positions monitor — all live, from any device.

How does the risk management work?

Multi-layer adaptive system: conviction sizing (position size scales with model confidence), circuit breaker (reduces size during drawdowns), and rolling performance monitor (adjusts exposure during cold streaks). Fixed stop-loss on every trade — no exceptions.

Is it Prop Firm ready?

Yes. Fixed stop-loss, no grid, no martingale, and controlled drawdown (7.1% max over 10 years) make it compatible with most Prop Firm rules.

Is there a live signal?

The developer prioritizes validated backtest methodology with published documentation, interactive reports, and portfolio correlation studies. Check the MQL5 comments section for the latest signal and report links.

What’s the win rate?

66.0% across 988 trades over 10 years. This is a realistic, sustainable win rate — not an inflated figure from curve-fitting or martingale recovery.

What’s the drawdown?

7.1% maximum drawdown ($5,166) across 10 years of validated data. Combined with +$171,780 profit and 3.06 profit factor, this represents excellent risk-adjusted performance.

Is the developer responsive?

Yes. Reviews highlight responsiveness, user-friendliness, and consistent support. The developer also publishes detailed methodology documentation and interactive reports.

How many people are using it?

62 purchases per month with 2 reviews (5.0 rating) and 183 demo downloads. Strong adoption for a newly published EA (released February 2026).

How is it set up?

Plug and Play. Open an XAUUSD H1 chart, attach Karat Killer, set your preferred risk percentage (default provided), click OK. No external configuration or optimization required.

Peter Jones

Us vs MQL5 Marketplace

See why 28,000+ customers choose us

|

CheaperForex

Best Value

|

MQL5 Direct | |

|---|---|---|

| Price | ✓ Save 50-80% | Full price |

| Crypto Discount | ✓ Extra 20% off | ✗ Not available |

| Refund Policy | ✓ Full refund before activation | ✗ Store credit only |

| Payment Options | ✓ Cards, Apple Pay, Crypto | ✓ Cards only |

| Activation Support | ✓ We install for you | ✓ Self-install |

| Ownership | ✓ Lifetime, no expiration | ✓ Lifetime, no expiration |

| Hardware Activations | ⚠ 1 (up to 10 MT5s) | ✓ 5 activations |

| Trustpilot | ✓ Rated "Excellent" | — Seller ratings vary |

Us vs MQL5 Marketplace

Tap to compare →

CheaperForex

MQL5 Direct

How We Deliver Your EA (2 Minutes)

Why Traders Trust Us

Frequently Asked Questions

Is this an official product?

Yes. This is activated directly from the developer's official MQL5 marketplace listing—guaranteed authentic.

Unlike downloadable files (which can be fake or cracked), this EA is installed through MQL5's one-click activation system, ensuring you get the real product with full functionality and instant automatic updates.

When you buy from us, you're getting the exact same lifetime license as buying directly from MQL5—just at a fraction of the price.

Are updates always free and instant?

Yes, product updates for this EA are always free and instant.

They can be downloaded from within the terminal from the marketplace.

Just go to the product listing and click "update" if there's one available.

How do I get this after paying?

Most activations are completed within 15-30 minutes of purchase.

Here's the simple process:

This is an official MQL5 product that must be activated directly from the marketplace—it cannot be downloaded as a standalone file.

Installation process:

1. After purchase, we'll schedule a quick activation session (usually within a few hours)

2. You grant us temporary access via UltraViewer or AnyDesk (takes ~2 minutes), OR provide temporary VPS credentials

3. We activate the EA on your MT5 terminal(s)

4. Done! The EA is permanently yours with instant updates from MQL5

The entire process is secure and takes about 2 minutes.

After activation, no further involvement from us is needed.

How does the 7-day refund policy work?

If you change your mind before we activate the official product in your MT5 terminal, you are eligible for a full refund. Absolutely no questions asked.

Once it has been activated and is working correctly, refunds are no longer available and our regular 7-day refund policy does not apply.

Once we've activated it for you, we can't take it back and it's yours permanently.

How long does activation take?

Usually within a few hours of purchase, but often much faster.

Immediately after purchase, you'll receive an instructional PDF explaining the simple activation process.

Don't worry—it's straightforward, and our refund policy applies anytime before we activate the EA on your terminal.

What if I reinstall MT5 or get a new computer?

Activations are tied to your hardware ID, not your MT5 installation.

Free reactivation if:

• You reinstall MT5 on the same computer

• You accidentally delete MT5

• Windows updates cause issues (this is rare)

• You reinstall Windows (sometimes this doesn't work, but we will always attempt it for you)

Reactivation NOT possible if:

• You get a new computer (different hardware)

• You upgrade major hardware components (motherboard, etc.)

Important: Treat your installation with care. If you're planning to reformat or upgrade hardware, contact us FIRST so we can assist you.

Contact [email protected] with your order number if you need help.

Why should I buy here?

Buying directly on MQL5 means paying full price upfront—often $500-$1,500—without knowing if the EA will work for you. If it doesn't perform or the developer abandons it, there's no refund.

At CheaperForex, you get the exact same official, lifetime-licensed copy for up to 70% less. Test it at a lower risk before committing full price elsewhere.

We've been trusted since 2019, and every EA is yours forever—no renewals, no expiry, no surprises. Smarter investing in trading tools.

Related Products

Official MT5 expert advisors, exclusive to CheaperForex, at the lowest prices.

-

CapitalGuard Grid EA MT5 – $10K Live Signal

Rated 0 out of 5$1,249.95Original price was: $1,249.95.$999.95Current price is: $999.95. -

Quantum King EA MT5

Rated 0 out of 5$599.99Original price was: $599.99.$269.95Current price is: $269.95. -

THOR Forex Hammer EA MT5

Rated 0 out of 5$299.00Original price was: $299.00.$99.95Current price is: $99.95. -

Synthara MT5 EA

Rated 0 out of 5$699.00Original price was: $699.00.$249.95Current price is: $249.95.