Quantum Valkyrie EA Review 2026 + Download Guide | 50% Off

Last updated: February 2026 • Early-stage assessment

🚀 Ready to Buy Quantum Valkyrie EA? Save ~$300

Available from ~$299 at CheaperForex (MQL5 price: $599).

✅ Same official EA with lifetime updates

✅ Full installation support included

✅ Extra 20% off with crypto payment

📑 Table of Contents

- 30 Second Overview

- Why Valkyrie Stands Out in the Quantum Lineup

- The Developer: Bogdan’s Empire Keeps Growing

- Live Performance: 6 Weeks of Clean Data

- The Fixed SL/TP Philosophy

- Backtest Sanity Check

- Who Should Consider Quantum Valkyrie

- Quantum Valkyrie vs Quantum Queen

- Critical Requirements

- Questions You Should Be Asking

- Our Assessment + How to Download

30 Second Overview of Quantum Valkyrie EA

Quantum Valkyrie EA is the newest member of Bogdan Ion Puscasu’s Quantum family — and it’s built on a fundamentally different philosophy than its siblings.

The pitch: Every trade has a fixed stop loss and take profit from the moment it opens. No grid. No martingale. No position stacking. Each trade stands completely alone with defined risk. That’s rare in the gold EA space, especially from a developer known for grid systems.

Early results: 135% growth in 6 weeks with just 7.4% max drawdown. An 88.9% win rate across 27 trades with a 4.77 profit factor. These numbers are exceptional — but 6 weeks is barely a blink in trading terms.

The trust factor: Bogdan Ion Puscasu has built the most successful EA ecosystem on MQL5. Quantum Queen, Quantum Emperor, Quantum King — all have extensive track records. When this developer releases a new product, the engineering quality isn’t in question. Only time will tell if the early performance sustains.

Our call: Promising start from a proven developer with a genuinely different approach. The fixed SL/TP architecture addresses the main criticism of grid trading. Six weeks isn’t enough to declare victory, but the foundation is solid.

Rating: 4/5 ⭐⭐⭐⭐ — Strong Early Promise

Why Valkyrie Stands Out in the Quantum Lineup

Bogdan Ion Puscasu already has a flagship gold EA — Quantum Queen, which has delivered 912% growth over 81 weeks. So why build another one?

Because Quantum Queen uses grid trading. And grid trading, for all its profitability, carries a specific risk: during strong trending markets, positions can accumulate before price reverts. That 36% max drawdown on Queen’s signal? That’s grid trading working as designed — but it’s not for everyone.

Quantum Valkyrie takes a different path entirely.

Every single trade opens with a predetermined stop loss and take profit. No grid structure expanding exposure. No martingale recovery multiplying lot sizes. No position stacking that changes behavior mid-execution. When you enter a trade, you know exactly what you can lose and what you can gain — before anything happens.

For traders who love the Quantum ecosystem but hate grid risk, Valkyrie is the answer they’ve been waiting for.

The Developer: Bogdan’s Empire Keeps Growing

At this point, Bogdan Ion Puscasu needs little introduction. His Quantum series dominates MQL5:

- Quantum Queen — 4.96★ from 445 reviews, 81 weeks live, 912% growth

- Quantum Emperor — 4.87★ from 496 reviews, GBPUSD specialist

- Quantum King — 4.97★ from 121 reviews, AUDCAD focus

- Quantum StarMan — Multi-currency grid system

- Quantum Baron — Crude oil trader

- Quantum Bitcoin — Crypto specialist

That’s thousands of verified customers across his product line. When a developer with this track record releases something new, the question isn’t “can he code?” — it’s “will this specific strategy perform?”

Valkyrie represents a strategic expansion. Bogdan recognized that some traders want Quantum-quality engineering without grid exposure. This EA is his answer to that demand.

Live Performance: 6 Weeks of Clean Data

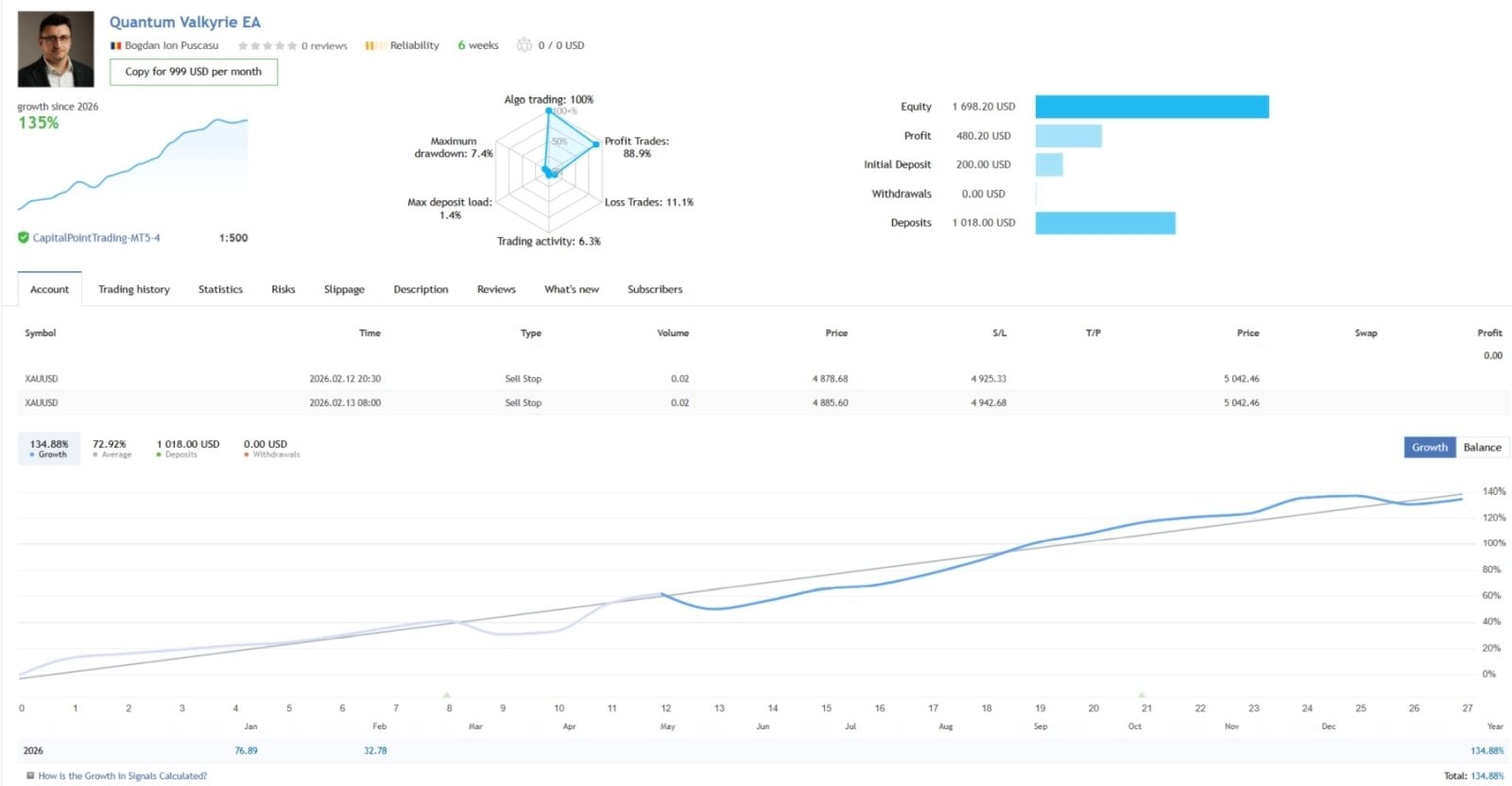

📊 Verified Live Signal (6 Weeks)

The Numbers:

- Growth: 134.88%

- Win Rate: 88.88% (24 wins, 3 losses)

- Profit Factor: 4.77

- Recovery Factor: 10.18

- Max Drawdown: 7.40%

- Total Trades: 27

- Avg Holding Time: 5 hours

- Max Deposit Load: 1.40%

- Initial Deposit: $200

- Current Equity: $1,698.20

- Broker: CapitalPointTrading (1:500)

Quantum Valkyrie EA — Live signal showing 135% growth, 88.9% win rate, and just 7.4% maximum drawdown over 6 weeks

Signal Link: MQL5 Verified Signal

What These Numbers Actually Mean

The 7.4% drawdown is the headline.

Compare that to Quantum Queen’s 36% max drawdown. Same developer, same asset class (gold), dramatically different risk profile. This is what fixed SL/TP architecture delivers — bounded, predictable risk.

The 88.9% win rate across 27 trades is excellent, but the sample size is small. We’d want to see this hold across 100+ trades before drawing conclusions. That said, it closely matches the 86.88% win rate from the 5-year backtest — a sign of consistency between testing and live execution.

The 4.77 profit factor means winning trades are generating nearly 5x more than losing trades cost. That’s exceptional efficiency, suggesting the EA is selective about entries rather than firing constantly.

The 1.4% max deposit load confirms the system isn’t overleveraging to achieve results. This is conservative position sizing — the returns come from accuracy, not from risking the farm on each trade.

⚠️ The Elephant in the Room: 6 Weeks

Let’s be direct: six weeks is not enough time to validate any trading system.

We’ve seen EAs look incredible for 2 months then blow up in month 3. We’ve seen perfect equity curves turn ugly when market conditions shift. Six weeks tells us the system can be profitable in current conditions — it doesn’t tell us how it handles:

- Extended ranging markets

- Flash crashes

- FOMC volatility

- Multi-week drawdowns

- Different gold market regimes

Why we’re still optimistic: The developer’s track record provides confidence that this isn’t amateur hour. Bogdan has kept Quantum Queen running publicly through 36% drawdowns for 81 weeks. He doesn’t hide poor performance. If Valkyrie hits rough patches, we expect he’ll keep the signal public and work through it.

Our recommendation: If you buy now, you’re betting on the developer’s pedigree more than the track record. That’s a reasonable bet given who we’re dealing with — but go in with eyes open.

Ready to Get Started?

Get Quantum Valkyrie EA for ~$299 (50% off MQL5’s $599)

Same official MQL5 product • Lifetime license • Free updates

The Fixed SL/TP Philosophy

This is what makes Valkyrie fundamentally different from most gold EAs — including its Quantum siblings.

How most gold EAs work:

Grid systems open multiple positions as price moves against you, averaging down and waiting for a reversal. When the reversal comes, all positions close profitably. When it doesn’t come (strong trend), drawdown compounds until either the market reverts or your account suffers.

How Quantum Valkyrie works:

Every trade opens with a fixed stop loss and take profit calculated dynamically based on current volatility. If you’re wrong, you lose the defined amount. If you’re right, you gain the defined amount. There’s no hoping for a reversal. No watching positions stack up. No praying the market comes back.

Trade opens → SL and TP set → One of them gets hit → Trade closes

That’s it. Clean, bounded, predictable.

Dynamic Calibration (Not Fixed Pips)

One smart design choice: the SL and TP levels aren’t static pip values. They’re calibrated based on the EA’s analysis of current market conditions.

During high volatility, stops and targets widen. During compression, they tighten. This means the system adapts to gold’s behavior rather than using one-size-fits-all levels that ignore context.

The result: an 88.9% win rate suggests the EA is accurately reading when to trade and where to place boundaries.

Backtest Sanity Check

The marketing shows $10,000 growing to $93.8 million over 5 years at extreme risk. As always, let’s be realistic about what this means.

You won’t make $93 million.

What the backtest validates:

- Win rate consistency: 86.88% backtest vs 88.9% live — they align

- Profit factor stability: 2.65 backtest vs 4.77 live — live is actually better

- Trade volume: 3,240 trades over 5 years = ~650/year = ~12/week

- Strategy robustness: Tested across COVID crash, inflation surge, rate hikes

The meaningful takeaway: The backtest shows the underlying logic has edge across various market conditions. The live signal is outperforming the backtest metrics so far — though 27 trades vs 3,240 trades is apples to oranges.

Who Should Consider Quantum Valkyrie

✅ Good Fit

- You want gold automation without grid risk

- Defined SL/TP on every trade appeals to you

- You trust Bogdan’s development track record

- You’re comfortable with early-adopter risk

- You have $500+ capital and a VPS

- You want lower drawdowns than Quantum Queen

- You prefer scalping (5-hour avg hold time)

⚠️ Not Right For

- You need 6+ months of proven results

- You can’t accept any losing trades (11% lose)

- You want multi-pair diversification

- Your broker has high spreads on gold

- You don’t have VPS for 24/5 operation

- You prefer grid’s higher potential returns

- You’re uncomfortable with new products

Quantum Valkyrie vs Quantum Queen

Since both trade gold and come from the same developer, here’s how they compare:

| Feature | Quantum Valkyrie | Quantum Queen |

|---|---|---|

| Strategy | Fixed SL/TP Scalping | Grid Trading |

| Max Drawdown (Live) | 7.4% | 36.4% |

| Growth (Live) | 135% (6 weeks) | 912% (81 weeks) |

| Win Rate | 88.9% | 76.2% |

| Track Record | 6 weeks | 81 weeks |

| Timeframe | M15 | Any (M1-Daily) |

| Grid/Martingale | None | Grid (no martingale) |

| MQL5 Price | $599 | $1,549 |

Choose Valkyrie if: You want defined risk on every trade and can accept a shorter track record.

Choose Queen if: You want 81 weeks of proven performance and can tolerate 36% drawdowns.

Best approach: Run both on separate accounts — different strategies, same developer quality, genuine diversification.

Critical Requirements

Valkyrie has specific needs. Skip these at your own risk:

1. ECN/Raw Spread Account (Mandatory)

The EA scalps on M15 with relatively tight targets. High spreads eat into profit margins. Use ECN, Raw, or Razor account types only.

2. VPS (Mandatory)

The developer is explicit: VPS isn’t recommended, it’s required. M15 scalping needs stable connectivity. Your home internet going down means missed trades and orphaned positions.

3. Minimum $500, Recommended $1,000+

Don’t run this undercapitalized. The position sizing needs room to work. The live signal started with $200 but added $818 in deposits to reach proper operation.

4. 1:500 Leverage Recommended

Higher leverage gives the EA flexibility to size positions properly. 1:100 minimum, 1:500 ideal.

5. Hedging Account Type

Must be hedging execution mode, not netting. Check your MT5 account settings.

Questions You Should Be Asking

Our Assessment

Verdict: Strong Foundation, Needs Time

What Quantum Valkyrie gets right:

- Clean architecture: Fixed SL/TP solves grid trading’s main weakness

- Developer pedigree: Bogdan’s track record is unmatched on MQL5

- Early metrics: 135% growth on 7.4% DD is exceptional risk-adjusted return

- Backtest alignment: Live win rate matches backtest — good sign

- Transparent signal: Verified, public, real broker

- Position sizing: Conservative 1.4% deposit load

What concerns us:

- Track record: 6 weeks, 27 trades — statistically insufficient

- No reviews yet: Product launched Feb 14, 2026 — zero MQL5 reviews

- Untested scenarios: How does it handle flash crashes, FOMC, extended ranges?

- New product risk: Even great developers release duds occasionally

Rating: 4/5 — We’re impressed by the early performance and the strategic thinking behind Valkyrie’s architecture. The lower rating (vs Queen’s 4.5) reflects the limited track record. Check back in 3 months for an updated assessment.

How to Download Quantum Valkyrie EA MT5

Looking to download Quantum Valkyrie EA for MT5? Here’s everything you need to know about getting this EA legitimately installed on your trading platform.

Option 1: Buy Direct from MQL5 Marketplace

- Visit the official MQL5 product page

- Click “Buy for $599”

- Complete payment through MQL5’s checkout

- Open MetaTrader 5 and go to Market tab

- Find Quantum Valkyrie in “Purchased” section

- Click “Install” — EA appears in your Navigator panel

Option 2: Get It Through CheaperForex (50% Off)

- Visit our Quantum Valkyrie EA product page

- Add to cart and checkout (~$299 vs $599 on MQL5)

- We remotely activate the official MQL5 license on your MT5

- EA appears in your Navigator — ready to trade

- All future updates download automatically from MQL5

MQL5 vs CheaperForex: Quick Comparison

| Feature | MQL5 Direct | CheaperForex |

|---|---|---|

| Price | $599 | ~$299 |

| Crypto Discount | None | Extra 20% off |

| Official License | ✓ Yes | ✓ Yes |

| Lifetime Updates | ✓ Yes | ✓ Yes |

| Installation Support | Self-install | We install for you |

| Refund Policy | Store credit only | Full refund before activation |

| Payment Options | Cards only | Cards, Apple Pay, Crypto |

⚠️ Warning About “Free Downloads”

- Malware disguised as an EA file

- Outdated/broken code that won’t execute

- Fake EAs that look similar but aren’t the real product

- Account credential theft

The only legitimate ways to get Quantum Valkyrie are through MQL5 directly or authorized resellers like CheaperForex.

Get Quantum Valkyrie EA — 50% Off MQL5 Price

The “Clean” Quantum — Fixed Risk on Every Trade

MQL5 Price: $599

CheaperForex: ~$299

Extra 20% off with crypto payment

Official MQL5 license • Lifetime updates • Installation support included

Looking for More Options?

- Quantum Queen EA — 81 weeks proven, grid trading, 912% growth

- Our Vetted EA Recommendations — Products with extended live validation

- All Gold Trading EAs — Browse our complete gold EA collection

Disclaimer: Forex trading carries substantial risk. Quantum Valkyrie EA is a new product with only 6 weeks of live performance data. Past performance doesn’t guarantee future results. The 135% growth and 7.4% drawdown are real but may not continue. Only trade with capital you can afford to lose. We receive compensation for sales made through our links.

Review methodology: This assessment is based on 6 weeks of verified MQL5 signal data, backtest analysis, and developer track record evaluation. We have not received payment from the developer for this review.

Next review update: May 2026 (after 3+ months of live data)