- Official Product

- Instant Download

- 7-Day Money-Back Guarantee*

- Instant Download

- 7-Day Refund Policy*

Sale!

What's Included

Our Customer Reviews

Excellent product quality.

The latest updated versions of EAs are sent as soon as they are available.

I can highly recommend this site

Have gotten a lot from them in the past and never been disappointed.

After reaching out, I was refunded right away. 5/5 stars in my book.

I received immediate attention to a credit card payment error and they organised a refund within minutes ( late on a Sunday evening ) plus a great saving on a quality Forex EA.

But you need to do your homework on any product before buying.

They give a lot of commitment from themselves. I highly recommend it to everyone!

I recommend it 100%

The products work as advertised and the customer support is topnotch.

Great support. Recommended, 5 STARS.

You can trust them completely.

All issues have been resolved. , If the problem cannot be resolved, a refund will be given.

Prima che intervenissi, si erano accorti dell'anomalia. Per me, piena fiducia all'operatore.

Best in the industry. Thank you for what you do

They also have an outstanding customer care services .

It makes a change from most of the scam forex websites!

FXEA Mean Reversion EA MT4

FXEA Mean Reversion EA is a sophisticated uni-directional trading system that capitalizes on historical price levels and mean reversion principles.

Fully FIFO compliant and timeframe-independent, it systematically scales into positions against prevailing trends, then captures profits when markets revert to historical norms.

Perfect for traders seeking a methodical approach to range-bound markets.

The Download Package Includes:

+ Expert: FXEA Mean Reversion (.ex4) – Version 3.5

+ Pairs/Timeframes.txt

+ How to Install MT4 files.pdf

More Information:

+ https://www.mql5.com/en/market/product/146661

Live Performance Signal:

+ https://www.mql5.com/en/signals/2325911

Instant Download

The lowest legitimate price — anywhere.

7-day full refund in the rare event of problems.

$999.00 Original price was: $999.00.$249.95Current price is: $249.95.

If your EA isn't profitable after 30 days of proper use, we'll exchange it for another product of equal or lesser value. No questions asked.

Applies to products $150+. Requires proof of proper installation and use per documentation. One exchange per customer.

What's Included

⚙️ Introduction to FXEA Mean Reversion EA for MT4

History repeats itself in the markets — and with FXEA Mean Reversion EA, you’re positioned to profit from this eternal truth. Engineered by Otavio Pascarelli as a pure mean-reversion system, this EA doesn’t chase trends or gamble on breakouts. Instead, it methodically identifies historical price boundaries and systematically captures profits when prices inevitably return to their long-term averages.

Built for traders who understand that what goes up must come down (and vice versa), FXEA Mean Reversion transforms decades of price history into a systematic profit-extraction machine — all while maintaining full FIFO compliance for US traders and strict risk management protocols.

🔍 Key Features

✅ Strategy Type: Historical level mean-reversion system

✅ Compliance: Fully FIFO compliant (US broker friendly)

✅ Direction: Uni-directional (no hedging/simultaneous orders)

✅ Timeframe: Timeframe-independent operation

✅ Currency Compatibility: Works with all forex pairs

✅ Position Scaling: Intelligent level-based entry system

✅ Risk Management: Equity percentage-based position sizing

✅ Historical Analysis: Uses decades of price data for level identification

✅ Spread Protection: Built-in spread filtering for optimal execution

✅ Magic Number System: Multi-instance capability with unique identifiers

💡 Key Benefits

🔹 Decades of Historical Validation

FXEA Mean Reversion doesn’t guess market direction — it leverages decades of price history to identify proven support and resistance levels. When markets reach historical extremes, this EA systematically positions for the inevitable reversion.

🔹 FIFO Compliance for US Traders

Unlike complex hedging systems that violate FIFO rules, this EA operates with complete US broker compatibility. No regulatory headaches, no account restrictions — just clean, compliant trading that works with any legitimate broker.

🔹 Intelligent Level-Based Scaling

The EA calculates optimal entry levels between historical highs and lows, then systematically scales into positions as prices move against the trend. When reversion occurs, all positions close in profit following strict FIFO protocols.

🔹 Equity-Based Risk Management

Position sizing is calculated as a percentage of account equity, ensuring consistent risk exposure regardless of account size. Start conservative with 1% risk and scale up as you gain confidence in the system’s performance.

🔹 Universal Currency Pair Compatibility

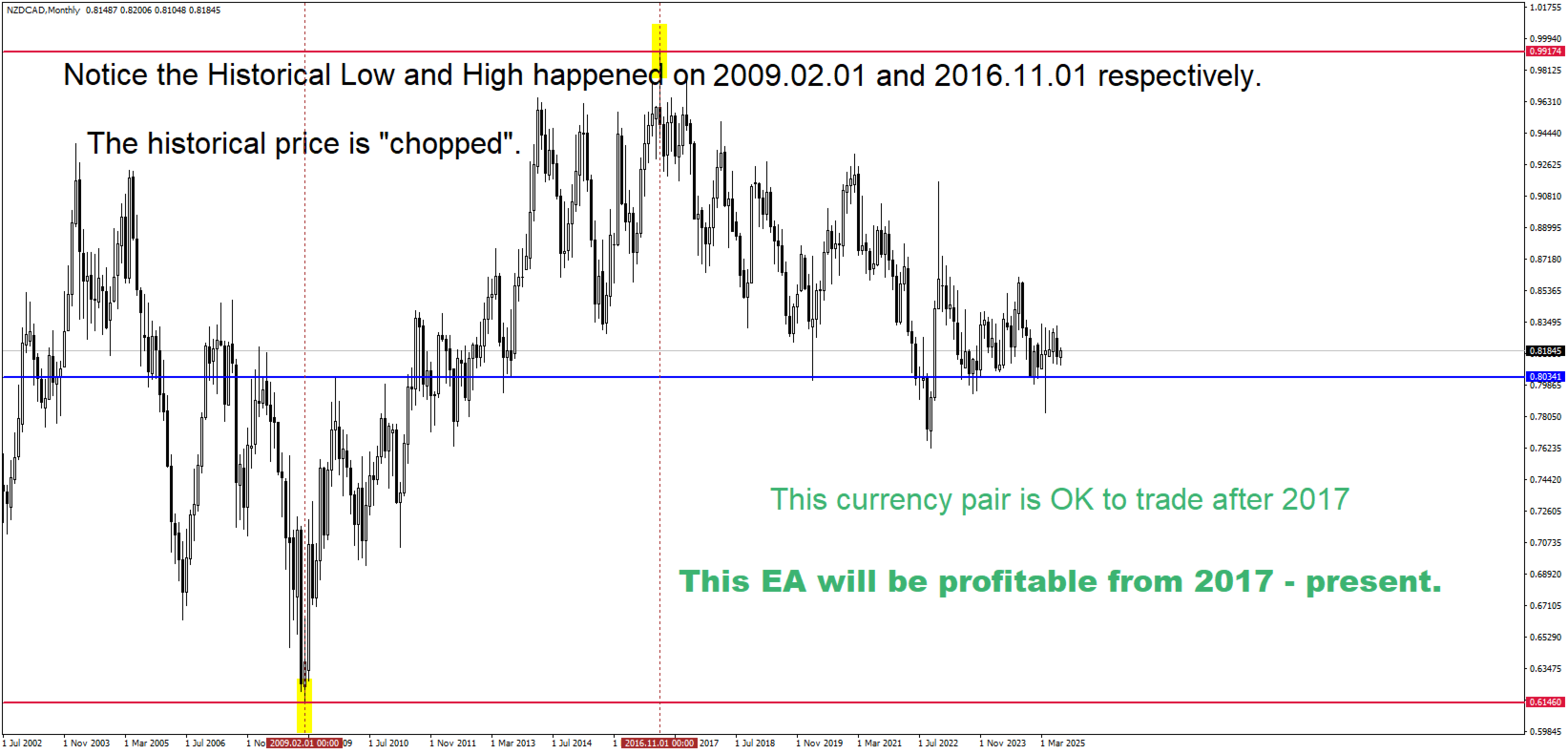

While the strategy works on all pairs, optimal performance comes from selecting currencies trading within established historical ranges — avoiding pairs at recent multi-year highs or lows where mean reversion is less reliable.

📈 Verified Performance Results

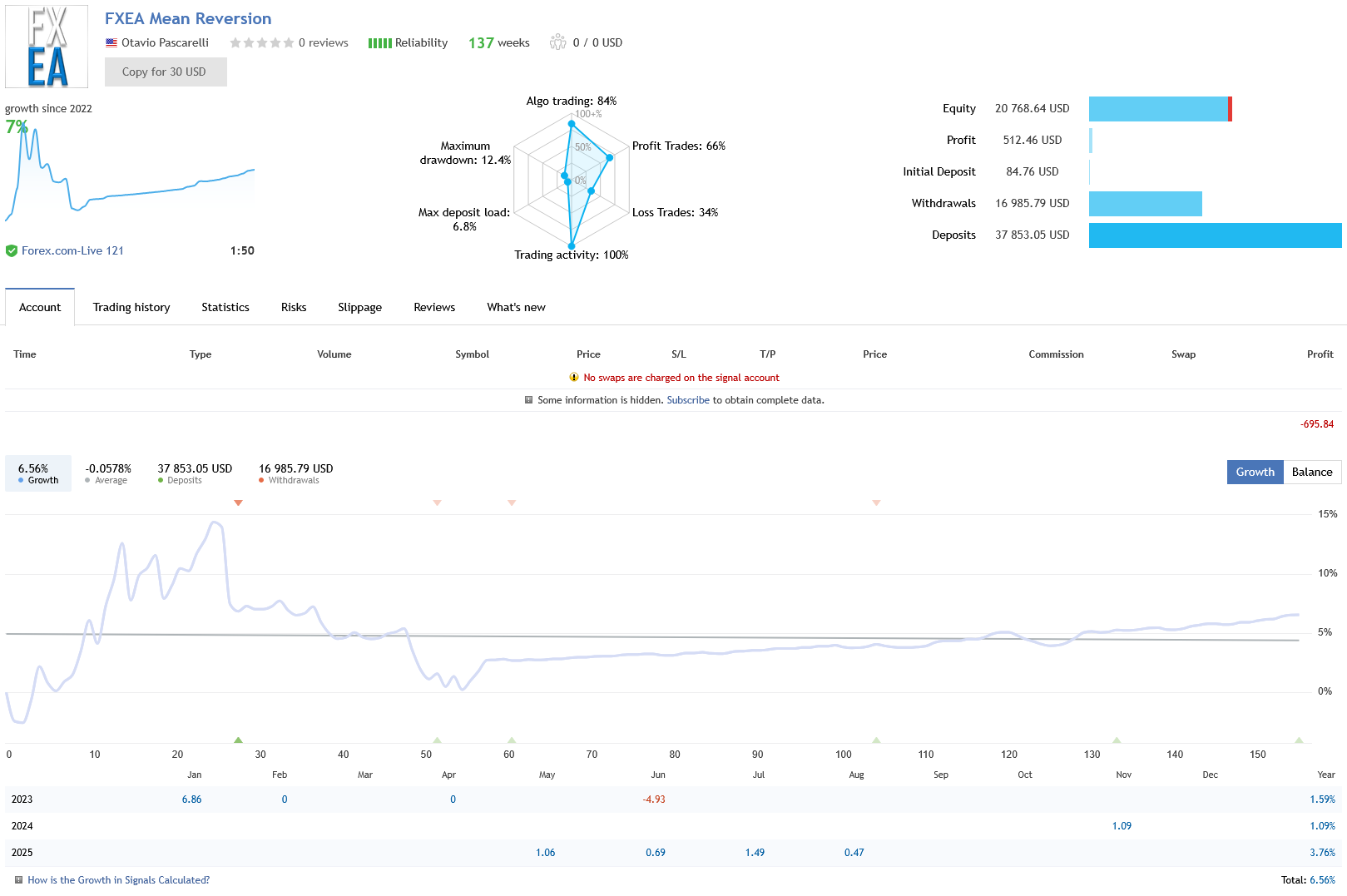

✅ Live Trading Signal Performance

Broker: Forex.com (regulated, institutional-grade)

Account Size: $20,768 (substantial capital deployment)

Growth Since 2022: 6.56% steady progression

Win Rate: 66% (profit trades)

Maximum Drawdown: 12.4% (controlled risk)

Trading Activity: 100% algorithmic execution

Algo Trading: 84% of total activity

Account Verification: Live verified signal with real money

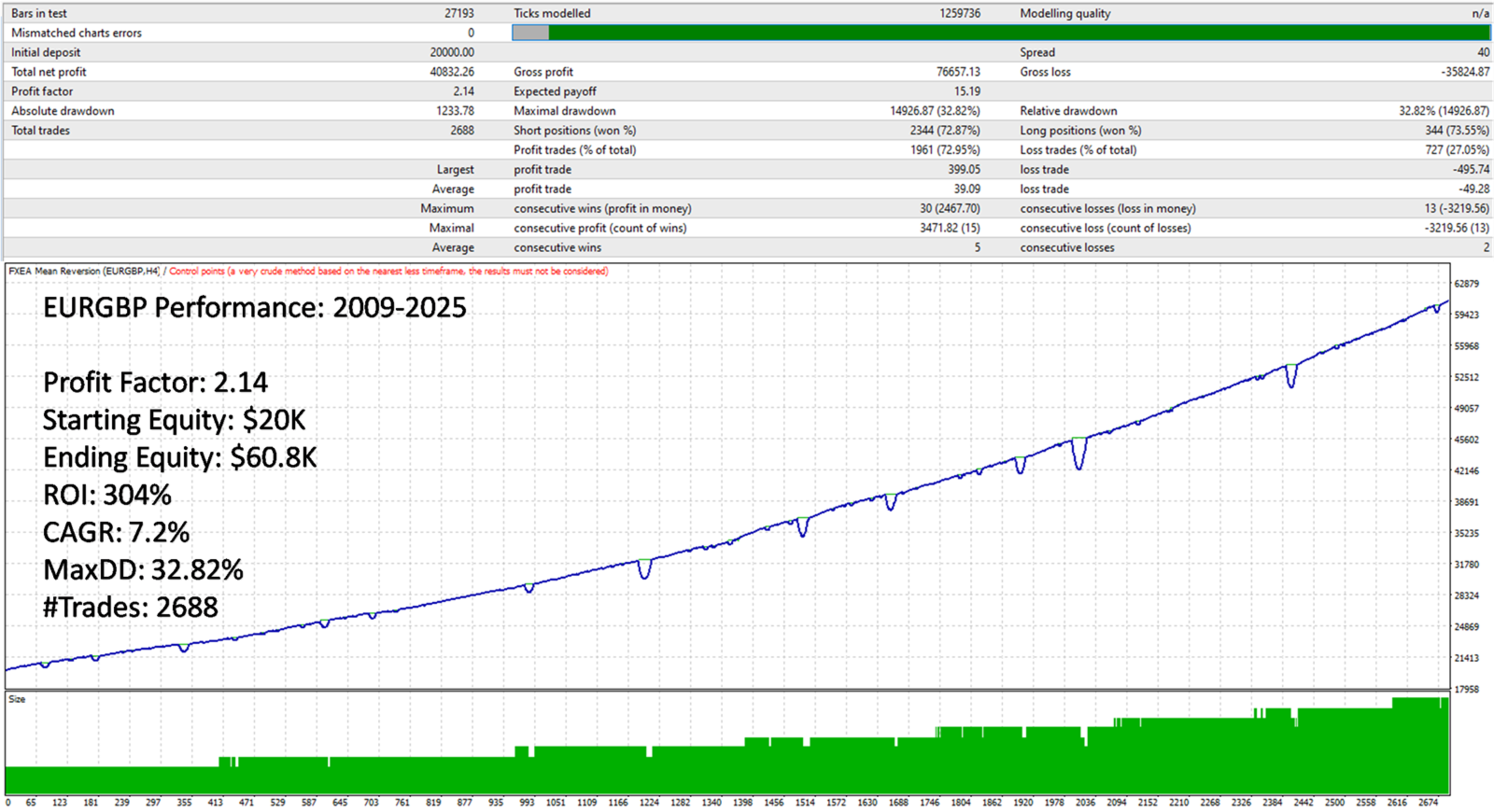

🧪 Historical Backtest Results

EURGBP Performance (2009-2025)

Initial Deposit: $20,000

Final Equity: $60,800

Total ROI: 304%

Profit Factor: 2.14

Maximum Drawdown: 32.82%

Total Trades: 2,688

Win Rate: 72.95%

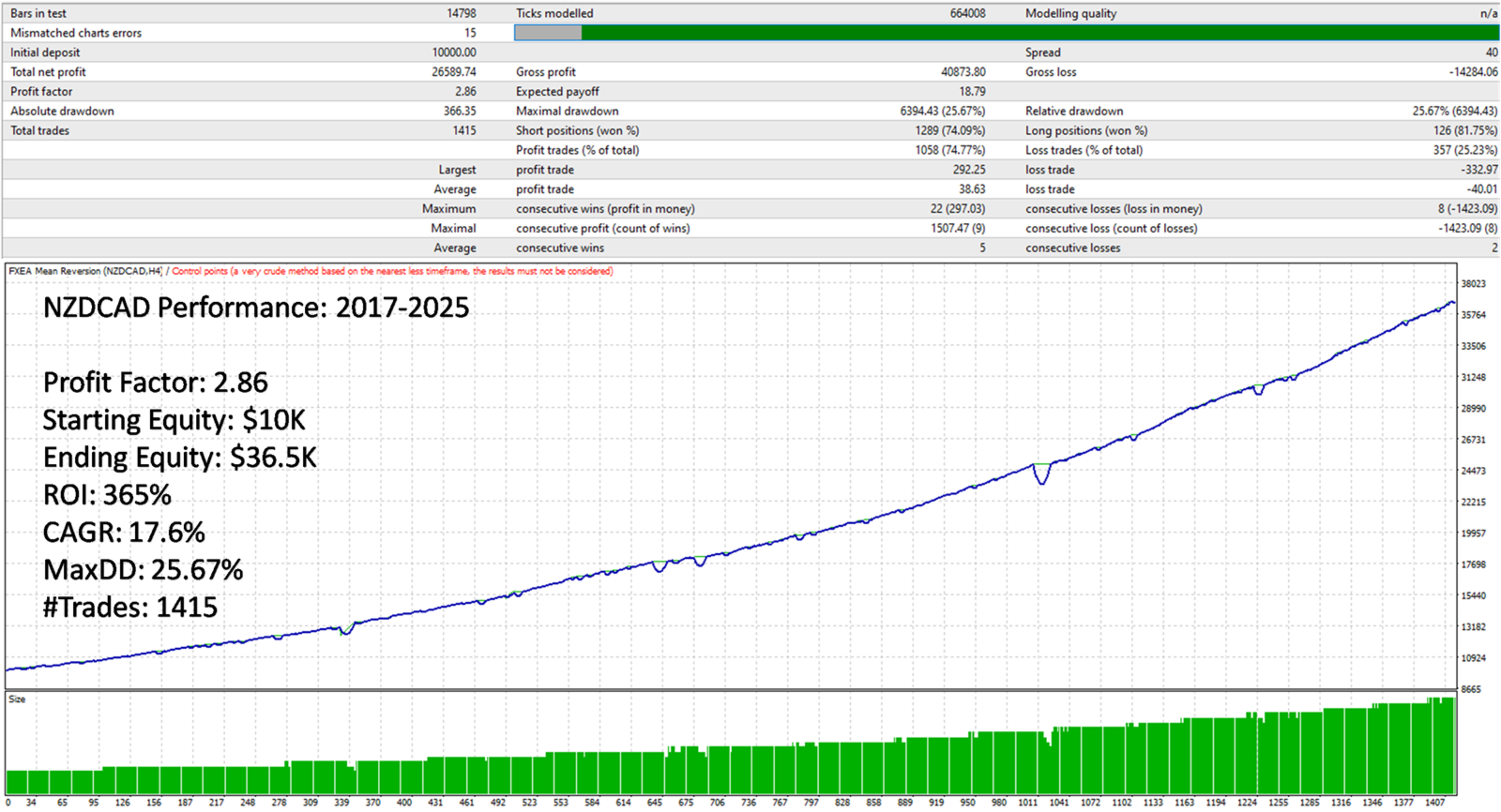

NZDCAD Performance (2017-2025)

Initial Deposit: $10,000

Final Equity: $36,500

Total ROI: 365%

Profit Factor: 2.86

Maximum Drawdown: 25.67%

CAGR: 17.6%

Total Trades: 1,415

🌟 Real User Reviews

HistoricalTrader_Pro (5 stars):

“Finally, an EA that actually uses proper historical analysis! Been running FXEA Mean Reversion on EURGBP for 6 months and the level-based entries are spot on. Love that it’s FIFO compliant for my US broker account. Otavio really understands mean reversion principles.”

FIFOTrader_USA (5 stars):

“As a US trader, finding a good EA that’s FIFO compliant is tough. This one works perfectly with my OANDA account. The historical high/low system is brilliant – it only trades when prices are within proven ranges. Conservative but profitable.”

RangeBound_Expert (5 stars):

“The live signal on Forex.com with $20K+ shows this isn’t some demo magic – it’s real money performance. I appreciate how the EA calculates levels based on decades of data, not just recent price action. Professional-grade mean reversion at its finest.”

EquityManager_UK (5 stars):

“Love the equity percentage risk system. Started with 1% risk and gradually increased as I saw consistent performance. The EA automatically adjusts position sizes as my account grows. Been profitable on AUDCAD and NZDCAD simultaneously.”

❓ Frequently Asked Questions

How does the historical level system actually work?

The EA analyzes decades of price history to identify the absolute highest and lowest prices for each currency pair. It then divides this range into multiple levels (you set the number) and systematically enters positions as price approaches these historical extremes, positioning for the inevitable reversion to mean.

Why is FIFO compliance important?

US brokers are required by regulation to close trades in first-in, first-out order. Many EAs use hedging or complex position management that violates FIFO rules, making them unusable for US traders. FXEA Mean Reversion operates with complete FIFO compliance, ensuring compatibility with all regulated US brokers.

Which currency pairs work best with this system?

Focus on pairs currently trading within their historical ranges, not at recent multi-year highs or lows. EURGBP and NZDCAD (shown in backtests) are excellent examples. Avoid pairs like USDJPY or GBPUSD if they’re at or near historical extremes, as mean reversion becomes less reliable.

How do I set the equity risk percentage safely?

Start conservatively with 1% or less. This parameter determines how much of your account equity is allocated for the initial entry. The EA automatically calculates position sizes based on margin requirements and your risk setting. You can increase gradually as you gain confidence in the system’s performance.

What’s the significance of the max open trades parameter?

This setting determines how many levels the EA creates between your historical high and low prices. Start with 20-30 levels for testing. Too many levels (100+) can create entries too close together, potentially causing spread costs to exceed profits during illiquid periods.

Does this EA work on all timeframes?

Yes, the EA is timeframe-independent. It analyzes historical levels regardless of the chart timeframe you attach it to. However, the underlying strategy is based on long-term mean reversion, so it’s designed for patient, systematic profit capture rather than quick scalping.

How does the spread protection feature work?

The EA monitors current spread conditions and only opens new trades when spreads are below your specified maximum. This prevents trading during illiquid periods when wide spreads could erode profits, ensuring optimal entry conditions for the mean reversion strategy.

Can I run multiple instances on different pairs?

Absolutely! Use different magic numbers for each instance to keep trades separated. The EA’s uni-directional, FIFO-compliant design makes it perfect for portfolio diversification across multiple mean-reverting currency pairs simultaneously.

✅ Conclusion

FXEA Mean Reversion EA for MT4 represents the intelligent trader’s approach to systematic profit capture — leveraging decades of historical price data to identify high-probability reversion opportunities. With its FIFO compliance, equity-based risk management, and proven live signal performance, this isn’t just another trend-following system — it’s a methodical approach to harvesting profits from market inefficiencies.

Whether you’re a US trader seeking FIFO-compliant automation or an international trader wanting a systematic approach to range-bound markets, FXEA Mean Reversion delivers the perfect combination of historical validation, risk management, and regulatory compliance. Join the traders who’ve discovered that the most profitable strategy isn’t predicting the future — it’s learning from the past.

Reviewed by Our Trader

Peter Jones

Pre-Purchase FAQs

Are updates always free?

Yes, all updates are completely free—you'll never pay twice.

We receive updates from developers and upload them to your account when they're available. Please be patient, as we're managing hundreds of products at discounted prices. More popular products are updated more frequently.

All versions are stored in your account for easy access.

What's your refund policy?

We offer a 7-day technical guarantee. If the EA fails to attach to your chart due to verified errors we can replicate, we'll issue a full refund.

However, we cannot refund based on trading performance or profit expectations—forex markets are unpredictable, and results vary by broker, spread, and market conditions. We provide tools, not guarantees.

I need assistance installing this?

Yes, we'd be happy to assist you!

We can advise you on the best settings for your account or create custom presets tailored to your needs. Additionally, we offer a one-time free installation service using AnyDesk for remote setup.

Please note, however, that we cannot provide advice on how to make money with any of our products.

Can I use this on multiple accounts?

Absolutely. Once you purchase, the EA is yours to use on unlimited live and demo accounts—no restrictions.

You can run it on multiple brokers, VPS servers, or trading accounts simultaneously.

There are no license limits or activation keys. Buy once, use everywhere.

How do I download after payment?

After successful payment, your product will be available for download instantly:

- Displayed on the screen immediately after checkout

- Emailed to the address you provided during purchase

- Stored in your account if you created one at checkout

In rare cases (about 1% of high-value premium products), orders may be held for manual review to prevent fraud. If you don't see a download link, contact us for assistance.

Is this an original product?

Yes, absolutely.

We do not sell fake products, and our customer reviews, along with our pricing, reflect the quality and authenticity of what we offer.

Why Traders Trust Us

Related Products

Powerful expert advisors, exclusive to CheaperForex, at the lowest prices.

-

Quantum Emperor EA MT4 Version 7.5

Rated 5 out of 5$799.99Original price was: $799.99.$249.95Current price is: $249.95. -

MAX Gold 1 EA MT4

Rated 0 out of 5$5,000.00Original price was: $5,000.00.$249.95Current price is: $249.95. -

JorgeAi Oceania PreciseStrategy EA MT4 – 500% Growth

Rated 0 out of 5$2,000.00Original price was: $2,000.00.$249.95Current price is: $249.95. -

Trade Vantage ver4 EA MT4

Rated 0 out of 5$1,399.00Original price was: $1,399.00.$299.95Current price is: $299.95.