- Official Product

- Instant Download

- 7-Day Money-Back Guarantee*

- Instant Download

- 7-Day Refund Policy*

Sale!

What's Included

Our Customer Reviews

Excellent product quality.

The latest updated versions of EAs are sent as soon as they are available.

I can highly recommend this site

Have gotten a lot from them in the past and never been disappointed.

After reaching out, I was refunded right away. 5/5 stars in my book.

I received immediate attention to a credit card payment error and they organised a refund within minutes ( late on a Sunday evening ) plus a great saving on a quality Forex EA.

But you need to do your homework on any product before buying.

They give a lot of commitment from themselves. I highly recommend it to everyone!

I recommend it 100%

The products work as advertised and the customer support is topnotch.

Great support. Recommended, 5 STARS.

You can trust them completely.

All issues have been resolved. , If the problem cannot be resolved, a refund will be given.

Prima che intervenissi, si erano accorti dell'anomalia. Per me, piena fiducia all'operatore.

Best in the industry. Thank you for what you do

They also have an outstanding customer care services .

It makes a change from most of the scam forex websites!

60CAL BMG E.I. EA MT4

60CAL BMG E.I. EA for MT4 is a battle-ready, institutional-grade gold trading robot built by Algo Edge Solutions.

This grid-based engine for XAUUSD uses real market inefficiencies—not curve-fitted tricks—to deliver high-frequency profits in aggressive conditions.

Fully optimized for FTMO challenges, it trades the M1 timeframe with dynamic precision, smart filtering, and tight risk management.

The Download Package Includes:

+ Expert: 60CAL BMG E.I. EA (.ex4) – Latest Version

+ Pairs/Timeframes.txt

+ How to Install MT4 files.pdf

More Information:

+ https://algoedgesolutions.com/products/eis

Live Performance Signal:

+ Unknown

Instant Download

The lowest legitimate price — anywhere.

7-day full refund in the rare event of problems.

$2,000.00 Original price was: $2,000.00.$349.95Current price is: $349.95.

If your EA isn't profitable after 30 days of proper use, we'll exchange it for another product of equal or lesser value. No questions asked.

Applies to products $150+. Requires proof of proper installation and use per documentation. One exchange per customer.

What's Included

⚔️ Introduction to 60CAL BMG E.I. EA (Sixty Cal)

60CAL BMG E.I. EA for MT4 is the ultimate gold trading algorithm for serious traders, prop firm challengers, and institutional-level strategists. Designed by Algo Edge Solutions, this EA doesn’t rely on indicators or hindsight-fitted setups. Instead, it exploits real-time structural inefficiencies, deploying a powerful grid engine with adaptive logic, momentum triggers, and multi-layered entries.

If you’re looking for a serious trading tool that thrives in volatility, adapts dynamically, and passes FTMO or similar evaluations—this is it.

🔍 Key Features

-

Trading Instrument: XAUUSD (Gold)

-

Style: Algorithmic, Intraday Grid Strategy

-

Timeframe: M1 (1 Minute)

-

Entry Engine: Proprietary momentum/volatility breakout algorithm

-

Exit Logic: Trailing TP, static/hybrid exits, invisible profit triggers

-

Order System: Multi-layer scaling with adaptive spacing & lot sizing

-

News Awareness: Integrated economic event monitoring

-

FTMO Ready: Full compatibility with prop firm rules and conditions

💡 Benefits of Using 60CAL BMG E.I.

✔️ Engineered for High-Pressure Trading

Perfect for prop firms and live accounts where every millisecond and tick matters.

✔️ Zero Curve-Fitting – All Real Market Logic

Trades based on timing, volatility, and price structure—not historical bias.

✔️ Customizable Time Filters & Safe Guardrails

Includes equity protection, SL/TP, and anti-overexposure controls.

✔️ Adaptive & Flexible

Switch between static, dynamic, or scaling lot modes depending on your capital and risk appetite.

✔️ Stress-Tested for Gold

Built specifically for the chaos and opportunity of XAUUSD.

⚙️ Strategy Breakdown

-

Entry Filters: Breakout zones + volatility distance check + time filter

-

Exit Triggers: Weight-based target logic, invisible TP zones

-

Lot Control: Fixed, stepped, multiplier, or dynamic volume scaling

-

Stop Loss System: Point-based SL with equity protection thresholds

-

Order Logic: Controlled grid spacing to adapt to price momentum

🧠 Anti-Overfitting & Design Philosophy

This EA is not trained on cherry-picked backtest years. It’s built on real-world trading logic and tested live under pressure. It avoids false precision by working with raw market behavior—volatility surges, price expansions, and inefficiency pockets—making it reliable and adaptive in changing conditions.

📈 Proof of Results

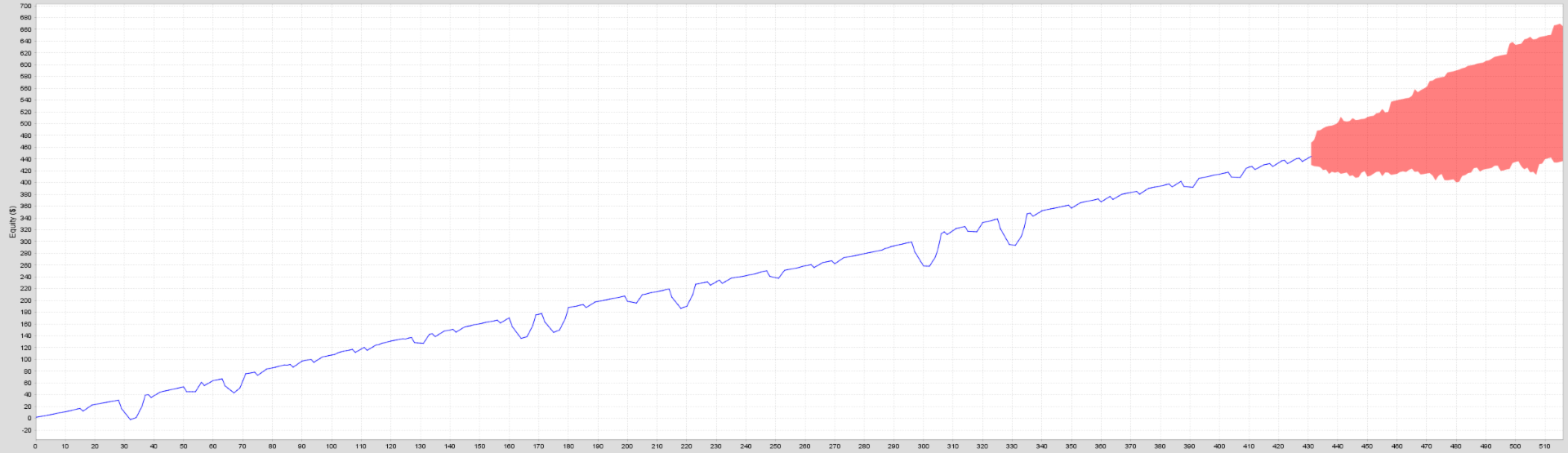

🔹 Backtest Performance:

-

✅ Over 500% Equity Growth in long-term simulation

-

✅ Flat drawdowns with structured recovery

-

✅ Consistent equity curve without high-risk exposure

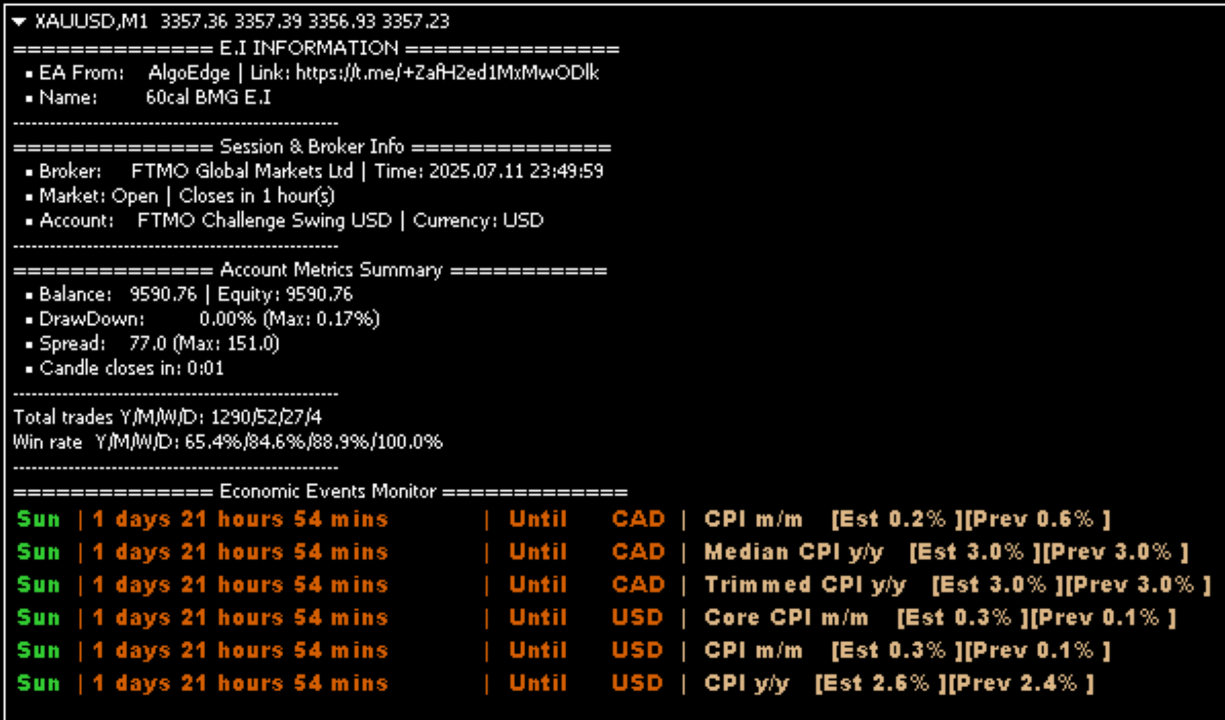

🔹 Live Account Stats:

-

📍 FTMO Swing Challenge Account

-

💰 Balance: $9,590.76 | Drawdown: 0.00%

-

✅ Win Rate (Daily): 100%

-

⚡ Spread-tested: 77 pts (max 151)

⭐ Real Trader Reviews

💬 “This EA is a beast. Passed my FTMO Swing Challenge without breaking a sweat. It handled gold spikes like a pro.”

— Dan M., FTMO Trader, UK

💬 “What impressed me most is the precision. It doesn’t flood the market—it waits, strikes, and exits clean.”

— Youssef K., Institutional Account Manager

💬 “Insane win rate and total control. I’ve used a lot of grid bots—this is easily the smartest one.”

— Adam T., Dubai

🧪 Suggested Use & Broker Setup

-

Market Conditions: Moderate volatility, directional trends

-

Platform: MT4 only

-

Best Brokers: IC Markets, Pepperstone, FTMO, Eightcap

-

Execution: Preferably <1ms latency on RAW/ECN accounts

-

Psychological Tip: Let the system run. Don’t micromanage trades—observe equity curves, not emotions.

❓ Frequently Asked Questions (FAQ)

1. Is 60CAL BMG E.I. EA safe for FTMO and other prop firm accounts?

Yes. It is fully FTMO-ready with built-in drawdown control, realistic lot sizing, and no hidden risk stacking. It’s designed to pass strict trading evaluations.

2. What pairs and timeframes does it support?

The EA is optimized exclusively for XAUUSD on the M1 timeframe. It uses real-time volatility and price mechanics tailored for gold, and should not be used on other pairs.

3. Does it use martingale or recovery grid?

No dangerous martingale scaling is used. It applies a controlled grid with adjustable spacing and smart exit logic to manage equity exposure safely.

4. Can I run it on a small account?

Yes, but a minimum of $500 is recommended, or $1,000+ for smoother performance. Lower deposits should use fixed lot mode or low multipliers.

5. Will it work on high-spread brokers?

It’s not recommended. Use RAW/ECN brokers with low spread and fast execution (<1ms latency) for best results.

6. How often does it trade per day?

It trades frequently but only when conditions match. Expect 5–20 trades/day depending on volatility, with high accuracy and smart entry filtering.

✅ Conclusion

60CAL BMG E.I. EA for MT4 isn’t just another gold bot—it’s a tactical weapon engineered for institutional-style execution. Whether you’re targeting FTMO, scaling a private fund, or building a consistent prop strategy, this EA brings precision, power, and professionalism to your XAUUSD trading.

Reviewed by Our Trader

Peter Jones

Pre-Purchase FAQs

Are updates always free?

Yes, all updates are completely free—you'll never pay twice.

We receive updates from developers and upload them to your account when they're available. Please be patient, as we're managing hundreds of products at discounted prices. More popular products are updated more frequently.

All versions are stored in your account for easy access.

What's your refund policy?

We offer a 7-day technical guarantee. If the EA fails to attach to your chart due to verified errors we can replicate, we'll issue a full refund.

However, we cannot refund based on trading performance or profit expectations—forex markets are unpredictable, and results vary by broker, spread, and market conditions. We provide tools, not guarantees.

I need assistance installing this?

Yes, we'd be happy to assist you!

We can advise you on the best settings for your account or create custom presets tailored to your needs. Additionally, we offer a one-time free installation service using AnyDesk for remote setup.

Please note, however, that we cannot provide advice on how to make money with any of our products.

Can I use this on multiple accounts?

Absolutely. Once you purchase, the EA is yours to use on unlimited live and demo accounts—no restrictions.

You can run it on multiple brokers, VPS servers, or trading accounts simultaneously.

There are no license limits or activation keys. Buy once, use everywhere.

How do I download after payment?

After successful payment, your product will be available for download instantly:

- Displayed on the screen immediately after checkout

- Emailed to the address you provided during purchase

- Stored in your account if you created one at checkout

In rare cases (about 1% of high-value premium products), orders may be held for manual review to prevent fraud. If you don't see a download link, contact us for assistance.

Is this an original product?

Yes, absolutely.

We do not sell fake products, and our customer reviews, along with our pricing, reflect the quality and authenticity of what we offer.

Why Traders Trust Us

Related Products

Powerful expert advisors, exclusive to CheaperForex, at the lowest prices.

-

Burning Grid EA MT5

Rated 0 out of 5$999.00Original price was: $999.00.$399.95Current price is: $399.95. -

ToTheMoon EA MT4 V3.5

Rated 0 out of 5$600.00Original price was: $600.00.$249.95Current price is: $249.95. -

Oceania Emperor AI EA MT4

Rated 0 out of 5$399.00Original price was: $399.00.$119.95Current price is: $119.95. -

EvoTrade EA MT4 Version 1.5

Rated 0 out of 5$799.00Original price was: $799.00.$169.95Current price is: $169.95.