Latest Version + All Future Updates Included!

Latest Version + All Updates

Official MQL5 EA. Massive Discount. Zero Catch.

We paid full price, so you don't have to. Get the genuine EA activated directly from MQL5 into your MT5 — same product, same updates, fraction of the cost.

Our Customer Reviews

Excellent product quality.

The latest updated versions of EAs are sent as soon as they are available.

I can highly recommend this site

Have gotten a lot from them in the past and never been disappointed.

After reaching out, I was refunded right away. 5/5 stars in my book.

I received immediate attention to a credit card payment error and they organised a refund within minutes ( late on a Sunday evening ) plus a great saving on a quality Forex EA.

But you need to do your homework on any product before buying.

They give a lot of commitment from themselves. I highly recommend it to everyone!

I recommend it 100%

The products work as advertised and the customer support is topnotch.

Great support. Recommended, 5 STARS.

You can trust them completely.

All issues have been resolved. , If the problem cannot be resolved, a refund will be given.

Prima che intervenissi, si erano accorti dell'anomalia. Per me, piena fiducia all'operatore.

Best in the industry. Thank you for what you do

They also have an outstanding customer care services .

It makes a change from most of the scam forex websites!

How MQL5 Activation Works

Purchase

Save 50-80%

on the exact same official product

Install

We activate it for you

in 60 seconds, directly from MQL5

Start Trading

Full ownership, no restrictions

It's yours, permanently

Future Updates

Free & instant updates

delivered straight to your MT5

AI Prop Firms EA MT5

Built for FTMO, The5ers, FundedNext, FundingPips and other prop firms, this system uses AI to analyze market conditions in real time, manage risk dynamically, and execute trades that comply with strict prop firm rules. No martingale, no grid, no high-risk recovery — just precision entries and capital protection.

- ✅ Daily Drawdown Guard — automatic protection against breaching daily loss limits

- ✅ Economic News Filter — avoids trading during high-impact announcements

- ✅ NO martingale / NO grid — single position, controlled risk logic

- ✅ 78.53% win rate — 5.37 profit factor in backtests

- ✅ Entry Time Offset — prevents synchronized trading detection

Intelligent automation built for prop firm challenges and funded accounts.

Official MQL5 EA. Massive Discount. Zero Catch.

We paid full price, so you don't have to. Get the genuine EA activated directly from MQL5 into your MT5 — same product, same updates, fraction of the cost.

$1,299.00 Original price was: $1,299.00.$689.95Current price is: $689.95.

Yes! All products listed on our site are in stock and ready for immediate activation.

There are no waiting periods or group buys. Purchase today, get it activated today.

Updates are downloaded directly from within your MT5 terminal — no need to contact us.

Simply open the developer's product page in the MQL5 marketplace and click "Update" whenever a new version is released. It's fully self-service and takes seconds.

Yes. This is activated directly from the developer's official MQL5 marketplace listing—guaranteed authentic.

Unlike downloadable files (which can be fake or cracked), this EA is installed through MQL5's one-click activation system, ensuring you get the real product with full functionality and instant automatic updates.

When you buy from us, you're getting the exact same lifetime license as buying directly from MQL5—just at a fraction of the price.

If you change your mind before we activate the official product in your MT5 terminal, you are eligible for a full refund. Absolutely no questions asked.

Once it has been activated and is working correctly, refunds are no longer available and our regular 7-day refund policy does not apply.

Once we've activated it for you, we can't take it back and it's yours permanently.

Buying directly on MQL5 means paying full price upfront—often $500-$1,500—without knowing if the EA will work for you. If it doesn't perform or the developer abandons it, there's no refund.

At CheaperForex, you get the exact same official, lifetime-licensed copy for up to 70% less. Test it at a lower risk before committing full price elsewhere.

We've been trusted since 2019, and every EA is yours forever—no renewals, no expiry, no surprises. Smarter investing in trading tools.

Simple: Volume purchasing + lower overhead = better prices for you.

We purchase licenses in bulk, then pass the wholesale savings to you. MQL5 charges full retail because they're a marketplace with fees and overhead. We buy direct and operate lean.

You get the exact same product:

✅ Same official MQL5 license (not cracked or pirated)

✅ Same lifetime updates from the developer

✅ Same technical support

✅ We handle the activation for you (under 2 minutes)

The only difference? You pay 50-80% less.

28,000+ customers trust us. Rated "Excellent" on Trustpilot with 116+ reviews.

No. As this is an official marketplace product, we cannot send you a direct file. The product must be activated directly inside your MT5 terminal via the official MQL5 marketplace.

This is the only legitimate way to receive the product and ensures you'll get ALL future updates automatically, which you can download yourself directly from the marketplace.

If you're looking for a downloadable file instead of legitimate marketplace activation, please do not purchase.

Risk-free purchase. Full refund if not satisfied.

We're so confident you'll love this EA that we offer a full refund within 7 days if you're not satisfied—no questions asked.

- ✓ Full refund if you don't activate the EA

- ✓ No complicated forms or hoops to jump through

- ✓ Simply email us within 7 days of purchase

- ✓ Your satisfaction is our #1 priority

Important: Refunds are only available before activation. Once the EA is installed on any MT5 platform, the activation is permanently consumed and cannot be reclaimed. This is standard MQL5 policy across all vendors to protect limited license slots.

Installed directly from the MQL5 marketplace

We can install it for you—no technical skills needed

Not tech-savvy? No problem. We'll handle the entire installation process for you via remote desktop—completely free.

- ✓ We remotely connect to your computer (with your permission)

- ✓ Install and configure the EA on your MT5 platform

- ✓ Set up optimal settings for your broker and account

- ✓ Verify everything is working correctly before we disconnect

- ✓ Typically takes under 2 minutes start to finish

How it works:

After purchase, simply email us or use our live chat. We'll schedule a quick session at your convenience using secure remote desktop software (AnyDesk or TeamViewer). You stay in control the entire time and can disconnect at any moment.

Major advantage: MQL5 marketplace doesn't offer any installation help. We do, free of charge.

It's installed from the official marketplace, there's no difference

Quick Summary:

AI Prop Firms EA for MT5 is an advanced fully automated trading system developed by MQL TOOLS SL, built specifically for prop trading firm environments.

This system uses Artificial Intelligence to analyze market conditions in real time, manage risk dynamically, and execute trades that comply with strict prop firm rules. Compatible with FTMO, The5ers, FundedNext, FundingPips, and any prop firm that supports MetaTrader 5. No martingale, no grid, no high-risk recovery — just precision-based entries and strict capital protection.

Official MQL5 Listing:

AI Prop Firms EA MT5

Developer Profile:

MQL TOOLS SL

Built Specifically for Prop Trading Firms

PROP FIRM COMPATIBLE

Designed to operate within the strict rules of:

- FTMO

- The5ers

- FundedNext

- FundingPips

- MyFundedFX

- And others…

Works on both evaluation challenges AND funded accounts

Unlike standard EAs that may violate prop firm rules through aggressive position sizing, high drawdowns, or news trading, AI Prop Firms is architected from the ground up to operate within prop firm constraints including daily drawdown limits, lower leverage conditions, and consistency requirements.

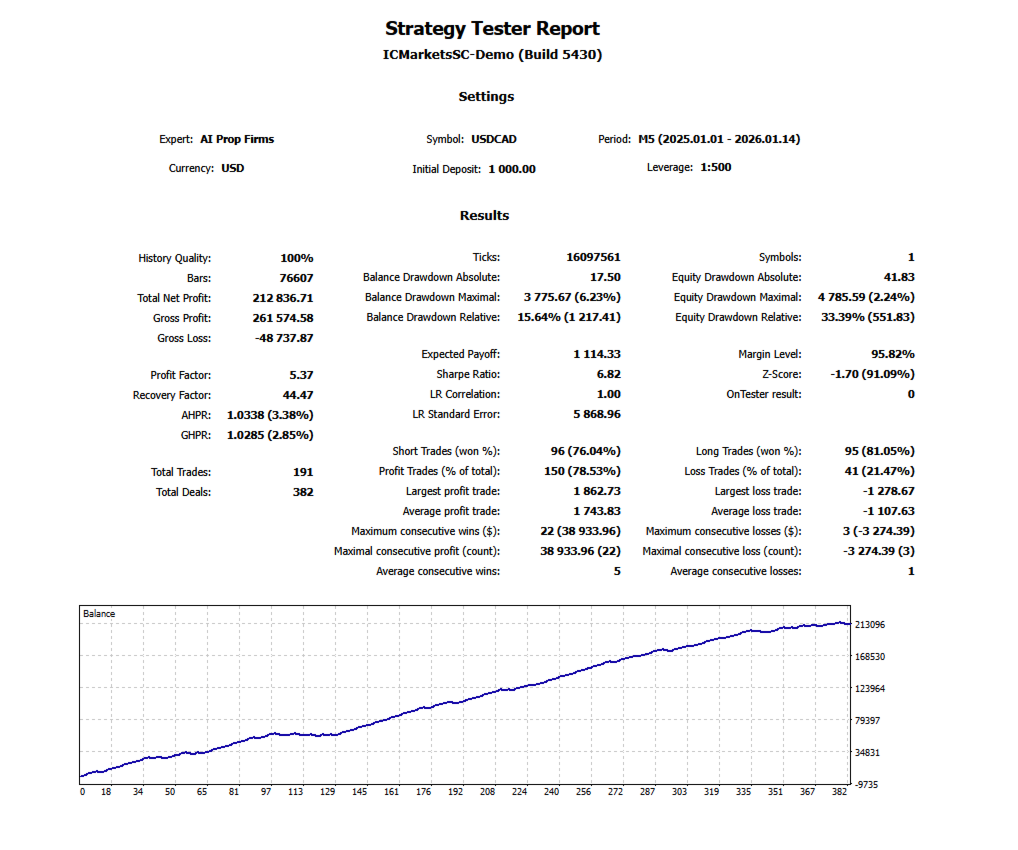

Backtest Results

Tested on USD/CAD M5 from January 2025 to January 2026 ($1,000 initial):

- Total Net Profit: $212,836.71

- Gross Profit: $261,574.58

- Gross Loss: -$48,737.87

- Profit Factor: 5.37 — exceptional

- Recovery Factor: 44.47

- Sharpe Ratio: 6.82

- Total Trades: 191

- Profit Trades: 150 (78.53%)

- Loss Trades: 41 (21.47%)

- Balance Drawdown Relative: 15.64%

- Equity Drawdown Relative: 33.39%

- Short Trades Won: 96 (76.04%)

- Long Trades Won: 95 (81.05%)

- Largest Profit Trade: $1,862.73

- Average Profit Trade: $1,743.83

- Largest Loss Trade: -$1,278.67

- Average Loss Trade: -$1,107.63

- Max Consecutive Wins: 22 ($38,933.96)

- Max Consecutive Losses: 3 (-$3,274.39)

- Average Consecutive Wins: 5

- Average Consecutive Losses: 1

- History Quality: 100%

- Z-Score: -1.70 (91.09%)

The 5.37 profit factor means the EA generates $5.37 in gross profit for every $1 of gross loss. Combined with 78.53% win rate and maximum 3 consecutive losses, these metrics demonstrate consistent performance.

Core Features

Daily Drawdown Guard

Automatically protects accounts from breaching daily loss limits. During periods of drawdown or unstable conditions, the system reduces exposure or temporarily pauses trading to protect account equity and stay within prop firm rules.

Economic News Protection Filter

Trading activity is automatically restricted before and after major economic announcements to reduce the risk of slippage and sudden price spikes. Essential for prop firms that prohibit news trading.

Entry Time Offset

Advanced execution logic that helps prevent synchronized trading across multiple accounts — a common cause of prop firm account termination for trade copying detection.

AI-Driven Trade Decisions

Every position is initiated by Artificial Intelligence based on:

- Real-time market analysis

- Probability assessment

- Adaptive execution logic

- Multiple data point evaluation

Adaptive TP, SL, and Trailing Control

Take Profit, Stop Loss, and Trailing Stop levels are dynamically adjusted in real time to reflect current volatility and liquidity — fully managed by AI.

Dynamic Risk Mode Switching

Based on live market behavior, the system automatically adapts its risk profile between conservative, balanced, and higher activity modes without user intervention.

Market Environment Recognition

AI continuously identifies prevailing market regimes:

- Trending phases

- Ranging conditions

- Elevated volatility

- Event-driven risk

The system avoids unfavorable environments automatically.

Precision Entry Filtering

Evaluates every potential setup and executes trades only when conditions meet strict quality criteria, reducing unnecessary exposure and low-probability entries.

AI Performance Reports

Generates concise weekly performance summaries with key statistics and insights to help monitor behavior and consistency.

Why No Martingale, No Grid

“The system does not use martingale, grid, or high-risk recovery techniques, making it suitable for long-term prop firm trading.”

Prop firms ban martingale and grid strategies because they inevitably lead to account blowouts. AI Prop Firms uses:

- Single position logic — one trade at a time, maximum risk always known

- Controlled risk — position sizing appropriate for prop firm rules

- Consistency focus — designed for steady performance, not explosive gains

More From the Developer

MQL TOOLS SL also creates AI Forex Robot, which we carry:

AI Forex Robot EA MT5

Another AI-powered trading system from the same developer. If you want exposure to different pairs beyond USD/CAD, AI Forex Robot offers complementary strategies.

User Reviews

★★★★★ “Finally, an EA built for prop firms.”

Tired of EAs that blow through my daily DD limit. AI Prop Firms actually respects the rules. The Daily Drawdown Guard has saved me multiple times. Passed my FTMO challenge.

— Thomas R., London

★★★★★ “Entry Time Offset is brilliant.”

My previous EA got flagged for trade copying because entries were too similar to other users. AI Prop Firms’ offset feature prevents that. Still funded after 3 months.

— Elena S., Berlin

★★★★☆ “Good EA, waiting for GBP/USD.”

USD/CAD works well but I want more pairs for diversification. Developer says GBP/USD coming soon. Four stars until then.

— James T., Sydney

★★★★★ “News filter actually works.”

No more surprise losses during NFP or FOMC. The economic filter blocks trades before announcements. Exactly what prop firms want to see.

— Sophie R., Paris

★★★★★ “78% win rate in live trading.”

Running it on FundedNext for 6 weeks now. Win rate matching the backtest. Drawdown stays controlled. This is what prop firm trading should look like.

— Marcus K., Toronto

Our Assessment

Transparent evaluation based on backtest performance and prop firm focus:

What We Found:

- Backtest Performance: 78.53% win rate, 5.37 profit factor — excellent for prop firm trading

- Risk Approach: NO martingale, NO grid — single position, controlled risk

- Prop Firm Features: Daily Drawdown Guard, News Filter, Entry Time Offset

- AI Technology: Adaptive TP/SL, dynamic risk modes, market regime recognition

- Compatibility: FTMO, The5ers, FundedNext, FundingPips, and any MT5 broker

- Trade Consistency: Max 3 consecutive losses, average 5 consecutive wins

- Current Limitation: USD/CAD only (GBP/USD coming soon)

- Developer: MQL TOOLS SL — also creates AI Forex Robot

- Best Suited For: Prop firm traders who need rule-compliant automation

- Overall: AI Prop Firms addresses the specific needs of prop firm traders with features like daily DD protection, news filtering, and entry offset. The no martingale/grid approach aligns with prop firm requirements. Single pair limitation will be addressed with upcoming GBP/USD addition.

Who Should Use This EA?

AI Prop Firms is ideal for traders who:

- Trade prop firm challenges (FTMO, FundedNext, The5ers, etc.)

- Have funded accounts and need rule-compliant trading

- Want daily drawdown protection built into the EA

- Need to avoid news trading per prop firm rules

- Want AI-driven automation without constant monitoring

NOT for traders who:

- Want to trade multiple pairs immediately (only USD/CAD currently)

- Prefer aggressive, high-risk strategies

- Don’t care about prop firm compliance

Technical Requirements

- Platform: MetaTrader 5

- Instrument: USD/CAD (GBP/USD coming soon)

- Timeframe: M1 or M5

- Minimum Deposit: $100

- Minimum Lots: 0.01

- Compatible: All prop firms and standard brokers (Raw, Hedging, Zero, Standard, Premium, ECN)

- VPS: Recommended for stable 24/5 connection

Setup

Preconfigured and ready to run:

- Attach EA to USD/CAD M5 chart

- Enable Algo Trading

- Adjust basic parameters if needed

- AI handles execution, risk control, and adaptation automatically

No complex setup or manual optimization required. The system is delivered fully configured for prop firm conditions.

Conclusion

AI Prop Firms EA for MT5 is intelligent automation built specifically for prop trading firm environments.

The features tell the story: Daily Drawdown Guard protects against breaching limits. Economic News Filter avoids announcements. Entry Time Offset prevents synchronized trading detection. And no martingale or grid means no sudden account blowouts.

The backtest delivers: 78.53% win rate, 5.37 profit factor, maximum 3 consecutive losses. These are metrics prop firms want to see — consistent performance without aggressive risk.

Compatible with FTMO, The5ers, FundedNext, FundingPips, and any prop firm that supports MetaTrader 5, AI Prop Firms is designed for traders who need rule-compliant automation for both evaluation challenges and funded accounts.

For prop firm traders who want professional-grade AI automation without risking their accounts to martingale blowouts or news trading violations, AI Prop Firms delivers exactly what the funded trading environment requires.

What Do You Receive?

– AI Prop Firms EA for MT5 – Latest Version

– Free lifetime updates

– For use on unlimited brokers and accounts

FAQs

What are the backtest results?

USD/CAD M5 (Jan 2025 – Jan 2026): $212,836 profit on $1,000, 78.53% win rate, 5.37 profit factor, 44.47 recovery factor. Max 3 consecutive losses, average 5 consecutive wins.

What prop firms is it compatible with?

All prop firms: FTMO, The5ers, FundedNext, FundingPips, MyFundedFX, and any other firm using MetaTrader 5. Works on both evaluation challenges AND funded accounts.

Does it use martingale or grid?

No. AI Prop Firms does NOT use martingale, grid, or high-risk recovery strategies. Single position logic with controlled risk — exactly what prop firms require.

What is the Daily Drawdown Guard?

Automatic protection that monitors daily loss limits. During drawdown or unstable conditions, the system reduces exposure or pauses trading to protect account equity and stay within prop firm rules.

Does it trade during news?

No. Built-in Economic News Filter automatically restricts trading before and after major economic announcements to avoid slippage and sudden volatility.

What is Entry Time Offset?

Advanced execution logic that prevents synchronized trading across multiple accounts — a common cause of prop firm termination for trade copying detection.

What pairs does it trade?

Currently optimized for USD/CAD. GBP/USD will be added as a free update. The system is specifically tuned for stable performance under prop firm conditions.

What timeframe?

M1 or M5. Attach to USD/CAD chart on either timeframe.

How does the AI work?

AI continuously evaluates price behavior, volatility, liquidity conditions, and market regimes. It adapts TP/SL levels, risk modes, and execution timing in real time without user intervention.

What is Dynamic Risk Mode Switching?

Based on live market behavior, the system automatically adapts between conservative, balanced, and higher activity modes without requiring manual adjustment.

What about market regime recognition?

AI identifies trending phases, ranging conditions, elevated volatility, and event-driven risk — automatically avoiding unfavorable environments.

What’s the minimum deposit?

$100 minimum. The system works with any account size and scales appropriately for prop firm conditions.

Does it work with regular brokers too?

Yes. Compatible with all prop firms AND any Forex broker supporting MT5 — Raw, Hedging, Zero, Standard, Premium, and ECN accounts.

Is setup complex?

No. Preconfigured settings with only a few user-adjustable inputs. Attach to chart, enable algo trading, and the AI handles execution, risk control, and adaptation automatically.

Are updates included?

Yes. All future updates provided free, including the upcoming GBP/USD addition. Latest version always available through MetaTrader platform.

💰 Compare Our Prices vs MQL5 Marketplace

See why 28,000+ customers choose us — click to expand

We lay it out for you — honestly. Here's what you get with us vs paying full price:

| Feature |

CheaperForex.com

💰 Best Value

|

MQL5 Marketplace |

|---|---|---|

| 💰 Price |

✅

Save 50-80%

|

❌

Full price

|

| 💎 Crypto Discount |

✅

Extra 20% off

|

❌

Not available

|

| 🔄 Risk Factor |

✅

Own the EA without huge investment

|

❌

Higher upfront cost

|

| 💳 Payment Options |

✅

Cards, Apple/Google Pay, Crypto

|

✅

Cards

|

| ↩️ Refund Policy |

✅

Full refund before activation

|

❌

Store credit only

|

| ⭐ Trustpilot Rating |

✅

Rated "Excellent"

|

🟡

Seller ratings vary

|

| ⚙️ Activation Support |

✅

We activate for you (takes 30 seconds)

|

✅

Self-install instantly

|

| 🔐 Ownership |

✅

Lifetime, no expiration

|

✅

Lifetime, no expiration

|

| 🔢 Hardware ID Activations |

⚠️

1 Unique Activation (10 MT5s)

|

✅

5 Unique Activations

|

CheaperForex.com

MQL5 Marketplace

Peter Jones

Product and Delivery FAQs

Below are some frequently asked questions about the delivery of your Expert Advisor.

Please read them carefully for clarification.

Yes. This is activated directly from the developer's official MQL5 marketplace listing—guaranteed authentic.

Unlike downloadable files (which can be fake or cracked), this EA is installed through MQL5's one-click activation system, ensuring you get the real product with full functionality and instant automatic updates.

When you buy from us, you're getting the exact same lifetime license as buying directly from MQL5—just at a fraction of the price.

Yes, product updates for this EA are always free and instant.

They can be downloaded from within the terminal from the marketplace.

Just go to the product listing and click "update" if there's one available.

Most activations are completed within 15-30 minutes of purchase.

Here's the simple process:

This is an official MQL5 product that must be activated directly from the marketplace—it cannot be downloaded as a standalone file.

Installation process:

1. After purchase, we'll schedule a quick activation session (usually within a few hours)

2. You grant us temporary access via UltraViewer or AnyDesk (takes ~2 minutes), OR provide temporary VPS credentials

3. We activate the EA on your MT5 terminal(s)

4. Done! The EA is permanently yours with instant updates from MQL5

The entire process is secure and takes about 2 minutes.

After activation, no further involvement from us is needed.

If you change your mind before we activate the official product in your MT5 terminal, you are eligible for a full refund. Absolutely no questions asked.

Once it has been activated and is working correctly, refunds are no longer available and our regular 7-day refund policy does not apply.

Once we've activated it for you, we can't take it back and it's yours permanently.

Usually within a few hours of purchase, but often much faster.

Immediately after purchase, you'll receive an instructional PDF explaining the simple activation process.

Don't worry—it's straightforward, and our refund policy applies anytime before we activate the EA on your terminal.

Activations are tied to your hardware ID, not your MT5 installation.

Here's how it works:

Free reactivation if:

- You reinstall MT5 on the same computer

- You accidentally delete MT5

- Windows updates cause issues (this is rare)

- You reinstall Windows, although sometimes this doesn't work, we will always attempt it for you.

Reactivation NOT possible if:

- You get a new computer (different hardware)

- You upgrade major hardware components (motherboard, etc.)

Important: Treat your installation with care. If you're planning to reformat or upgrade hardware, contact us FIRST so we can assist you.

Once your hardware ID changes, we cannot recover the activation.

Contact [email protected] with your order number if you need help.

Buying directly on MQL5 means paying full price upfront—often $500-$1,500—without knowing if the EA will work for you. If it doesn't perform or the developer abandons it, there's no refund.

At CheaperForex, you get the exact same official, lifetime-licensed copy for up to 70% less. Test it at a lower risk before committing full price elsewhere.

We've been trusted since 2019, and every EA is yours forever—no renewals, no expiry, no surprises. Smarter investing in trading tools.

Watch: How We Deliver Your EA (2 Minutes)

Related Products

Official MT5 expert advisors, exclusive to CheaperForex at the lowest prices.

-

CapitalGuard Grid EA MT5 – $10K Live Signal

Rated 0 out of 5$1,249.95Original price was: $1,249.95.$999.95Current price is: $999.95. -

Axonshift EA MT5

Rated 0 out of 5$799.00Original price was: $799.00.$319.95Current price is: $319.95. -

Burning Grid EA MT5

Rated 0 out of 5$999.00Original price was: $999.00.$399.95Current price is: $399.95. -

AI Neuro Dynamics MT5 EA

Rated 0 out of 5$599.00Original price was: $599.00.$239.95Current price is: $239.95.

Why Traders Trust Us

- ⭐ We are rated excellent on Trustpilot

- 🏆 In business since 2019

- ⚡ Free and fast product updates

- 🚫 Instant access – no 'group buys' hassle

- 🔄 7-day refund policy for product errors

- 🖥️ We can install it for you using UltraViewer

- 💬 Responsive support team

- 🔒 Pay with cards, Apple Pay, GPay, or crypto

Support & Community

Live Chat

Click to message us on Telegram @CheaperForex

Join Channel

Stay updated by joining our free Telegram channel.