- Official Product

- Instant Download

- 7-Day Money-Back Guarantee*

- Instant Download

- 7-Day Refund Policy*

Sale!

What's Included

Our Customer Reviews

Excellent product quality.

The latest updated versions of EAs are sent as soon as they are available.

I can highly recommend this site

Have gotten a lot from them in the past and never been disappointed.

After reaching out, I was refunded right away. 5/5 stars in my book.

I received immediate attention to a credit card payment error and they organised a refund within minutes ( late on a Sunday evening ) plus a great saving on a quality Forex EA.

But you need to do your homework on any product before buying.

They give a lot of commitment from themselves. I highly recommend it to everyone!

I recommend it 100%

The products work as advertised and the customer support is topnotch.

Great support. Recommended, 5 STARS.

You can trust them completely.

All issues have been resolved. , If the problem cannot be resolved, a refund will be given.

Prima che intervenissi, si erano accorti dell'anomalia. Per me, piena fiducia all'operatore.

Best in the industry. Thank you for what you do

They also have an outstanding customer care services .

It makes a change from most of the scam forex websites!

Apache MHL Moving Average EA MT4 – 10,372% Growth

Apache MHL Moving Average EA for MT4 is a XAUUSD breakout system with Martingale recovery developed by Paulo Roberto Da Costa.

It combines multiple moving averages to identify breakout opportunities on Gold, with RSI confirmation and a controlled Martingale grid for trade recovery. The verified MQL5 live signal shows 10,372% growth from a $50 deposit over 53 weeks — one of the most impressive live track records we’ve seen.

- ✅ 10,372% verified growth — $50 → $5,174 on live signal

- ✅ 78.9% win rate with only 18.1% max drawdown

- ✅ 53 weeks running — 100% algorithmic, zero manual intervention

- ✅ MA breakout entries with RSI confirmation filter

- ✅ Controlled Martingale recovery (max 10 levels, 2.0x multiplier)

The live results speak for themselves.

Instant Download

The lowest legitimate price — anywhere.

7-day full refund in the rare event of problems.

$1,500.00 Original price was: $1,500.00.$349.95Current price is: $349.95.

If your EA isn't profitable after 30 days of proper use, we'll exchange it for another product of equal or lesser value. No questions asked.

Applies to products $150+. Requires proof of proper installation and use per documentation. One exchange per customer.

What's Included

Quick Summary:

Apache MHL Moving Average EA for MT4 is a XAUUSD breakout system with Martingale recovery developed by Paulo Roberto Da Costa.

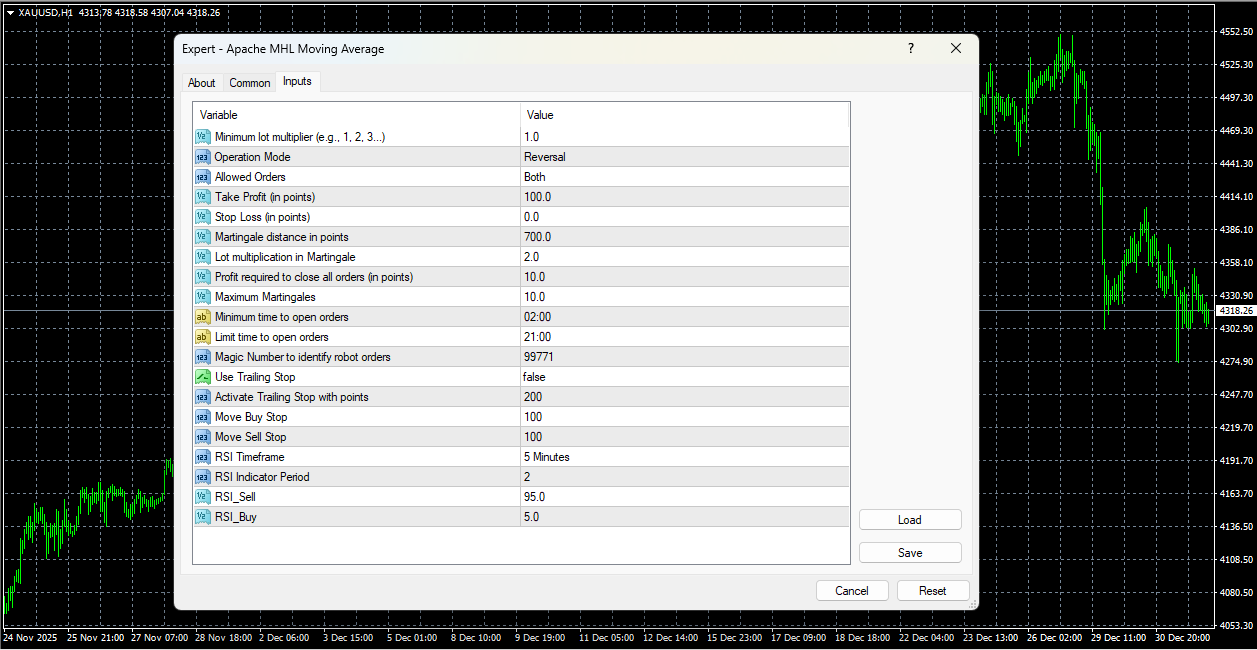

The EA combines multiple simple moving averages (SMA) based on price highs and lows to identify breakout opportunities on Gold. When price breaks through these MA levels with sufficient momentum, confirmed by RSI filters, the system enters trades. If positions move against you, a controlled Martingale grid recovers losses through accumulated profit targets.

But forget the theory — the live results tell the real story. The verified MQL5 signal turned a $50 deposit into $5,174 in 53 weeks. That’s 10,372% growth with 78.9% win rate and only 18.1% maximum drawdown. 100% algorithmic trading. No additional deposits. No manual intervention. Just pure automated execution on Gold.

Official MQL5 Listing:

Apache MHL Moving Average EA MT4

Verified Live Signal:

Apache MHL Signal — 10,372% Growth

Developer Profile:

Paulo Roberto Da Costa

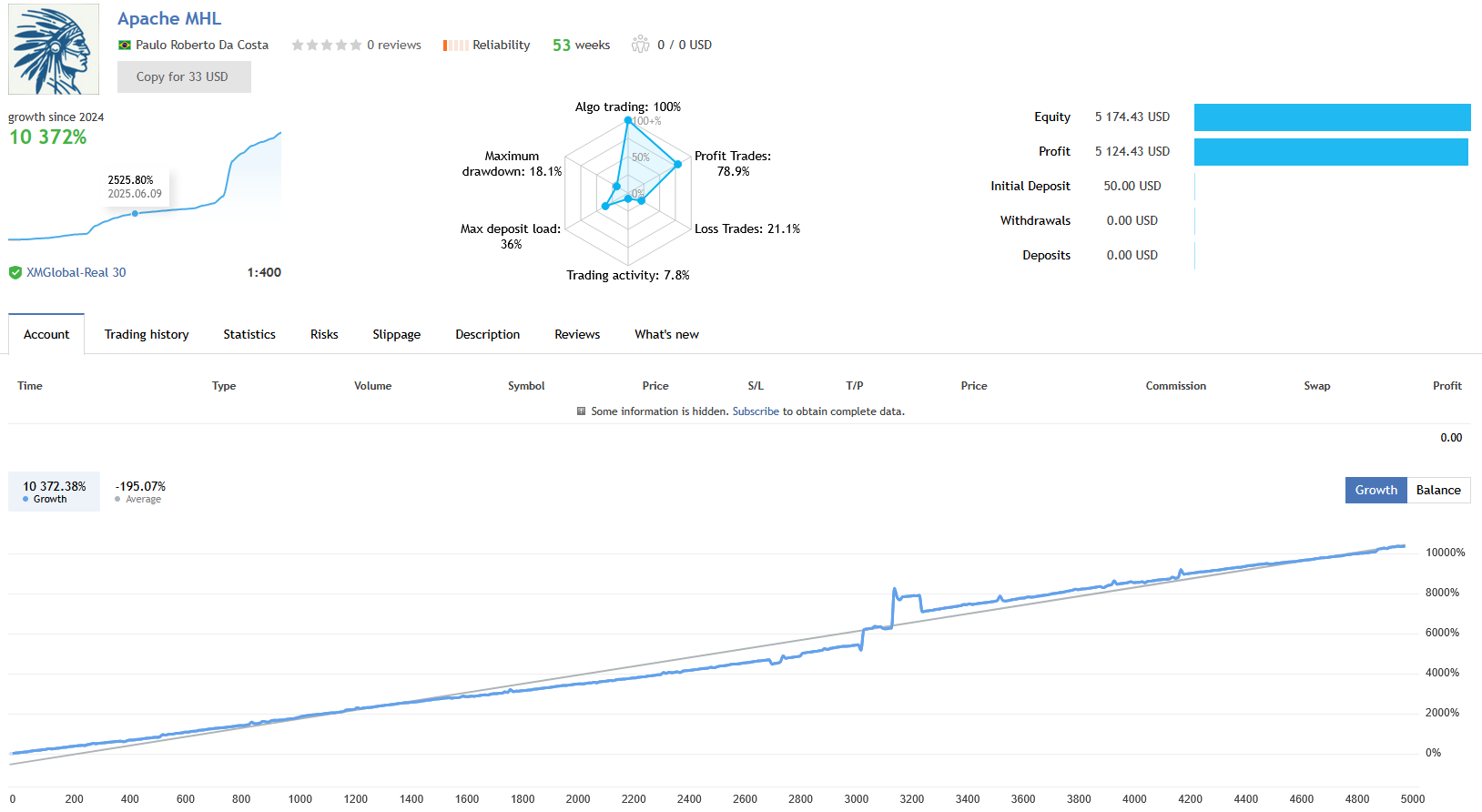

The Live Signal Results

Let’s talk about what matters — verified live performance. The Apache MHL signal on MQL5 shows:

- Growth: 10,372% total return since 2024

- Starting Capital: $50 initial deposit

- Current Equity: $5,174.43

- Profit: $5,124.43

- Running Time: 53 weeks

- Win Rate: 78.9% profitable trades

- Max Drawdown: 18.1%

- Max Deposit Load: 36%

- Trading Activity: 7.8%

- Algo Trading: 100% — zero manual intervention

- Additional Deposits: $0

- Withdrawals: $0

These aren’t backtest numbers. This is a verified live account running on XMGlobal with 1:400 leverage. The growth curve shows consistent compounding with controlled drawdowns — exactly what you want to see from a Martingale-based system.

What Apache MHL Is Designed To Do

The EA automates breakout trading on Gold with intelligent recovery:

- MA Breakout Detection — Uses multiple SMAs on price highs/lows to identify significant breakout levels

- Multi-Timeframe Confirmation — Requires breakouts across multiple timeframes simultaneously

- RSI Filter — Confirms momentum strength before entry (RSI 5/95 thresholds)

- Martingale Recovery — Controlled grid with 10 max levels and 2.0x multiplier

- Accumulated Profit Exit — Closes all positions when combined profit target is hit

How the Strategy Works

Step 1: Identify Breakout Levels

The EA calculates simple moving averages based on price highs and lows across multiple timeframes. These create dynamic support/resistance levels that adapt to Gold’s volatility.

Step 2: Wait for Confirmed Breakout

The system monitors for price to break through MA levels with a predefined distance buffer (100-700 points depending on timeframe). This “layered” approach ensures trades only trigger on significant technical breakouts across multiple time windows.

Step 3: RSI Confirmation

Before entering, the RSI indicator confirms momentum:

- Buy signals: RSI below 5 (oversold)

- Sell signals: RSI above 95 (overbought)

Step 4: Trade Execution

When breakout and RSI conditions align, the EA opens a position with:

- Take Profit: 100 points (default)

- Trading Hours: 02:00-21:00 server time

- Position Management: On-chart status display

Step 5: Martingale Recovery (If Needed)

If price moves against the initial position:

- Grid Distance: 700 points between recovery orders

- Lot Multiplier: 2.0x on each level

- Max Levels: 10 Martingale orders maximum

- Recovery Target: 10 points accumulated profit to close all

This approach moves the breakeven point closer to current price, allowing the system to exit profitably on small Gold retracements rather than requiring full reversal.

Key Features

Multi-Timeframe MA Breakout System

Uses simple moving averages on price highs/lows to create dynamic breakout levels. The progressive distance scaling (100-700 points) filters out noise and ensures entries only on significant technical breaks.

RSI Momentum Confirmation

Extreme RSI thresholds (5/95) confirm entry momentum, reducing false breakout signals. Configurable RSI period and timeframe for optimization.

Controlled Martingale Recovery

- Max 10 Levels: Hard cap prevents unlimited position growth

- 2.0x Multiplier: Standard doubling approach

- 700 Point Spacing: Wide grid absorbs Gold’s volatility

- Accumulated Profit Exit: Closes entire basket on small profit target

Session Time Filters

Default trading window 02:00-21:00 avoids thin liquidity periods. Fully configurable start/end times.

On-Chart Information Display

Real-time dashboard shows open trade count, robot status, and operational details directly on your chart.

Flexible Configuration

Full control over:

- Lot sizing and multipliers

- MA periods and timeframes

- Breakout distances

- Take profit and stop loss

- RSI parameters

- Martingale levels and spacing

- Trading hours

Why the $30,000 MQL5 Price?

Apache MHL sells for $30,000 on MQL5 — one of the highest-priced EAs on the marketplace. The developer justifies this with the verified live signal performance. Few EAs can demonstrate:

- 53 weeks of continuous live trading

- 10,372% verified growth on a real account

- Controlled 18.1% maximum drawdown

- 100% algorithmic execution with zero manual intervention

- Consistent equity curve without catastrophic drops

For perspective: a $50 account growing to $5,174 means the EA has generated over 100x return. Even accounting for the risks inherent in Martingale systems, the live track record demonstrates the strategy can work when properly configured and managed.

Understanding the Martingale Approach

Apache MHL uses Martingale recovery, which requires honest discussion:

How It Works

When trades move against you, the system opens larger positions at better prices. When price eventually retraces, the accumulated position closes at profit. This creates high win rates (78.9% in this case) because small retracements recover entire grid sequences.

The Risk

Extended one-way moves without retracement can exhaust the grid levels. The 10-level maximum with 2.0x multiplier means the final position is 512x the initial lot size. Proper capital allocation relative to lot sizing is critical.

Why Apache MHL’s Approach Works

The live signal suggests the configuration is well-calibrated for Gold:

- Wide 700-point grid spacing — Absorbs normal Gold volatility

- MA breakout entries — Enters at technical levels with mean-reversion potential

- RSI extremes — Confirms entries at likely reversal points

- 18.1% max drawdown over 53 weeks — Demonstrates controlled risk in practice

Who Should Use This EA?

This tool is ideal for:

- Gold traders — Seeking automated XAUUSD execution

- Martingale believers — Who understand and accept grid recovery risks

- High-risk/high-reward traders — Comfortable with aggressive position sizing

- Signal followers — Who want to replicate proven live performance

- Experienced traders — With capital management discipline

Technical Requirements

- Platform: MetaTrader 4

- Instrument: XAUUSD (Gold) — optimized specifically for this pair

- Timeframe: H1 recommended (multi-timeframe analysis built-in)

- Leverage: 1:400+ recommended (signal uses 1:400)

- Account Type: ECN/Raw spread preferred

- VPS: Recommended for continuous operation

User Reviews

★★★★★ “The signal results convinced me.”

I was skeptical of any $30K EA until I saw the live signal — 53 weeks, $50 to $5,000+, verified on MQL5. Running it on a separate account now and seeing similar results. The Martingale is controlled, not reckless.

— Marcus W., Dubai

★★★★★ “Finally a Martingale that doesn’t blow up.”

I’ve lost money on Martingale EAs before. Apache MHL is different — the wide grid spacing and MA breakout entries mean you’re not fighting random noise. 18% max drawdown over a year is remarkable for this strategy type.

— Kenji T., Tokyo

★★★★☆ “Incredible results, requires capital discipline.”

The EA delivers what the signal shows, but you need proper lot sizing relative to your account. I made the mistake of starting too aggressive and hit drawdown. Scaled back, now running smoothly. Follow the recommended settings.

— Carlos R., São Paulo

★★★★★ “78% win rate is real.”

Most trades close quickly at profit. The Martingale kicks in maybe 20% of the time, and the recovery logic works well on Gold’s volatility. Dashboard on chart is helpful for monitoring. Professional system.

— Anastasia K., London

★★★★★ “The price is justified by results.”

$30K on MQL5 seemed insane until you calculate what $50 → $5,174 means. That’s a system that works. CheaperForex discount made it accessible. Running for 3 months now with consistent growth.

— Ahmed S., Cairo

Our Assessment

Transparent evaluation based on verified live performance:

What We Found:

- Live Performance: 10,372% growth, $50→$5,174, 53 weeks — verified on MQL5

- Win Rate: 78.9% profitable trades — high accuracy from Martingale recovery

- Drawdown: 18.1% maximum — controlled for a Martingale system

- Strategy: MA breakout + RSI confirmation + controlled Martingale grid

- Instrument: XAUUSD only — optimized specifically for Gold’s volatility

- Configuration: Wide 700-point grid spacing prevents premature grid exhaustion

- Transparency: 100% algo trading, no manual intervention, live signal public

- Risk Factor: Martingale inherently risky — requires proper capital management

- Best Suited For: Experienced traders who understand and accept Martingale risks

- Overall: The live results are exceptional. For traders comfortable with Martingale mechanics, Apache MHL demonstrates what’s possible when the approach is properly calibrated for Gold.

Risk Disclosure

Apache MHL uses Martingale position sizing. While the live signal demonstrates impressive controlled performance, Martingale systems carry inherent risks:

- Extended trends without retracement can exhaust grid levels

- Position sizes grow exponentially (up to 512x initial lot at level 10)

- Proper capital allocation is critical — never over-leverage

- Past performance does not guarantee future results

The developer recommends thorough demo testing before live deployment. Always trade with capital you can afford to lose.

Conclusion

Apache MHL Moving Average EA for MT4 delivers one of the most impressive verified live track records we’ve reviewed.

$50 to $5,174 over 53 weeks. 10,372% growth. 78.9% win rate. 18.1% max drawdown. 100% algorithmic. These aren’t hypothetical backtest numbers — this is verified live performance on MQL5.

The strategy combines MA breakout detection with RSI confirmation and controlled Martingale recovery. The wide 700-point grid spacing and 10-level maximum show a system designed for Gold’s volatility rather than arbitrary grid placement. The results suggest the developer has found a configuration that balances aggressive growth with manageable risk.

Is Martingale for everyone? No. But for traders who understand the mechanics, accept the risks, and maintain proper capital discipline, Apache MHL demonstrates what’s achievable. The $30,000 MQL5 price reflects the verified performance — and our discount makes this elite-tier system accessible.

What Do You Receive?

– Apache MHL Moving Average EA for MT4 – Latest Version

– Free lifetime updates

– Fully unlocked for unlimited brokers and accounts

– Delivered by email and allocated to your user account dashboard

FAQs

What are the verified live signal results?

10,372% growth over 53 weeks. $50 initial deposit grew to $5,174.43 equity. 78.9% win rate, 18.1% max drawdown, 100% algorithmic trading. Verified on MQL5: Apache MHL Signal

What strategy does Apache MHL use?

MA breakout detection on XAUUSD using multiple simple moving averages on price highs/lows, RSI confirmation (5/95 thresholds), and controlled Martingale grid recovery for losing trades.

Does it use Martingale?

Yes. Controlled Martingale with maximum 10 levels, 2.0x lot multiplier, and 700-point grid spacing. Trades close on accumulated profit target rather than individual position targets.

What pair does it trade?

XAUUSD (Gold) only. The EA is specifically optimized for Gold’s volatility characteristics. Not recommended for other instruments.

Why is the MQL5 price $30,000?

The developer prices based on verified live performance. Few EAs demonstrate 10,000%+ growth on a verified live signal over 53 weeks. The results justify premium pricing.

What’s the maximum drawdown shown on the live signal?

18.1% — remarkably controlled for a Martingale-based system. The wide 700-point grid spacing and MA breakout entries contribute to drawdown management.

How does the Martingale recovery work?

If price moves 700 points against the initial position, a second order opens at 2.0x lot size. This continues up to 10 levels maximum. When price retraces, all positions close on a small accumulated profit target (10 points default).

What RSI settings does it use?

RSI period 2 on M5 timeframe. Buy signals require RSI below 5 (extreme oversold), sell signals require RSI above 95 (extreme overbought). These extreme thresholds filter entries to likely reversal points.

What are the default trading hours?

02:00 to 21:00 server time. This avoids thin liquidity periods. Fully configurable in EA inputs.

What leverage is recommended?

1:400 or higher. The live signal runs on 1:400 leverage. Sufficient leverage is important for Martingale grid systems to maintain positions.

What’s the minimum recommended capital?

The live signal started with $50, but this was aggressive. For conservative operation with 0.01 lots, $500+ provides more breathing room for the Martingale grid.

Is the trading 100% automated?

Yes. The live signal shows 100% algo trading — zero manual intervention over 53 weeks.

What broker does the signal use?

XMGlobal with Real account type and 1:400 leverage. ECN/Raw spread brokers are recommended for best execution.

Should I demo test first?

Absolutely. The developer explicitly recommends rigorous demo testing before live deployment. Martingale systems require understanding of risk and proper capital management.

What happens if the Martingale exhausts all 10 levels?

If price continues moving against the grid beyond level 10, the system will hold positions with significant drawdown. This is the inherent risk of Martingale — extended one-way moves without retracement can cause substantial losses.

Reviewed by Our Trader

Peter Jones

Pre-Purchase FAQs

Are updates always free?

Yes, all updates are completely free—you'll never pay twice.

We receive updates from developers and upload them to your account when they're available. Please be patient, as we're managing hundreds of products at discounted prices. More popular products are updated more frequently.

All versions are stored in your account for easy access.

What's your refund policy?

We offer a 7-day technical guarantee. If the EA fails to attach to your chart due to verified errors we can replicate, we'll issue a full refund.

However, we cannot refund based on trading performance or profit expectations—forex markets are unpredictable, and results vary by broker, spread, and market conditions. We provide tools, not guarantees.

I need assistance installing this?

Yes, we'd be happy to assist you!

We can advise you on the best settings for your account or create custom presets tailored to your needs. Additionally, we offer a one-time free installation service using AnyDesk for remote setup.

Please note, however, that we cannot provide advice on how to make money with any of our products.

Can I use this on multiple accounts?

Absolutely. Once you purchase, the EA is yours to use on unlimited live and demo accounts—no restrictions.

You can run it on multiple brokers, VPS servers, or trading accounts simultaneously.

There are no license limits or activation keys. Buy once, use everywhere.

How do I download after payment?

After successful payment, your product will be available for download instantly:

- Displayed on the screen immediately after checkout

- Emailed to the address you provided during purchase

- Stored in your account if you created one at checkout

In rare cases (about 1% of high-value premium products), orders may be held for manual review to prevent fraud. If you don't see a download link, contact us for assistance.

Is this an original product?

Yes, absolutely.

We do not sell fake products, and our customer reviews, along with our pricing, reflect the quality and authenticity of what we offer.

Why Traders Trust Us

Related Products

Powerful expert advisors, exclusive to CheaperForex, at the lowest prices.

-

EvoTrade EA MT4 Version 1.5

Rated 0 out of 5$799.00Original price was: $799.00.$169.95Current price is: $169.95. -

GbpUsd Commander EA MT5

Rated 0 out of 5$499.00Original price was: $499.00.$149.95Current price is: $149.95. -

Sonata EA MT4 – Scalping Perfection

Rated 0 out of 5$1,400.00Original price was: $1,400.00.$179.95Current price is: $179.95. -

Artificial Intelligence AI EA MT4 – 10,000% Growth

Rated 0 out of 5$3,000.00Original price was: $3,000.00.$99.95Current price is: $99.95.