- Official Product

- Instant Download

- 7-Day Money-Back Guarantee*

- Instant Download

- 7-Day Refund Policy*

Sale!

What's Included

Our Customer Reviews

Excellent product quality.

The latest updated versions of EAs are sent as soon as they are available.

I can highly recommend this site

Have gotten a lot from them in the past and never been disappointed.

After reaching out, I was refunded right away. 5/5 stars in my book.

I received immediate attention to a credit card payment error and they organised a refund within minutes ( late on a Sunday evening ) plus a great saving on a quality Forex EA.

But you need to do your homework on any product before buying.

They give a lot of commitment from themselves. I highly recommend it to everyone!

I recommend it 100%

The products work as advertised and the customer support is topnotch.

Great support. Recommended, 5 STARS.

You can trust them completely.

All issues have been resolved. , If the problem cannot be resolved, a refund will be given.

Prima che intervenissi, si erano accorti dell'anomalia. Per me, piena fiducia all'operatore.

Best in the industry. Thank you for what you do

They also have an outstanding customer care services .

It makes a change from most of the scam forex websites!

Fundamental Hunter EA MT4

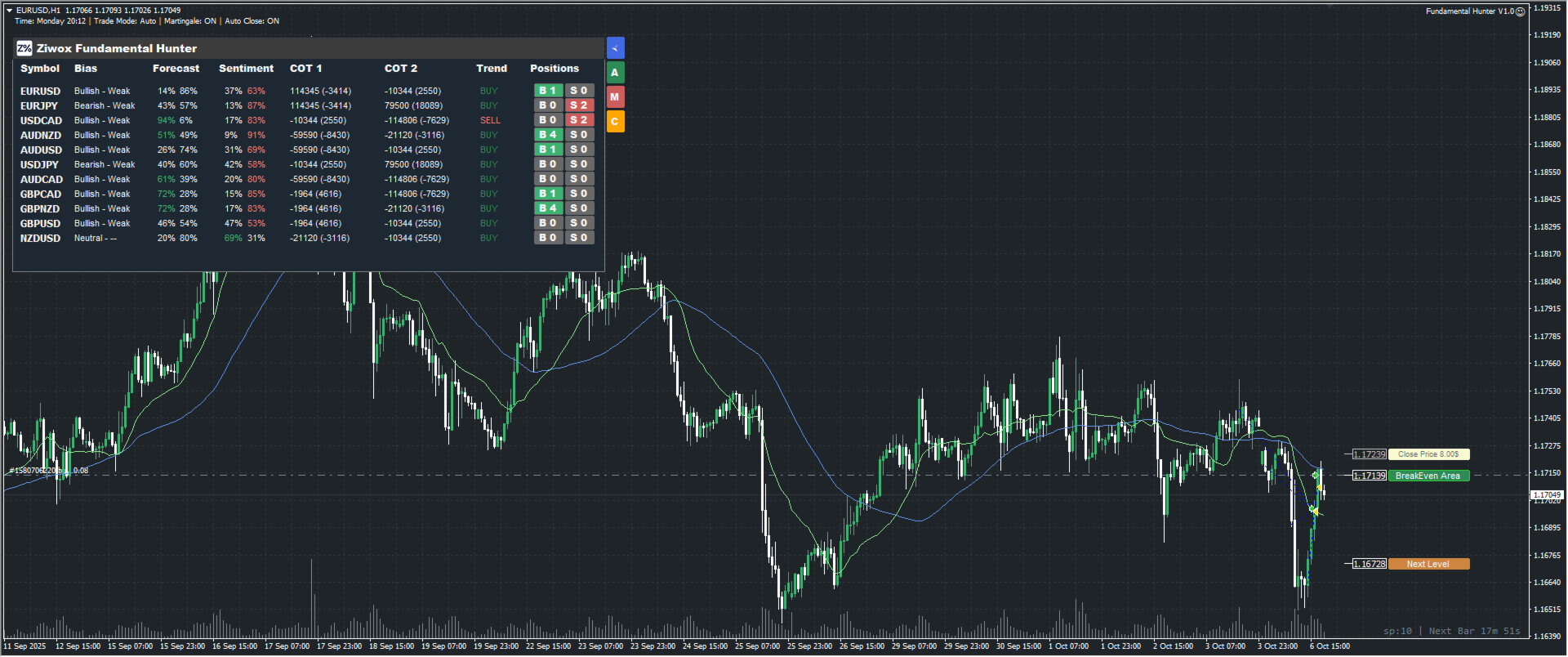

Fundamental Hunter EA: AI-powered forex robot that trades with institutional data. Combines CFTC positioning, macroeconomic fundamentals, retail sentiment, and technical analysis for high-probability entries. No guessing — just smart money tracking.

- ✓ 21% verified live growth (71.9% win rate)

- ✓ Real-time dashboard with CFTC, sentiment & fundamental data

- ✓ Adaptive scalping + HFT mode + Safe AI-optimized martingale

- ✓ Works on all major/minor pairs

- ✓ Plug-and-play setup — no complex configuration

Trade alongside the big players. Follow the data that moves markets.

The Download Package Includes:

- Fundamental Hunter EA (.ex4) – Latest Version

- Installation Guide PDF

- How to Install MT4 Files.pdf

- Recommended Pairs List

- Real-Time Dashboard (Built-in)

Instant Download

The lowest legitimate price — anywhere.

7-day full refund in the rare event of problems.

$1,200.00 Original price was: $1,200.00.$299.95Current price is: $299.95.

If your EA isn't profitable after 30 days of proper use, we'll exchange it for another product of equal or lesser value. No questions asked.

Applies to products $150+. Requires proof of proper installation and use per documentation. One exchange per customer.

What's Included

Quick Summary: Fundamental Hunter by Sara Sabaghi is an AI-powered MT4 Expert Advisor that combines CFTC institutional positioning, real-time economic data, retail sentiment analysis, and technical momentum to identify high-probability entries. No guessing. No lagging indicators. Just data-driven precision.

Overview

Most Expert Advisors rely solely on technical indicators—moving averages, RSI, MACD—which are reactive by nature and often arrive late to profitable moves. This system operates differently.

It taps into the same data streams professional traders and institutions monitor: CFTC Commitment of Traders reports, macroeconomic releases, and retail sentiment imbalances. By combining these fundamental layers with AI-driven technical analysis, it identifies where institutional capital is positioned and enters trades only when all signals align.

How It Works

Four-Layer Data Confluence System

Before making any trading decision, the system processes four critical data streams:

- CFTC Commitment of Traders Data — Tracks institutional positioning to reveal where banks, hedge funds, and commercial traders are placing capital. This exposes directional bias before retail traders catch on.

- Fundamental Economic Data — Monitors key macroeconomic indicators: inflation (CPI), interest rate decisions, Non-Farm Payrolls, PMI data, GDP releases, and central bank sentiment.

- Retail Sentiment Analysis — Measures crowd positioning across brokers. When retail is heavily positioned one direction, institutions often move opposite. The system exploits these contrarian setups.

- AI Technical Engine — Combines fundamental layers with real-time price action, momentum filters, and volatility analysis to determine optimal entry timing.

When all four factors point in the same direction, the system identifies a high-probability confluence zone and executes automatically.

Professional Dashboard

The on-chart dashboard displays real-time analytical data directly on your trading chart:

- Live fundamental and macroeconomic indicators

- CFTC positioning reports showing institutional bias

- Retail sentiment readings (% long vs. short)

- Current technical trend direction for each pair

- Manual Buy/Sell buttons for semi-automated control

You’ll have full transparency into why each decision is made, not just when trades execute.

Strategy & Risk Management

Adaptive Trading Modes

The system primarily operates as a scalping strategy, capturing rapid profits from short-term movements. However, it adapts to market conditions:

- Scalping Mode (Default) — Opens controlled trades with tight stops and quick profit targets when data alignment is detected

- High-Frequency Trading Mode — During volatility spikes and momentum acceleration (major news releases, breakouts), it switches to HFT mode for rapid trade execution

- Low-Volatility Protection — In choppy, stagnant markets, AI algorithms recognize unfavorable conditions and limit entries to protect your account

Smart Martingale Recovery

The integrated martingale system includes critical safety features absent in typical implementations:

- Maximum grid depth limits prevent runaway lot size escalation

- Equity-based exposure caps stop overtrading

- Dynamic spacing based on ATR and volatility

- AI monitoring disables recovery during unfavorable regimes

This keeps drawdowns manageable while giving losing positions a statistically sound path to breakeven or profit.

Key Features

| Feature | Details |

|---|---|

| Data Sources | CFTC positioning, economic data, retail sentiment, AI technical analysis |

| Strategy Type | Trend-following scalper with HFT and Smart Martingale |

| Supported Pairs | All major and minor forex pairs |

| Dashboard | Live on-chart display of fundamental data and institutional positioning |

| Risk Controls | Fixed SL/TP, equity protection, exposure caps, depth-limited martingale |

| Setup | Plug-and-play with default settings; no optimization required |

Technical Specifications

- Platform: MetaTrader 4

- Strategy: Trend-following scalper with HFT and Smart Martingale

- Data Inputs: CFTC reports, economic releases, retail sentiment (via API)

- Currency Pairs: All majors and minors (EURUSD, GBPUSD, USDJPY, AUDUSD, etc.)

- Minimum Balance: $500 USD recommended

- Broker Type: ECN/RAW spread accounts recommended

- VPS: Recommended for 24/5 uptime and stable API connections

⚙️ Quick Setup

- Attach to your desired trading pair in MT4

- Use default settings (pre-configured)

- Enable AutoTrading

- Run on VPS for best results

📦 What You Get

- Fundamental Hunter – Official .ex4 version

- Built-in dashboard (no separate indicators needed)

- Recommended pairs list

- Free updates and email support

More Information

-

- Original MQL5 Product: https://www.mql5.com/en/market/product/82722

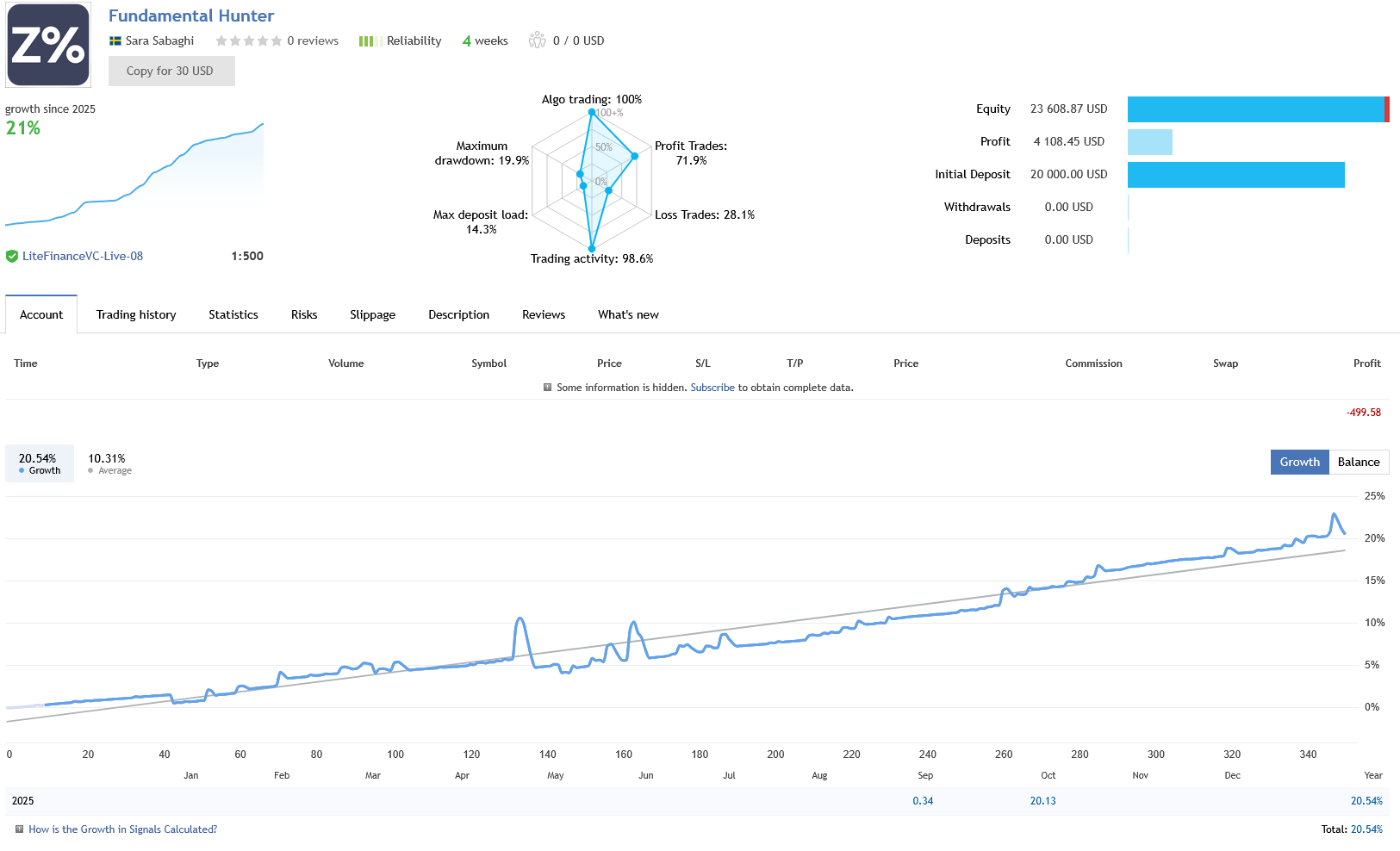

📈 Verified Live Performance

All performance data comes from live trading with real money, publicly tracked and verified by third-party monitoring.

Live Signal Stats (October 2025)

- Growth Since 2025: 21% over 4+ months

- Starting Balance: $20,000 USD

- Current Equity: $23,608.87 USD

- Total Profit: $4,108.45 USD

- Win Rate: 71.9%

- Maximum Drawdown: 19.9%

- Trading Activity: 98.6%

View the Live Signal

All trades, profit/loss, and statistics are publicly verified:

📊 Live Performance Signal: https://www.mql5.com/en/signals/2334233

FAQs

How is this different from other EAs?

Most EAs use only technical indicators like moving averages or RSI, which lag behind price action. This system analyzes CFTC institutional positioning, macroeconomic releases, and retail sentiment—the same data professional traders monitor—before combining it with technical analysis for entry timing.

Does it use martingale or grid strategies?

Yes, but with critical safety improvements. The Smart Martingale System includes maximum depth limits, equity-based exposure caps, volatility-aware spacing, and AI monitoring that disables recovery during unfavorable market conditions. It’s designed to recover positions safely without excessive risk.

What currency pairs does it trade?

All major and minor forex pairs: EURUSD, GBPUSD, USDJPY, AUDUSD, USDCAD, EURJPY, GBPJPY, AUDCAD, GBPCAD, NZDUSD, and more. The dashboard displays data for multiple pairs simultaneously.

Do I need external indicators or plugins?

No. Everything is built into the single .ex4 file—dashboard, data feeds, AI engine, and execution logic. Just attach to a chart and enable AutoTrading.

What’s the minimum recommended balance?

$500 USD minimum for proper lot sizing and risk management. Larger balances ($1,000+) give the recovery system more room during drawdown periods.

Is a VPS required?

Highly recommended. A VPS ensures 24/5 uptime, stable internet connection, and uninterrupted API access to data feeds. Without one, you risk missing trades during downtime.

What broker type works best?

ECN or RAW spread brokers with tight spreads and fast execution. Avoid dealing desk brokers with excessive requotes, as scalping and HFT modes require clean order execution.

How often does it trade?

Frequency depends on market conditions and data confluence. During active periods with strong alignment, it may open multiple trades daily. In quiet conditions, it waits for higher-probability setups. The live signal shows 98.6% trading activity.

Can I control risk levels?

Yes. Adjustable parameters include lot sizing, maximum exposure, daily/weekly loss limits, and martingale depth. You control how aggressively or conservatively it trades.

What is the win rate?

The verified live account shows 71.9% profitable trades with 28.1% losses. Consistent profitability comes from the multi-layer data confluence system that only enters when all signals align.

What Traders Say

- Marcus T., Frankfurt: “The CFTC data integration is brilliant. I can see where institutions are positioned before entering trades. The dashboard alone is worth the price.”

- Priya K., Mumbai: “Most EAs blow accounts with reckless martingale. This Smart Martingale respects risk limits—drawdown stayed under 20% even during volatile weeks.”

- Ahmed R., Dubai: “The AI pauses trading during choppy conditions instead of forcing entries. That discipline saved my account multiple times.”

- Sophie L., Paris: “I run it on 6 pairs simultaneously. The dashboard gives a complete market overview at a glance. The 71% win rate speaks for itself.”

Final Verdict

This system represents an evolution in automated trading. Instead of relying solely on lagging indicators, it incorporates the fundamental data that institutional traders use to make informed decisions.

By tracking institutional positioning through CFTC reports, monitoring macroeconomic fundamentals, analyzing retail sentiment for contrarian signals, and combining it all with AI-driven technical analysis, the system identifies high-probability trades that make sense from multiple perspectives.

The verified live performance—21% growth over four months with a 71.9% win rate and controlled 19.9% drawdown—proves this works in real market conditions with real money.

Stop guessing. Trade with the data that moves markets.

Reviewed by Our Trader

Peter Jones

Pre-Purchase FAQs

Are updates always free?

Yes, all updates are completely free—you'll never pay twice.

We receive updates from developers and upload them to your account when they're available. Please be patient, as we're managing hundreds of products at discounted prices. More popular products are updated more frequently.

All versions are stored in your account for easy access.

What's your refund policy?

We offer a 7-day technical guarantee. If the EA fails to attach to your chart due to verified errors we can replicate, we'll issue a full refund.

However, we cannot refund based on trading performance or profit expectations—forex markets are unpredictable, and results vary by broker, spread, and market conditions. We provide tools, not guarantees.

I need assistance installing this?

Yes, we'd be happy to assist you!

We can advise you on the best settings for your account or create custom presets tailored to your needs. Additionally, we offer a one-time free installation service using AnyDesk for remote setup.

Please note, however, that we cannot provide advice on how to make money with any of our products.

Can I use this on multiple accounts?

Absolutely. Once you purchase, the EA is yours to use on unlimited live and demo accounts—no restrictions.

You can run it on multiple brokers, VPS servers, or trading accounts simultaneously.

There are no license limits or activation keys. Buy once, use everywhere.

How do I download after payment?

After successful payment, your product will be available for download instantly:

- Displayed on the screen immediately after checkout

- Emailed to the address you provided during purchase

- Stored in your account if you created one at checkout

In rare cases (about 1% of high-value premium products), orders may be held for manual review to prevent fraud. If you don't see a download link, contact us for assistance.

Is this an original product?

Yes, absolutely.

We do not sell fake products, and our customer reviews, along with our pricing, reflect the quality and authenticity of what we offer.

Why Traders Trust Us

Related Products

Powerful expert advisors, exclusive to CheaperForex, at the lowest prices.

-

Nas100 Scalping EA MT4

Rated 0 out of 5$100.00Original price was: $100.00.$29.95Current price is: $29.95. -

LENA Scalp EA MT4

Rated 0 out of 5$1,200.00Original price was: $1,200.00.$99.95Current price is: $99.95. -

Aura Bitcoin Hash MT5

Rated 0 out of 5$599.00Original price was: $599.00.$249.95Current price is: $249.95. -

Idol EA MT4 – Excellent Results

Rated 0 out of 5$1,999.00Original price was: $1,999.00.$149.95Current price is: $149.95.