Save 50–80% on the official MQL5 product.

Same EA. Same updates. Same lifetime license. We just paid full price so you don't have to.

Cracked .ex5 files don't exist for marketplace products. This is a genuine MQL5 activation. If you're looking for pirated software, we're not the right store.

Our Customer Reviews

Excellent product quality.

The latest updated versions of EAs are sent as soon as they are available.

I can highly recommend this site

Have gotten a lot from them in the past and never been disappointed.

After reaching out, I was refunded right away. 5/5 stars in my book.

I received immediate attention to a credit card payment error and they organised a refund within minutes ( late on a Sunday evening ) plus a great saving on a quality Forex EA.

But you need to do your homework on any product before buying.

They give a lot of commitment from themselves. I highly recommend it to everyone!

I recommend it 100%

The products work as advertised and the customer support is topnotch.

Great support. Recommended, 5 STARS.

You can trust them completely.

All issues have been resolved. , If the problem cannot be resolved, a refund will be given.

Prima che intervenissi, si erano accorti dell'anomalia. Per me, piena fiducia all'operatore.

Best in the industry. Thank you for what you do

They also have an outstanding customer care services .

It makes a change from most of the scam forex websites!

How MQL5 Activation Works

Installation is completed in under 5 minutes

Purchase

Save 50–80%

on the exact same official product

We Activate It

Activated on your MT5 terminal

remotely in 60 seconds, ready to trade

Attach & Trade

Attach to your chart

open MT5, attach to chart, begin trading

Free Updates

Always the latest version

updates arrive straight to your MT5

New to Expert Advisors? We Can Help.

Most customers install using our step-by-step PDF guide. If you require full assistance, we will install and configure the EA on your behalf — at no charge. Simply message us after purchase.

Golden Hen EA MT5

Golden Hen EA for MT5 is a multi-strategy Gold trading system developed by Taner Altinsoy.

It combines eight independent trading strategies across multiple timeframes (M5 to H12), each with fixed Stop Loss and Take Profit. The critical differentiator: no grid, no martingale, no averaging. Every trade has defined risk. The live signal shows 18% growth with only 5.5% maximum drawdown — and 10 five-star reviews confirm it delivers.

- ✅ 8 independent strategies — diversified approach across timeframes

- ✅ NO grid, NO martingale, NO averaging — fixed SL/TP on every trade

- ✅ 5.5% max drawdown on live signal — exceptional risk control

- ✅ Prop firm ready — built-in daily loss protection

- ✅ 10 five-star reviews, 20 purchases/month

Eight strategies. One EA. Zero dangerous techniques.

Save 50–80% on this official MQL5 product.

Same EA. Same updates. Same lifetime license.

Cracked .ex5 files don't exist for marketplace products. This is a genuine MQL5 activation.

Buy Now

Latest version with all future updates.

Activated from the MQL5 marketplace, directly into your MT5 terminals.

Don't risk being scammed by fake resellers. We are the only EA reseller rated Excellent on Trustpilot — check it yourself.

$899.00 Original price was: $899.00.$449.95Current price is: $449.95.

The lowest genuine reseller price. · Price reflects current MQL5 listing and may change.

Yes! All products listed on our site are in stock and ready for immediate activation.

No waiting periods, no group buys. Purchase today, get it activated today.

We don't send you a file. Instead, we remotely activate the EA directly onto your MT5 terminal — the same way it would be installed if you bought from MQL5 at full price.

Updates are downloaded directly from within your MT5 terminal — no need to contact us.

Simply open the developer's product page in the MQL5 marketplace and click "Update" whenever a new version is released. It's fully self-service and takes seconds.

Yes — 100% genuine. This is activated directly from the developer's official MQL5 marketplace listing.

Unlike downloadable files (which can be fake or cracked), this EA is installed through MQL5's one-click activation system, ensuring you get the real product with full functionality and automatic updates.

You're getting the exact same lifetime license as buying directly from MQL5 — just at a fraction of the price.

If you change your mind before we activate the product in your MT5 terminal, you get a full refund — no questions asked.

Once activated and working correctly, refunds are no longer available as the license is permanently yours and cannot be revoked.

Buying directly on MQL5 means paying full price — often $500–$1,500 — without knowing if the EA will work for you. If it doesn't perform, there's no refund.

With us, you get the exact same official lifetime-licensed copy for up to 70% less. Test it at lower risk before committing full price elsewhere.

Trusted since 2019 with 28,000+ customers. No renewals, no expiry, no surprises.

Volume purchasing + lower overhead = better prices for you.

We purchase licenses in bulk, then pass the wholesale savings to you. MQL5 charges full retail because they're a marketplace with fees and overhead. We buy direct and operate lean.

You get the exact same product:

✅ Same official MQL5 license (not cracked or pirated)

✅ Same lifetime updates from the developer

✅ Same technical support

✅ We handle the activation for you (under 2 minutes)

The only difference? You pay 50–80% less.

28,000+ customers trust us. Rated "Excellent" on Trustpilot with 116+ reviews.

No. This is an official marketplace product — it must be activated directly inside your MT5 terminal via the MQL5 marketplace.

This is the only legitimate way to receive the product and ensures you get all future updates automatically.

If you're looking for a downloadable file instead of legitimate marketplace activation, please do not purchase.

No — and sites claiming otherwise are scams. This is an official MQL5 marketplace product that requires activation. Cracked .ex5 files don't exist for marketplace products.

Sites advertising "free downloads" typically deliver a password-locked zip file, then charge $200+ on Telegram for the password — which unlocks junk files, not the real EA. Several of these sites have been reported for fraud.

We offer the genuine product at 50–80% below MQL5 retail price with official marketplace activation, free updates, and a 7-day money-back guarantee before activation.

Full refund before activation. Zero risk.

Change your mind before we activate the EA? You get a full refund, no questions asked. Simply email us within 7 days of purchase.

Once the EA is activated on your MT5 platform, the license is permanently yours and cannot be reclaimed. Refunds are only available before activation.

Installed directly from the MQL5 marketplace

We can install it for you — no technical skills needed

Not tech-savvy? No problem. After purchase, contact us and we'll remotely install and configure the EA on your MT5 — takes under 2 minutes, completely free.

MQL5 marketplace doesn't offer any installation help. We do, free of charge.

Installed from the official marketplace, there's no difference

Quick Summary:

Golden Hen EA for MT5 is a multi-strategy Gold trading system developed by Taner Altinsoy.

This EA combines eight independent trading strategies, each analyzing different market conditions across multiple timeframes (M5, M30, H2, H4, H6, H12). The critical differentiator that sets Golden Hen apart: no grid, no martingale, no averaging. Every single trade has a predefined Stop Loss and Take Profit. You always know your risk.

The verified live signal shows 18% growth with only 5.5% maximum drawdown. The 2025 backtest delivers a 5.59 profit factor and 84.4% win rate. With 10 five-star reviews and 20 purchases per month, traders are validating that Golden Hen delivers what most Gold EAs promise but fail to provide: consistent returns without dangerous position management.

Official MQL5 Listing:

Golden Hen EA MT5

Verified Live Signal:

Golden Hen Signal — 18% Growth, 5.5% Max DD

Developer Profile:

Taner Altinsoy

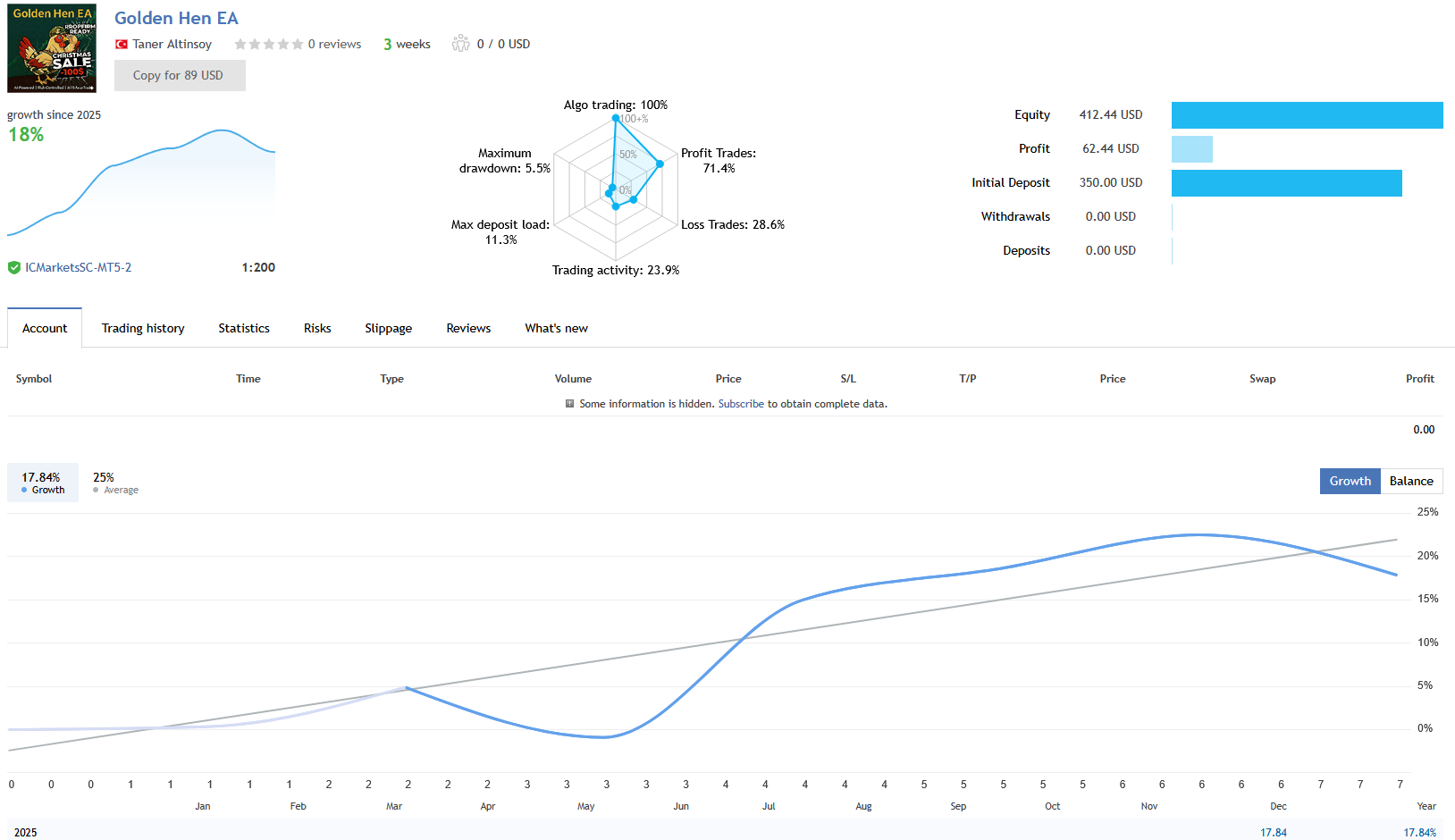

The Live Signal Results

Verified performance on MQL5:

- Growth: 18% (17.84% precise)

- Initial Deposit: $350

- Current Equity: $412.44

- Profit: $62.44

- Win Rate: 71.4% profitable trades

- Max Drawdown: 5.5% — exceptionally controlled

- Max Deposit Load: 11.3%

- Trading Activity: 23.9%

- Algo Trading: 100%

- Broker: ICMarketsSC-MT5-2

- Leverage: 1:200

The 5.5% max drawdown is what professional traders notice first. Most Gold EAs show 20-50% drawdowns because they rely on grid or martingale recovery. Golden Hen keeps risk controlled because every trade has fixed SL/TP — no position averaging, no lot multiplication, no hoping the market reverses.

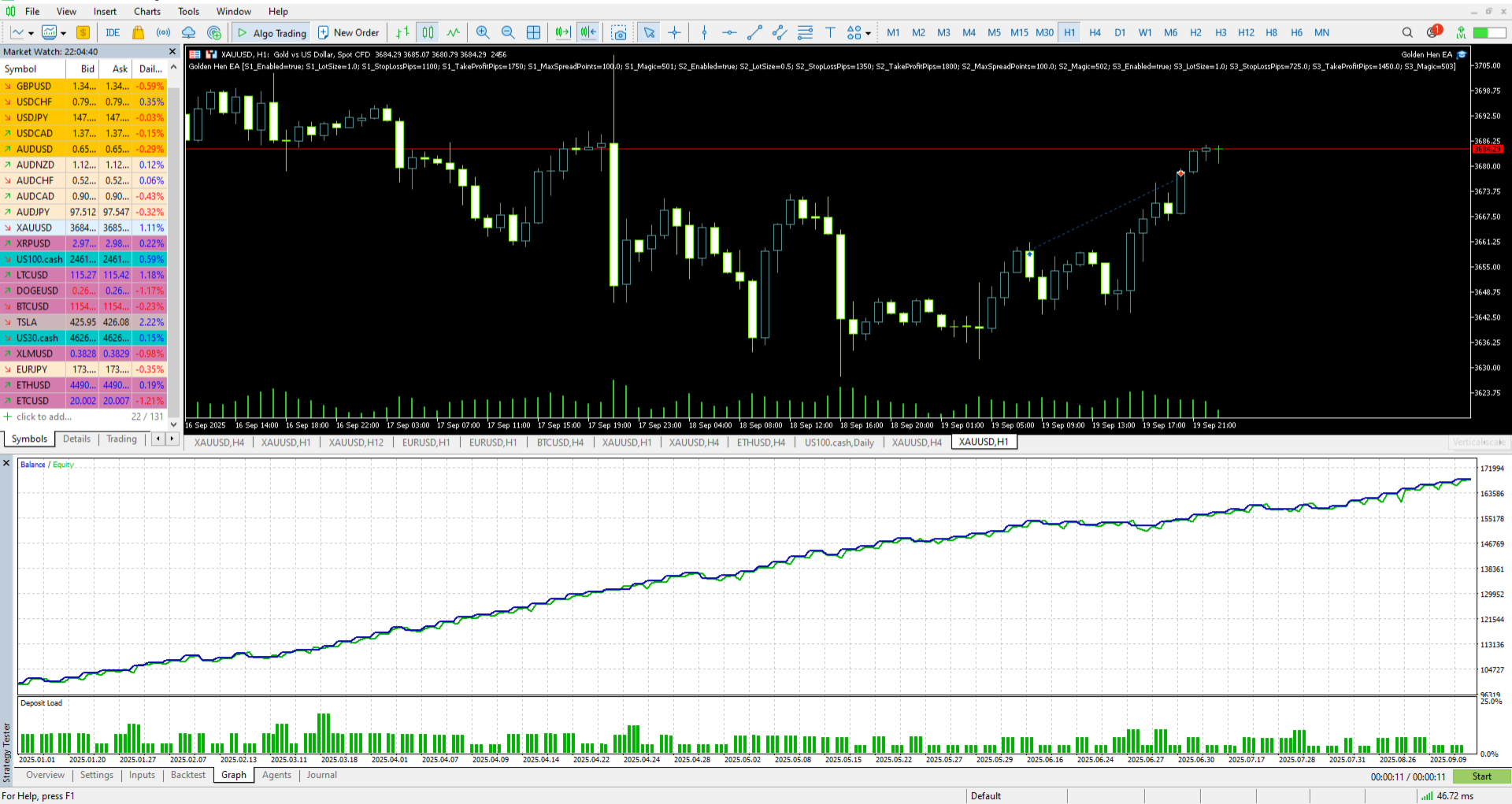

2025 Backtest Results

The 2025 strategy test results are exceptional:

- Initial Deposit: $100,000

- Total Net Profit: $68,052.99 (68% return)

- Gross Profit: $82,895.16

- Gross Loss: -$14,842.17

- Profit Factor: 5.59 — exceptional

- Recovery Factor: 18.20

- Sharpe Ratio: 18.46

- Balance Drawdown Relative: 1.28%

- Equity Drawdown Relative: 2.41%

- Total Trades: 77

- Profit Trades: 65 (84.42%)

- Loss Trades: 12 (15.58%)

- Largest Profit Trade: $1,902.45

- Max Consecutive Wins: 15 ($19,254.98)

- Z-Score: 1.87 (93.85%)

A 5.59 profit factor means the EA generates $5.59 in gross profit for every $1 of gross loss. Combined with the 18.20 recovery factor and 84.4% win rate, these metrics demonstrate a robust, well-designed system.

What Golden Hen Is Designed To Do

The EA delivers diversified Gold trading through eight independent strategies:

- Multi-Timeframe Analysis — Strategies operate across M5, M30, H2, H4, H6, and H12

- Independent Triggers — Each strategy has its own entry logic and conditions

- Fixed Risk Per Trade — Predefined SL/TP on every position

- No Dangerous Techniques — Zero grid, zero martingale, zero averaging

- Automatic Filter Management — Volatility and session filters built-in

The Eight Strategies Explained

Strategy 1 (M30) — Bullish Reversal Pattern

Analyzes a specific sequence of recent bars to identify potential bullish reversal signals following a defined bearish pattern. Short-term reversal plays on the 30-minute timeframe.

Strategy 2 (H4) — Momentum After Downtrend

Identifies strong bullish momentum after a sustained downward trend. Uses the low of the previous H4 bar as a reference point for analysis. Catches trend exhaustion and reversal.

Strategy 3 (M30) — Session-Based Entry

Monitors price action relative to the low of an earlier trading session to identify potential entry points. Session-aware trading that respects market structure.

Strategy 4 (H2/H6) — Trend-Following

Uses a trend indicator on a higher timeframe (H6) as a primary filter and seeks entry signals on the lower timeframe (H2). Classic trend-following with multi-timeframe confirmation.

Strategy 5 (M5) — Tokyo-London Breakout

Identifies the high and low range of the Tokyo session and monitors for price breakouts relative to these levels during the London session. Session breakout with defined range.

Strategy 6 (H12/H4) — Major Bottom Identification

Designed to identify major trend bottoms by monitoring extreme oversold conditions on the H12 timeframe. Waits for severely overextended conditions, then looks for bullish confirmation. Structured with 1:6 risk/reward ratio.

Strategy 7 (H2/H3) — Bottom-Fishing Reversal

Monitors price action for consolidation patterns at potential market lows. Aims to catch the early stages of a new upward trend. Structured with 1:4 risk/reward ratio.

Strategy 8 (H2/H6) — Trend Continuation

Designed to capitalize on market momentum. Identifies a significant trend breakout and patiently waits for a corrective pullback (retracement) to validate the move before entering.

All eight strategies operate together but can be enabled or disabled individually via input parameters.

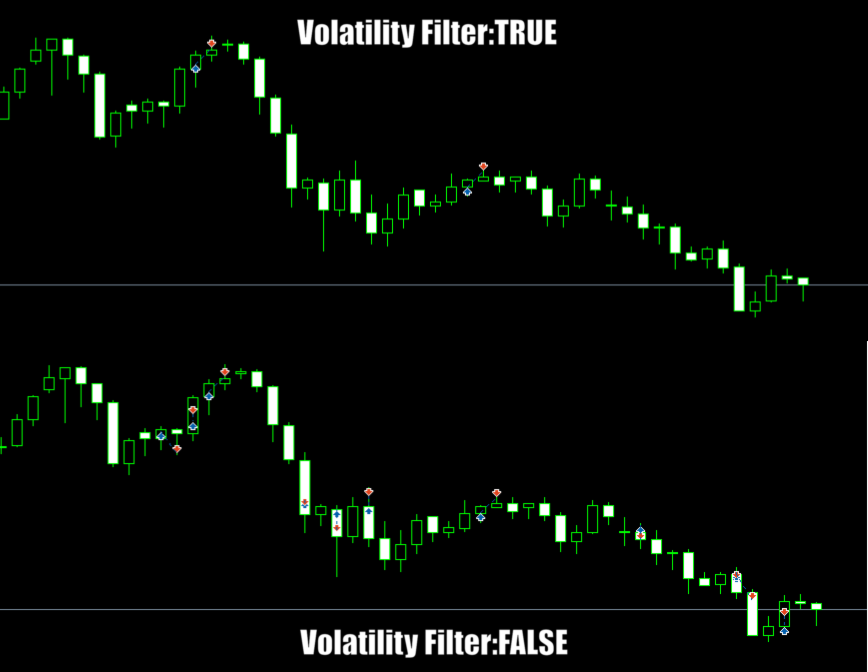

The Volatility Filter

The Dynamic Volatility Filter automatically pauses trading during high-risk periods. This prevents entries during extreme market conditions that could lead to excessive slippage or erratic price action. As shown in the comparison, enabling the filter results in fewer but higher-quality entries.

Key Features

8 Strategies in One EA

Short, medium, and long-term reversal signals all working independently. Diversification across timeframes and market conditions.

No Grid, No Martingale, No Averaging

Every trade has fixed Stop Loss and Take Profit. You always know your maximum risk. No position pyramiding, no lot multiplication, no hoping the market comes back.

Smart Auto-Lot System

Integrated money management with 3 selectable risk levels (Low, Medium, High) to automatically calculate lot sizes based on balance.

Prop Firm Daily Protection

Built-in safety mechanism that instantly closes all open trades and blocks new entries until the next day if your ‘Max Daily Loss’ limit is reached. Prevents drawdown violations that fail prop firm challenges.

Balance Protection Filter

Automatically disables all new trades if account balance falls below a user-defined minimum value, protecting capital during adverse conditions.

Dynamic Volatility Filter

Automatically pauses trading during high-risk periods, providing an essential layer of safety.

Advanced Price Action Filters

Identifies strong market reversals with minimal false signals across all eight strategies.

FIFO Compliant & Broker Friendly

Works with 4 or 5-digit brokers, ECN accounts, and supports FIFO compliance for US traders.

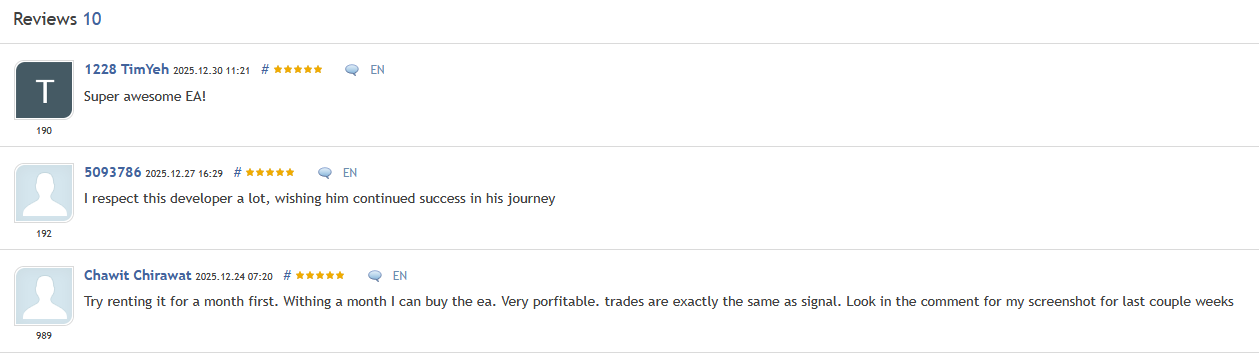

What Real Users Say

1228 TimYeh (5 stars):

“Super awesome EA!”

5093786 (5 stars):

“I respect this developer a lot, wishing him continued success in his journey”

Chawit Chirawat (5 stars):

“Try renting it for a month first. Within a month I can buy the ea. Very profitable. Trades are exactly the same as signal. Look in the comment for my screenshot for last couple weeks”

Additional User Reviews

★★★★★ “Finally an EA without dangerous techniques.”

After losing money on martingale EAs, I specifically looked for something with fixed SL/TP. Golden Hen delivers exactly that — eight strategies, all with defined risk. The 5.5% max DD on the live signal sold me.

— Andreas K., Frankfurt

★★★★★ “Prop firm approved.”

Passed my FTMO challenge using Golden Hen. The daily loss protection feature prevented me from hitting the max DD limit twice. Worth every penny for prop traders.

— David L., Singapore

★★★★☆ “Trades match the signal exactly.”

Been running it for 3 weeks alongside the signal. My trades are identical to the signal trades. That’s rare — most EAs have timing differences. Only giving 4 stars because I want more trade frequency.

— Carlos M., Madrid

★★★★★ “The backtest numbers are real.”

I ran my own backtest before buying. Got nearly identical results to what the developer shows. 5.59 profit factor, 84% win rate. The EA does what it promises.

— Yuki T., Tokyo

★★★★★ “Eight strategies means diversification.”

Instead of one strategy that works in one market condition, you get eight perspectives. When one strategy is quiet, others are working. Smooths out the equity curve.

— Sophie R., Paris

Our Assessment

Transparent evaluation based on verified performance and strategy design:

What We Found:

- Live Performance: 18% growth with 5.5% max drawdown — exceptional risk control

- Backtest Quality: 5.59 profit factor, 18.20 recovery factor, 84.4% win rate — robust metrics

- Strategy Design: 8 independent strategies across 6 timeframes — genuine diversification

- Risk Approach: NO grid, NO martingale, NO averaging — fixed SL/TP on every trade

- Prop Firm Features: Built-in daily loss protection prevents DD violations

- Market Demand: 20 purchases/month, 10 five-star reviews — validated by traders

- Volatility Filter: Auto-pauses during high-risk periods

- Best Suited For: Traders who want Gold exposure without dangerous position management

- Not For: Traders expecting aggressive returns from leveraged grid systems

- Overall: Golden Hen is what serious Gold traders look for: multiple strategies working together, defined risk on every trade, and performance backed by live signal and verified reviews. The absence of grid/martingale alone sets it apart from 90% of Gold EAs.

Why No Grid/Martingale Matters

Most Gold EAs use grid or martingale techniques because they produce impressive short-term results. The problem:

- Grid/Martingale Risk: Positions multiply during drawdowns, eventually reaching margin call

- Undefined Maximum Loss: You never know how bad it can get

- Prop Firm Killers: One bad sequence fails the challenge

- Account Blowups: 100% loss is mathematically inevitable given enough time

Golden Hen takes the opposite approach:

- Fixed SL/TP: Every trade has defined risk before entry

- No Position Multiplication: Lot sizes don’t increase on losing trades

- Predictable Drawdown: 5.5% max DD because risk is controlled

- Prop Firm Compatible: Passes challenges because it respects daily loss limits

Who Should Use This EA?

This tool is ideal for:

- Conservative Gold traders — Who want exposure without reckless risk

- Prop firm traders — Who need daily loss protection and controlled drawdowns

- Grid/martingale refugees — Who’ve been burned and want defined risk

- Diversification seekers — Who value 8 strategies over 1

- Long-term investors — Building accounts steadily over months

Technical Requirements

- Platform: MetaTrader 5

- Instrument: XAUUSD (Gold) — specifically optimized

- Timeframe: Any (EA handles multi-timeframe analysis internally)

- Leverage: Minimum 1:30

- Minimum Deposit: $200

- Recommended Brokers: IC Markets, Pepperstone, FP Markets, Eightcap, Tickmill, FXOpen, FxPro

- VPS: Strongly recommended for 24/7 operation

Lot Sizing Guidelines

- $201 – $500 Balance: 0.01 lots

- $501 – $1,000 Balance: 0.01 – 0.02 lots

- $1,000+ Balance: 0.01 – 0.02 lots per $1,000

- Prop Firms: 0.01 lots per $5,000 balance

Important: VPS Requirement

For optimal performance, Golden Hen requires uninterrupted 24/7 operation. Some strategies (like Strategy 4) track market conditions step-by-step. Restarting MT5 or the EA resets internal memory, which can cause the EA to skip valid signals. Running the EA on a reliable VPS is strongly recommended.

Conclusion

Golden Hen EA for MT5 delivers what professional Gold traders actually want: multiple strategies, defined risk, and consistent performance.

The numbers speak for themselves: 18% live growth with 5.5% max drawdown. 5.59 profit factor in backtests. 84.4% win rate. But the real story is what Golden Hen doesn’t do — no grid, no martingale, no averaging. Every trade has fixed Stop Loss and Take Profit. You always know your risk.

Eight independent strategies across six timeframes provide genuine diversification. The prop firm daily protection prevents challenge failures. The volatility filter pauses trading during dangerous conditions. And 10 five-star reviews plus 20 purchases per month confirm traders are getting what they paid for.

For Gold traders who’ve been burned by aggressive EAs and want something sustainable, Golden Hen earns its name: consistent golden eggs, not lottery tickets.

What Do You Receive?

– Golden Hen EA for MT5 – Latest version + ALL future updates

– Pre-configured .SET file included

– Free lifetime updates

– Fully unlocked for unlimited brokers and accounts

FAQs

What are the verified live signal results?

18% growth with 5.5% max drawdown. $350 initial deposit grew to $412 equity. 71.4% win rate. Verified on MQL5: Golden Hen Signal

What strategy does Golden Hen use?

Eight independent strategies across multiple timeframes (M5, M30, H2, H4, H6, H12). Each strategy has its own entry logic: reversal patterns, momentum detection, session breakouts, trend-following, and bottom-fishing setups.

Does it use grid or martingale?

No. Golden Hen does NOT use grid, martingale, or averaging techniques. Every trade has predefined fixed Stop Loss and Take Profit. You always know your maximum risk.

What makes the 5.5% max drawdown impressive?

Most Gold EAs show 20-50% drawdowns because they use grid/martingale recovery. Golden Hen’s fixed SL/TP approach keeps drawdown controlled — even during adverse market conditions.

What are the backtest results?

2025 backtest: $68,052 profit on $100K (68% return), 5.59 profit factor, 18.20 recovery factor, 84.4% win rate, 1.28% max balance drawdown. Exceptional metrics.

Is it prop firm compatible?

Yes. Built-in Prop Firm Daily Protection instantly closes all trades and blocks new entries if your ‘Max Daily Loss’ limit is reached. Prevents challenge failures from drawdown violations.

What pair and timeframe?

XAUUSD (Gold) only. Attach to any timeframe — the EA handles multi-timeframe analysis internally across M5 to H12.

Can I enable/disable individual strategies?

Yes. All eight strategies can be toggled on/off individually via input parameters. Run all eight for diversification or select specific strategies.

What’s the volatility filter?

The Dynamic Volatility Filter automatically pauses trading during high-risk periods. Reduces entries during extreme market conditions to avoid slippage and erratic price action.

What leverage is required?

Minimum 1:30. Live signal uses 1:200 on IC Markets. Higher leverage provides more flexibility but isn’t required.

What’s the minimum deposit?

$200. For $201-$500 balance, use 0.01 lots. For prop firms, use 0.01 lots per $5,000 balance.

Do I need a VPS?

Strongly recommended. Some strategies track market conditions step-by-step. Restarting MT5 resets internal memory and can cause missed signals. 24/7 VPS operation ensures optimal performance.

What risk/reward ratios do the strategies use?

Varies by strategy. Strategy 6 targets 1:6 R:R for major bottom identification. Strategy 7 targets 1:4 R:R for bottom-fishing reversals. Other strategies use appropriate R:R for their setups.

What do the MQL5 reviews say?

10 five-star reviews. Users praise profitability, signal accuracy (“trades are exactly the same as signal”), and developer support. 20 purchases per month demonstrate market demand.

Is there a set file included?

Yes. Pre-configured .SET file included — download, load, and run. No complex settings required.

Peter Jones

Us vs MQL5 Marketplace

See why 28,000+ customers choose us

|

CheaperForex

Best Value

|

MQL5 Direct | |

|---|---|---|

| Price | ✓ Save 50-80% | Full price |

| Crypto Discount | ✓ Extra 20% off | ✗ Not available |

| Refund Policy | ✓ Full refund before activation | ✗ Store credit only |

| Payment Options | ✓ Cards, Apple Pay, Crypto | ✓ Cards only |

| Activation Support | ✓ We install for you | ✓ Self-install |

| Ownership | ✓ Lifetime, no expiration | ✓ Lifetime, no expiration |

| Hardware Activations | ⚠ 1 (up to 10 MT5s) | ✓ 5 activations |

| Trustpilot | ✓ Rated "Excellent" | — Seller ratings vary |

Us vs MQL5 Marketplace

Tap to compare →

CheaperForex

MQL5 Direct

How We Deliver Your EA (2 Minutes)

Why Traders Trust Us

Frequently Asked Questions

Is this an official product?

Yes. This is activated directly from the developer's official MQL5 marketplace listing—guaranteed authentic.

Unlike downloadable files (which can be fake or cracked), this EA is installed through MQL5's one-click activation system, ensuring you get the real product with full functionality and instant automatic updates.

When you buy from us, you're getting the exact same lifetime license as buying directly from MQL5—just at a fraction of the price.

Are updates always free and instant?

Yes, product updates for this EA are always free and instant.

They can be downloaded from within the terminal from the marketplace.

Just go to the product listing and click "update" if there's one available.

How do I get this after paying?

Most activations are completed within 15-30 minutes of purchase.

Here's the simple process:

This is an official MQL5 product that must be activated directly from the marketplace—it cannot be downloaded as a standalone file.

Installation process:

1. After purchase, we'll schedule a quick activation session (usually within a few hours)

2. You grant us temporary access via UltraViewer or AnyDesk (takes ~2 minutes), OR provide temporary VPS credentials

3. We activate the EA on your MT5 terminal(s)

4. Done! The EA is permanently yours with instant updates from MQL5

The entire process is secure and takes about 2 minutes.

After activation, no further involvement from us is needed.

How does the 7-day refund policy work?

If you change your mind before we activate the official product in your MT5 terminal, you are eligible for a full refund. Absolutely no questions asked.

Once it has been activated and is working correctly, refunds are no longer available and our regular 7-day refund policy does not apply.

Once we've activated it for you, we can't take it back and it's yours permanently.

How long does activation take?

Usually within a few hours of purchase, but often much faster.

Immediately after purchase, you'll receive an instructional PDF explaining the simple activation process.

Don't worry—it's straightforward, and our refund policy applies anytime before we activate the EA on your terminal.

What if I reinstall MT5 or get a new computer?

Activations are tied to your hardware ID, not your MT5 installation.

Free reactivation if:

• You reinstall MT5 on the same computer

• You accidentally delete MT5

• Windows updates cause issues (this is rare)

• You reinstall Windows (sometimes this doesn't work, but we will always attempt it for you)

Reactivation NOT possible if:

• You get a new computer (different hardware)

• You upgrade major hardware components (motherboard, etc.)

Important: Treat your installation with care. If you're planning to reformat or upgrade hardware, contact us FIRST so we can assist you.

Contact [email protected] with your order number if you need help.

Why should I buy here?

Buying directly on MQL5 means paying full price upfront—often $500-$1,500—without knowing if the EA will work for you. If it doesn't perform or the developer abandons it, there's no refund.

At CheaperForex, you get the exact same official, lifetime-licensed copy for up to 70% less. Test it at a lower risk before committing full price elsewhere.

We've been trusted since 2019, and every EA is yours forever—no renewals, no expiry, no surprises. Smarter investing in trading tools.

Related Products

Official MT5 expert advisors, exclusive to CheaperForex, at the lowest prices.

-

Axonshift EA MT5

Rated 0 out of 5$799.00Original price was: $799.00.$319.95Current price is: $319.95. -

Ultimate Pulse EA MT5

Rated 0 out of 5$599.00Original price was: $599.00.$229.95Current price is: $229.95. -

ARIA Connector EA MT5

Rated 0 out of 5$1,400.00Original price was: $1,400.00.$399.95Current price is: $399.95. -

Synthara MT5 EA

Rated 0 out of 5$699.00Original price was: $699.00.$249.95Current price is: $249.95.