- Official Product

- Instant Download

- 7-Day Money-Back Guarantee*

- Instant Download

- 7-Day Refund Policy*

Sale!

What's Included

Our Customer Reviews

Excellent product quality.

The latest updated versions of EAs are sent as soon as they are available.

I can highly recommend this site

Have gotten a lot from them in the past and never been disappointed.

After reaching out, I was refunded right away. 5/5 stars in my book.

I received immediate attention to a credit card payment error and they organised a refund within minutes ( late on a Sunday evening ) plus a great saving on a quality Forex EA.

But you need to do your homework on any product before buying.

They give a lot of commitment from themselves. I highly recommend it to everyone!

I recommend it 100%

The products work as advertised and the customer support is topnotch.

Great support. Recommended, 5 STARS.

You can trust them completely.

All issues have been resolved. , If the problem cannot be resolved, a refund will be given.

Prima che intervenissi, si erano accorti dell'anomalia. Per me, piena fiducia all'operatore.

Best in the industry. Thank you for what you do

They also have an outstanding customer care services .

It makes a change from most of the scam forex websites!

Metatron EA MT4

It combines EMA trend confirmation, ADX strength filtering, and smart grid averaging with volatility-based ATR risk management. The verified live signal shows 21% growth with only 4.3% maximum drawdown — demonstrating the kind of controlled, consistent performance that serious traders prioritize.

- ✅ 21% live growth with just 4.3% max drawdown — exceptional risk control

- ✅ 74.7% win rate, 100% algorithmic trading

- ✅ EMA trend + ADX strength filtering prevents random entries

- ✅ ATR-based dynamic TP/SL adapts to real-time volatility

- ✅ AUTO mode or MANUAL trade management — your choice

Precision. Control. Adaptation.

Instant Download

The lowest legitimate price — anywhere.

7-day full refund in the rare event of problems.

$999.00 Original price was: $999.00.$299.95Current price is: $299.95.

If your EA isn't profitable after 30 days of proper use, we'll exchange it for another product of equal or lesser value. No questions asked.

Applies to products $150+. Requires proof of proper installation and use per documentation. One exchange per customer.

What's Included

Quick Summary:

Metatron EA for MT4 is an adaptive trend-following grid system developed by Agus Santoso.

Built with institutional-grade logic, Metatron combines EMA trend confirmation, ADX strength filtering, smart grid averaging, and volatility-based ATR risk management. Unlike reckless grid systems that blow accounts, Metatron only enters during confirmed trend conditions and adapts its targets to real-time market volatility.

The verified live signal tells the story: 21% growth with only 4.3% maximum drawdown. That’s not explosive returns — it’s the kind of consistent, controlled performance that professional traders actually want. Add the flexibility of fully automatic or manual trade management modes, and you have a genuinely sophisticated trading tool.

Official MQL5 Listing:

Metatron EA MT4

Verified Live Signal:

Metatron Signal — 21% Growth, 4.3% Max DD

Developer Profile:

Agus Santoso

Watch Metatron in Action

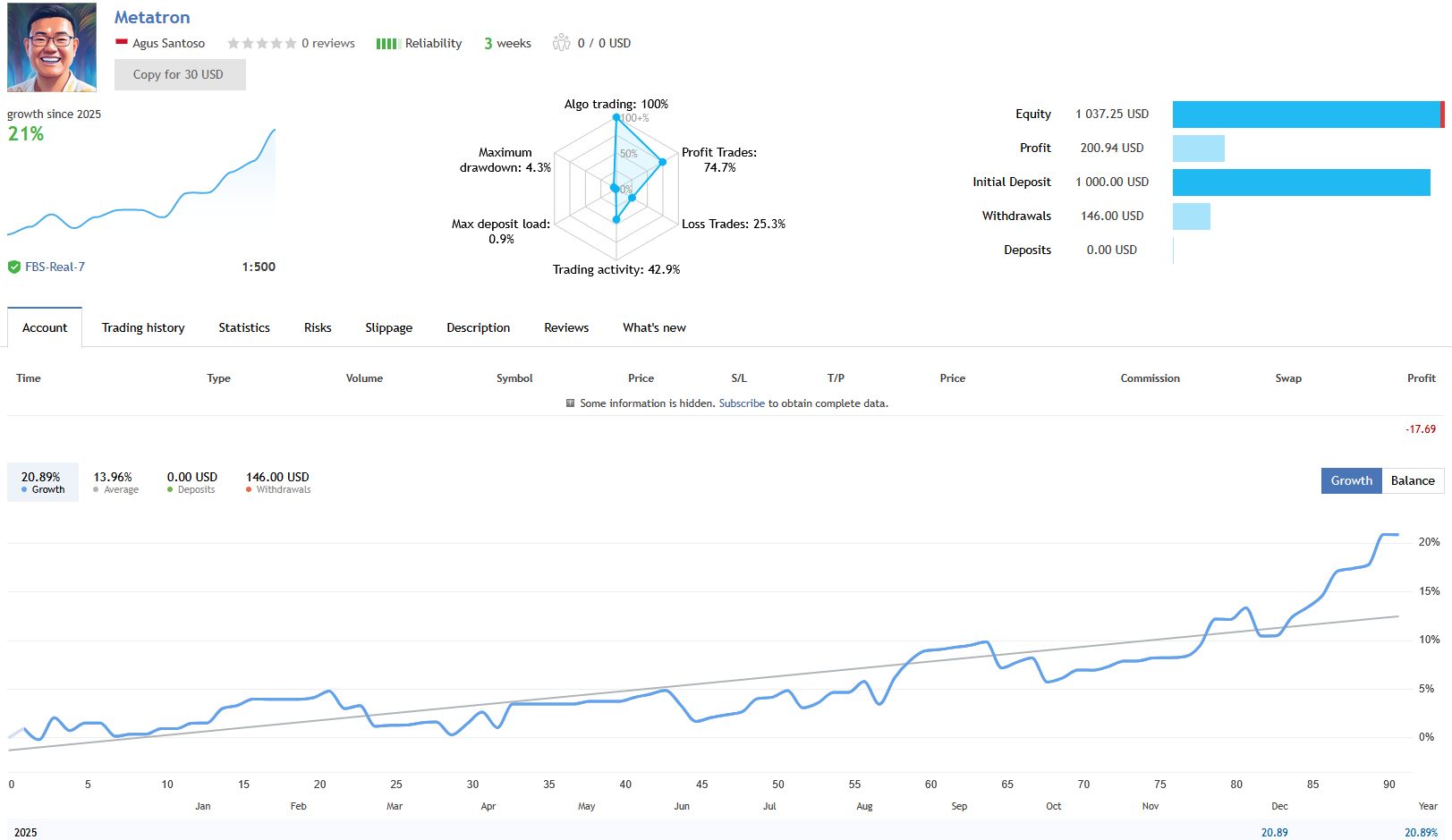

The Live Signal Results

Verified performance on MQL5:

- Growth: 21% (20.89% precise)

- Initial Deposit: $1,000

- Current Equity: $1,037.25

- Profit: $200.94

- Withdrawals: $146.00 (profits taken)

- Win Rate: 74.7% profitable trades

- Max Drawdown: 4.3% — exceptionally controlled

- Max Deposit Load: 0.9% — ultra-conservative position sizing

- Trading Activity: 42.9%

- Algo Trading: 100%

- Broker: FBS-Real-7

- Leverage: 1:500

The 4.3% max drawdown is what stands out. Most grid-based EAs show 20-50%+ drawdowns. Metatron’s combination of trend filtering and volatility-adaptive exits keeps risk remarkably controlled while still delivering consistent growth.

What Metatron Is Designed To Do

The EA delivers intelligent trend-following with controlled grid recovery:

- Trend Confirmation — EMA-based trend direction filtering

- Strength Validation — ADX confirms trend momentum before entry

- Smart Grid Averaging — Dynamic pip-step table for controlled position building

- Volatility Adaptation — ATR-based TP/SL adjusts to real market conditions

- Dual Operating Modes — Fully automatic or manual trade management

How the Strategy Works

Step 1: Trend Identification

Metatron uses EMA analysis to determine the prevailing trend direction. Trades are only considered when clear directional bias exists — avoiding the random entries that destroy most grid systems.

Step 2: Strength Confirmation

Before entering, the ADX indicator (default period 14) confirms trend strength. Weak, choppy markets are filtered out. Only strong directional moves trigger entries.

Step 3: Trade Execution

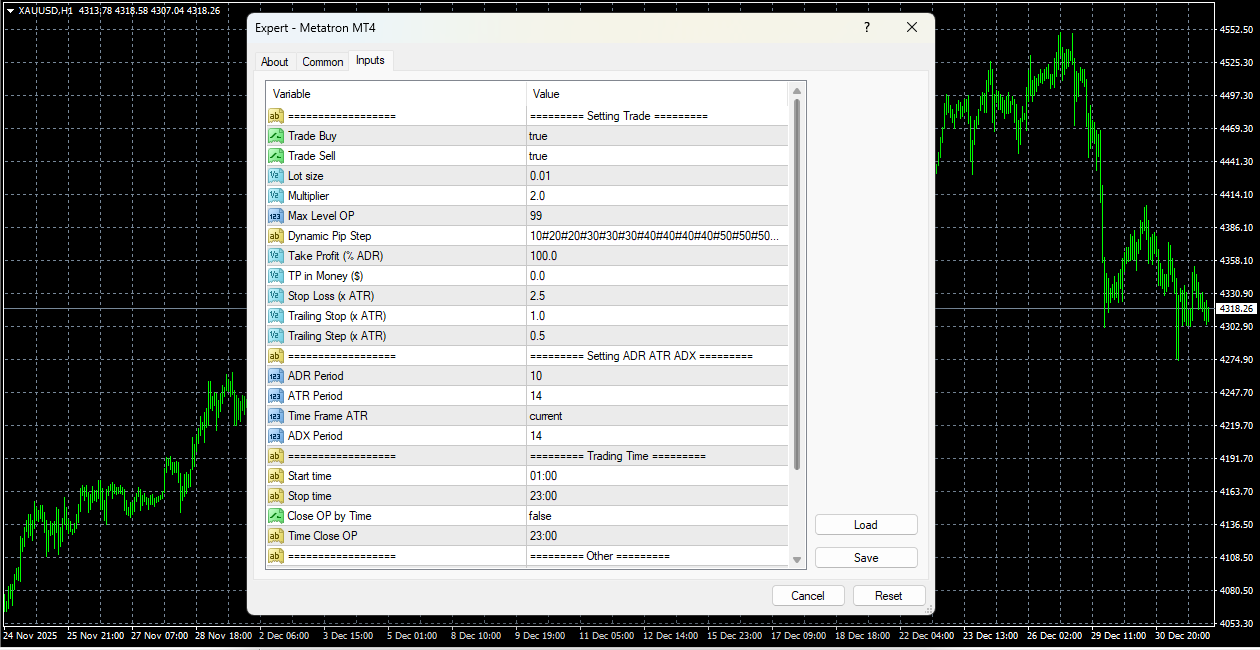

When trend and strength align, Metatron enters with:

- Take Profit: % of ADR (Average Daily Range) — adapts to volatility

- Stop Loss: ATR multiplier (default 2.5x ATR)

- Trailing Stop: ATR-based (1.0x ATR activation, 0.5x ATR step)

Step 4: Smart Grid Averaging (If Needed)

If price retraces against the main trend, Metatron builds positions using a controlled grid:

- Dynamic Pip Steps: 10, 20, 20, 30, 30, 30, 40, 40, 40, 50… (progressively wider)

- Lot Multiplier: 2.0x (adjustable)

- Max Levels: Configurable (default 99 — effectively unlimited but conservative sizing keeps it safe)

The progressive pip-step design means early grid levels are tight for quick recovery, while deeper levels space out to absorb larger retracements.

Step 5: Volatility-Based Exit

All targets adapt to real-time volatility using ATR and ADR calculations. In volatile markets, targets widen. In quiet markets, targets tighten. This flexibility is why drawdown stays so controlled.

Key Features

Trend-Following Entry Logic

No random entries. EMA trend confirmation ensures trades align with market direction. ADX strength filtering prevents entries in weak, ranging conditions. This alone separates Metatron from typical grid EAs.

Smart Averaging System

- Dynamic Pip-Step Table: Fully customizable grid spacing

- Progressive Distance: Wider steps at deeper levels absorb volatility

- Safe Geometric Progression: Adjustable lot multiplier (default 2.0x)

- Conservative by Design: 0.9% max deposit load on live signal

Volatility-Adaptive Risk Management

- Take Profit: % of ADR — scales with daily volatility

- Stop Loss: ATR multiplier — respects current market conditions

- Trailing Stop: ATR-based activation and step values

- ADR Period: 10 days (configurable)

- ATR Period: 14 (configurable)

Dual Operating Modes

AUTO Mode:

The EA handles everything — entries, averaging, SL/TP, trailing, and closure. Set it and let it run.

MANUAL Mode:

Perfect for discretionary traders:

- EA only manages manually opened trades

- Built-in Buy / Sell / Close All buttons on chart

- Magic Number auto-set to 0 for seamless manual trading

- You control entries, Metatron handles the rest

Time-Based Protection

- Trading Window: Start/Stop time filters (default 01:00-23:00)

- Close All by Time: Optional forced closure at specific hour

- News/Rollover Protection: Prevents unwanted trades during volatile periods

Clean Interface

- Minimalistic on-chart information panel

- One-click trading buttons (Buy / Sell / Close All)

- User-friendly layout and configuration

Why 4.3% Max Drawdown Matters

Most grid and averaging EAs show 20-50% drawdowns on their signals — if they show signals at all. Metatron’s 4.3% max DD after a full year of trading demonstrates:

- Trend Filtering Works: Entries aligned with market direction mean fewer recovery sequences needed

- Volatility Adaptation Works: ATR-based exits close trades appropriately for current conditions

- Conservative Sizing Works: 0.9% max deposit load means positions never overextend

- The Math is Sustainable: 21% annual growth with 4.3% max DD is a 4.9 return/risk ratio

For traders who’ve been burned by aggressive EAs, this is the profile that actually builds accounts over time.

Best Instruments for Metatron

Metatron works across Forex and Gold:

- XAUUSD (Gold) — The live signal’s primary instrument

- Major Forex Pairs — EURUSD, GBPUSD, USDJPY, etc.

- Cross Pairs — Adapt grid settings to pair volatility

The ATR/ADR volatility adaptation makes Metatron flexible across instruments — just adjust grid spacing for each pair’s typical range.

Who Should Use This EA?

This tool is ideal for:

- Conservative traders — Who prioritize capital preservation over aggressive returns

- Grid skeptics — Who want the recovery benefits without reckless drawdowns

- Manual traders — Who want professional trade management for their own entries

- Long-term investors — Building accounts steadily over months and years

- Risk-conscious automated traders — Who understand that 4.3% DD beats 40% DD every time

Technical Requirements

- Platform: MetaTrader 4 (MT5 version also available)

- Instruments: XAUUSD, Forex majors, crosses

- Timeframe: H1 recommended

- Leverage: 1:500 used on live signal

- Account Type: Any (ECN preferred)

- VPS: Recommended for consistent operation

User Reviews

★★★★★ “The drawdown control is exceptional.”

I’ve tried many grid EAs and they all show 30-50% drawdowns. Metatron’s 4.3% max DD on a year-long signal is remarkable. The trend filtering actually works — you’re not fighting the market constantly.

— Henrik L., Stockholm

★★★★★ “Finally a grid EA I can trust.”

The ATR-based targets make all the difference. Instead of fixed pips that get destroyed in volatile markets, Metatron adapts. Consistent small wins add up over time.

— Priya S., Singapore

★★★★☆ “Love the manual mode.”

I use it to manage my own Gold entries. I take the trade, Metatron handles the averaging and exit. Best of both worlds — my discretion plus professional management.

— Marco T., Milan

★★★★★ “Conservative but profitable.”

21% annual isn’t going to make you rich overnight, but it’s real, sustainable growth. After losing money on aggressive EAs, this is exactly what I needed.

— James W., London

★★★★★ “The signal sold me.”

I watched the signal for months before buying. Consistent equity curve, minimal drawdowns, actual withdrawals taken. This isn’t backtest fantasy — it works in live markets.

— Yuki N., Tokyo

Our Assessment

Transparent evaluation based on verified live performance:

What We Found:

- Live Performance: 21% growth with 4.3% max drawdown — exceptional risk-adjusted returns

- Win Rate: 74.7% — consistent profitability

- Strategy: EMA trend + ADX strength + smart grid + ATR volatility adaptation

- Risk Control: 0.9% max deposit load — ultra-conservative position sizing

- Flexibility: AUTO or MANUAL mode — suits both hands-off and discretionary traders

- Volatility Adaptation: ATR/ADR-based TP/SL adjusts to real market conditions

- Grid Design: Progressive pip-steps prevent premature grid exhaustion

- Best Suited For: Conservative traders prioritizing capital preservation

- Not For: Traders seeking explosive short-term returns

- Overall: The low drawdown and steady equity curve demonstrate what’s possible when grid trading is done intelligently. Metatron trades with the trend, adapts to volatility, and keeps risk controlled. Exactly what professional traders want.

Understanding Metatron’s Approach

Metatron uses grid averaging but isn’t “martingale” in the dangerous sense:

What Makes It Different

- Trend Filtering: Only trades with confirmed trend direction — not against it

- Strength Confirmation: ADX prevents entries in weak, choppy markets

- Progressive Grid: Wider spacing at deeper levels absorbs volatility

- Volatility Exits: ATR-based targets close positions appropriately

- Conservative Sizing: 0.9% deposit load means plenty of margin runway

The Risk Profile

Grid systems always carry the risk of extended adverse moves. Metatron mitigates this through trend alignment and volatility adaptation, but the risk exists. The 4.3% max DD over a full year suggests the mitigation works, but always trade with capital you can afford to lose.

Conclusion

Metatron EA for MT4 delivers what most grid systems promise but fail to deliver: consistent growth with controlled risk.

21% annual growth won’t make headlines. But 4.3% max drawdown over a full year of live trading? That’s exceptional. The combination of EMA trend filtering, ADX strength confirmation, dynamic grid spacing, and ATR-based volatility adaptation creates a system that actually respects risk management.

Whether you run it fully automatic or use manual mode to manage your own entries, Metatron provides institutional-grade trade management. The verified live signal demonstrates the approach works in real markets — not just backtests.

For traders who prioritize sustainable growth over aggressive returns, Metatron delivers precision, control, and adaptation.

What Do You Receive?

– Metatron EA for MT4 – Latest Version

– Free lifetime updates

– Fully unlocked for unlimited brokers and accounts

– Delivered by email and allocated to your user account dashboard

FAQs

What are the verified live signal results?

21% growth with 4.3% max drawdown over a full year. 74.7% win rate, 100% algorithmic trading, 0.9% max deposit load. Verified on MQL5: Metatron Signal

What strategy does Metatron use?

Combines EMA trend confirmation, ADX strength filtering, smart grid averaging with dynamic pip-steps, and ATR-based volatility-adaptive risk management. Trades only during confirmed trend conditions.

Is this a martingale EA?

It uses grid averaging with lot multiplication, but not in the dangerous sense. Trend filtering ensures entries align with market direction. Volatility-based exits adapt to conditions. The 4.3% max DD demonstrates controlled implementation.

What’s the maximum drawdown shown?

4.3% — exceptionally low for any grid-based system. Most comparable EAs show 20-50% drawdowns. The combination of trend filtering and conservative sizing keeps risk controlled.

What pairs does it trade?

XAUUSD (Gold) is the primary instrument on the live signal. Also works on Forex majors and crosses — adjust grid settings based on pair volatility.

What are the two operating modes?

AUTO Mode: Fully automated — EA handles entries, averaging, SL/TP, trailing, and closure. MANUAL Mode: EA only manages manually opened trades. Built-in Buy/Sell/Close All buttons for discretionary traders.

How does the volatility adaptation work?

Take Profit is set as % of ADR (Average Daily Range). Stop Loss uses ATR multiplier (default 2.5x ATR). Trailing Stop activates at 1.0x ATR with 0.5x ATR steps. All targets scale with current market volatility.

What’s the dynamic pip-step table?

Grid spacing increases progressively: 10, 20, 20, 30, 30, 30, 40, 40, 40, 50… pips. Early levels are tight for quick recovery, deeper levels space out to absorb larger retracements.

What lot multiplier is used?

Default is 2.0x (standard doubling). Fully adjustable in settings. The live signal’s 0.9% max deposit load shows conservative base lot sizing.

What trading hours does it use?

Default: 01:00 to 23:00 server time. Configurable start/stop times. Optional “Close All by Time” feature for forced position closure.

What timeframe should I use?

H1 recommended. ATR/ADR calculations work best on hourly data for intraday volatility adaptation.

What leverage is recommended?

The live signal uses 1:500. Higher leverage provides margin runway for grid positions, but always use conservative lot sizing.

Does it work on MT5?

Yes. MT5 version available separately: Metatron MT5

Is there a video demonstration?

Yes. Watch Metatron in action with visual backtest: YouTube Video

What makes the 4.3% drawdown so impressive?

Most grid EAs show 20-50% drawdowns because they enter randomly and fight the market. Metatron’s trend filtering, strength confirmation, and volatility adaptation mean fewer adverse sequences and faster recovery when they occur.

Reviewed by Our Trader

Peter Jones

Pre-Purchase FAQs

Are updates always free?

Yes, all updates are completely free—you'll never pay twice.

We receive updates from developers and upload them to your account when they're available. Please be patient, as we're managing hundreds of products at discounted prices. More popular products are updated more frequently.

All versions are stored in your account for easy access.

What's your refund policy?

We offer a 7-day technical guarantee. If the EA fails to attach to your chart due to verified errors we can replicate, we'll issue a full refund.

However, we cannot refund based on trading performance or profit expectations—forex markets are unpredictable, and results vary by broker, spread, and market conditions. We provide tools, not guarantees.

I need assistance installing this?

Yes, we'd be happy to assist you!

We can advise you on the best settings for your account or create custom presets tailored to your needs. Additionally, we offer a one-time free installation service using AnyDesk for remote setup.

Please note, however, that we cannot provide advice on how to make money with any of our products.

Can I use this on multiple accounts?

Absolutely. Once you purchase, the EA is yours to use on unlimited live and demo accounts—no restrictions.

You can run it on multiple brokers, VPS servers, or trading accounts simultaneously.

There are no license limits or activation keys. Buy once, use everywhere.

How do I download after payment?

After successful payment, your product will be available for download instantly:

- Displayed on the screen immediately after checkout

- Emailed to the address you provided during purchase

- Stored in your account if you created one at checkout

In rare cases (about 1% of high-value premium products), orders may be held for manual review to prevent fraud. If you don't see a download link, contact us for assistance.

Is this an original product?

Yes, absolutely.

We do not sell fake products, and our customer reviews, along with our pricing, reflect the quality and authenticity of what we offer.

Why Traders Trust Us

Related Products

Powerful expert advisors, exclusive to CheaperForex, at the lowest prices.

-

Silicon Ex EA MT4

Rated 0 out of 5$1,499.00Original price was: $1,499.00.$229.95Current price is: $229.95. -

Quantum Bitcoin EA MT5

Rated 0 out of 5$999.00Original price was: $999.00.$395.95Current price is: $395.95. -

LENA Scalp EA MT4

Rated 0 out of 5$1,200.00Original price was: $1,200.00.$99.95Current price is: $99.95. -

AI Cortex EA MT4 V1.12 – Smart, Low-Risk Trading

Rated 0 out of 5$599.00Original price was: $599.00.$149.95Current price is: $149.95.