- Official Product

- Instant Download

- 7-Day Money-Back Guarantee*

- Instant Download

- 7-Day Refund Policy*

Sale!

What's Included

Our Customer Reviews

Excellent product quality.

The latest updated versions of EAs are sent as soon as they are available.

I can highly recommend this site

Have gotten a lot from them in the past and never been disappointed.

After reaching out, I was refunded right away. 5/5 stars in my book.

I received immediate attention to a credit card payment error and they organised a refund within minutes ( late on a Sunday evening ) plus a great saving on a quality Forex EA.

But you need to do your homework on any product before buying.

They give a lot of commitment from themselves. I highly recommend it to everyone!

I recommend it 100%

The products work as advertised and the customer support is topnotch.

Great support. Recommended, 5 STARS.

You can trust them completely.

All issues have been resolved. , If the problem cannot be resolved, a refund will be given.

Prima che intervenissi, si erano accorti dell'anomalia. Per me, piena fiducia all'operatore.

Best in the industry. Thank you for what you do

They also have an outstanding customer care services .

It makes a change from most of the scam forex websites!

Nasdaq100 Algo Trading EA MT4 – 210% Gain with IC Markets

The Nasdaq100 Algo Trading EA for MetaTrader 4 (MT4) is a robust and sophisticated Expert Advisor developed by Lo Thi Mai Loan.

With over 13 years of programming and trading experience, the EA was designed to offer stable and consistent profits over the long term.

Unlike many trading bots that rely on risky strategies like Martingale, Grid, or Hedging, this EA focuses on price action and precision entries, using an efficient risk management system.

The Download Package Includes:

+ Expert: Nasdaq100 Algo Trading MT4 (.ex4 file) V1.1

+ Presets

+ How to Install files.pdf

+ Pairs and Timeframes.txt

More Information:

+ https://www.mql5.com/en/market/product/119583

Live Signal Performance:

+ https://www.mql5.com/en/signals/2233257

Instant Download

The lowest legitimate price — anywhere.

7-day full refund in the rare event of problems.

$998.00 Original price was: $998.00.$289.95Current price is: $289.95.

If your EA isn't profitable after 30 days of proper use, we'll exchange it for another product of equal or lesser value. No questions asked.

Applies to products $150+. Requires proof of proper installation and use per documentation. One exchange per customer.

What's Included

Nasdaq100 Algo Trading EA for MT4 by Lo Thi Mai Loan

Introduction

The Nasdaq100 Algo Trading EA for MetaTrader 4 (MT4) is a robust and sophisticated Expert Advisor developed by Lo Thi Mai Loan. With over 13 years of programming and trading experience, the EA was designed to offer stable and consistent profits over the long term. Unlike many trading bots that rely on risky strategies like Martingale, Grid, or Hedging, this EA focuses on price action and precision entries, using an efficient risk management system. The result is an algorithm that can deliver stable returns without exposing your account to excessive risk, making it ideal for traders looking for consistent growth in the NASDAQ market.

The EA is available on CheaperForex.com and stands out as a trusted and reliable solution for traders aiming to capitalize on the volatile but lucrative Nasdaq100 market.

Description: How Nasdaq100 Algo Trading EA Works

The Nasdaq100 Algo Trading EA employs a unique price action strategy based on the Dravas breakout mindset, focusing on capturing breakouts and trend movements in the Nasdaq100 index. Here’s a breakdown of how the EA operates:

- Risk-Averse Trading Strategy

The EA uses a conservative approach to trading by setting a fixed stop loss for each position. Unlike many EAs that use grid or martingale systems, the Nasdaq100 Algo Trading EA opens only one trade at a time, minimizing risk and exposure. It employs a tight risk-reward ratio (RR), and take profits (TP) can vary, ranging from 0.2 to 2 RR. This means that trades are quickly closed in profit to capture short-term market movements effectively. - Dravas Breakout Entry Points

The EA identifies breakouts and potential entry points based on the Dravas breakout trading approach, focusing on key levels of support and resistance. This ensures that entries are based on strong technical foundations, with the potential for price to make a decisive move in a specific direction. - Prop-Firm Friendly Features

The EA is designed with features that make it suitable for prop trading firms, including:- Drawdown Management: Limits drawdowns to protect account equity.

- News Filters: Allows you to avoid trading around high-impact news events.

- Trading Session Controls: Traders can specify trading hours to match preferred market sessions, like New York or London.

- Three Modes of Strategy

The EA offers three different strategy modes, with customizable settings to suit various trading styles. Each mode comes with its risk settings, take-profit targets, and trade management rules, providing flexibility for both conservative and aggressive trading approaches. - Regular Algorithm Updates

The EA’s algorithm is updated regularly based on market conditions and user feedback, ensuring that it stays optimized and responsive to current trading environments.

Trading Specifications: Recommended Pairs, Timeframe, and Minimum Balance

- Recommended Pairs: The EA is optimized for Nasdaq100-related pairs like Nas100, USTech, US100. It can also be used on US30 or DJ30 (Dow Jones), though these are not the primary focus.

- Timeframe: Best results are seen on the M15 (15-minute chart), which balances short-term market movements and signal accuracy.

- Spread and Broker Requirements: To achieve optimal performance, a broker that offers 2-digit spreads between 50-100 on Nasdaq100 pairs is recommended.

- Minimum Deposit: The EA is flexible in terms of capital requirements, with no specific minimum deposit required. The minimum balance depends on your broker’s specifications, and the EA adapts well to both small and large accounts.

Backtesting Results and Live Performance

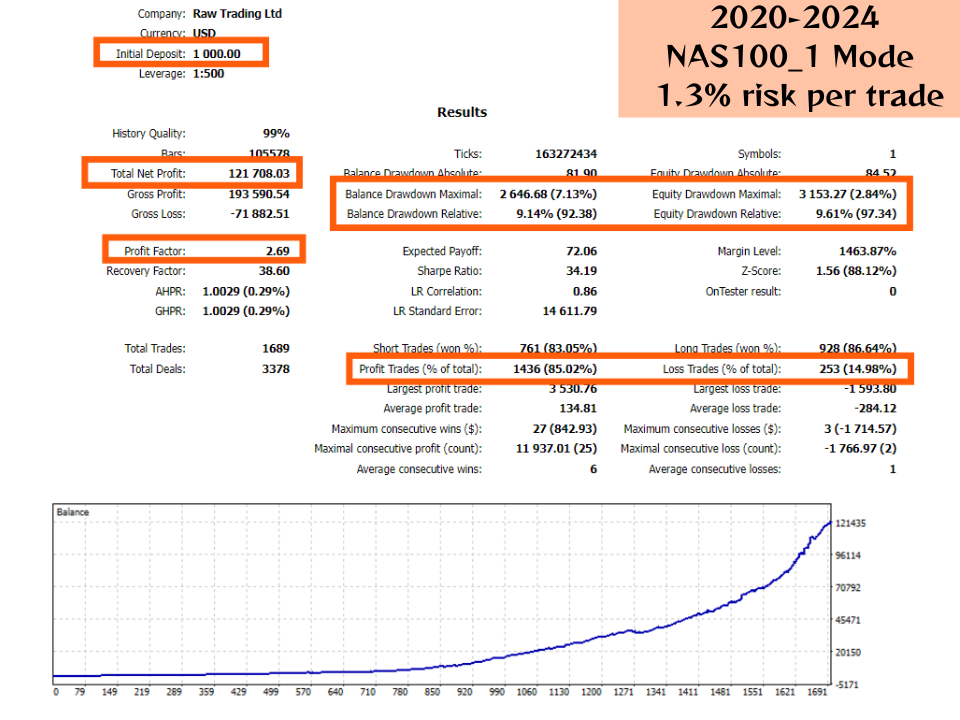

Backtesting: 2020-2024 (1.3% and 3% Risk Per Trade)

The EA has undergone extensive backtesting from 2020 to 2024, with two key risk profiles:

- 1.3% Risk Per Trade

- Initial Deposit: $1,000

- Total Net Profit: $121,708.03

- Profit Factor: 2.69 (indicating solid profit generation compared to losses).

- Drawdown: Maximum relative drawdown of 9.61%, showcasing low-risk exposure.

- Winning Trades: An impressive 85.02% of trades were profitable, highlighting the EA’s precision in trade entries and exits.

- Profit Consistency: The balance curve from the backtest shows a steady, upward growth, indicating a consistent and reliable performance.

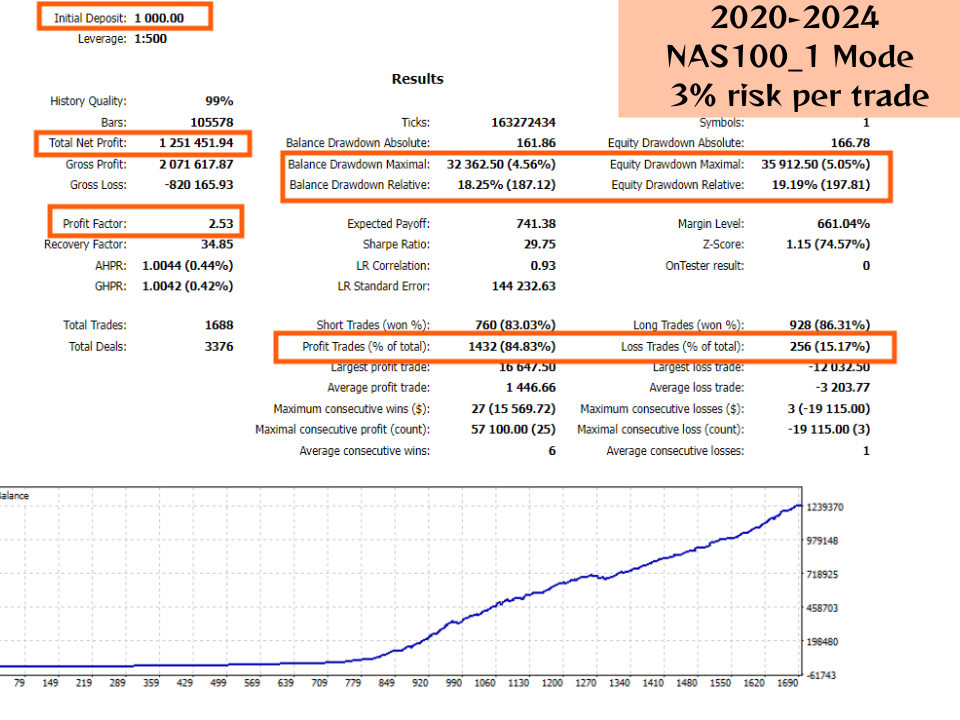

- 3% Risk Per Trade

- Initial Deposit: $1,000

- Total Net Profit: $1,251,451.94

- Profit Factor: 2.53, demonstrating high profitability even with an increased risk profile.

- Drawdown: The relative drawdown increased to 18.52%, which is expected given the higher risk per trade.

- Winning Trades: A win rate of 84.83%, providing a balance between aggressive gains and disciplined risk management.

Both backtests clearly demonstrate the EA’s ability to adapt to different risk profiles while maintaining steady profits and controlled drawdowns.

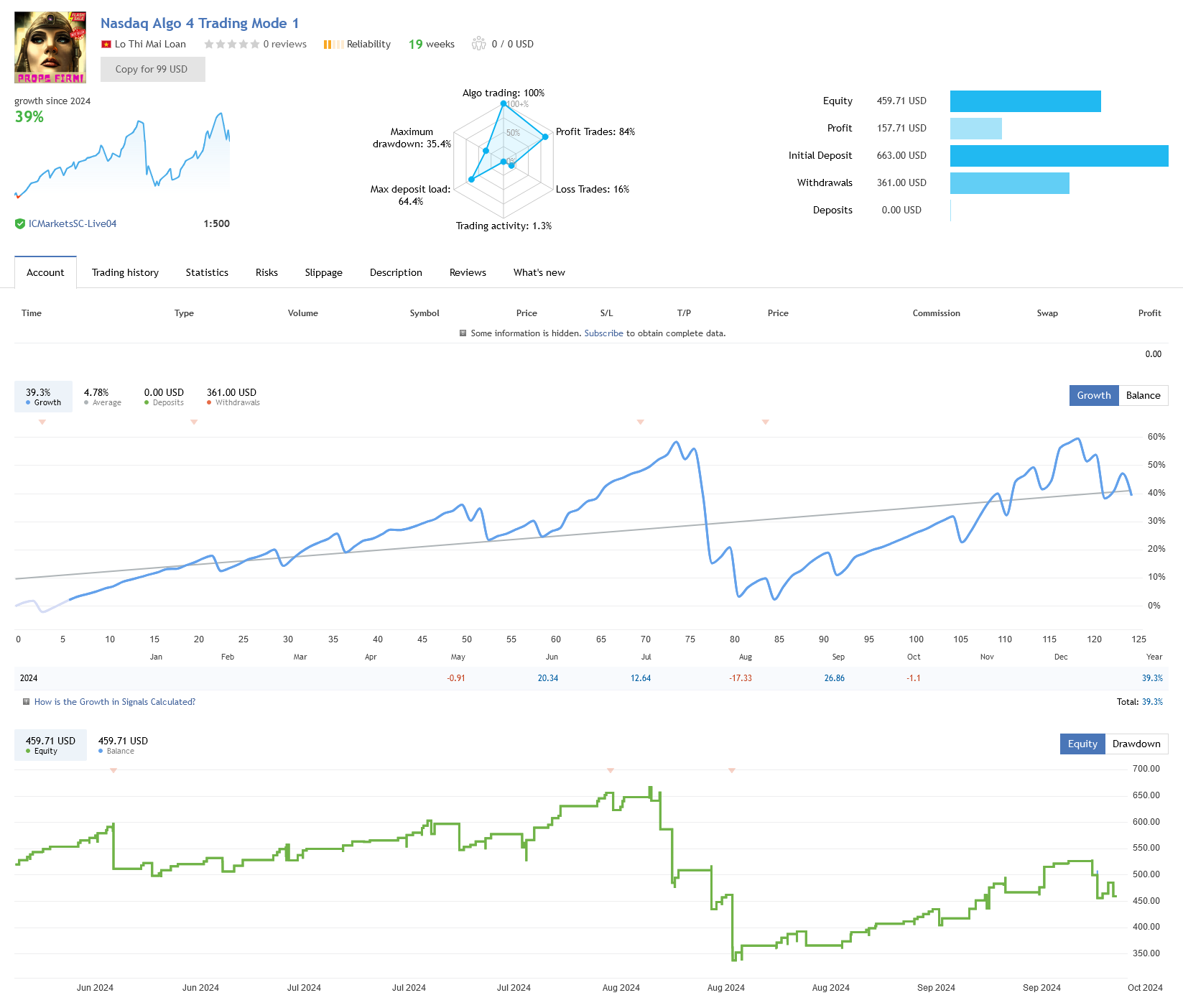

Live Performance Signal

The EA has also proven its reliability in live market conditions with a verified signal:

- Account Growth: 39.3% growth since the start of 2024.

- Consistent Monthly Performance: With average returns of 4.78%, the EA demonstrates steady profitability.

- Maximum Drawdown: The drawdown remained controlled at 35.4%, well within acceptable risk parameters for most traders.

- Equity and Balance Growth: The account’s equity and balance have shown a steady upward trend, confirming the backtested results and proving its live market capabilities.

- Profitable Trades: An 84% win rate over the live performance period, reinforcing the EA’s effectiveness.

Inputs and Customizable Parameters

The Nasdaq100 Algo Trading EA allows traders to customize and optimize trading to their preferences with several parameters:

- Risk Management Settings: Choose between fixed lot sizes or adjust based on account balance with percentage-based risk settings.

- Prop Settings: Control drawdowns effectively with maximum allowable drawdown settings.

- Smart Money: Activate features like trailing stop loss, trailing take profits, and step in points to adapt to different market conditions.

- Trading Times and News Filter: Traders can specify trading windows and use the news filter to avoid entering trades before and after high-impact economic events.

These inputs allow traders to fully customize the EA based on their risk tolerance, trading style, and market preferences.

Our Thoughts

The Nasdaq100 Algo Trading EA is a standout solution for traders looking for stable, consistent growth in the Nasdaq100 market. Its price action-driven strategy and disciplined risk management ensure that traders are not exposed to excessive risk, making it suitable for both conservative and aggressive traders. The high win rate, flexibility of inputs, and user-friendly settings make it an excellent choice for anyone seeking to automate their Nasdaq trading.

The fact that the EA does not use risky strategies like Martingale, Grid, or Hedging is a major plus, as it offers a risk-averse approach while still capturing significant profits.

User Reviews

The EA has started to gain recognition for its stability, performance, and transparency:

- johnny_trades: “The Nasdaq100 Algo Trading EA is a great addition to my portfolio. The risk settings are clear, and I appreciate the news filter. It’s been performing well in live markets.”

- tech_analysis101: “Love how customizable the settings are. I’ve been running it on a $5000 account with conservative risk, and the returns are impressive!”

- nasdaq_enthusiast: “Finally, an EA that understands the Nasdaq market! The backtests align with my live results, and the drawdown control is a lifesaver.”

Conclusion

The Nasdaq100 Algo Trading EA for MT4, developed by Lo Thi Mai Loan, stands as a powerful automated trading tool for traders who want to capitalize on the lucrative opportunities within the Nasdaq100 market. With its adaptable inputs, multiple strategy modes, and risk-focused approach, it is an EA that caters to both new and experienced traders alike. The backtested and live performance data support its ability to deliver steady profits while maintaining drawdown control.

Whether you’re looking for a conservative, steady growth or want to take advantage of higher risk-reward strategies, this EA can adapt to your needs. Start automating your Nasdaq trading journey today with the Nasdaq100 Algo Trading EA, available now on CheaperForex.com.

Reviewed by Our Trader

Peter Jones

Pre-Purchase FAQs

Are updates always free?

Yes, all updates are completely free—you'll never pay twice.

We receive updates from developers and upload them to your account when they're available. Please be patient, as we're managing hundreds of products at discounted prices. More popular products are updated more frequently.

All versions are stored in your account for easy access.

What's your refund policy?

We offer a 7-day technical guarantee. If the EA fails to attach to your chart due to verified errors we can replicate, we'll issue a full refund.

However, we cannot refund based on trading performance or profit expectations—forex markets are unpredictable, and results vary by broker, spread, and market conditions. We provide tools, not guarantees.

I need assistance installing this?

Yes, we'd be happy to assist you!

We can advise you on the best settings for your account or create custom presets tailored to your needs. Additionally, we offer a one-time free installation service using AnyDesk for remote setup.

Please note, however, that we cannot provide advice on how to make money with any of our products.

Can I use this on multiple accounts?

Absolutely. Once you purchase, the EA is yours to use on unlimited live and demo accounts—no restrictions.

You can run it on multiple brokers, VPS servers, or trading accounts simultaneously.

There are no license limits or activation keys. Buy once, use everywhere.

How do I download after payment?

After successful payment, your product will be available for download instantly:

- Displayed on the screen immediately after checkout

- Emailed to the address you provided during purchase

- Stored in your account if you created one at checkout

In rare cases (about 1% of high-value premium products), orders may be held for manual review to prevent fraud. If you don't see a download link, contact us for assistance.

Is this an original product?

Yes, absolutely.

We do not sell fake products, and our customer reviews, along with our pricing, reflect the quality and authenticity of what we offer.

Why Traders Trust Us

Related Products

Powerful expert advisors, exclusive to CheaperForex, at the lowest prices.

-

Quantix EA MT4

Rated 0 out of 5$1,000.00Original price was: $1,000.00.$199.95Current price is: $199.95. -

Quantum Gold Emperor EA MT4 V2.8

Rated 0 out of 5$599.00Original price was: $599.00.$249.95Current price is: $249.95. -

Gold Scalping Zig Zag Pattern EA MT4 – For Small Accounts

Rated 0 out of 5$499.00Original price was: $499.00.$149.95Current price is: $149.95. -

MAX Gold 1 EA MT4

Rated 0 out of 5$5,000.00Original price was: $5,000.00.$249.95Current price is: $249.95.