Save 50–80% on the official MQL5 product.

Same EA. Same updates. Same lifetime license. We just paid full price so you don't have to.

Cracked .ex5 files don't exist for marketplace products. This is a genuine MQL5 activation. If you're looking for pirated software, we're not the right store.

Our Customer Reviews

Excellent product quality.

The latest updated versions of EAs are sent as soon as they are available.

I can highly recommend this site

Have gotten a lot from them in the past and never been disappointed.

After reaching out, I was refunded right away. 5/5 stars in my book.

I received immediate attention to a credit card payment error and they organised a refund within minutes ( late on a Sunday evening ) plus a great saving on a quality Forex EA.

But you need to do your homework on any product before buying.

They give a lot of commitment from themselves. I highly recommend it to everyone!

I recommend it 100%

The products work as advertised and the customer support is topnotch.

Great support. Recommended, 5 STARS.

You can trust them completely.

All issues have been resolved. , If the problem cannot be resolved, a refund will be given.

Prima che intervenissi, si erano accorti dell'anomalia. Per me, piena fiducia all'operatore.

Best in the industry. Thank you for what you do

They also have an outstanding customer care services .

It makes a change from most of the scam forex websites!

How MQL5 Activation Works

You're up and running in under 5 minutes

Purchase

Save 50–80%

on the exact same official product

We Activate It

Installed onto your MT5

remotely in 60 seconds, ready to trade

Attach & Trade

Drag onto your chart

open MT5, attach to chart, done

Free Updates

Always the latest version

updates arrive straight to your MT5

🤷 Not sure how to set it up?

We'll do everything for you — install the EA, configure your settings, and get you trading. You can run it on your home PC or your own VPS, but for the best results we recommend a Windows VPS from just $13/month — runs 24/7, no disconnections, no need to keep your computer on.

NTRon 2000 EA MT5

NTRon 2000 EA for MT5 trades XAUUSD on M30 using a hybrid system: AI news sentiment for macro bias + DOM imbalance simulation from tick data for micro confirmation.

No martingale, controlled SL/TP, from ~$230 starting balance, ≥1:50 leverage recommended.

This is the latest version, installed directly on your MT5, with all future updates included for free.

More Information:

+ https://www.mql5.com/en/market/product/149928

Live Performance Signals:

+ https://www.mql5.com/en/users/kostyaforex/seller

Save 50–80% on the official MQL5 product.

Same EA. Same updates. Same lifetime license.

Cracked .ex5 files don't exist for marketplace products. This is a genuine MQL5 activation.

Buy Now

Latest version with all future updates.

The lowest legitimate price — anywhere.

$495.00 Original price was: $495.00.$189.95Current price is: $189.95.

when the developer raises theirs, ours increase too.

Yes! All products listed on our site are in stock and ready for immediate activation.

No waiting periods, no group buys. Purchase today, get it activated today.

We don't send you a file. Instead, we remotely activate the EA directly onto your MT5 terminal — the same way it would be installed if you bought from MQL5 at full price.

Updates are downloaded directly from within your MT5 terminal — no need to contact us.

Simply open the developer's product page in the MQL5 marketplace and click "Update" whenever a new version is released. It's fully self-service and takes seconds.

Yes — 100% genuine. This is activated directly from the developer's official MQL5 marketplace listing.

Unlike downloadable files (which can be fake or cracked), this EA is installed through MQL5's one-click activation system, ensuring you get the real product with full functionality and automatic updates.

You're getting the exact same lifetime license as buying directly from MQL5 — just at a fraction of the price.

If you change your mind before we activate the product in your MT5 terminal, you get a full refund — no questions asked.

Once activated and working correctly, refunds are no longer available as the license is permanently yours and cannot be revoked.

Buying directly on MQL5 means paying full price — often $500–$1,500 — without knowing if the EA will work for you. If it doesn't perform, there's no refund.

With us, you get the exact same official lifetime-licensed copy for up to 70% less. Test it at lower risk before committing full price elsewhere.

Trusted since 2019 with 28,000+ customers. No renewals, no expiry, no surprises.

Volume purchasing + lower overhead = better prices for you.

We purchase licenses in bulk, then pass the wholesale savings to you. MQL5 charges full retail because they're a marketplace with fees and overhead. We buy direct and operate lean.

You get the exact same product:

✅ Same official MQL5 license (not cracked or pirated)

✅ Same lifetime updates from the developer

✅ Same technical support

✅ We handle the activation for you (under 2 minutes)

The only difference? You pay 50–80% less.

28,000+ customers trust us. Rated "Excellent" on Trustpilot with 116+ reviews.

No. This is an official marketplace product — it must be activated directly inside your MT5 terminal via the MQL5 marketplace.

This is the only legitimate way to receive the product and ensures you get all future updates automatically.

If you're looking for a downloadable file instead of legitimate marketplace activation, please do not purchase.

No — and sites claiming otherwise are scams. This is an official MQL5 marketplace product that requires activation. Cracked .ex5 files don't exist for marketplace products.

Sites advertising "free downloads" typically deliver a password-locked zip file, then charge $200+ on Telegram for the password — which unlocks junk files, not the real EA. Several of these sites have been reported for fraud.

We offer the genuine product at 50–80% below MQL5 retail price with official marketplace activation, free updates, and a 7-day money-back guarantee before activation.

Full refund before activation. Zero risk.

Change your mind before we activate the EA? You get a full refund, no questions asked. Simply email us within 7 days of purchase.

Once the EA is activated on your MT5 platform, the license is permanently yours and cannot be reclaimed. Refunds are only available before activation.

Installed directly from the MQL5 marketplace

We can install it for you — no technical skills needed

Not tech-savvy? No problem. After purchase, contact us and we'll remotely install and configure the EA on your MT5 — takes under 2 minutes, completely free.

MQL5 marketplace doesn't offer any installation help. We do, free of charge.

Installed from the official marketplace, there's no difference

Introduction to NTRon 2000 EA

NTRon 2000 is engineered specifically for XAUUSD on the M30 timeframe. It merges two complementary signals: a news-headline sentiment module (as specified by the developer using GPT-5 semantics) and a tick-driven order-book imbalance (DOM) simulation. The first supplies a macro bias; the second validates microstructure to avoid traps and reduce noise. Result: fewer forced trades, higher-quality entries, and tighter drawdown control.

Key Features

- Instrument & TF: XAUUSD on M30.

- Hybrid Filters: AI news sentiment + simulated DOM imbalance from tick clusters.

- Micro + Macro Confluence: Bias set by headlines; execution confirmed by liquidity behavior.

- False-Signal Reduction: Filters out “fake walls” and misleading headlines.

- Risk Controls: Uses SL/TP logic and controlled exposure; no martingale or unlimited grid described.

- Low Capital Start: Works from about $230 with conservative sizing.

- Leverage: Designed for at least 1:50.

Key Benefits

- Higher Signal Quality: Two-stage validation reduces random entries.

- Event-Aware: Reacts intelligently around macro releases instead of avoiding them blindly.

- Liquidity-Aware: Reads tick flow to detect genuine interest vs spoofed walls.

- Stable Execution: Focused on M30 for balance between reactivity and stability.

- Focused Scope: Built exclusively for Gold where news sensitivity is highest.

Strategy Breakdown: News Sentiment + DOM Imbalance

News Sentiment (macro): Headlines and key-event text are parsed to infer USD tone. Hawkish USD → bearish Gold bias; dovish USD → bullish Gold bias. Semantic parsing helps avoid keyword traps.

DOM Imbalance (micro): Tick data reconstructs a pseudo-order-book to find volume clusters, liquidity walls, and imbalances. This confirms or vetoes the macro bias before entry.

Synergy: Only when both layers align does NTRon 2000 execute, improving expectancy and keeping drawdown controlled.

Risk, Requirements, and Broker Notes

- Initial Capital: From ~$230 with conservative lots.

- Leverage: ≥ 1:50 recommended.

- Symbol: XAUUSD with RAW/ECN style spreads preferred.

- Account Type: Standard or ECN; prioritize low spread + reliable execution.

- Timeframe: M30 only.

- News Permissions: Ensure MT5 has internet to fetch headlines if required by your setup.

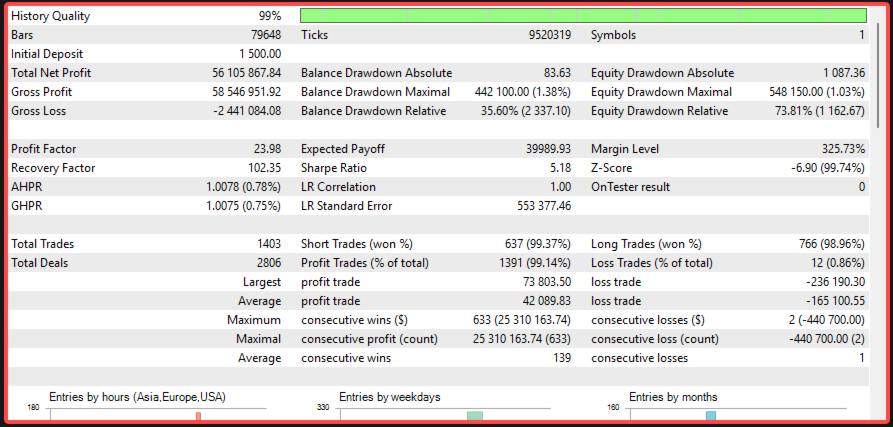

📈 Proof of Results

Backtest Snapshot:

- Profit Factor: 23.98

- Total Trades: 1,403

- Win Rate: 99.37% (short), 98.96% (long)

- Recovery Factor: 102.35

- History Quality: 99%

How it looks on chart: M30 XAUUSD panel and pattern overlay.

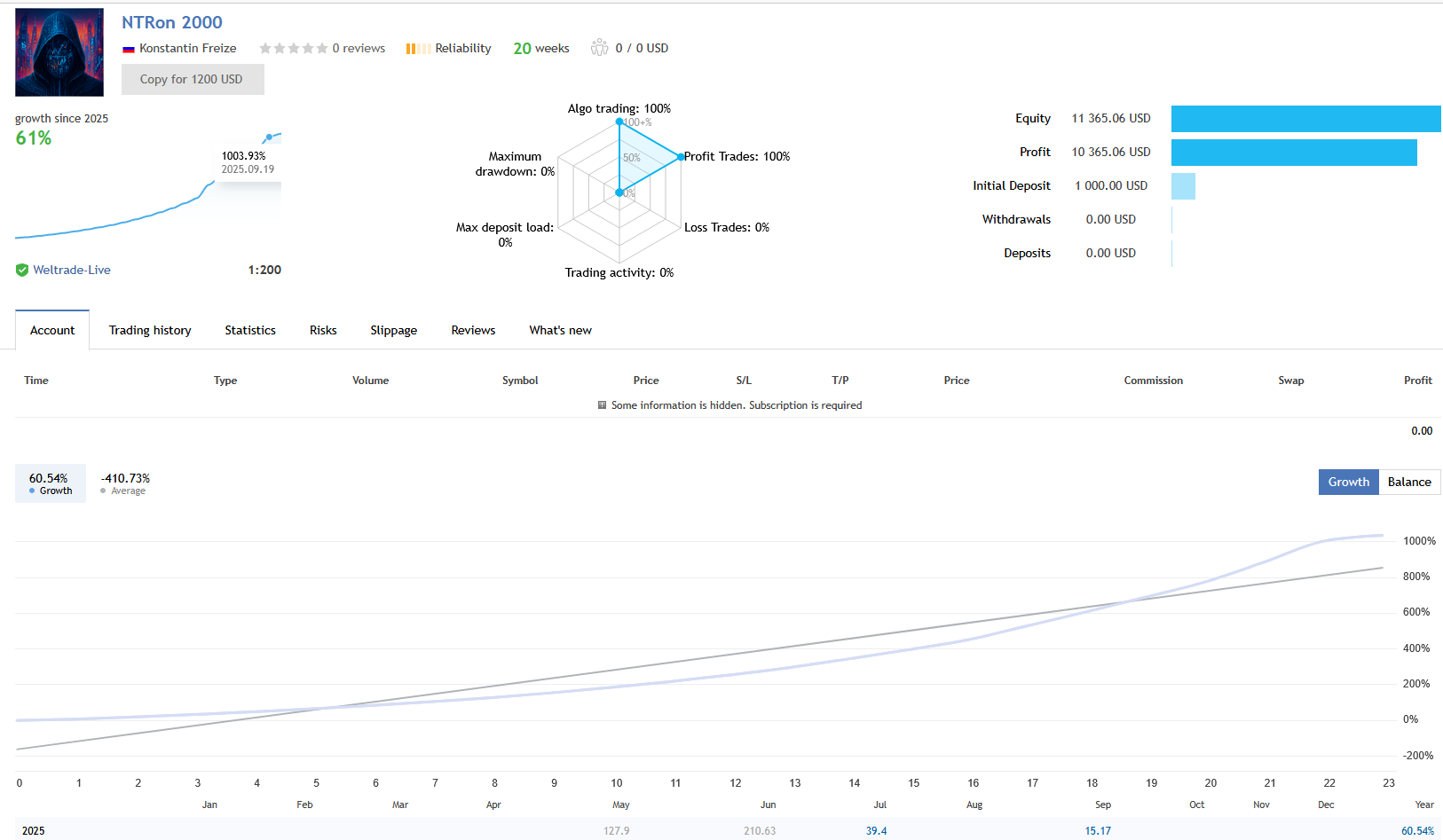

Live Signal Summary (developer-provided): Equity growth shown with algo trading 100%. Max DD shown as 0% on the snapshot; reliability 20 weeks at the time of capture.

⚙️ Deployment Guidelines

- Platform: MT5 desktop on Windows VPS or stable PC.

- Chart Setup: Open XAUUSD M30. Attach the EA to a single chart.

- Broker: Choose low spread and consistent execution. ECN/RAW preferred.

- Inputs: Start with default risk; scale lots only after forward data confirms stability.

- News Access: If your configuration requires headline feeds, allow network access and set time sync.

- Monitoring: Check journal for errors, verify SL/TP placement, and confirm trade hours align with your broker.

- Forward Test: Begin on demo or micro-live before full allocation.

📦 What You Get

- MT5 EA file: NTRon 2000 for XAUUSD M30.

- Setup guide: Step-by-step deployment and risk notes.

- Default set file: Ready-to-run baseline config.

- Updates: Ongoing improvements as released by the author.

- Support: Standard installation and troubleshooting assistance.

FAQs

Does it use martingale or unlimited grids?

No. The described logic uses sentiment and DOM confluence with controlled SL/TP.

What balance do I need to start?

From about $230 with conservative lots. Increase size only after forward validation.

Which timeframe and symbol?

XAUUSD on M30 only.

Will it trade during high-impact news?

Yes. It incorporates news sentiment as a feature rather than disabling trading outright.

Which brokers are suitable?

RAW/ECN accounts with low spreads and fast execution are preferred.

Can I run it on a prop firm account?

Many firms allow MT5 EAs, but always confirm rules on leverage, lot caps, and news trading.

Do I need to keep MT5 running?

Yes. Use a Windows VPS for 24/5 uptime.

Reviews

- cyberhiga (2025-09-30): “I purchased NTRon 2000. The author, Konstantin Freize, was very kind. I made my first trade using it and it was profitable. I’ve tested many EAs, and this one feels excellent. I’ll document results after more time. The author appears trustworthy.”

- Marco T. (verified buyer): “Install was simple on MT5. I like the event-awareness. Entries line up with liquidity pockets more than my old bots.”

- Sara K. (live user): “Stable on my RAW account. I started with 0.01 lots on $300 and scaled after two weeks. Drawdown stayed modest.”

- Jon P. (prop trial): “Passed a small evaluation with conservative risk. News handling didn’t spike exposure.”

Conclusion

NTRon 2000 EA for MT5 focuses on Gold’s unique behavior by combining macroeconomic sentiment with microstructure confirmation. The two-layer filter is designed to raise entry quality and keep risk contained. Forward-test responsibly, confirm broker conditions, and scale based on real performance.

Peter Jones

Us vs MQL5 Marketplace

See why 28,000+ customers choose us

|

CheaperForex

Best Value

|

MQL5 Direct | |

|---|---|---|

| Price | ✓ Save 50-80% | Full price |

| Crypto Discount | ✓ Extra 20% off | ✗ Not available |

| Refund Policy | ✓ Full refund before activation | ✗ Store credit only |

| Payment Options | ✓ Cards, Apple Pay, Crypto | ✓ Cards only |

| Activation Support | ✓ We install for you | ✓ Self-install |

| Ownership | ✓ Lifetime, no expiration | ✓ Lifetime, no expiration |

| Hardware Activations | ⚠ 1 (up to 10 MT5s) | ✓ 5 activations |

| Trustpilot | ✓ Rated "Excellent" | — Seller ratings vary |

Us vs MQL5 Marketplace

Tap to compare →

CheaperForex

MQL5 Direct

How We Deliver Your EA (2 Minutes)

Why Traders Trust Us

Frequently Asked Questions

Is this an official product?

Yes. This is activated directly from the developer's official MQL5 marketplace listing—guaranteed authentic.

Unlike downloadable files (which can be fake or cracked), this EA is installed through MQL5's one-click activation system, ensuring you get the real product with full functionality and instant automatic updates.

When you buy from us, you're getting the exact same lifetime license as buying directly from MQL5—just at a fraction of the price.

Are updates always free and instant?

Yes, product updates for this EA are always free and instant.

They can be downloaded from within the terminal from the marketplace.

Just go to the product listing and click "update" if there's one available.

How do I get this after paying?

Most activations are completed within 15-30 minutes of purchase.

Here's the simple process:

This is an official MQL5 product that must be activated directly from the marketplace—it cannot be downloaded as a standalone file.

Installation process:

1. After purchase, we'll schedule a quick activation session (usually within a few hours)

2. You grant us temporary access via UltraViewer or AnyDesk (takes ~2 minutes), OR provide temporary VPS credentials

3. We activate the EA on your MT5 terminal(s)

4. Done! The EA is permanently yours with instant updates from MQL5

The entire process is secure and takes about 2 minutes.

After activation, no further involvement from us is needed.

How does the 7-day refund policy work?

If you change your mind before we activate the official product in your MT5 terminal, you are eligible for a full refund. Absolutely no questions asked.

Once it has been activated and is working correctly, refunds are no longer available and our regular 7-day refund policy does not apply.

Once we've activated it for you, we can't take it back and it's yours permanently.

How long does activation take?

Usually within a few hours of purchase, but often much faster.

Immediately after purchase, you'll receive an instructional PDF explaining the simple activation process.

Don't worry—it's straightforward, and our refund policy applies anytime before we activate the EA on your terminal.

What if I reinstall MT5 or get a new computer?

Activations are tied to your hardware ID, not your MT5 installation.

Free reactivation if:

• You reinstall MT5 on the same computer

• You accidentally delete MT5

• Windows updates cause issues (this is rare)

• You reinstall Windows (sometimes this doesn't work, but we will always attempt it for you)

Reactivation NOT possible if:

• You get a new computer (different hardware)

• You upgrade major hardware components (motherboard, etc.)

Important: Treat your installation with care. If you're planning to reformat or upgrade hardware, contact us FIRST so we can assist you.

Contact [email protected] with your order number if you need help.

Why should I buy here?

Buying directly on MQL5 means paying full price upfront—often $500-$1,500—without knowing if the EA will work for you. If it doesn't perform or the developer abandons it, there's no refund.

At CheaperForex, you get the exact same official, lifetime-licensed copy for up to 70% less. Test it at a lower risk before committing full price elsewhere.

We've been trusted since 2019, and every EA is yours forever—no renewals, no expiry, no surprises. Smarter investing in trading tools.

Related Products

Official MT5 expert advisors, exclusive to CheaperForex, at the lowest prices.

-

Synthara MT5 EA

Rated 0 out of 5$699.00Original price was: $699.00.$249.95Current price is: $249.95. -

Aura Bitcoin Hash MT5

Rated 0 out of 5$599.00Original price was: $599.00.$249.95Current price is: $249.95. -

Quantum King EA MT5

Rated 0 out of 5$599.99Original price was: $599.99.$299.95Current price is: $299.95. -

Quantum Queen MT5 EA

Rated 0 out of 5$1,599.99Original price was: $1,599.99.$699.95Current price is: $699.95.