- Official Product

- Instant Download

- 7-Day Money-Back Guarantee*

- Instant Download

- 7-Day Refund Policy*

Sale!

What's Included

Our Customer Reviews

Excellent product quality.

The latest updated versions of EAs are sent as soon as they are available.

I can highly recommend this site

Have gotten a lot from them in the past and never been disappointed.

After reaching out, I was refunded right away. 5/5 stars in my book.

I received immediate attention to a credit card payment error and they organised a refund within minutes ( late on a Sunday evening ) plus a great saving on a quality Forex EA.

But you need to do your homework on any product before buying.

They give a lot of commitment from themselves. I highly recommend it to everyone!

I recommend it 100%

The products work as advertised and the customer support is topnotch.

Great support. Recommended, 5 STARS.

You can trust them completely.

All issues have been resolved. , If the problem cannot be resolved, a refund will be given.

Prima che intervenissi, si erano accorti dell'anomalia. Per me, piena fiducia all'operatore.

Best in the industry. Thank you for what you do

They also have an outstanding customer care services .

It makes a change from most of the scam forex websites!

Opal EA MT4

Opal EA for MT4 is an AI-driven EURUSD H1 robot with round-level detection, two-step trailing stop, news/time filters, and robust money management.

Low–mid risk defaults. ECN/RAW + VPS recommended.

The Download Package Includes:

+ Opal EA (.ex4) – V1.0

+ Pairs/Timeframes.txt

+ How to Install MT4 files.pdf

More Information:

+ https://www.mql5.com/en/market/product/106596

Live Performance Signal:

+ https://www.mql5.com/en/signals/2116681

Instant Download

The lowest legitimate price — anywhere.

7-day full refund in the rare event of problems.

$480.00 Original price was: $480.00.$49.95Current price is: $49.95.

If your EA isn't profitable after 30 days of proper use, we'll exchange it for another product of equal or lesser value. No questions asked.

Applies to products $150+. Requires proof of proper installation and use per documentation. One exchange per customer.

What's Included

Quick Summary: Opal EA for MT4 by Oeyvind Borgsoe is a fully automated EURUSD H1 system that blends AI-driven logic, psychological round-level detection, strict money management, a two-step trailing stop, news/time filters, and an optional recovery layer. Default risk: low–mid. ECN/RAW + VPS recommended.

Introduction

Opal focuses on disciplined execution, capital protection, and adaptability. It uses AI calculations to score setups, aligns entries around round numbers where orders often cluster, and manages exits with a two-stage trailing engine. Filters for session time and news reduce low-quality trades.

Key Features at a Glance

| Feature | Details |

|---|---|

| Money Management | Risk-based sizing, equity guards, and optional recovery module. |

| Round-Level Logic | Detects psychological prices; adapts entries/exits near whole numbers. |

| Two-Step Trailing Stop | Stage 1 lock-in, Stage 2 follow-through for trend persistence. |

| Filters | Time filter and news protection to avoid adverse windows. |

| AI Scoring | Combines technical structure with model-based probabilities. |

| User Experience | Clean panel, presets, and simple parameter groups. |

How Opal Trades

Opal evaluates market structure and volatility, then checks proximity to psychological levels where liquidity concentrates. Entries are confirmed by AI score and filter state. After entry, the two-step trailing secures break-even then follows momentum, while money-management caps exposure.

Specifications & Requirements

- Platform: MT4.

- Symbol: EURUSD.

- Timeframe: H1.

- Minimum Deposit: ≈ $100.

- Account: ECN/RAW spreads + reliable VPS.

- Default Risk: low–mid.

Settings Overview

- Lot Sizing: fixed or risk-percent; equity-based guards.

- Recovery: optional controlled recovery profile (off by default for caution).

- Trailing Engine: step-1 lock, step-2 dynamic trail.

- Round-Level Params: sensitivity near whole numbers.

- News Filter: pause before/after high-impact events; minutes configurable.

- Time Filter: trading sessions by day/hour.

- Panel/ID: magic number, comment, and UI options.

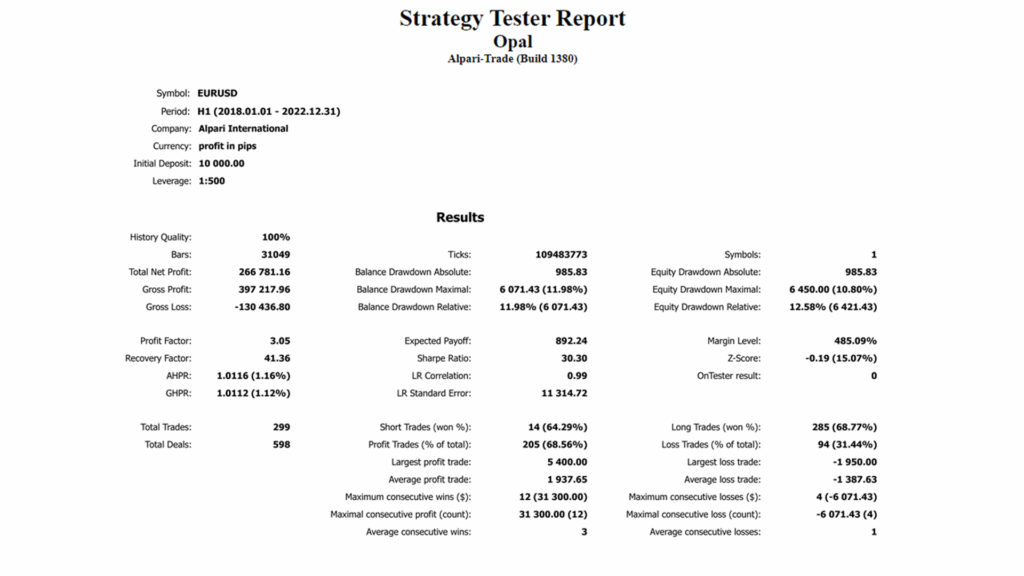

📈 Proof of Results

Developer-supplied materials. Independent verification advised. Backtests illustrate behavior; live results vary.

- Backtest Report (EURUSD H1, 2018–2022) — Profit Factor 3.05, Recovery 41.36, Sharpe 30.30, Total Trades 299, Balance DD rel ≈12%, Equity DD max ≈10.8%.

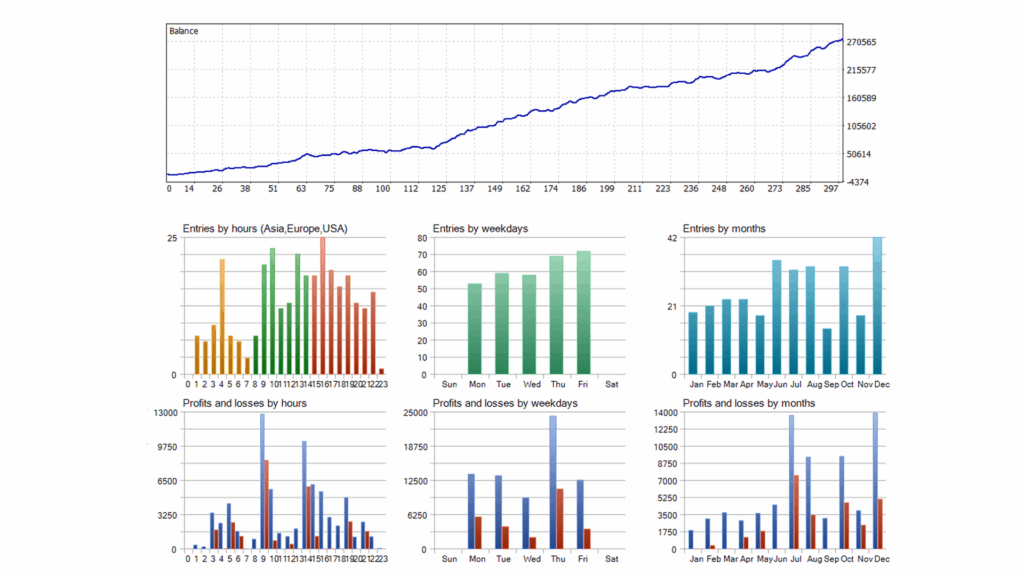

- Backtest Distributions — smooth balance curve and entries/profit by hour/day/month visuals.

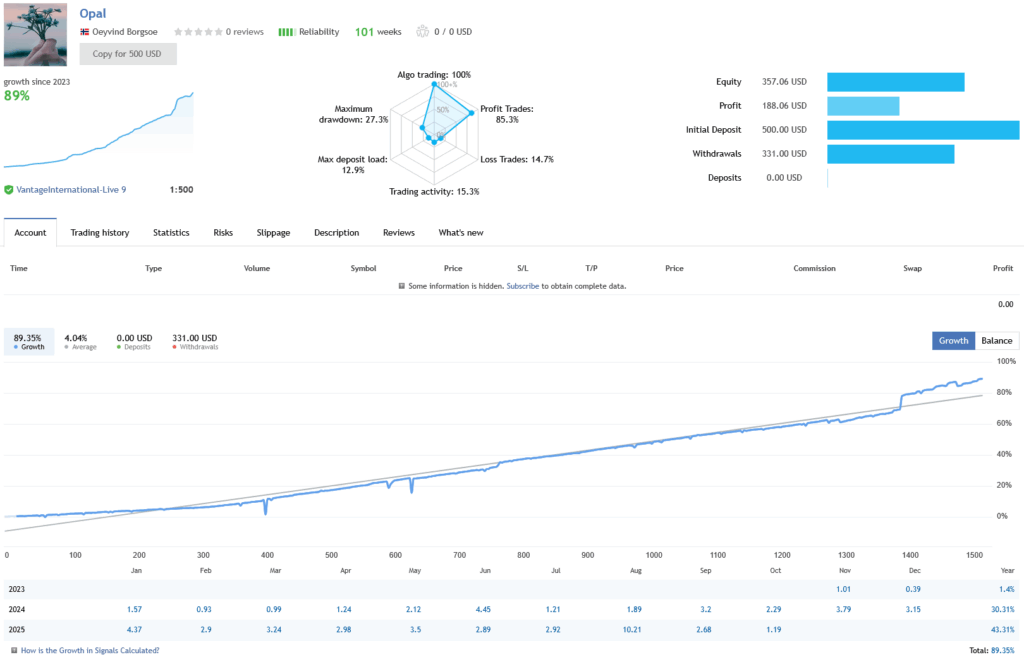

- Live Signal Snapshot — Growth since 2023 ≈89%, Max DD ≈27.3%, Profit trades ≈85.3%, Trading activity ≈15.3%, leverage 1:500.

⚙️ Deployment Guidelines

- Use ECN/RAW account and a Windows VPS for uptime.

- Attach Opal to EURUSD H1. Start with default low–mid risk.

- Enable news and time filters to match your broker session.

- Scale lot size only after a period of forward validation.

📦 What You Get

- MT4 EA: Opal for EURUSD H1.

- Preset(s): conservative default plus recovery profile.

- User Guide

- Updates & support

FAQs

Does Opal use martingale or grid?

No. Sizing is fixed or risk-percent with equity guards. An optional recovery profile exists but is not martingale and is off by default.

Why round-level logic?

Orders cluster at whole numbers. Opal adapts entries/exits around these psychological prices.

Minimum deposit and leverage?

From about $100 on ECN/RAW. Use broker leverage per your policy; risk-percent controls exposure.

Do I need a VPS?

Yes. Uptime and stable latency improve execution.

Backtest vs live?

Backtests are favorable and informational. Expect live variation due to spread, slippage, and news conditions.

Reviews

- Daniel K. (live user): “Install took minutes. Round-number behavior is noticeable—fewer whipsaws around 1.0800/1.0900. Trailing logic is clean.”

- María S. (prop eval): “Passed phase 1 using low-mid risk. The news filter kept me out of messy CPI prints.”

- Igor P. (forward test): “Three weeks on ECN with VPS. Equity curve steady, no runaway exposure. Recovery profile stayed off as advised.”

Conclusion

Opal EA for MT4 offers a pragmatic EURUSD H1 approach: AI scoring, round-level awareness, and strict risk engineering. Run it on ECN/RAW with a VPS, validate forward, and scale deliberately.

Risk Disclaimer

Trading involves risk. Developer materials are informative, not guarantees. Results vary by broker, liquidity, and settings. Test on demo before going live.

Reviewed by Our Trader

Peter Jones

Pre-Purchase FAQs

Are updates always free?

Yes, all updates are completely free—you'll never pay twice.

We receive updates from developers and upload them to your account when they're available. Please be patient, as we're managing hundreds of products at discounted prices. More popular products are updated more frequently.

All versions are stored in your account for easy access.

What's your refund policy?

We offer a 7-day technical guarantee. If the EA fails to attach to your chart due to verified errors we can replicate, we'll issue a full refund.

However, we cannot refund based on trading performance or profit expectations—forex markets are unpredictable, and results vary by broker, spread, and market conditions. We provide tools, not guarantees.

I need assistance installing this?

Yes, we'd be happy to assist you!

We can advise you on the best settings for your account or create custom presets tailored to your needs. Additionally, we offer a one-time free installation service using AnyDesk for remote setup.

Please note, however, that we cannot provide advice on how to make money with any of our products.

Can I use this on multiple accounts?

Absolutely. Once you purchase, the EA is yours to use on unlimited live and demo accounts—no restrictions.

You can run it on multiple brokers, VPS servers, or trading accounts simultaneously.

There are no license limits or activation keys. Buy once, use everywhere.

How do I download after payment?

After successful payment, your product will be available for download instantly:

- Displayed on the screen immediately after checkout

- Emailed to the address you provided during purchase

- Stored in your account if you created one at checkout

In rare cases (about 1% of high-value premium products), orders may be held for manual review to prevent fraud. If you don't see a download link, contact us for assistance.

Is this an original product?

Yes, absolutely.

We do not sell fake products, and our customer reviews, along with our pricing, reflect the quality and authenticity of what we offer.

Why Traders Trust Us

Related Products

Powerful expert advisors, exclusive to CheaperForex, at the lowest prices.

-

Magnat EA MT4 V1.5 – Official & Latest Version

Rated 0 out of 5$9,000.00Original price was: $9,000.00.$199.95Current price is: $199.95. -

Quantum Gold Emperor EA MT4 V2.8

Rated 0 out of 5$599.00Original price was: $599.00.$249.95Current price is: $249.95. -

Eve EA MT4 – 488% Profit with IC Markets

Rated 0 out of 5$1,499.00Original price was: $1,499.00.$249.95Current price is: $249.95. -

Sonata EA MT4 – Scalping Perfection

Rated 0 out of 5$1,400.00Original price was: $1,400.00.$179.95Current price is: $179.95.