Save 50–80% on the official MQL5 product.

Same EA. Same updates. Same lifetime license. We just paid full price so you don't have to.

Cracked .ex5 files don't exist for marketplace products. This is a genuine MQL5 activation. If you're looking for pirated software, we're not the right store.

Our Customer Reviews

Excellent product quality.

The latest updated versions of EAs are sent as soon as they are available.

I can highly recommend this site

Have gotten a lot from them in the past and never been disappointed.

After reaching out, I was refunded right away. 5/5 stars in my book.

I received immediate attention to a credit card payment error and they organised a refund within minutes ( late on a Sunday evening ) plus a great saving on a quality Forex EA.

But you need to do your homework on any product before buying.

They give a lot of commitment from themselves. I highly recommend it to everyone!

I recommend it 100%

The products work as advertised and the customer support is topnotch.

Great support. Recommended, 5 STARS.

You can trust them completely.

All issues have been resolved. , If the problem cannot be resolved, a refund will be given.

Prima che intervenissi, si erano accorti dell'anomalia. Per me, piena fiducia all'operatore.

Best in the industry. Thank you for what you do

They also have an outstanding customer care services .

It makes a change from most of the scam forex websites!

How MQL5 Activation Works

Installation is completed in under 5 minutes

Purchase

Save 50–80%

on the exact same official product

We Activate It

Activated on your MT5 terminal

remotely in 60 seconds, ready to trade

Attach & Trade

Attach to your chart

open MT5, attach to chart, begin trading

Free Updates

Always the latest version

updates arrive straight to your MT5

New to Expert Advisors? We Can Help.

Most customers install using our step-by-step PDF guide. If you require full assistance, we will install and configure the EA on your behalf — at no charge. Simply message us after purchase.

The ORB Master EA MT5

The ORB Master EA for MT5 trades Opening Range Breakouts on US500, US30, NAS100, DAX from a single EURUSD M15 chart.

12 uncorrelated strategies, no grid/martingale, dynamic trailing SL/TP, prop-firm tools, and out-of-sample stress testing.

This is the latest version, installed directly on your MT5, with all future updates included for free.

More Information:

+ https://www.mql5.com/en/market/product/150079

Live Performance Signals:

+ https://www.mql5.com/en/users/strueli/seller

Save 50–80% on the official MQL5 product.

Same EA. Same updates. Same lifetime license.

Cracked .ex5 files don't exist for marketplace products. This is a genuine MQL5 activation.

Buy Now

Latest version with all future updates.

Activated from the MQL5 marketplace, directly into your MT5 terminals.

$599.00 Original price was: $599.00.$299.95Current price is: $299.95.

The lowest genuine reseller price.

You're paying for trust and genuine delivery from a verified seller. Price reflects current MQL5 listing and may change.

Yes! All products listed on our site are in stock and ready for immediate activation.

No waiting periods, no group buys. Purchase today, get it activated today.

We don't send you a file. Instead, we remotely activate the EA directly onto your MT5 terminal — the same way it would be installed if you bought from MQL5 at full price.

Updates are downloaded directly from within your MT5 terminal — no need to contact us.

Simply open the developer's product page in the MQL5 marketplace and click "Update" whenever a new version is released. It's fully self-service and takes seconds.

Yes — 100% genuine. This is activated directly from the developer's official MQL5 marketplace listing.

Unlike downloadable files (which can be fake or cracked), this EA is installed through MQL5's one-click activation system, ensuring you get the real product with full functionality and automatic updates.

You're getting the exact same lifetime license as buying directly from MQL5 — just at a fraction of the price.

If you change your mind before we activate the product in your MT5 terminal, you get a full refund — no questions asked.

Once activated and working correctly, refunds are no longer available as the license is permanently yours and cannot be revoked.

Buying directly on MQL5 means paying full price — often $500–$1,500 — without knowing if the EA will work for you. If it doesn't perform, there's no refund.

With us, you get the exact same official lifetime-licensed copy for up to 70% less. Test it at lower risk before committing full price elsewhere.

Trusted since 2019 with 28,000+ customers. No renewals, no expiry, no surprises.

Volume purchasing + lower overhead = better prices for you.

We purchase licenses in bulk, then pass the wholesale savings to you. MQL5 charges full retail because they're a marketplace with fees and overhead. We buy direct and operate lean.

You get the exact same product:

✅ Same official MQL5 license (not cracked or pirated)

✅ Same lifetime updates from the developer

✅ Same technical support

✅ We handle the activation for you (under 2 minutes)

The only difference? You pay 50–80% less.

28,000+ customers trust us. Rated "Excellent" on Trustpilot with 116+ reviews.

No. This is an official marketplace product — it must be activated directly inside your MT5 terminal via the MQL5 marketplace.

This is the only legitimate way to receive the product and ensures you get all future updates automatically.

If you're looking for a downloadable file instead of legitimate marketplace activation, please do not purchase.

No — and sites claiming otherwise are scams. This is an official MQL5 marketplace product that requires activation. Cracked .ex5 files don't exist for marketplace products.

Sites advertising "free downloads" typically deliver a password-locked zip file, then charge $200+ on Telegram for the password — which unlocks junk files, not the real EA. Several of these sites have been reported for fraud.

We offer the genuine product at 50–80% below MQL5 retail price with official marketplace activation, free updates, and a 7-day money-back guarantee before activation.

Full refund before activation. Zero risk.

Change your mind before we activate the EA? You get a full refund, no questions asked. Simply email us within 7 days of purchase.

Once the EA is activated on your MT5 platform, the license is permanently yours and cannot be reclaimed. Refunds are only available before activation.

Installed directly from the MQL5 marketplace

We can install it for you — no technical skills needed

Not tech-savvy? No problem. After purchase, contact us and we'll remotely install and configure the EA on your MT5 — takes under 2 minutes, completely free.

MQL5 marketplace doesn't offer any installation help. We do, free of charge.

Installed from the official marketplace, there's no difference

Quick Summary: The ORB Master EA for MT5 trades the Opening Range Breakout on US500, US30, NAS100, DAX. Runs from a single EURUSD M15 chart, launching 12 uncorrelated strategies across indices with dynamic trailing SL/TP, prop-firm controls, and out-of-sample stress testing.

Introduction to The ORB Master

The ORB Master is a high-discipline implementation of the classic Opening Range Breakout. It targets the early momentum window after the US and European market opens on four leading indices: US500 (S&P 500), US30 (Dow), NAS100 (NASDAQ), DAX. Each index runs three distinct modules, creating a diversified 12-strategy portfolio with robust trade management and strict risk limits.

Key Features at a Glance

| Feature | Details |

|---|---|

| Risk Management | No grid, no martingale, no reckless averaging; disciplined entries with trailing SL/TP. |

| Optimized Assets | US30, US500, NASDAQ (NAS100), DAX. |

| Recommended Timeframe | M15. |

| Chart to Use | EURUSD M15 (EA handles all 4 indices from one chart). |

| Strategy Count | 12 uncorrelated variations in parallel for diversification. |

| Prop Firm Compatible | Controls for unique trades, daily DD cap, time filters, and randomization. |

| Minimum Balance | ~$500 baseline (adjust for broker min lot and risk mode). |

| Broker Recommendation | Low-spread broker with reliable index CFDs and correct trading sessions. |

How It Works: Opening Range Breakout

After session open, the EA measures the initial range and seeks momentum continuation. Breakouts often align with the day’s dominant trend, giving a directional bias. Entries are filtered per index and managed by dynamic trailing to lock gains and reduce give-back.

Portfolio Design & Risk Controls

- 12 modules: 3 per index to spread logic across uncorrelated variants.

- Trailing engine: Adaptive SL/TP to capture extension while cutting losers.

- Prop-safe options: Unique-trade settings, randomization, and Max Daily Drawdown stop.

- Robustness: Developed with out-of-sample stress tests on unseen data to avoid curve-fit traps.

Setup: Live/Demo

- Add to MT5 allowed URLs:

https://www.worldtimeserver.com/. - Enable AutoTrading in MT5.

- Open EURUSD M15 and attach the EA.

- Load a supplied set file.

- Set broker symbols for US500, US30, NAS100, DAX.

- Click OK. The EA will manage all four indices from this single chart.

Backtesting Guidelines

- Run tester on EURUSD M15 with the EA attached.

- Load one of the included set files.

- Ensure symbol names match your broker for US500/US30/NAS100/DAX.

- Set correct GMT offset (AutoGMT, or GMT+2 winter / GMT+3 summer) or adjust trading hours.

- Use at least 2–3 years for meaningful statistics.

Main Parameters

- Info Panel: show panel; scale for 4K; disable update in tester for speed.

- Order Handling: set SL/TP after entry if broker limits; virtual expiration if needed.

- Per-Index Controls: enable US500/US30/NAS100/DAX, set symbol names, start/stop times, Strat1/2/3, max spread, randomization.

- Prop-Firm Unique Trades: customize entries/exits per index to differ from other users.

- Lot Sizing: Fixed or Max Risk per Strategy driven by historical DD; supports equity-based calc, Max Daily DD, OnlyUp.

- Time & News Filters: AutoGMT/manual offsets; NFP, CPI, and IR filters with pre/post minutes; trading-hours filter; delete/close outside windows.

- Magic/Comments: base magic number and comment formatting controls.

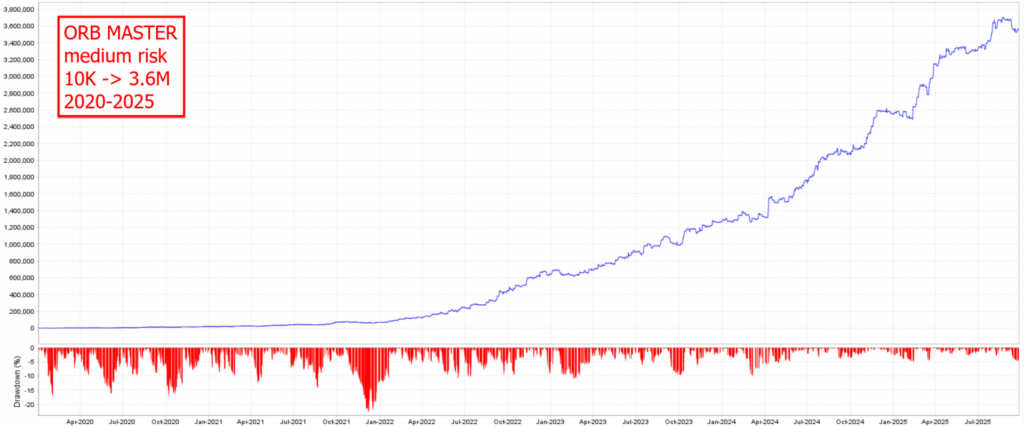

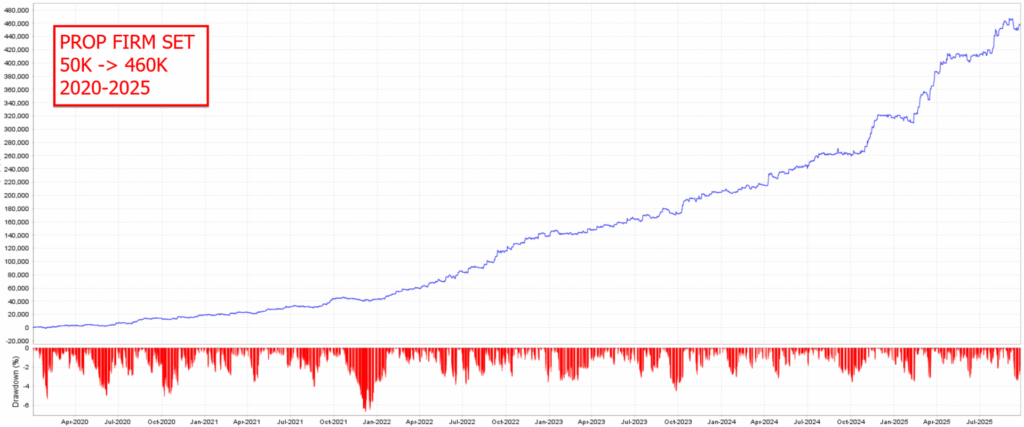

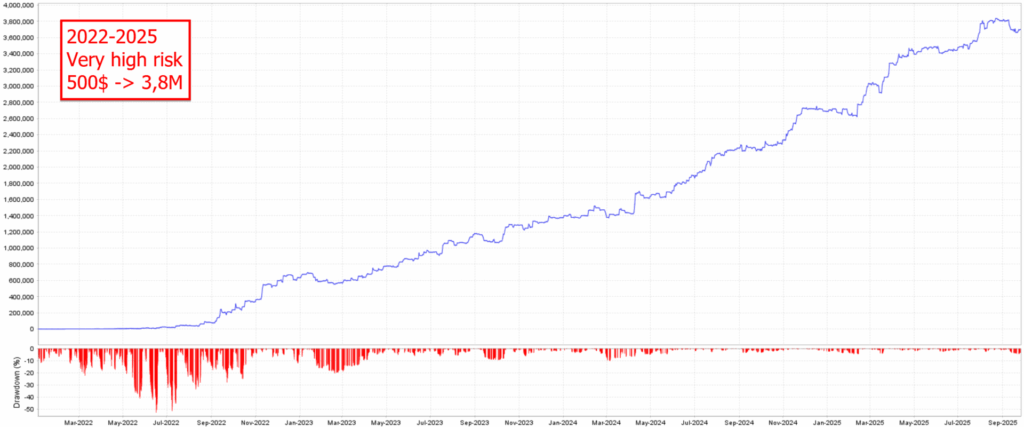

📈 Proof of Results

Backtests and third-party screenshots provided by the developer. Independent verification is advised.

- Medium-risk backtest (2020–2025): growth from 10k to ≈3.6M with controlled drawdown

- Prop-firm preset (2020–2025): growth from 50k to ≈460k under tighter constraints

- Very high-risk profile (2022–2025): 500 → ≈3.8M with deeper drawdowns

⚙️ Deployment Guidelines

- Environment: MT5 on Windows VPS for 24/5 uptime.

- Symbols: Confirm correct index tickers and sessions with your broker.

- Risk Mode: Start conservative; let forward data accumulate before scaling.

- Daily DD Guard: Use the built-in Max Daily Drawdown for prop-style protection.

- News Windows: Configure NFP/CPI/IR filters per your rules and risk tolerance.

- Audit Logs: Monitor the Experts/Journal tabs for symbol or session mismatches.

📦 What You Get

- MT5 EA: The ORB Master.

- Preset set files: Medium risk, prop-firm, and high-beta profiles.

- User guide: Setup, hours, symbol mapping, and prop controls.

- Ongoing updates: As released by the developer.

- Support: Standard install and troubleshooting help.

FAQs

Does it use grid or martingale?

No. The system relies on defined ORB entries and trailing management.

Which chart and timeframe do I run?

Attach to EURUSD M15. The EA handles all four indices internally.

What minimum balance is sensible?

About $500 for baseline use. Adjust for broker min lot and risk mode.

Is it prop-firm friendly?

Yes. Unique-trade settings, randomization, and Max Daily DD help align with rules.

How do I set sessions correctly?

Use AutoGMT or apply winter GMT+2 / summer GMT+3. Confirm broker trading hours.

Can I disable trading around major news?

Yes. NFP, CPI, and Interest-Rate filters can close or prevent trades for a defined window.

Reviews

- kwikky69 (EN): Reports steady results, clear docs, and appreciates news filter plus virtual expiration. Notes disciplined behavior during volatility.

- Dany Steyaert (EN): Confident in build quality; consistent with other professional releases by the dev.

- Sharif Hamwi (EN): Says the EA performs as described; highlights responsiveness and thorough guidance from the seller.

About the Developer

Profalgo Limited states a pragmatic approach: no AI hype or “perfect straight lines.” Over 15 years of system building, with emphasis on robust development and live alignment over curve-fit theatrics.

Conclusion

The ORB Master EA for MT5 packages a disciplined ORB methodology into a diversified index portfolio with strong trade management and prop-aware controls. Set sessions correctly, begin conservatively, and scale only after forward validation.

Peter Jones

Us vs MQL5 Marketplace

See why 28,000+ customers choose us

|

CheaperForex

Best Value

|

MQL5 Direct | |

|---|---|---|

| Price | ✓ Save 50-80% | Full price |

| Crypto Discount | ✓ Extra 20% off | ✗ Not available |

| Refund Policy | ✓ Full refund before activation | ✗ Store credit only |

| Payment Options | ✓ Cards, Apple Pay, Crypto | ✓ Cards only |

| Activation Support | ✓ We install for you | ✓ Self-install |

| Ownership | ✓ Lifetime, no expiration | ✓ Lifetime, no expiration |

| Hardware Activations | ⚠ 1 (up to 10 MT5s) | ✓ 5 activations |

| Trustpilot | ✓ Rated "Excellent" | — Seller ratings vary |

Us vs MQL5 Marketplace

Tap to compare →

CheaperForex

MQL5 Direct

How We Deliver Your EA (2 Minutes)

Why Traders Trust Us

Frequently Asked Questions

Is this an official product?

Yes. This is activated directly from the developer's official MQL5 marketplace listing—guaranteed authentic.

Unlike downloadable files (which can be fake or cracked), this EA is installed through MQL5's one-click activation system, ensuring you get the real product with full functionality and instant automatic updates.

When you buy from us, you're getting the exact same lifetime license as buying directly from MQL5—just at a fraction of the price.

Are updates always free and instant?

Yes, product updates for this EA are always free and instant.

They can be downloaded from within the terminal from the marketplace.

Just go to the product listing and click "update" if there's one available.

How do I get this after paying?

Most activations are completed within 15-30 minutes of purchase.

Here's the simple process:

This is an official MQL5 product that must be activated directly from the marketplace—it cannot be downloaded as a standalone file.

Installation process:

1. After purchase, we'll schedule a quick activation session (usually within a few hours)

2. You grant us temporary access via UltraViewer or AnyDesk (takes ~2 minutes), OR provide temporary VPS credentials

3. We activate the EA on your MT5 terminal(s)

4. Done! The EA is permanently yours with instant updates from MQL5

The entire process is secure and takes about 2 minutes.

After activation, no further involvement from us is needed.

How does the 7-day refund policy work?

If you change your mind before we activate the official product in your MT5 terminal, you are eligible for a full refund. Absolutely no questions asked.

Once it has been activated and is working correctly, refunds are no longer available and our regular 7-day refund policy does not apply.

Once we've activated it for you, we can't take it back and it's yours permanently.

How long does activation take?

Usually within a few hours of purchase, but often much faster.

Immediately after purchase, you'll receive an instructional PDF explaining the simple activation process.

Don't worry—it's straightforward, and our refund policy applies anytime before we activate the EA on your terminal.

What if I reinstall MT5 or get a new computer?

Activations are tied to your hardware ID, not your MT5 installation.

Free reactivation if:

• You reinstall MT5 on the same computer

• You accidentally delete MT5

• Windows updates cause issues (this is rare)

• You reinstall Windows (sometimes this doesn't work, but we will always attempt it for you)

Reactivation NOT possible if:

• You get a new computer (different hardware)

• You upgrade major hardware components (motherboard, etc.)

Important: Treat your installation with care. If you're planning to reformat or upgrade hardware, contact us FIRST so we can assist you.

Contact [email protected] with your order number if you need help.

Why should I buy here?

Buying directly on MQL5 means paying full price upfront—often $500-$1,500—without knowing if the EA will work for you. If it doesn't perform or the developer abandons it, there's no refund.

At CheaperForex, you get the exact same official, lifetime-licensed copy for up to 70% less. Test it at a lower risk before committing full price elsewhere.

We've been trusted since 2019, and every EA is yours forever—no renewals, no expiry, no surprises. Smarter investing in trading tools.

Related Products

Official MT5 expert advisors, exclusive to CheaperForex, at the lowest prices.

-

Quantum Emperor EA MT5

Rated 0 out of 5$799.00Original price was: $799.00.$399.95Current price is: $399.95. -

Bomber Corporation EA MT5

Rated 0 out of 5$399.00Original price was: $399.00.$169.95Current price is: $169.95. -

Mad Turtle EA MT5

Rated 0 out of 5$1,700.00Original price was: $1,700.00.$629.95Current price is: $629.95. -

One Man Army EA MT5

Rated 0 out of 5$599.99Original price was: $599.99.$299.95Current price is: $299.95.