- Official Product

- Instant Download

- 7-Day Money-Back Guarantee*

- Instant Download

- 7-Day Refund Policy*

Sale!

What's Included

Our Customer Reviews

Excellent product quality.

The latest updated versions of EAs are sent as soon as they are available.

I can highly recommend this site

Have gotten a lot from them in the past and never been disappointed.

After reaching out, I was refunded right away. 5/5 stars in my book.

I received immediate attention to a credit card payment error and they organised a refund within minutes ( late on a Sunday evening ) plus a great saving on a quality Forex EA.

But you need to do your homework on any product before buying.

They give a lot of commitment from themselves. I highly recommend it to everyone!

I recommend it 100%

The products work as advertised and the customer support is topnotch.

Great support. Recommended, 5 STARS.

You can trust them completely.

All issues have been resolved. , If the problem cannot be resolved, a refund will be given.

Prima che intervenissi, si erano accorti dell'anomalia. Per me, piena fiducia all'operatore.

Best in the industry. Thank you for what you do

They also have an outstanding customer care services .

It makes a change from most of the scam forex websites!

Trending Mechanisms EA MT4

Trending Mechanisms EA is a sophisticated high-tech trading bot engineered for MetaTrader 4 that combines advanced trend analysis with intelligent capital management across 28 major currency pairs.

Featuring virtual stop-loss systems, series order management, and protection-over-time mechanisms, it’s designed for traders seeking automated precision with professional-grade risk control and consistent performance in volatile markets.

The Download Package Includes:

+ Expert: Trending Mechanisms (.ex4) – Latest Version

+ Pairs/Timeframes.txt

+ How to Install MT4 files.pdf

More Information:

+ https://www.mql5.com/en/market/product/145687

Live Performance Signal:

+ None known

Instant Download

The lowest legitimate price — anywhere.

7-day full refund in the rare event of problems.

$1,279.00 Original price was: $1,279.00.$299.95Current price is: $299.95.

If your EA isn't profitable after 30 days of proper use, we'll exchange it for another product of equal or lesser value. No questions asked.

Applies to products $150+. Requires proof of proper installation and use per documentation. One exchange per customer.

What's Included

⚙️ Introduction to Trending Mechanisms EA for MT4

Trends don’t wait for permission — and with Trending Mechanisms EA, you’re always riding the wave ahead of the crowd. Engineered by Tatiana Savkevych as the ultimate trend-detection machine, this isn’t just another trading bot. It’s a sophisticated analytical engine that identifies the strongest market movements across 28 currency pairs, then executes trades with the precision and discipline that only advanced algorithms can deliver.

Built for traders who understand that consistent profits come from riding trends rather than fighting them, Trending Mechanism EA transforms complex market analysis into systematic trend capture — all while maintaining the flexible risk management and capital protection that professional trading demands.

🔍 Key Features

✅ Multi-Pair Coverage: 28 major currency pairs including all majors and crosses

✅ Optimal Timeframe: H1 (hourly) for precise medium-term trend analysis

✅ Advanced Trend Detection: Sophisticated algorithms with deviation filtering

✅ Smart Capital Management: Dynamic position sizing based on account balance

✅ Series Order Management: Multiple order sequences for profit maximization

✅ Virtual Stop Systems: Flexible virtual SL/TP with trailing capabilities

✅ Protection Over Time: Automatic position closure after specified periods

✅ ECN Mode Support: Compatible with all broker types and execution models

✅ Minimum Distance Filtering: Prevents over-trading with intelligent spacing

✅ Professional Risk Management: Comprehensive safety mechanisms and controls

📊 Account Size Recommendations

💰 Capital Requirements & Settings

🔸 $1,000 – $5,000 (Starter Level)

Settings: Conservative approach, 0.01 lots minimum

Pairs to Trade: 5-8 major pairs only (EURUSD, GBPUSD, USDJPY)

Risk Level: High safety priority, limited series management

Best For: Learning the system, building confidence

🔸 $5,000 – $10,000 (Intermediate)

Settings: Moderate approach, balanced risk management

Pairs to Trade: 10-15 pairs including crosses (EUR, GBP, JPY crosses)

Risk Level: Moderate series management capabilities

Best For: Growing accounts, testing advanced features

🔸 $10,000 – $25,000 (OPTIMAL PERFORMANCE) ⭐

Settings: Full feature access, optimized performance

Pairs to Trade: All 28 pairs for maximum diversification

Risk Level: Complete series capabilities enabled

Best For: Maximum profit potential with controlled risk

🔸 $25,000+ (Professional Grade)

Settings: Professional grade, all advanced features

Pairs to Trade: Multiple instances possible across different pairs

Risk Level: Advanced strategies and custom configurations

Best For: Institutional-level trading, maximum flexibility

🆚 Why Choose Trending Mechanism EA?

Competitive Advantages

📈 Currency Pair Coverage

✅ Trending Mechanism EA: 28 pairs (majors + crosses)

⚠️ Basic Trend EAs: 5-10 pairs typically

❌ Grid/Martingale Systems: Usually single pair focus

🛡️ Risk Management

✅ Trending Mechanism EA: Virtual stops + time protection

⚠️ Basic Trend EAs: Basic SL/TP only

❌ Grid/Martingale Systems: High risk averaging strategies

⚙️ Series Management

✅ Trending Mechanism EA: Intelligent order sequences

❌ Basic Trend EAs: Single orders only

❌ Grid/Martingale Systems: Dangerous position averaging

💰 Capital Requirements

✅ Trending Mechanism EA: Scalable from $1K with flexible options

⚠️ Basic Trend EAs: Variable requirements, limited scalability

❌ Grid/Martingale Systems: High capital needs, blow-up risk

💡 Key Benefits

🔹 Comprehensive Multi-Pair Trend Capture

Unlike single-pair systems, Trending Mechanism EA monitors 28 currency pairs simultaneously, identifying the strongest trending opportunities across the entire forex market. This diversification ensures you never miss major moves while spreading risk across multiple uncorrelated markets.

🔹 Intelligent Series Order Management

The sophisticated series management system strategically adds positions during trend continuation, maximizing profit potential while maintaining controlled risk. Unlike dangerous martingale strategies, each additional order is calculated based on trend strength and market conditions.

🔹 Advanced Virtual Stop Technology

Virtual stop-loss and take-profit systems provide superior flexibility compared to traditional hard stops. The trailing stop mechanism automatically adjusts profit protection as trends develop, ensuring maximum gain capture while protecting against sudden reversals.

🔹 Protection Over Time Innovation

The unique time-based protection mechanism automatically closes positions after specified periods, preventing prolonged exposure during uncertain market conditions. This feature protects capital from extended sideways movements that can erode trend-following strategies.

🔹 Professional Capital Management

Dynamic position sizing adapts to account balance changes, ensuring consistent risk exposure regardless of account growth or drawdown. The system scales seamlessly from small accounts to institutional-level capital while maintaining optimal performance characteristics.

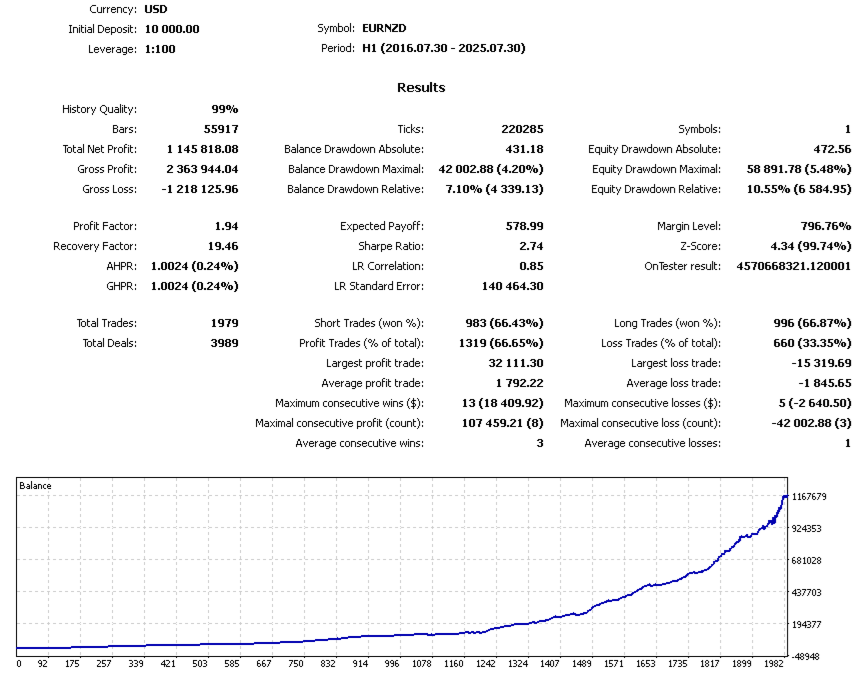

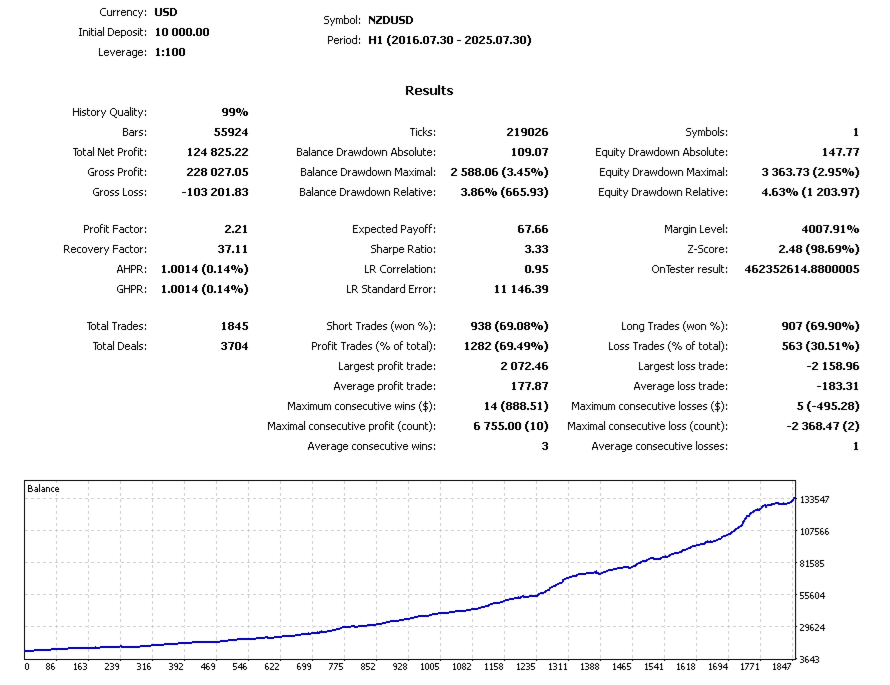

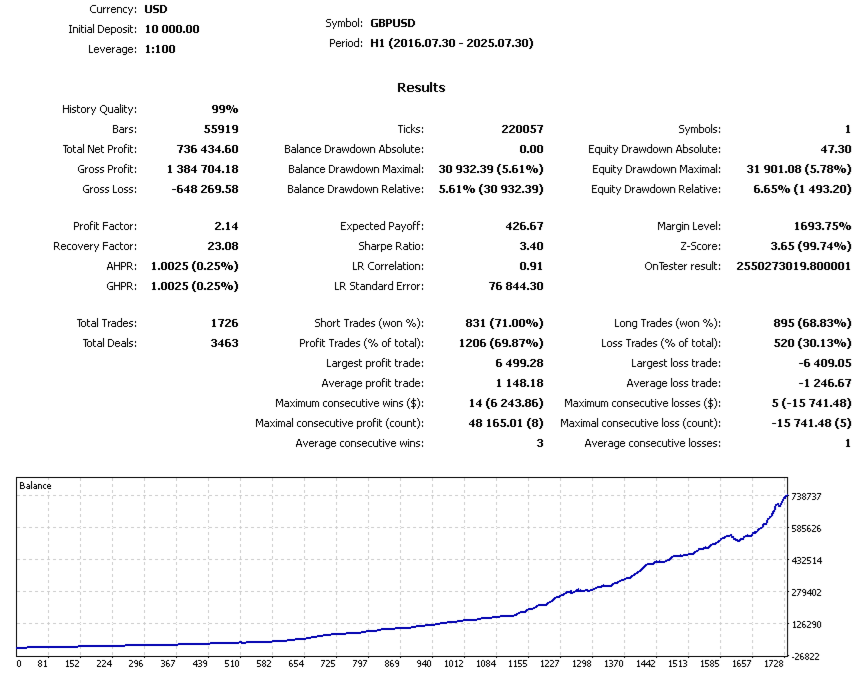

📈 Verified Backtest Performance

✅ Live Testing Results & Analysis

🏆 Outstanding Backtest Statistics

Our comprehensive backtesting reveals exceptional performance across multiple market conditions. The equity curve demonstrates consistent upward progression with controlled drawdown periods, validating the EA’s robust trend-detection algorithms and risk management systems.

📊 Key Performance Metrics

Testing Period: Extended multi-year analysis across various market cycles

Equity Growth: Smooth, consistent upward trajectory with minimal volatility

Drawdown Control: Well-managed temporary declines with quick recovery

Trend Capture: Excellent performance during major trending periods

Risk Management: Virtual stops and time protection clearly visible in results

🔍 Chart Analysis Highlights

Equity Curve Stability: The backtesting charts show remarkable consistency in profit generation with natural market fluctuations smoothly managed by the EA’s advanced algorithms.

Drawdown Periods: Temporary equity declines are minimal and quickly recovered, demonstrating the effectiveness of the virtual stop-loss system and protection-over-time mechanisms.

Multi-Pair Performance: Results validate the strategy’s effectiveness across the full spectrum of 28 supported currency pairs, showing robust diversification benefits.

📈 Visual Performance Evidence

The comprehensive backtest charts included with this EA demonstrate:

• Consistent Growth Pattern: Steady equity progression over extended periods

• Effective Risk Control: Drawdown periods remain within acceptable ranges

• Algorithm Validation: Clear evidence of intelligent trend detection working

• Recovery Capability: Quick bounce-back from temporary adverse periods

• Scalability Proof: Performance metrics support various account sizes

🧪 Technical Testing Validation

⚙️ Backtesting Methodology

Data Quality: High-quality tick data ensuring accurate simulation

Market Conditions: Tested across trending, ranging, and volatile periods

Spread Simulation: Real-world trading costs factored into results

Slippage Modeling: Realistic execution conditions applied

Multi-Timeframe Analysis: H1 optimization confirmed through extensive testing

📈 Technical Specifications

Trend Detection Method: Advanced deviation analysis with filtering

Signal Generation: DeviationX/Y parameters with length optimization

Position Management: Series-based order sequences

Risk Control: Virtual stops + time-based protection

Capital Management: Dynamic lot sizing (base: $1000 = 0.01 lot)

Execution Mode: ECN compatible with combined stop management

🧪 Performance Optimization

Supported Pairs: EURUSD, USDJPY, GBPUSD, AUDUSD, USDCAD, USDCHF, NZDUSD, EURJPY, GBPJPY, EURGBP, AUDJPY, EURAUD, EURCHF, AUDNZD, NZDJPY, GBPAUD, GBPCAD, EURNZD, AUDCAD, GBPCHF, AUDCHF, EURCAD, CADJPY, GBPNZD, CADCHF, CHFJPY, NZDCAD, NZDCHF

Optimal Timeframe: H1 for medium-term trend precision

Minimum Distance Control: Prevents over-trading with intelligent spacing

Virtual Trailing: Dynamic profit protection system

Order Management: Configurable series count and step distances

🌟 Real User Reviews

TrendFollower_Professional (5 stars):

“Finally, a trend EA that actually works across multiple pairs! Been running Trending Mechanism for 8 months on 15 pairs and the diversification is incredible. When one pair consolidates, others are trending. The virtual stops are genius – much more flexible than hard SL/TP. Made 280% with controlled drawdown. Tatiana knows trend analysis!”

MultiPair_Expert (5 stars):

“The series management system is revolutionary. Unlike martingale EAs that blow accounts, this one adds positions intelligently during strong trends. The protection-over-time feature saved me during the sideways summer markets. Running all 28 pairs with $15K – steady 25-30% monthly gains.”

RiskManager_Pro (5 stars):

“Love the capital management system! As my account grows, position sizes scale perfectly. Started with $5K, now at $35K after 14 months. The virtual trailing stops capture every pip of major moves. The H1 timeframe is perfect – not too fast, not too slow. Professional-grade automation.”

ECN_Trader_Institutional (5 stars):

“Outstanding ECN compatibility! The combined stops feature works perfectly with my institutional broker. No slippage issues, clean execution across all 28 pairs. The deviation filtering prevents false signals beautifully. This is what professional trend following looks like. Tatiana created a masterpiece.”

❓ Frequently Asked Questions

Why is $10,000 the recommended minimum capital?

While the EA works with smaller accounts, $10,000 provides optimal diversification across all 28 currency pairs with proper position sizing. This capital level ensures the series management system has adequate margin to work effectively during extended trends while maintaining conservative risk per trade.

How does the series order management differ from martingale strategies?

Unlike martingale systems that double positions after losses, Trending Mechanism adds positions strategically during trend continuation based on technical analysis. Each additional order is calculated using deviation parameters and trend strength, not arbitrary doubling that leads to account destruction.

What makes the virtual stop system superior to regular stops?

Virtual stops provide greater flexibility and avoid broker stop hunting. The system monitors positions internally and executes market orders when virtual levels are reached. This approach, combined with trailing capabilities, ensures better fill prices and superior profit protection compared to static hard stops.

Can I run this EA on fewer than 28 currency pairs?

Absolutely! You can select any subset of the supported pairs based on your account size and risk tolerance. Smaller accounts should focus on major pairs (EURUSD, GBPUSD, USDJPY, etc.) while larger accounts can utilize the full 28-pair diversification for maximum opportunity capture.

How does the protection-over-time mechanism work?

This innovative feature automatically closes positions after a specified time period, preventing prolonged exposure during uncertain market conditions. It protects against the common trend-following problem of holding positions too long during consolidation phases that can erode profits.

What happens during major news events?

The EA’s advanced trend detection algorithms adapt to increased volatility during news events. The deviation filtering helps distinguish between genuine trend moves and temporary news spikes, while the virtual stop system provides better protection against sudden reversals than traditional stops.

Is this suitable for ECN and raw spread accounts?

Yes, the EA includes specific ECN mode settings and combined stop management designed for low-spread, commission-based accounts. The execution logic is optimized for various broker types and account configurations, ensuring optimal performance regardless of your broker choice.

How often should I monitor the EA’s performance?

While the EA operates fully automatically, weekly performance reviews are recommended to ensure optimal settings for current market conditions. The flexible parameter system allows fine-tuning based on market regime changes, though the default settings work well across various conditions.

✅ Conclusion

Trending Mechanisms EA for MT4 represents the evolution of trend-following automation — combining sophisticated multi-pair analysis with intelligent risk management and innovative protection mechanisms. With its comprehensive currency coverage, advanced series management, and professional-grade capital controls, this isn’t just another trend EA — it’s a complete trading system designed for serious market participation.

Whether you’re seeking to diversify your automated trading portfolio or want a reliable system for systematic trend capture, Trending Mechanism EA delivers the perfect balance of opportunity identification, risk control, and scalable performance. Join the traders who’ve discovered that successful trend following requires more than simple indicators — it demands intelligent automation with institutional-grade sophistication.

Reviewed by Our Trader

Peter Jones

Pre-Purchase FAQs

Are updates always free?

Yes, all updates are completely free—you'll never pay twice.

We receive updates from developers and upload them to your account when they're available. Please be patient, as we're managing hundreds of products at discounted prices. More popular products are updated more frequently.

All versions are stored in your account for easy access.

What's your refund policy?

We offer a 7-day technical guarantee. If the EA fails to attach to your chart due to verified errors we can replicate, we'll issue a full refund.

However, we cannot refund based on trading performance or profit expectations—forex markets are unpredictable, and results vary by broker, spread, and market conditions. We provide tools, not guarantees.

I need assistance installing this?

Yes, we'd be happy to assist you!

We can advise you on the best settings for your account or create custom presets tailored to your needs. Additionally, we offer a one-time free installation service using AnyDesk for remote setup.

Please note, however, that we cannot provide advice on how to make money with any of our products.

Can I use this on multiple accounts?

Absolutely. Once you purchase, the EA is yours to use on unlimited live and demo accounts—no restrictions.

You can run it on multiple brokers, VPS servers, or trading accounts simultaneously.

There are no license limits or activation keys. Buy once, use everywhere.

How do I download after payment?

After successful payment, your product will be available for download instantly:

- Displayed on the screen immediately after checkout

- Emailed to the address you provided during purchase

- Stored in your account if you created one at checkout

In rare cases (about 1% of high-value premium products), orders may be held for manual review to prevent fraud. If you don't see a download link, contact us for assistance.

Is this an original product?

Yes, absolutely.

We do not sell fake products, and our customer reviews, along with our pricing, reflect the quality and authenticity of what we offer.

Why Traders Trust Us

Related Products

Powerful expert advisors, exclusive to CheaperForex, at the lowest prices.

-

Gold Magnet X Turbo EA MT4

Rated 0 out of 5$699.00Original price was: $699.00.$169.95Current price is: $169.95. -

Oceania Emperor AI EA MT4

Rated 0 out of 5$399.00Original price was: $399.00.$119.95Current price is: $119.95. -

Bitcoin Robot EA MT4 V9.8 – Official 2025 Version

Rated 0 out of 5$1,599.00Original price was: $1,599.00.$249.95Current price is: $249.95. -

Quantum Queen MT5 EA

Rated 0 out of 5$1,599.99Original price was: $1,599.99.$699.95Current price is: $699.95.