Save 50–80% on the official MQL5 product.

Same EA. Same updates. Same lifetime license. We just paid full price so you don't have to.

Cracked .ex5 files don't exist for marketplace products. This is a genuine MQL5 activation. If you're looking for pirated software, we're not the right store.

Our Customer Reviews

Excellent product quality.

The latest updated versions of EAs are sent as soon as they are available.

I can highly recommend this site

Have gotten a lot from them in the past and never been disappointed.

After reaching out, I was refunded right away. 5/5 stars in my book.

I received immediate attention to a credit card payment error and they organised a refund within minutes ( late on a Sunday evening ) plus a great saving on a quality Forex EA.

But you need to do your homework on any product before buying.

They give a lot of commitment from themselves. I highly recommend it to everyone!

I recommend it 100%

The products work as advertised and the customer support is topnotch.

Great support. Recommended, 5 STARS.

You can trust them completely.

All issues have been resolved. , If the problem cannot be resolved, a refund will be given.

Prima che intervenissi, si erano accorti dell'anomalia. Per me, piena fiducia all'operatore.

Best in the industry. Thank you for what you do

They also have an outstanding customer care services .

It makes a change from most of the scam forex websites!

How MQL5 Activation Works

You're up and running in under 5 minutes

Purchase

Save 50–80%

on the exact same official product

We Activate It

Installed onto your MT5

remotely in 60 seconds, ready to trade

Attach & Trade

Drag onto your chart

open MT5, attach to chart, done

Free Updates

Always the latest version

updates arrive straight to your MT5

🤷 Not sure how to set it up?

We'll do everything for you — install the EA, configure your settings, and get you trading. You can run it on your home PC or your own VPS, but for the best results we recommend a Windows VPS from just $13/month — runs 24/7, no disconnections, no need to keep your computer on.

VectorPrime EA MT5

VectorPrime EA is a high performance MT5 expert advisor that uses multi-layered vector logic for safe, structured execution.

It avoids martingale/grid completely, achieves +121% live growth with 1.1% drawdown, and adapts to volatility using its modular AI architecture.

This is the latest version with ongoing updates.

More Information:

+ https://www.mql5.com/en/market/product/147111

Live Performance Signals:

+ https://www.mql5.com/en/signals/2327845

Save 50–80% on the official MQL5 product.

Same EA. Same updates. Same lifetime license.

Cracked .ex5 files don't exist for marketplace products. This is a genuine MQL5 activation.

Buy Now

Latest version with all future updates.

The lowest legitimate price — anywhere.

$599.00 Original price was: $599.00.$279.95Current price is: $279.95.

when the developer raises theirs, ours increase too.

Yes! All products listed on our site are in stock and ready for immediate activation.

No waiting periods, no group buys. Purchase today, get it activated today.

We don't send you a file. Instead, we remotely activate the EA directly onto your MT5 terminal — the same way it would be installed if you bought from MQL5 at full price.

Updates are downloaded directly from within your MT5 terminal — no need to contact us.

Simply open the developer's product page in the MQL5 marketplace and click "Update" whenever a new version is released. It's fully self-service and takes seconds.

Yes — 100% genuine. This is activated directly from the developer's official MQL5 marketplace listing.

Unlike downloadable files (which can be fake or cracked), this EA is installed through MQL5's one-click activation system, ensuring you get the real product with full functionality and automatic updates.

You're getting the exact same lifetime license as buying directly from MQL5 — just at a fraction of the price.

If you change your mind before we activate the product in your MT5 terminal, you get a full refund — no questions asked.

Once activated and working correctly, refunds are no longer available as the license is permanently yours and cannot be revoked.

Buying directly on MQL5 means paying full price — often $500–$1,500 — without knowing if the EA will work for you. If it doesn't perform, there's no refund.

With us, you get the exact same official lifetime-licensed copy for up to 70% less. Test it at lower risk before committing full price elsewhere.

Trusted since 2019 with 28,000+ customers. No renewals, no expiry, no surprises.

Volume purchasing + lower overhead = better prices for you.

We purchase licenses in bulk, then pass the wholesale savings to you. MQL5 charges full retail because they're a marketplace with fees and overhead. We buy direct and operate lean.

You get the exact same product:

✅ Same official MQL5 license (not cracked or pirated)

✅ Same lifetime updates from the developer

✅ Same technical support

✅ We handle the activation for you (under 2 minutes)

The only difference? You pay 50–80% less.

28,000+ customers trust us. Rated "Excellent" on Trustpilot with 116+ reviews.

No. This is an official marketplace product — it must be activated directly inside your MT5 terminal via the MQL5 marketplace.

This is the only legitimate way to receive the product and ensures you get all future updates automatically.

If you're looking for a downloadable file instead of legitimate marketplace activation, please do not purchase.

No — and sites claiming otherwise are scams. This is an official MQL5 marketplace product that requires activation. Cracked .ex5 files don't exist for marketplace products.

Sites advertising "free downloads" typically deliver a password-locked zip file, then charge $200+ on Telegram for the password — which unlocks junk files, not the real EA. Several of these sites have been reported for fraud.

We offer the genuine product at 50–80% below MQL5 retail price with official marketplace activation, free updates, and a 7-day money-back guarantee before activation.

Full refund before activation. Zero risk.

Change your mind before we activate the EA? You get a full refund, no questions asked. Simply email us within 7 days of purchase.

Once the EA is activated on your MT5 platform, the license is permanently yours and cannot be reclaimed. Refunds are only available before activation.

Installed directly from the MQL5 marketplace

We can install it for you — no technical skills needed

Not tech-savvy? No problem. After purchase, contact us and we'll remotely install and configure the EA on your MT5 — takes under 2 minutes, completely free.

MQL5 marketplace doesn't offer any installation help. We do, free of charge.

Installed from the official marketplace, there's no difference

🧭 Table of Contents

- 🧠 Introduction to VectorPrime EA (2 min read)

- 🧩 Core AI Modules (1 min read)

- 📈 Backtest & Live Performance (2 min read)

- ⚙️ Deployment Guidelines (1 min read)

- 📦 What You Get (30 sec read)

- ⭐ User Reviews (1 min read)

- ❓ FAQ (1.5 min read)

- ✅ Final Thoughts (30 sec read)

🧠 Introduction to VectorPrime EA for MT5

VectorPrime EA is a precision-built expert advisor developed by Maxim Kurochkin, designed for H1 trading on MetaTrader 5 using proprietary vector-based market interpretation. It avoids all probabilistic forecasting, grid, martingale, or news-dependency — instead, it follows a structured logic based on direction, momentum, and matrix-level price behavior.

This system analyzes interconnected vectors of price activity, forming a multi-dimensional market map to trigger context-aware trades. With fixed Stop Loss/Take Profit levels and an adaptive execution protocol, VectorPrime provides exceptional stability in both volatile and ranging environments — making it ideal for traders seeking professional-grade, low-drawdown systems.

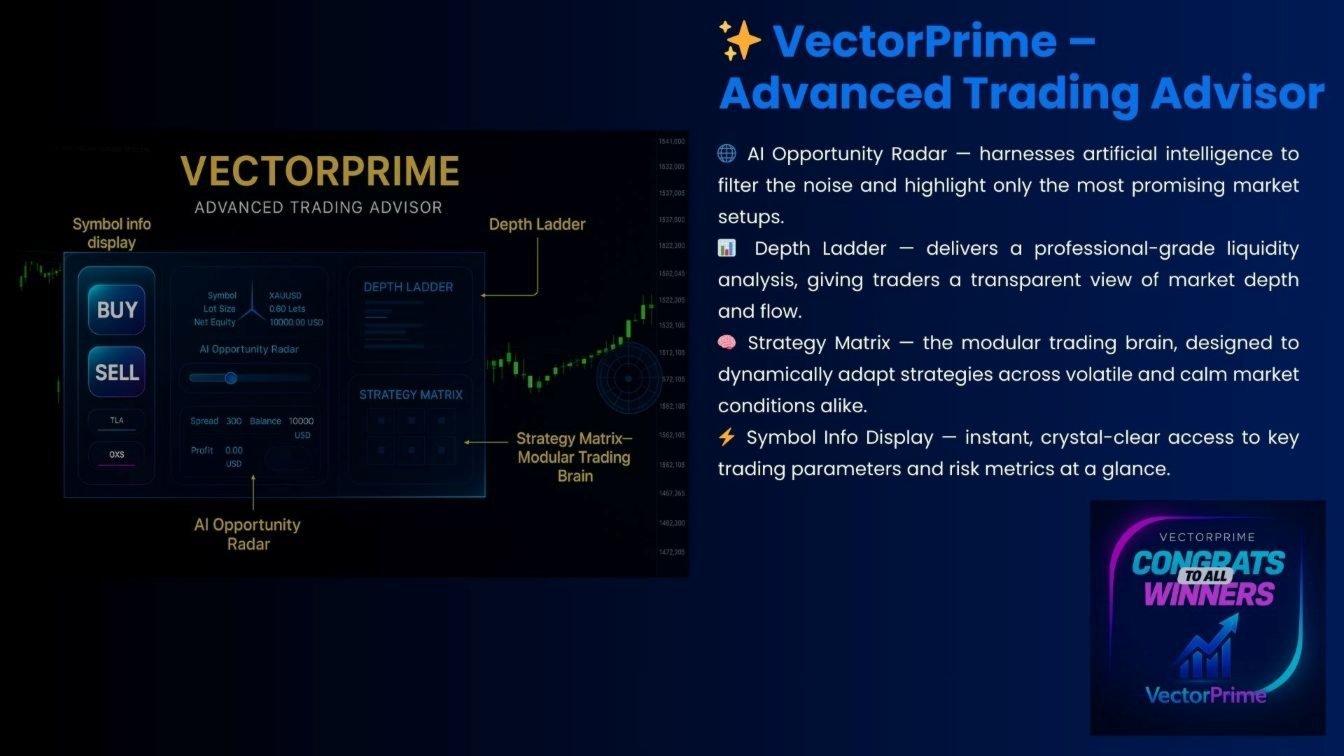

🧩 Core AI Modules

- 📡 AI Opportunity Radar: Filters out market noise to detect optimal entry scenarios

- 🧠 Strategy Matrix: Modular trade logic that adjusts to volatility conditions

- 📊 Depth Ladder: Real-time market flow visualization and decision weighting

- 🧮 Vector Dynamics Engine: Breaks down price flow into directional components

- 🔁 Prime Momentum Layer: Evaluates micro-impulses for trade validation

- 🔲 Matrix Vector Module: Builds a multi-dimensional model of price structure

Each trade is placed with predefined risk limits and zero dependency on external signals or news. VectorPrime’s logic allows it to remain resilient under asymmetric liquidity, weekend gaps, and session transitions.

📈 Backtest & Live Performance

✅ Real Signal (Verified Live Account)

- Growth: +121%

- Max Drawdown: 1.1%

- Win Rate: 100%

- Trading Activity: 1.1%

- Deposit Load: 3.6%

-

AI Vectorprime EA MT5 Live Trading Performance on a Real Account

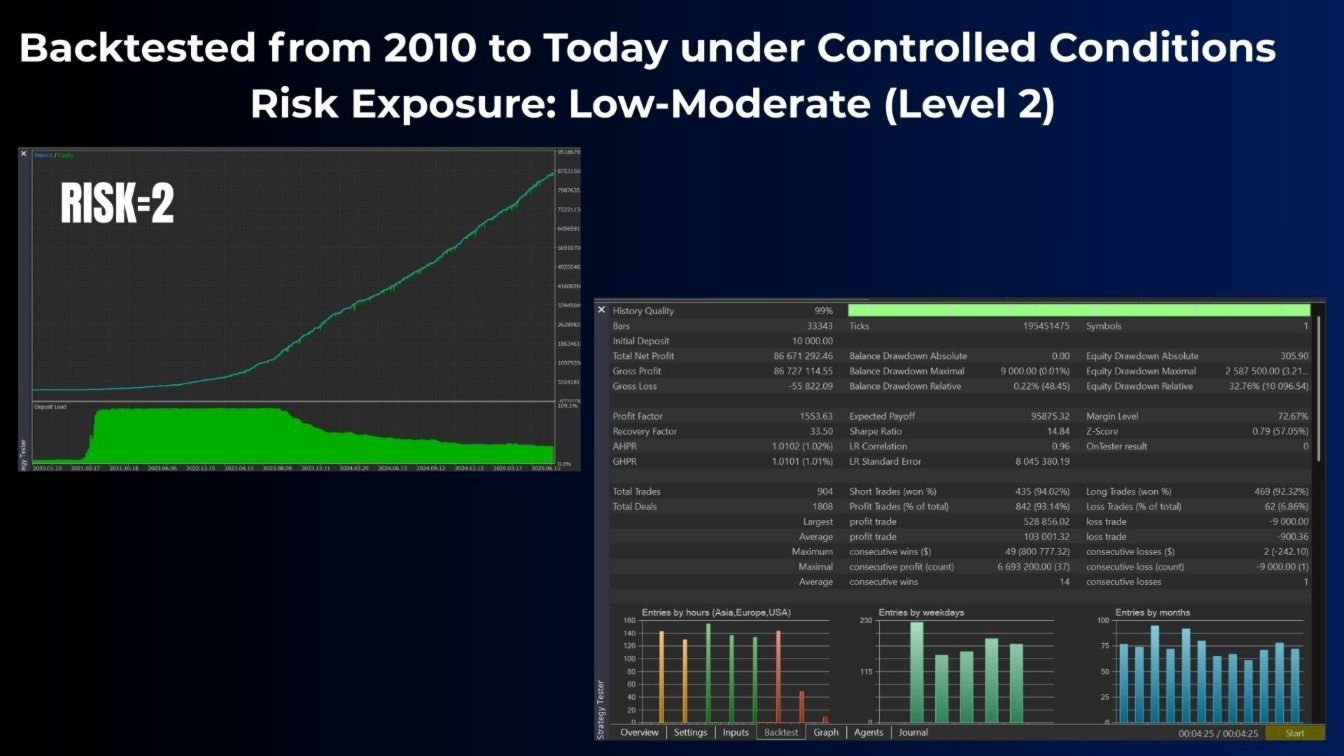

📊 Backtest (Risk Level 2 – Low/Moderate)

- Net Profit: $86,671,292

- Max Drawdown: 0.22%

- Profit Factor: 1553.63

- Recovery Factor: 33.50

- Sharpe Ratio: 14.84

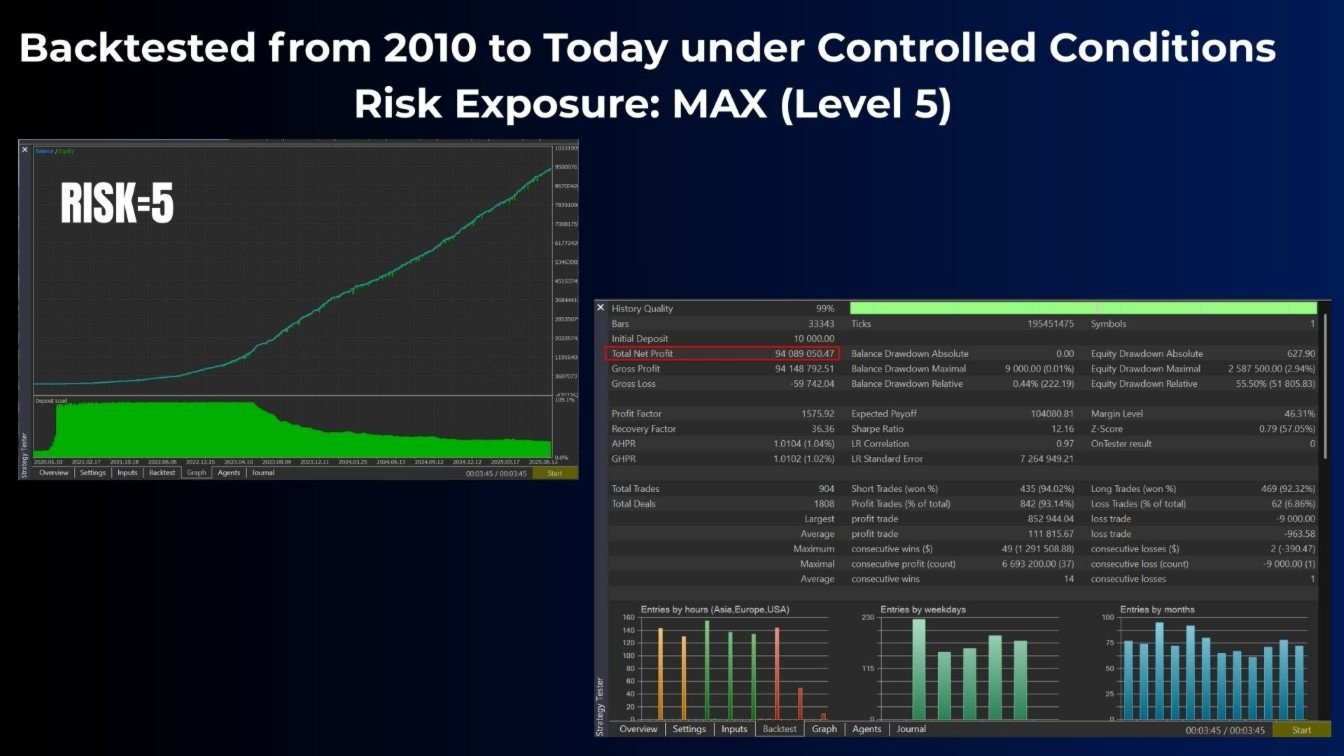

🔥 Backtest (Risk Level 5 – Maximum)

- Net Profit: $94,089,050

- Max Drawdown: 0.44%

- Profit Factor: 1575.92

- Sharpe Ratio: 12.16

⚙️ Deployment Guidelines

- 🕒 Recommended Timeframe: H1

- 💵 Minimum Capital: $500

- 📉 Broker Type: ECN / Raw Spread

- 📶 Latency: Best with low-latency VPS

- 🛡️ Risk Style: Fixed SL/TP, no martingale, grid, or position scaling

- ✅ Prop Firm Safe: Yes (drawdown limits respected)

📦 What You Get

- ✔️ VectorPrime EA directly from the market

- ✔️ Verified performance

- ✔️ Installation assistance

- ✔️ Free updates and every version release

- ✔️ Lifetime license with no renewal fees

⭐ Real User Reviews

“After a week of testing, VectorPrime runs smoothly. It’s stable, clean, and feels much safer than my old grid bots.”

– Ca Phu Minh

“The system is unique. The matrix logic takes a bit to understand, but it’s clearly well-designed. I’ll be going live next week.”

– Jegan E.

“Very high hit rate. Live profits from day one. No overtrading at all.”

– Sven Weller

“Support is responsive and professional. This feels like a proper AI system, not a retail gimmick.”

– louish123

❓ Frequently Asked Questions

Does VectorPrime EA use martingale or grid?

No. It uses a structured execution logic with fixed SL/TP on every trade.

Can I use this for prop firm challenges?

Yes. It was designed to respect structured drawdown and pass strict prop firm risk requirements.

What pairs does it trade?

It is deployed per symbol — the backtest examples use gold (XAUUSD), but it’s optimized per market. Only use one pair per chart.

Is it beginner friendly?

Yes, if you’re comfortable with MT5. Install it, set your risk level, and it runs autonomously.

How often does it trade?

It’s selective. With live trading activity at 1.1%, it only enters when market vectors align with predefined structures.

✅ Final Thoughts

VectorPrime EA represents a new class of algorithmic trading — one focused on stability, structured execution, and vector-driven price interpretation. If you’re tired of aggressive, high-risk bots, this is your calm in the chaos. Use it with confidence on a live or prop firm account, and let it handle the complexity for you.

🎯 Add to Cart now – Lifetime Access, Real Results

Peter Jones

Us vs MQL5 Marketplace

See why 28,000+ customers choose us

|

CheaperForex

Best Value

|

MQL5 Direct | |

|---|---|---|

| Price | ✓ Save 50-80% | Full price |

| Crypto Discount | ✓ Extra 20% off | ✗ Not available |

| Refund Policy | ✓ Full refund before activation | ✗ Store credit only |

| Payment Options | ✓ Cards, Apple Pay, Crypto | ✓ Cards only |

| Activation Support | ✓ We install for you | ✓ Self-install |

| Ownership | ✓ Lifetime, no expiration | ✓ Lifetime, no expiration |

| Hardware Activations | ⚠ 1 (up to 10 MT5s) | ✓ 5 activations |

| Trustpilot | ✓ Rated "Excellent" | — Seller ratings vary |

Us vs MQL5 Marketplace

Tap to compare →

CheaperForex

MQL5 Direct

How We Deliver Your EA (2 Minutes)

Why Traders Trust Us

Frequently Asked Questions

Is this an official product?

Yes. This is activated directly from the developer's official MQL5 marketplace listing—guaranteed authentic.

Unlike downloadable files (which can be fake or cracked), this EA is installed through MQL5's one-click activation system, ensuring you get the real product with full functionality and instant automatic updates.

When you buy from us, you're getting the exact same lifetime license as buying directly from MQL5—just at a fraction of the price.

Are updates always free and instant?

Yes, product updates for this EA are always free and instant.

They can be downloaded from within the terminal from the marketplace.

Just go to the product listing and click "update" if there's one available.

How do I get this after paying?

Most activations are completed within 15-30 minutes of purchase.

Here's the simple process:

This is an official MQL5 product that must be activated directly from the marketplace—it cannot be downloaded as a standalone file.

Installation process:

1. After purchase, we'll schedule a quick activation session (usually within a few hours)

2. You grant us temporary access via UltraViewer or AnyDesk (takes ~2 minutes), OR provide temporary VPS credentials

3. We activate the EA on your MT5 terminal(s)

4. Done! The EA is permanently yours with instant updates from MQL5

The entire process is secure and takes about 2 minutes.

After activation, no further involvement from us is needed.

How does the 7-day refund policy work?

If you change your mind before we activate the official product in your MT5 terminal, you are eligible for a full refund. Absolutely no questions asked.

Once it has been activated and is working correctly, refunds are no longer available and our regular 7-day refund policy does not apply.

Once we've activated it for you, we can't take it back and it's yours permanently.

How long does activation take?

Usually within a few hours of purchase, but often much faster.

Immediately after purchase, you'll receive an instructional PDF explaining the simple activation process.

Don't worry—it's straightforward, and our refund policy applies anytime before we activate the EA on your terminal.

What if I reinstall MT5 or get a new computer?

Activations are tied to your hardware ID, not your MT5 installation.

Free reactivation if:

• You reinstall MT5 on the same computer

• You accidentally delete MT5

• Windows updates cause issues (this is rare)

• You reinstall Windows (sometimes this doesn't work, but we will always attempt it for you)

Reactivation NOT possible if:

• You get a new computer (different hardware)

• You upgrade major hardware components (motherboard, etc.)

Important: Treat your installation with care. If you're planning to reformat or upgrade hardware, contact us FIRST so we can assist you.

Contact [email protected] with your order number if you need help.

Why should I buy here?

Buying directly on MQL5 means paying full price upfront—often $500-$1,500—without knowing if the EA will work for you. If it doesn't perform or the developer abandons it, there's no refund.

At CheaperForex, you get the exact same official, lifetime-licensed copy for up to 70% less. Test it at a lower risk before committing full price elsewhere.

We've been trusted since 2019, and every EA is yours forever—no renewals, no expiry, no surprises. Smarter investing in trading tools.

Related Products

Official MT5 expert advisors, exclusive to CheaperForex, at the lowest prices.

-

Synthara MT5 EA

Rated 0 out of 5$699.00Original price was: $699.00.$249.95Current price is: $249.95. -

AI Neuro Dynamics MT5 EA

Rated 0 out of 5$599.00Original price was: $599.00.$239.95Current price is: $239.95. -

Golden Hen EA MT5

Rated 0 out of 5$799.00Original price was: $799.00.$399.95Current price is: $399.95. -

Quantum Queen MT5 EA

Rated 0 out of 5$1,549.99Original price was: $1,549.99.$699.95Current price is: $699.95.