Save 50–80% on the official MQL5 product.

Same EA. Same updates. Same lifetime license. We just paid full price so you don't have to.

Cracked .ex5 files don't exist for marketplace products. This is a genuine MQL5 activation. If you're looking for pirated software, we're not the right store.

Our Customer Reviews

Excellent product quality.

The latest updated versions of EAs are sent as soon as they are available.

I can highly recommend this site

Have gotten a lot from them in the past and never been disappointed.

After reaching out, I was refunded right away. 5/5 stars in my book.

I received immediate attention to a credit card payment error and they organised a refund within minutes ( late on a Sunday evening ) plus a great saving on a quality Forex EA.

But you need to do your homework on any product before buying.

They give a lot of commitment from themselves. I highly recommend it to everyone!

I recommend it 100%

The products work as advertised and the customer support is topnotch.

Great support. Recommended, 5 STARS.

You can trust them completely.

All issues have been resolved. , If the problem cannot be resolved, a refund will be given.

Prima che intervenissi, si erano accorti dell'anomalia. Per me, piena fiducia all'operatore.

Best in the industry. Thank you for what you do

They also have an outstanding customer care services .

It makes a change from most of the scam forex websites!

How MQL5 Activation Works

You're up and running in under 5 minutes

Purchase

Save 50–80%

on the exact same official product

We Activate It

Installed onto your MT5

remotely in 60 seconds, ready to trade

Attach & Trade

Drag onto your chart

open MT5, attach to chart, done

Free Updates

Always the latest version

updates arrive straight to your MT5

🤷 Not sure how to set it up?

We'll do everything for you — install the EA, configure your settings, and get you trading. You can run it on your home PC or your own VPS, but for the best results we recommend a Windows VPS from just $13/month — runs 24/7, no disconnections, no need to keep your computer on.

VolumeHedger EA MT5

VolumeHedger EA for MT5 is a volume-triggered hedging loop with spoofing-protected exits, slippage control, holiday/gap filters, and custom-indicator entries.

Live signal (PUPrime): ~85% growth, 13.5% max drawdown, 63.7% win rate since 2025.

Minimum balance from $10 with included set files (BTCUSD, Gold, funded accounts).

This is the latest version, installed directly on your MT5, with all future updates included for free.

More Information:

+ https://www.mql5.com/en/market/product/143890

Live Performance Signals:

+ https://www.mql5.com/en/users/kanfur78/seller

Save 50–80% on the official MQL5 product.

Same EA. Same updates. Same lifetime license.

Cracked .ex5 files don't exist for marketplace products. This is a genuine MQL5 activation.

Buy Now

Latest version with all future updates.

The lowest legitimate price — anywhere.

$749.00 Original price was: $749.00.$299.95Current price is: $299.95.

when the developer raises theirs, ours increase too.

Yes! All products listed on our site are in stock and ready for immediate activation.

No waiting periods, no group buys. Purchase today, get it activated today.

We don't send you a file. Instead, we remotely activate the EA directly onto your MT5 terminal — the same way it would be installed if you bought from MQL5 at full price.

Updates are downloaded directly from within your MT5 terminal — no need to contact us.

Simply open the developer's product page in the MQL5 marketplace and click "Update" whenever a new version is released. It's fully self-service and takes seconds.

Yes — 100% genuine. This is activated directly from the developer's official MQL5 marketplace listing.

Unlike downloadable files (which can be fake or cracked), this EA is installed through MQL5's one-click activation system, ensuring you get the real product with full functionality and automatic updates.

You're getting the exact same lifetime license as buying directly from MQL5 — just at a fraction of the price.

If you change your mind before we activate the product in your MT5 terminal, you get a full refund — no questions asked.

Once activated and working correctly, refunds are no longer available as the license is permanently yours and cannot be revoked.

Buying directly on MQL5 means paying full price — often $500–$1,500 — without knowing if the EA will work for you. If it doesn't perform, there's no refund.

With us, you get the exact same official lifetime-licensed copy for up to 70% less. Test it at lower risk before committing full price elsewhere.

Trusted since 2019 with 28,000+ customers. No renewals, no expiry, no surprises.

Volume purchasing + lower overhead = better prices for you.

We purchase licenses in bulk, then pass the wholesale savings to you. MQL5 charges full retail because they're a marketplace with fees and overhead. We buy direct and operate lean.

You get the exact same product:

✅ Same official MQL5 license (not cracked or pirated)

✅ Same lifetime updates from the developer

✅ Same technical support

✅ We handle the activation for you (under 2 minutes)

The only difference? You pay 50–80% less.

28,000+ customers trust us. Rated "Excellent" on Trustpilot with 116+ reviews.

No. This is an official marketplace product — it must be activated directly inside your MT5 terminal via the MQL5 marketplace.

This is the only legitimate way to receive the product and ensures you get all future updates automatically.

If you're looking for a downloadable file instead of legitimate marketplace activation, please do not purchase.

No — and sites claiming otherwise are scams. This is an official MQL5 marketplace product that requires activation. Cracked .ex5 files don't exist for marketplace products.

Sites advertising "free downloads" typically deliver a password-locked zip file, then charge $200+ on Telegram for the password — which unlocks junk files, not the real EA. Several of these sites have been reported for fraud.

We offer the genuine product at 50–80% below MQL5 retail price with official marketplace activation, free updates, and a 7-day money-back guarantee before activation.

Full refund before activation. Zero risk.

Change your mind before we activate the EA? You get a full refund, no questions asked. Simply email us within 7 days of purchase.

Once the EA is activated on your MT5 platform, the license is permanently yours and cannot be reclaimed. Refunds are only available before activation.

Installed directly from the MQL5 marketplace

We can install it for you — no technical skills needed

Not tech-savvy? No problem. After purchase, contact us and we'll remotely install and configure the EA on your MT5 — takes under 2 minutes, completely free.

MQL5 marketplace doesn't offer any installation help. We do, free of charge.

Installed from the official marketplace, there's no difference

VolumeHedger EA for MT5 (Volume Hedger)

VolumeHedger EA is a robust, volume-driven hedging system for MT5. Instead of guessing direction, it opens a bi-directional loop once volume conditions are met, then manages exposure with smart position limits, spoofing-resistant exits, slippage control, and dynamic pips adjustment. You can plug in your own indicator to define the first entry—no need to buy multiple EAs for entries.

🔑 Highlights

- Custom-Indicator Entries — point the EA to any indicator (path + buffer index + shift) and let that define the first trade of the loop.

- Hedged Martingale Loop — opens Buy & Sell as needed; caps are enforced by maximum positions and risk rules.

- Spoofing Protection — hides the real TP; closes positions the moment price hits target to reduce manipulation risk.

- Dynamic Volume Multiplier — scales via more trades rather than oversized lots. Balance- or equity-based modes; remembers the starting baseline.

- Execution Resilience — slippage detection updates TP/SL/prices on the fly; spread guard and critical spread pause during spikes.

- Environment Filters — bank-holiday filter (USD, EUR, GBP, JPY, CAD, CHF, AUD, NZD, CNY), time permissions, first-75-minutes block, gap protection for weekends, and market cooldown timers.

- Multi-Symbol & Multi-EA — block or allow new entries using Magic Number lists; coordinate with your other EAs.

🧩 How the Loop Works

- First Trade — launched by volume threshold or your chosen entry strategy (Candle+ATR, ADX, or Custom Indicator).

- Bi-Directional Hedging — EA opens opposite-side positions as rules require; can close older legs to minimise loss.

- Risk Envelope — loop ends only at target profit or when position limit/margin constraint is reached.

- Re-Analysis — after the first loop, the EA re-evaluates to reduce further risk.

🛡️ Spoofing Protection

This protection hides the true TP level from the broker/exchange and manually exits at target, helping avoid adverse micro-manipulation. Sudden exits may include slippage—often favourable when momentum is with you.

🎚️ Dynamic Volume Multiplier

Goal: increase the number of positions as balance grows, not the lot size. Choose Balance-based or Equity-based scaling. The EA remembers the smart starting balance, so withdrawals/deposits don’t distort sizing.

🔌 Entry Strategies (use your indicator)

- Candle Pattern + ATR

- ADX

- Custom Indicator — set indicator path, buffer index (0,1,2…), and shift (0=current, 1=closed bar). Ideal for catching vertical moves.

🕒 Time Permissions & Weekend Gap Protection

- Trading schedule — permit hours like

03:30–21:30or overnight spans; block selected weekdays (1–7). - First 75 minutes — EA blocks the first trade early each day to avoid chaotic opens.

- Gap Protection — if true, places a hedge for weekend carry; removes it at a set hour and updates original TP/SL based on outcome.

🧊 Market Cooldown & Bank Holidays

- After Trade Pending Timer — enforce a cooling period (e.g., 6 H1 candles) after a loop closes.

- Holiday Filter — pause X days before/after major holidays (USD, EUR, GBP, JPY, CAD, CHF, AUD, NZD, CNY).

📐 Dynamic Pips Adjustment

Automatically adapts Distance and TP as price regimes shift (great for XAUUSD long backtests). Configure Baseline Price, Price Interval (e.g. 200), and Percentage (e.g. 10–13%). Example: if gold rises from $3,000 to $3,300 and Distance is 1,300 points with 10% adjustment, it will auto-increase to ~1,430 points.

📈 Live Trading Performance (Verified Signal)

The developer runs VolumeHedger EA on a live account. Current signal snapshot:

- Growth: ≈ 85% since 2025

- Max drawdown: 13.5%

- Profit trades: 63.7%

- Max deposit load: 10.6%

- Algo trading: 100% • Trading activity: 27.2%

- Initial deposit: $300 • Profit: $230.12 • Equity: $331.84

- Broker feed: PUPrime-Live2 • Leverage: 1:500

Note: Live results vary by broker, spreads, swaps, and risk settings. Past performance is not a guarantee of future results.

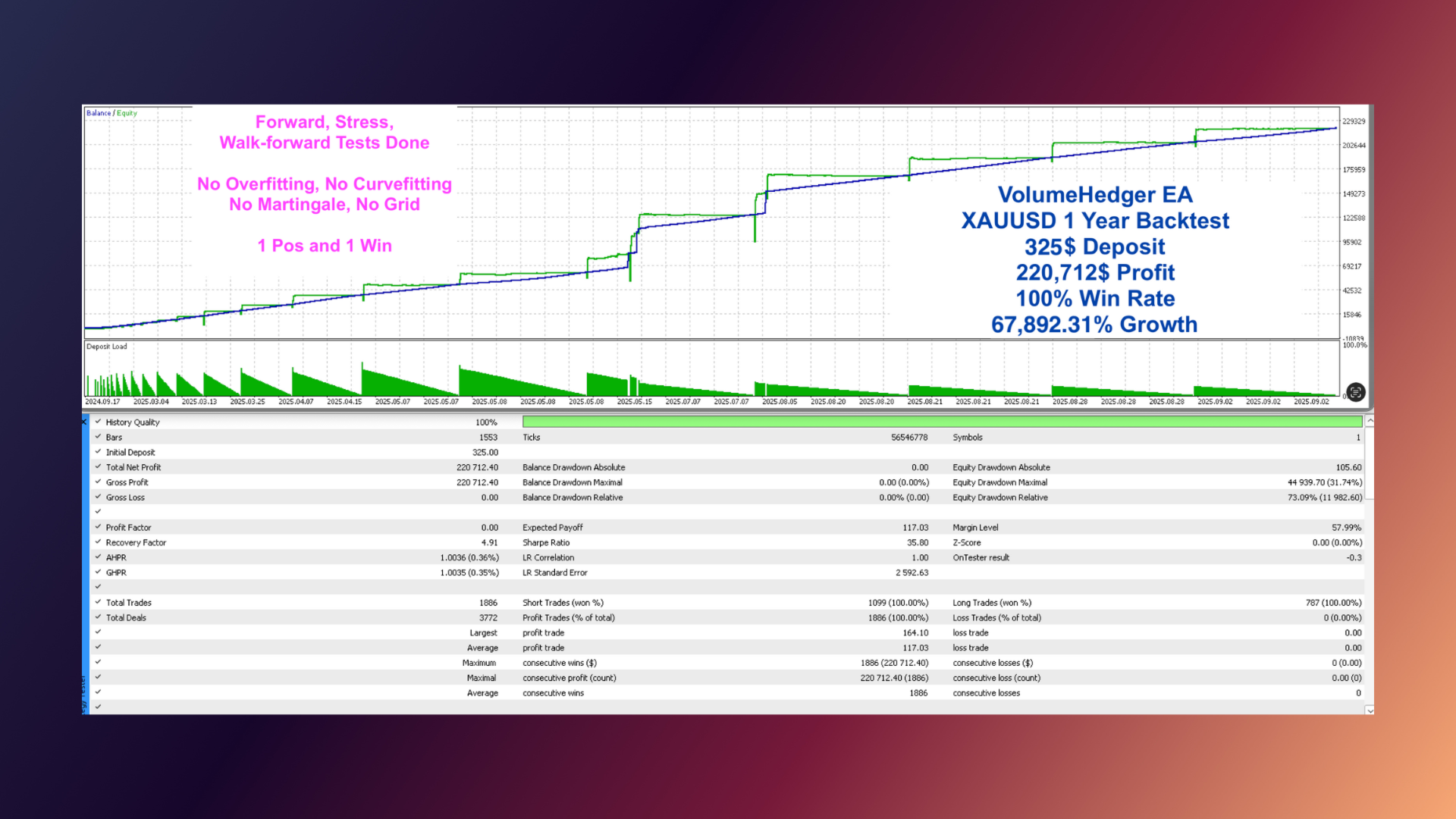

📈 Backtest: XAUUSD (1 Year)

Sample from the developer’s tests: $325 deposit → $220,712 profit with 100% win rate (growth ~67,892%). Walk-forward and stress tests applied. Note: backtests are illustrative and not guarantees; validate on your broker.

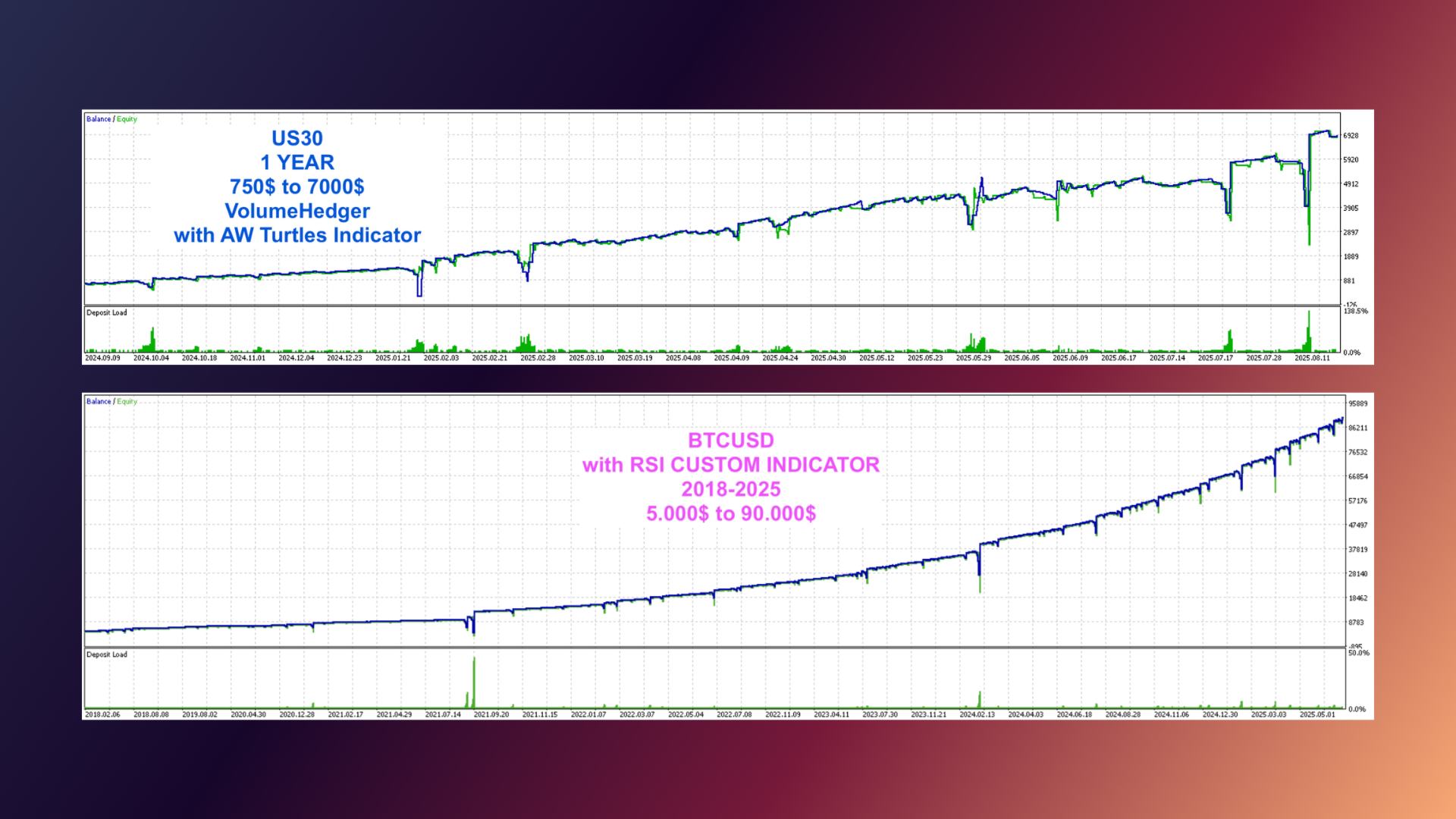

📊 Backtests: US30 & BTCUSD Examples

- US30 (1 year) — ~$750 → $7,000 with volume-triggered loops and indicator-assisted entries.

- BTCUSD (2018–2025) — ~$5,000 → $90,000 using an RSI-based custom indicator.

🖥️ On-Chart Walkthrough

The panel shows Minimum Balance Calculation by distance and max positions, a Manual Start button for the loop, and a visible tag when Spoofing Protection is active.

🧭 Requirements & Notes

- Minimum Balance: from $10 (with set file). The panel also displays the required minimum for your settings.

- Leverage: 1:500+ recommended to reduce margin pressure.

- Latency: tolerant; designed to work even around 500ms.

- Sets included: BTCUSD, Funded Accounts, Gold.

❓ Frequently Asked Questions

What is the minimum balance required?

From $10 with the included set file. The on-chart calculator shows the minimum for your distance/positions.

Does it use martingale or grid?

It employs a hedged martingale loop with a strict position limit. The Dynamic Volume Multiplier prefers more trades over larger lots.

Which instruments are best?

Forex, Gold, Indices, Crypto. Works well on assets with sharp swings or durable trends.

Do I need a VPS?

Latency tolerant, but a VPS is recommended for 24/5 reliability.

Can I coordinate with other EAs?

Yes — use Blocked/Allowed Magic Number lists to sequence entries and control exposure across charts.

Is it prop-firm friendly?

Depends on the firm. Some restrict hedging or martingale. A funded-account set is included; check rules first.

⭐ Trader Reviews

Sacha F. D. C. — “Algorithm is efficient and the dev is super responsive. Install support was excellent.”

wda24729 — “Ran it on demo for a month, then live on four accounts. The loop logic + sets for gold and BTC have been solid. Dev answers questions fast.”

Barış Ş. — “I’ve followed Furkan’s work for over a year. He builds practical algos and keeps iterating. VolumeHedger is his most versatile tool.”

Emily R. — “Custom indicator entry is the killer feature. I plug my own signals in; EA handles the loop and risk.”

Victor M. — “Spoofing protection + holiday/gap filters saved me a few times. Latency isn’t fussy; still I run a VPS for uptime.”

⚙️ Usage Recommendations

- Tune the lotsize list to match Distance/TP ratio.

- Enable the After Trade Timer (6–12 hours) to let markets cool after a loop.

- Use Dynamic Volume Multiplier for compounding; consider Equity-based mode in multi-EA setups.

- Enable Dynamic Pips for long backtests (XAUUSD).

- Run multiple symbols and manage exposure with Blocked/Allowed Magic lists.

- Try Gap Protection if you include Fridays in your schedule.

📦 What You Get

- ✔️ VolumeHedger EA for MT5 (latest build)

- ✔️ Set files for BTCUSD, Funded Accounts, and Gold

- ✔️ Quick-start & indicator-integration guide (buffers/shift)

- ✔️ Email support & all future updates

👤 About the Developer

H. Furkan Ozturk has 10+ years in software development and 2+ years focused on algorithmic trading. He builds strategies from indicators on request and shares tools widely to keep improving through community feedback.

Conclusion

VolumeHedger EA is a pragmatic approach to volatile markets: volume-triggered entries, a hedged loop with clear limits, spoofing-resistant exits, and broad risk filters. Add your own indicator for precision entries, run it across symbols, and manage exposure with Magic lists. As always, forward-test and size conservatively.

Peter Jones

Us vs MQL5 Marketplace

See why 28,000+ customers choose us

|

CheaperForex

Best Value

|

MQL5 Direct | |

|---|---|---|

| Price | ✓ Save 50-80% | Full price |

| Crypto Discount | ✓ Extra 20% off | ✗ Not available |

| Refund Policy | ✓ Full refund before activation | ✗ Store credit only |

| Payment Options | ✓ Cards, Apple Pay, Crypto | ✓ Cards only |

| Activation Support | ✓ We install for you | ✓ Self-install |

| Ownership | ✓ Lifetime, no expiration | ✓ Lifetime, no expiration |

| Hardware Activations | ⚠ 1 (up to 10 MT5s) | ✓ 5 activations |

| Trustpilot | ✓ Rated "Excellent" | — Seller ratings vary |

Us vs MQL5 Marketplace

Tap to compare →

CheaperForex

MQL5 Direct

How We Deliver Your EA (2 Minutes)

Why Traders Trust Us

Frequently Asked Questions

Is this an official product?

Yes. This is activated directly from the developer's official MQL5 marketplace listing—guaranteed authentic.

Unlike downloadable files (which can be fake or cracked), this EA is installed through MQL5's one-click activation system, ensuring you get the real product with full functionality and instant automatic updates.

When you buy from us, you're getting the exact same lifetime license as buying directly from MQL5—just at a fraction of the price.

Are updates always free and instant?

Yes, product updates for this EA are always free and instant.

They can be downloaded from within the terminal from the marketplace.

Just go to the product listing and click "update" if there's one available.

How do I get this after paying?

Most activations are completed within 15-30 minutes of purchase.

Here's the simple process:

This is an official MQL5 product that must be activated directly from the marketplace—it cannot be downloaded as a standalone file.

Installation process:

1. After purchase, we'll schedule a quick activation session (usually within a few hours)

2. You grant us temporary access via UltraViewer or AnyDesk (takes ~2 minutes), OR provide temporary VPS credentials

3. We activate the EA on your MT5 terminal(s)

4. Done! The EA is permanently yours with instant updates from MQL5

The entire process is secure and takes about 2 minutes.

After activation, no further involvement from us is needed.

How does the 7-day refund policy work?

If you change your mind before we activate the official product in your MT5 terminal, you are eligible for a full refund. Absolutely no questions asked.

Once it has been activated and is working correctly, refunds are no longer available and our regular 7-day refund policy does not apply.

Once we've activated it for you, we can't take it back and it's yours permanently.

How long does activation take?

Usually within a few hours of purchase, but often much faster.

Immediately after purchase, you'll receive an instructional PDF explaining the simple activation process.

Don't worry—it's straightforward, and our refund policy applies anytime before we activate the EA on your terminal.

What if I reinstall MT5 or get a new computer?

Activations are tied to your hardware ID, not your MT5 installation.

Free reactivation if:

• You reinstall MT5 on the same computer

• You accidentally delete MT5

• Windows updates cause issues (this is rare)

• You reinstall Windows (sometimes this doesn't work, but we will always attempt it for you)

Reactivation NOT possible if:

• You get a new computer (different hardware)

• You upgrade major hardware components (motherboard, etc.)

Important: Treat your installation with care. If you're planning to reformat or upgrade hardware, contact us FIRST so we can assist you.

Contact [email protected] with your order number if you need help.

Why should I buy here?

Buying directly on MQL5 means paying full price upfront—often $500-$1,500—without knowing if the EA will work for you. If it doesn't perform or the developer abandons it, there's no refund.

At CheaperForex, you get the exact same official, lifetime-licensed copy for up to 70% less. Test it at a lower risk before committing full price elsewhere.

We've been trusted since 2019, and every EA is yours forever—no renewals, no expiry, no surprises. Smarter investing in trading tools.

Related Products

Official MT5 expert advisors, exclusive to CheaperForex, at the lowest prices.

-

Axonshift EA MT5

Rated 0 out of 5$799.00Original price was: $799.00.$319.95Current price is: $319.95. -

Syna EA MT5

Rated 0 out of 5$3,197.79Original price was: $3,197.79.$1,499.95Current price is: $1,499.95. -

THOR Forex Hammer EA MT5

Rated 0 out of 5$299.00Original price was: $299.00.$99.95Current price is: $99.95. -

One Man Army EA MT5

Rated 0 out of 5$599.99Original price was: $599.99.$299.95Current price is: $299.95.