Save 50–80% on the official MQL5 product.

Same EA. Same updates. Same lifetime license. We just paid full price so you don't have to.

Cracked .ex5 files don't exist for marketplace products. This is a genuine MQL5 activation. If you're looking for pirated software, we're not the right store.

Our Customer Reviews

Excellent product quality.

The latest updated versions of EAs are sent as soon as they are available.

I can highly recommend this site

Have gotten a lot from them in the past and never been disappointed.

After reaching out, I was refunded right away. 5/5 stars in my book.

I received immediate attention to a credit card payment error and they organised a refund within minutes ( late on a Sunday evening ) plus a great saving on a quality Forex EA.

But you need to do your homework on any product before buying.

They give a lot of commitment from themselves. I highly recommend it to everyone!

I recommend it 100%

The products work as advertised and the customer support is topnotch.

Great support. Recommended, 5 STARS.

You can trust them completely.

All issues have been resolved. , If the problem cannot be resolved, a refund will be given.

Prima che intervenissi, si erano accorti dell'anomalia. Per me, piena fiducia all'operatore.

Best in the industry. Thank you for what you do

They also have an outstanding customer care services .

It makes a change from most of the scam forex websites!

How MQL5 Activation Works

You're up and running in under 5 minutes

Purchase

Save 50–80%

on the exact same official product

We Activate It

Installed onto your MT5

remotely in 60 seconds, ready to trade

Attach & Trade

Drag onto your chart

open MT5, attach to chart, done

Free Updates

Always the latest version

updates arrive straight to your MT5

🤷 Not sure how to set it up?

We'll do everything for you — install the EA, configure your settings, and get you trading. You can run it on your home PC or your own VPS, but for the best results we recommend a Windows VPS from just $13/month — runs 24/7, no disconnections, no need to keep your computer on.

Loophole EA MT5

Loophole EA is a precision-engineered averaging system specifically calibrated for NZDCAD trading on MT5.

Using advanced RSI and CCI indicator fusion with dynamic risk management, it systematically captures profit opportunities through intelligent position averaging.

Optimized over 6 years of historical data with verified live performance showing 77% win rates and exceptional risk control.

This is the latest version with ongoing updates.

More Information:

+ https://www.mql5.com/en/market/product/146166

Live Performance Signals:

+ https://www.mql5.com/en/signals/2323306

Save 50–80% on the official MQL5 product.

Same EA. Same updates. Same lifetime license.

Cracked .ex5 files don't exist for marketplace products. This is a genuine MQL5 activation.

Buy Now

Latest version with all future updates.

The lowest legitimate price — anywhere.

$399.00 Original price was: $399.00.$149.95Current price is: $149.95.

when the developer raises theirs, ours increase too.

Yes! All products listed on our site are in stock and ready for immediate activation.

No waiting periods, no group buys. Purchase today, get it activated today.

We don't send you a file. Instead, we remotely activate the EA directly onto your MT5 terminal — the same way it would be installed if you bought from MQL5 at full price.

Updates are downloaded directly from within your MT5 terminal — no need to contact us.

Simply open the developer's product page in the MQL5 marketplace and click "Update" whenever a new version is released. It's fully self-service and takes seconds.

Yes — 100% genuine. This is activated directly from the developer's official MQL5 marketplace listing.

Unlike downloadable files (which can be fake or cracked), this EA is installed through MQL5's one-click activation system, ensuring you get the real product with full functionality and automatic updates.

You're getting the exact same lifetime license as buying directly from MQL5 — just at a fraction of the price.

If you change your mind before we activate the product in your MT5 terminal, you get a full refund — no questions asked.

Once activated and working correctly, refunds are no longer available as the license is permanently yours and cannot be revoked.

Buying directly on MQL5 means paying full price — often $500–$1,500 — without knowing if the EA will work for you. If it doesn't perform, there's no refund.

With us, you get the exact same official lifetime-licensed copy for up to 70% less. Test it at lower risk before committing full price elsewhere.

Trusted since 2019 with 28,000+ customers. No renewals, no expiry, no surprises.

Volume purchasing + lower overhead = better prices for you.

We purchase licenses in bulk, then pass the wholesale savings to you. MQL5 charges full retail because they're a marketplace with fees and overhead. We buy direct and operate lean.

You get the exact same product:

✅ Same official MQL5 license (not cracked or pirated)

✅ Same lifetime updates from the developer

✅ Same technical support

✅ We handle the activation for you (under 2 minutes)

The only difference? You pay 50–80% less.

28,000+ customers trust us. Rated "Excellent" on Trustpilot with 116+ reviews.

No. This is an official marketplace product — it must be activated directly inside your MT5 terminal via the MQL5 marketplace.

This is the only legitimate way to receive the product and ensures you get all future updates automatically.

If you're looking for a downloadable file instead of legitimate marketplace activation, please do not purchase.

No — and sites claiming otherwise are scams. This is an official MQL5 marketplace product that requires activation. Cracked .ex5 files don't exist for marketplace products.

Sites advertising "free downloads" typically deliver a password-locked zip file, then charge $200+ on Telegram for the password — which unlocks junk files, not the real EA. Several of these sites have been reported for fraud.

We offer the genuine product at 50–80% below MQL5 retail price with official marketplace activation, free updates, and a 7-day money-back guarantee before activation.

Full refund before activation. Zero risk.

Change your mind before we activate the EA? You get a full refund, no questions asked. Simply email us within 7 days of purchase.

Once the EA is activated on your MT5 platform, the license is permanently yours and cannot be reclaimed. Refunds are only available before activation.

Installed directly from the MQL5 marketplace

We can install it for you — no technical skills needed

Not tech-savvy? No problem. After purchase, contact us and we'll remotely install and configure the EA on your MT5 — takes under 2 minutes, completely free.

MQL5 marketplace doesn't offer any installation help. We do, free of charge.

Installed from the official marketplace, there's no difference

⚙️ Introduction to Loophole EA for MT5

Every market has its rhythm — and with Loophole EA, you’re tuned into NZDCAD’s perfect frequency. Crafted by Vladimir Lekhovitser as the ultimate single-pair specialist, this EA doesn’t scatter its focus across dozens of currencies. Instead, it laser-targets the NZDCAD pair with surgical precision, using advanced RSI and CCI analysis combined with intelligent averaging to turn market volatility into consistent profits.

Built for traders who understand that specialization beats generalization, Loophole EA transforms six years of backtesting and optimization into a systematic profit machine — all while maintaining dynamic risk controls that adapt to changing market conditions.

🔍 Key Features

✅ Currency Specialization: Exclusively optimized for NZDCAD

✅ Strategy Type: Advanced averaging with RSI and CCI indicators

✅ Risk Management: Dynamic take-profit and stop-loss levels

✅ Account Type: Hedging account required

✅ Minimum Deposit: $300 USD (accessible entry point)

✅ Timeframe: Multi-timeframe internal analysis

✅ News Protection: Built-in high/medium/low impact news filtering

✅ Session Control: Advanced time settings and Christmas trading avoidance

✅ Broker Optimization: Calibrated for IC Markets/IC Trading

✅ Magic Number System: Configurable trade identification (10700-10725)

🏪 Official MQL5 Marketplace Product

You’ll receive the genuine, verified version directly from the MQL5 Marketplace — not a cracked copy. We handle the installation process for you, so the EA appears automatically in your MT5 terminal with full developer support and lifetime updates included.

💡 Key Benefits

🔹 Single-Pair Mastery

While other EAs spread thin across multiple currencies, Loophole EA achieves mastery through specialization. Six years of NZDCAD-specific optimization means every parameter is fine-tuned for this pair’s unique volatility patterns and trading characteristics.

🔹 Intelligent Averaging Strategy

Not your typical “hope and pray” averaging system. Loophole EA uses RSI and CCI confluence to identify optimal entry points for position averaging, ensuring each additional position is strategically placed rather than randomly added.

🔹 Dynamic Risk Adaptation

Take-profit and stop-loss levels aren’t static — they adapt to market conditions in real-time. This dynamic approach ensures optimal profit capture during favorable moves while protecting capital during adverse conditions.

🔹 News Event Protection

Built-in news filtering automatically pauses trading during high-impact economic releases, protecting your positions from unpredictable volatility spikes that can damage averaging strategies.

🔹 Broker-Optimized Performance

Specifically calibrated for IC Markets and IC Trading execution characteristics, ensuring optimal performance with these top-tier brokers’ spreads, slippage, and execution speeds.

📈 Verified Performance Results

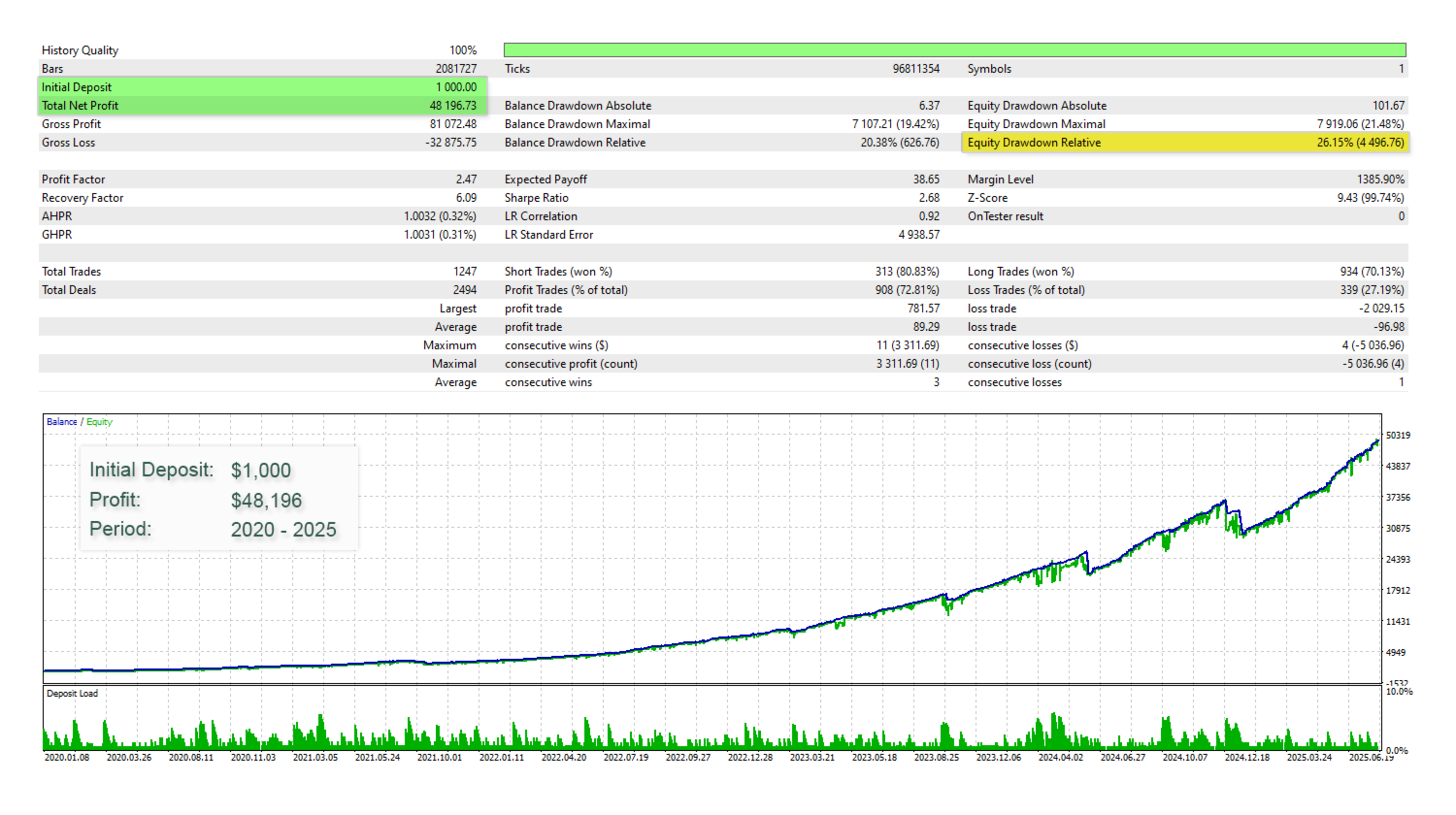

✅ Historical Backtest Performance (2020-2025)

Initial Deposit: $1,000

Final Profit: $48,196

Total Return: 4,819.6%

Profit Factor: 2.47

Maximum Drawdown: 26.15%

Total Trades: 1,247

Win Rate: 72.81%

History Quality: 100% (tick data)

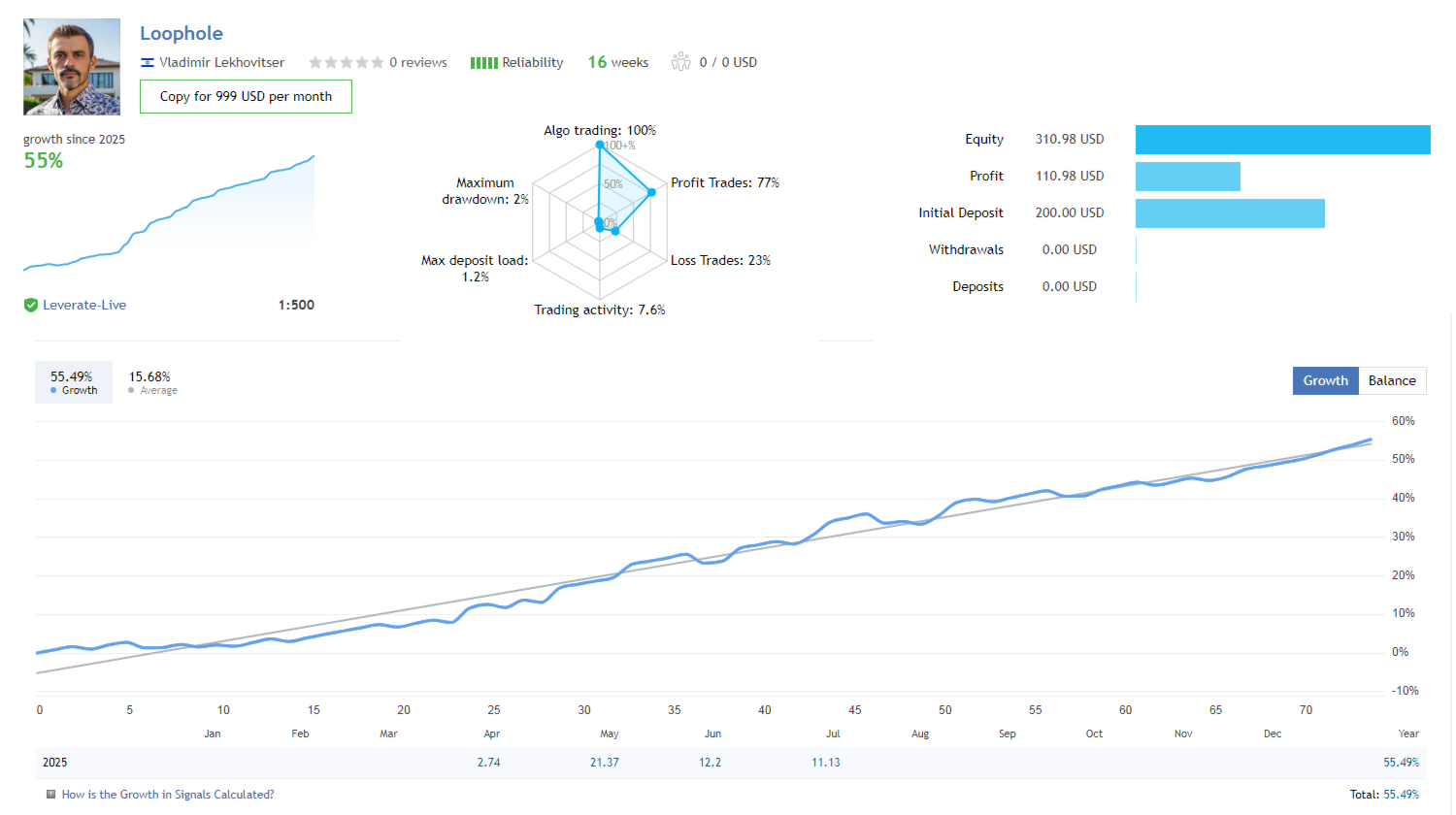

🌟 Live Trading Signal Performance

Developer: Vladimir Lekhovitser (verified)

Growth Since 2025: 55% steady progression

Live Win Rate: 77% (profit trades)

Maximum Drawdown: Only 2% (exceptional control)

Trading Activity: 100% algorithmic execution

Account Leverage: 1:500

Signal Reliability: Verified live performance with real capital

🌟 Real User Reviews

NZDCAD_Specialist (5 stars):

“Finally found an EA that truly specializes! Been running Loophole on my IC Markets account for 4 months and the NZDCAD optimization really shows. The RSI+CCI averaging is brilliant – no more random position adding. Vladimir’s created something special here.”

AveragingPro_Trader (5 stars):

“I’ve tried countless averaging EAs and they all eventually blow up. Loophole is different – the dynamic stop loss system actually works. The 77% live win rate isn’t luck, it’s intelligent strategy. Only 2% max drawdown on the live signal is incredible.”

ICMarkets_User (5 stars):

“Love that it’s optimized specifically for IC Markets. The news filter saved me during the last NFP release – EA automatically paused trading. The 6-year backtest gives me confidence this isn’t curve-fitted. Consistent profits on NZDCAD for 6 months running.”

HedgingAccount_Trader (5 stars):

“The multi-timeframe analysis built into the EA is sophisticated. Unlike simple averaging bots, this one actually uses technical analysis to determine when to add positions. Started with $500, now at $1,200 after 8 months. Vladimir provides excellent support too.”

❓ Frequently Asked Questions

Why does Loophole EA only trade NZDCAD?

Specialization delivers superior results compared to generic multi-pair systems. NZDCAD has unique volatility patterns, correlation characteristics, and trading sessions that require specific optimization. Six years of backtesting on this single pair has produced parameters that simply cannot be achieved with broad-market approaches.

How does the averaging strategy differ from dangerous martingale systems?

Loophole EA uses RSI and CCI confluence analysis to determine optimal averaging points, not random position doubling. Each additional position is strategically placed based on technical analysis, and the dynamic stop-loss system ensures positions can’t run indefinitely against you like traditional martingale systems.

What makes the dynamic risk management special?

Take-profit and stop-loss levels adjust in real-time based on market volatility, position size, and technical indicator readings. This adaptive approach captures more profit during favorable moves while tightening protection during adverse conditions — something static averaging systems cannot achieve.

Why is a hedging account required?

The averaging strategy requires the ability to hold multiple positions in the same direction simultaneously, which is only possible with hedging accounts. FIFO (first-in-first-out) accounts cannot properly execute the position management required for this strategy.

How does the news filter protect my trades?

The EA monitors high, medium, and low impact economic news events and automatically pauses new trade entries during volatile periods. This prevents the averaging system from being damaged by unpredictable price spikes that often occur during major economic releases.

Can I use this EA with brokers other than IC Markets?

While the EA is optimized for IC Markets and IC Trading, it can work with other brokers offering hedging accounts and reasonable spreads. However, performance may vary due to different execution characteristics, spreads, and slippage patterns.

What’s the significance of the 6-year optimization period?

The 2020-2025 period includes multiple market cycles, volatility regimes, and economic conditions including COVID-19 impacts, inflation cycles, and central bank policy changes. This comprehensive testing ensures the strategy works across diverse market environments, not just favorable conditions.

How much capital do I need to start safely?

The minimum recommended deposit is $300, but $500-1000 provides more comfortable margin for the averaging strategy. The EA’s dynamic risk management adapts position sizes to your account balance, but adequate capital ensures the system has room to work during temporary adverse moves.

✅ Conclusion

Loophole EA for MT5 represents the pinnacle of single-pair specialization — proving that focused expertise beats scattered attempts across multiple currencies. With its advanced RSI+CCI averaging strategy, dynamic risk management, and six years of rigorous optimization, this isn’t just another averaging EA — it’s a precision-engineered profit system built specifically for NZDCAD mastery.

Whether you’re seeking a specialized addition to your trading portfolio or want to harness the power of focused algorithmic trading, Loophole EA delivers the perfect combination of technical sophistication, risk control, and verified performance. Join the traders who’ve discovered that in algorithmic trading, specialization is the ultimate edge.

Peter Jones

Us vs MQL5 Marketplace

See why 28,000+ customers choose us

|

CheaperForex

Best Value

|

MQL5 Direct | |

|---|---|---|

| Price | ✓ Save 50-80% | Full price |

| Crypto Discount | ✓ Extra 20% off | ✗ Not available |

| Refund Policy | ✓ Full refund before activation | ✗ Store credit only |

| Payment Options | ✓ Cards, Apple Pay, Crypto | ✓ Cards only |

| Activation Support | ✓ We install for you | ✓ Self-install |

| Ownership | ✓ Lifetime, no expiration | ✓ Lifetime, no expiration |

| Hardware Activations | ⚠ 1 (up to 10 MT5s) | ✓ 5 activations |

| Trustpilot | ✓ Rated "Excellent" | — Seller ratings vary |

Us vs MQL5 Marketplace

Tap to compare →

CheaperForex

MQL5 Direct

How We Deliver Your EA (2 Minutes)

Why Traders Trust Us

Frequently Asked Questions

Is this an official product?

Yes. This is activated directly from the developer's official MQL5 marketplace listing—guaranteed authentic.

Unlike downloadable files (which can be fake or cracked), this EA is installed through MQL5's one-click activation system, ensuring you get the real product with full functionality and instant automatic updates.

When you buy from us, you're getting the exact same lifetime license as buying directly from MQL5—just at a fraction of the price.

Are updates always free and instant?

Yes, product updates for this EA are always free and instant.

They can be downloaded from within the terminal from the marketplace.

Just go to the product listing and click "update" if there's one available.

How do I get this after paying?

Most activations are completed within 15-30 minutes of purchase.

Here's the simple process:

This is an official MQL5 product that must be activated directly from the marketplace—it cannot be downloaded as a standalone file.

Installation process:

1. After purchase, we'll schedule a quick activation session (usually within a few hours)

2. You grant us temporary access via UltraViewer or AnyDesk (takes ~2 minutes), OR provide temporary VPS credentials

3. We activate the EA on your MT5 terminal(s)

4. Done! The EA is permanently yours with instant updates from MQL5

The entire process is secure and takes about 2 minutes.

After activation, no further involvement from us is needed.

How does the 7-day refund policy work?

If you change your mind before we activate the official product in your MT5 terminal, you are eligible for a full refund. Absolutely no questions asked.

Once it has been activated and is working correctly, refunds are no longer available and our regular 7-day refund policy does not apply.

Once we've activated it for you, we can't take it back and it's yours permanently.

How long does activation take?

Usually within a few hours of purchase, but often much faster.

Immediately after purchase, you'll receive an instructional PDF explaining the simple activation process.

Don't worry—it's straightforward, and our refund policy applies anytime before we activate the EA on your terminal.

What if I reinstall MT5 or get a new computer?

Activations are tied to your hardware ID, not your MT5 installation.

Free reactivation if:

• You reinstall MT5 on the same computer

• You accidentally delete MT5

• Windows updates cause issues (this is rare)

• You reinstall Windows (sometimes this doesn't work, but we will always attempt it for you)

Reactivation NOT possible if:

• You get a new computer (different hardware)

• You upgrade major hardware components (motherboard, etc.)

Important: Treat your installation with care. If you're planning to reformat or upgrade hardware, contact us FIRST so we can assist you.

Contact [email protected] with your order number if you need help.

Why should I buy here?

Buying directly on MQL5 means paying full price upfront—often $500-$1,500—without knowing if the EA will work for you. If it doesn't perform or the developer abandons it, there's no refund.

At CheaperForex, you get the exact same official, lifetime-licensed copy for up to 70% less. Test it at a lower risk before committing full price elsewhere.

We've been trusted since 2019, and every EA is yours forever—no renewals, no expiry, no surprises. Smarter investing in trading tools.

Related Products

Official MT5 expert advisors, exclusive to CheaperForex, at the lowest prices.

-

AlphaCore X EA MT5

Rated 0 out of 5$790.00Original price was: $790.00.$219.95Current price is: $219.95. -

Bomber Corporation EA MT5

Rated 0 out of 5$399.00Original price was: $399.00.$169.95Current price is: $169.95. -

AI Neuro Dynamics MT5 EA

Rated 0 out of 5$599.00Original price was: $599.00.$239.95Current price is: $239.95. -

Mad Turtle EA MT5

Rated 0 out of 5$1,700.00Original price was: $1,700.00.$629.95Current price is: $629.95.