- Official Product

- Instant Download

- 7-Day Money-Back Guarantee*

- Instant Download

- 7-Day Refund Policy*

Sale!

💰 Make profits or exchange this product for FREE

💰 Profit or Exchange FREE

📦 What's Included

Detailed PDF with screenshots showing every step of the installation process

Optimized parameters and configuration guidance included in your download package

When we release new versions, download them free from your account - you own this EA for life

Direct email support for installation help and technical questions

If the EA fails to attach due to verified technical errors we can replicate, full refund issued

Over 28,000 customers served since 2019. See verified reviews →

AI Prop Firms EA MT4

AI Prop Firms EA for MT4 is a prop firm compliant automated trading system from MQL TOOLS SL, engineered for funded trading environments.

Designed to work within the strict parameters of FTMO, FundedNext, The5ers, and FundingPips, this EA leverages artificial intelligence for real-time market analysis and dynamic risk management. The system avoids martingale and grid strategies entirely, focusing instead on precision entries with strict capital protection protocols.

- ✅ Automatic Daily DD Protection — prevents breaching prop firm loss limits

- ✅ News Event Avoidance — stops trading around high-impact releases

- ✅ Zero martingale / Zero grid — controlled single-position trading

- ✅ 5.37 profit factor — 78.53% win rate in strategy testing

- ✅ Trade Timing Randomization — avoids copy trading detection

Professional automation designed for prop firm challenges and funded accounts.

Instant Download

- Official Version

- Free Updates

- 30-Day Free Exchange

- Official Version

- Free Updates

- 30-Day Free Exchange

$1,099.00 Original price was: $1,099.00.$299.95Current price is: $299.95.

If it doesn't make you money, exchange it for free! We want you to be fully satisfied with your investment, that's why we offer a FREE exchange if your product isn't profitable for you after 30 days of using it.

How It Works:

- Use the EA for at least 30 days following the recommended settings. A demo account is always recommended to begin with.

- If you're not satisfied, contact our support team with:

- MT4/MT5 trading logs since the date of purchase

- Screenshots of your settings

- Brief explanation of your experience

- Choose: Exchange for another EA or receive full store credit

Terms/Requirements:

- Must provide proof of proper installation and use

- EA must be used according to documentation

- Does not apply to user error or settings modifications

- Only applies to products valued $150 or more & one use per customer

We want you to become profitable and be happy with your investment.

What Happens After Purchase:

? Instant download + email delivery Immediately after payment, you receive download links via email plus access to your customer dashboard. ? Free updates All future versions are free. Download new updates anytime from your account - you never pay twice. ? Customer support Direct email support for installation help and technical questions from our team. ? 7-day refund guarantee If the EA fails to attach to your chart due to verified technical errors we can replicate, we'll issue a full refund within 7 days. Does not cover trading performance.Quick Summary:

AI Prop Firms EA for MT4 is a prop firm compliant automated trading system from MQL TOOLS SL, engineered specifically for funded trading environments.

The system leverages artificial intelligence to evaluate market conditions continuously, adapting risk parameters and execution timing to comply with prop firm regulations. Whether you’re running FTMO challenges, trading The5ers funded accounts, or using FundedNext or FundingPips, this EA operates within the strict boundaries these firms require. No martingale strategies, no grid systems, no high-risk recovery methods — just intelligent, controlled automation.

Official MQL5 Listing:

AI Prop Firms EA MT4

Developer Profile:

MQL TOOLS SL

Engineered for Funded Trading

WORKS WITH ALL MAJOR PROP FIRMS

Tested and compatible with:

- FTMO

- FundedNext

- The5ers

- FundingPips

- MyFundedFX

- Any MT4 prop firm

Suitable for evaluation phases and live funded trading

Standard trading robots often fail prop firm requirements through excessive drawdowns, aggressive lot sizing, or trading during restricted news periods. AI Prop Firms takes a different approach — the entire architecture is built around prop firm compliance, from daily loss protection to news filtering to trade timing diversification.

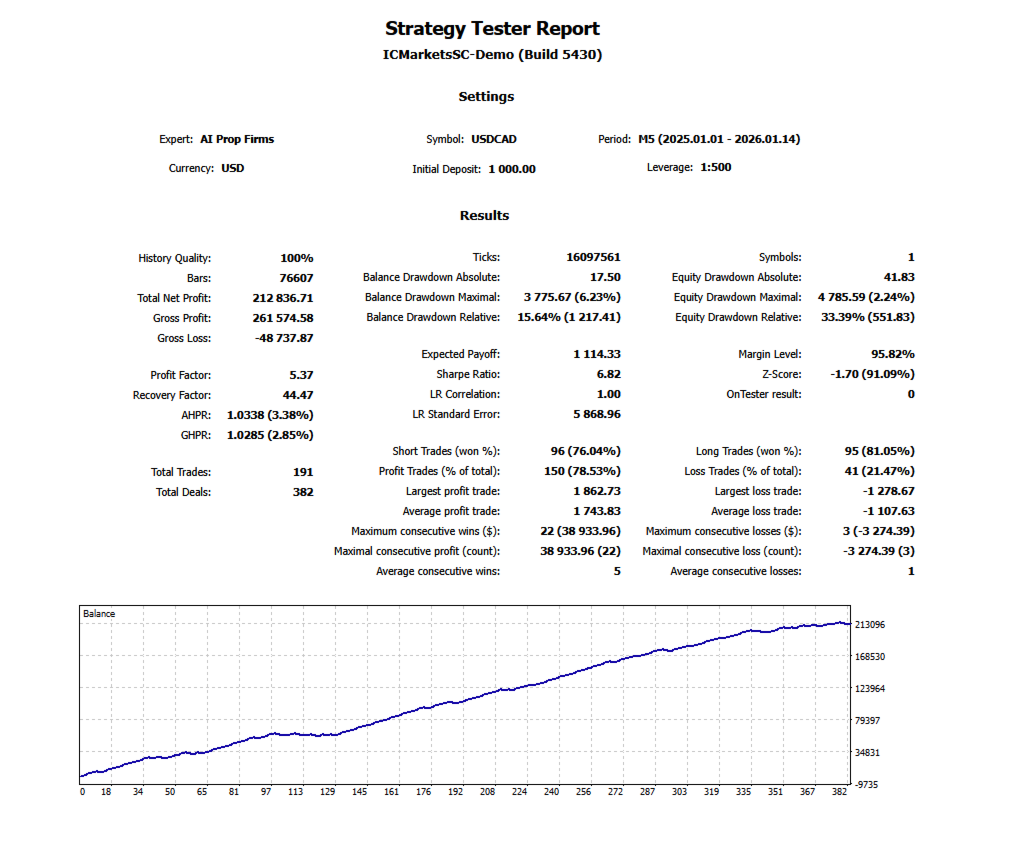

Strategy Testing Results

Performance data from USD/CAD M5 testing (January 2025 – January 2026, $1,000 starting capital):

- Net Profit: $212,836.71

- Winning Trades: 150 of 191 (78.53%)

- Losing Trades: 41 of 191 (21.47%)

- Profit Factor: 5.37

- Recovery Factor: 44.47

- Sharpe Ratio: 6.82

- Gross Profit: $261,574.58

- Gross Loss: -$48,737.87

- Balance Drawdown: 15.64%

- Equity Drawdown: 33.39%

- Long Position Win Rate: 81.05%

- Short Position Win Rate: 76.04%

- Best Trade: $1,862.73

- Worst Trade: -$1,278.67

- Average Winner: $1,743.83

- Average Loser: -$1,107.63

- Longest Win Streak: 22 trades ($38,933.96)

- Longest Loss Streak: 3 trades (-$3,274.39)

- Typical Win Streak: 5 trades

- Typical Loss Streak: 1 trade

- Data Quality: 100%

A 5.37 profit factor indicates the system generates over five dollars in profit for every dollar lost. The 78.53% win rate combined with favorable risk-reward ratios produces the consistency prop firms look for.

Prop Firm Protection Features

Daily Loss Limit Protection

The Daily Drawdown Guard continuously monitors account equity against daily loss thresholds. When approaching limits or during volatile conditions, the system automatically scales back exposure or halts trading entirely — preventing the account breaches that end funded careers.

Economic Calendar Integration

High-impact news releases like NFP, FOMC, and CPI create unpredictable price spikes that violate many prop firm trading rules. The Economic News Filter automatically suspends activity before and after major announcements, eliminating this risk entirely.

Trade Timing Diversification

The Entry Time Offset feature introduces controlled randomization to trade execution timing. This prevents the synchronized entry patterns that prop firms flag as potential copy trading — a common reason for account termination even among legitimate traders.

Intelligent Position Management

All trade decisions flow through AI analysis that considers:

- Current volatility conditions

- Liquidity depth

- Probability assessments

- Real-time price behavior

Dynamic Stop Loss and Take Profit

Rather than fixed pip values, TP and SL levels adjust dynamically based on current market volatility and liquidity conditions. The AI manages these parameters continuously throughout each trade.

Automatic Risk Profile Adjustment

Market conditions change — the EA responds accordingly. When volatility spikes or trends break down, the system shifts between conservative, balanced, and active risk modes automatically without requiring manual intervention.

Market Regime Detection

The AI identifies whether markets are trending, ranging, experiencing elevated volatility, or facing event-driven risk. Unfavorable conditions trigger automatic trading restrictions.

Quality-Filtered Entries

Not every setup gets traded. The system applies strict quality criteria to each potential entry, filtering out low-probability setups that would create unnecessary exposure and erode consistency.

Weekly Performance Summaries

AI-generated reports provide key statistics and behavioral insights, helping track consistency over time — exactly what prop firms evaluate.

Why Grid and Martingale Don’t Belong in Prop Trading

“AI Prop Firms operates without martingale, grid, or aggressive recovery systems — the strategies that consistently blow prop firm accounts and destroy funded careers.”

Prop trading firms explicitly prohibit these approaches because they inevitably produce catastrophic losses. AI Prop Firms takes the opposite approach:

- One trade at a time — risk exposure is always quantified

- Appropriate position sizing — lots sized for prop firm leverage and rules

- Steady performance focus — consistency over explosive but unsustainable gains

Related Product From MQL TOOLS SL

The same developer also creates AI Forex Robot, available here:

AI Forex Robot EA MT4

An AI-driven trading system with broader pair coverage. For traders wanting to diversify beyond USD/CAD while maintaining the same quality of development.

Trader Feedback

★★★★★ “Exactly what prop trading needs.”

Every other EA I tried eventually hit my daily loss limit. This one actually stops before that happens. Currently on month four of my FTMO funded account.

— Michael R., Manchester

★★★★★ “The timing offset saved my account.”

Got flagged for copy trading with my previous robot — entries were too similar to others using it. AI Prop Firms randomizes execution enough to avoid detection. Still funded.

— Anna K., Munich

★★★★☆ “Solid performance, needs more pairs.”

USD/CAD results are excellent but I’d like to trade more instruments. Developer mentioned GBP/USD is coming. Four stars until that arrives.

— Ryan T., Melbourne

★★★★★ “News filter is essential.”

Lost two funded accounts to NFP spikes before finding this EA. The automatic news pause means I never have to worry about release schedules again.

— Claire P., Lyon

★★★★★ “Matching the test results in live trading.”

Six weeks on FundedNext — win rate holding at 77%, drawdown controlled. The strategy testing was accurate, which is rare for EAs.

— Daniel K., Vancouver

Our Assessment

Objective evaluation based on strategy testing and prop firm suitability:

What We Found:

- Strategy Test Results: 5.37 profit factor with 78.53% winning trades — strong for funded trading

- Risk Architecture: Zero martingale, zero grid — individual position management only

- Prop Firm Features: Daily DD protection, news filtering, entry timing offset

- AI Implementation: Dynamic TP/SL, automatic risk mode adjustment, regime detection

- Firm Compatibility: FTMO, FundedNext, The5ers, FundingPips, all MT4 brokers

- Trade Consistency: Average 5-trade win streaks, maximum 3-trade losing streaks

- Current Scope: USD/CAD optimized (GBP/USD expansion planned)

- Developer: MQL TOOLS SL — established with AI Forex Robot

- Ideal For: Traders requiring rule-compliant automation for prop firm environments

- Summary: AI Prop Firms addresses funded trading requirements directly — daily loss protection, news avoidance, and entry diversification all built in. The absence of martingale/grid aligns with prop firm mandates. Single pair limitation will expand with upcoming GBP/USD support.

Ideal User Profile

AI Prop Firms suits traders who:

- Run prop firm evaluations — FTMO, FundedNext, The5ers challenges

- Manage funded accounts — need ongoing rule compliance

- Require automatic DD protection — can’t risk manual monitoring failures

- Must avoid news trading — as per firm restrictions

- Want hands-off operation — AI manages all decisions

Not recommended for traders who:

- Need immediate multi-pair trading (currently USD/CAD only)

- Prefer high-risk aggressive strategies

- Don’t require prop firm compliance features

System Requirements

- Platform: MetaTrader 4

- Trading Pair: USD/CAD (GBP/USD update coming)

- Chart Timeframe: M1 or M5

- Starting Capital: $100 minimum

- Lot Sizing: 0.01 minimum

- Account Types: All prop firms plus standard brokers (Raw, ECN, Standard, Zero, Hedging, Premium)

- Connection: VPS recommended for uninterrupted 24/5 operation

Getting Started

Configuration is minimal:

- Load the EA onto a USD/CAD M5 chart

- Activate algorithmic trading

- Review the few adjustable parameters

- Let the AI handle execution, risk management, and market adaptation

The system ships fully configured for prop firm conditions — no complex optimization or parameter tuning needed.

Conclusion

AI Prop Firms EA for MT4 represents purpose-built automation for the funded trading environment.

Every feature addresses real prop firm requirements: the Daily Drawdown Guard prevents limit breaches, the Economic News Filter avoids restricted trading periods, and the Entry Time Offset protects against copy trading flags. The complete absence of martingale and grid strategies means no sudden catastrophic losses.

Strategy testing demonstrates 78.53% winning trades with a 5.37 profit factor — the kind of consistent results that pass challenges and keep funded accounts active. Maximum three consecutive losses and average five consecutive wins show the reliability prop firms evaluate.

Fully compatible with FTMO, The5ers, FundedNext, FundingPips, and any prop firm supporting MetaTrader 4, this EA serves traders who need professional automation that respects the rules of funded trading.

For prop firm traders seeking AI-powered automation without the account-ending risks of martingale systems or news trading violations, AI Prop Firms delivers compliant performance for both evaluation phases and funded accounts.

What Do You Receive?

– AI Prop Firms EA for MT4 – Latest Version

– Free updates for life (when we receive them)

– Unlimited broker and account activation

– Email delivery with user dashboard allocation

FAQs

What performance does strategy testing show?

USD/CAD M5 testing (Jan 2025 – Jan 2026): $212,836 profit from $1,000 start, 5.37 profit factor, 78.53% winning trades, 44.47 recovery factor. Typical win streak of 5 trades, maximum losing streak of 3 trades.

Which prop trading firms are supported?

All major firms: FTMO, FundedNext, The5ers, FundingPips, MyFundedFX, plus any proprietary trading firm using MetaTrader 4. Suitable for both challenge phases and live funded trading.

Are martingale or grid strategies used?

Absolutely not. AI Prop Firms avoids martingale, grid, and aggressive recovery methods entirely. The system uses controlled single-position trading — exactly what funded trading requires.

How does the Daily DD Protection work?

The system continuously monitors equity against daily loss thresholds. When drawdown approaches limits or market conditions become unstable, exposure automatically reduces or trading pauses completely to prevent account breaches.

What about trading during news releases?

Automatically avoided. The Economic Calendar Integration suspends all trading activity before and after major announcements like NFP, FOMC, and CPI to prevent slippage-related losses.

What does Entry Time Offset do?

This feature introduces controlled randomization to trade execution timing, preventing the synchronized entry patterns that trigger copy trading flags at prop firms — even for legitimate solo traders.

Which currency pairs are traded?

Currently optimized for USD/CAD — a pair well-suited to prop firm conditions. GBP/USD support is planned as a free update. Strategy is specifically calibrated for funded trading environments.

What chart timeframe is required?

M1 or M5 charts. Attach to USD/CAD on either timeframe for operation.

How does the AI component function?

Artificial intelligence continuously processes price behavior, volatility levels, liquidity conditions, and market regime data. TP/SL levels, risk profiles, and execution timing adapt in real-time without manual adjustment.

What is automatic risk mode switching?

The system transitions between conservative, balanced, and active risk profiles based on live market conditions — all automatically managed without requiring user input.

How does market regime detection work?

AI classification identifies trending markets, ranging conditions, high-volatility periods, and event-risk environments — automatically restricting trading during unfavorable regimes.

What starting capital is needed?

$100 minimum balance. The system scales appropriately for any account size while maintaining prop firm compliance parameters.

Can this work with standard brokers too?

Yes. Fully compatible with prop firms AND regular Forex brokers running MT4 — including Raw, ECN, Standard, Zero, Hedging, and Premium account types.

Is configuration complicated?

Not at all. Ships fully configured with minimal user-adjustable parameters. Load onto chart, enable algo trading, and AI handles execution, risk management, and market adaptation automatically.

Are future updates included?

Yes. All updates provided free of charge when we get them.

Reviewed by Our Trader

Peter Jones

Pre-Purchase FAQs

Yes, all updates are completely free—you'll never pay twice.

We receive updates from developers and upload them to your account when they're available.

Please be patient, as we're managing hundreds of products at discounted prices. More popular products are updated more frequently.

All versions are stored in your account for easy access.

We offer a 7-day technical guarantee. If the EA fails to attach to your chart due to verified errors we can replicate, we'll issue a full refund.

However, we cannot refund based on trading performance or profit expectations—forex markets are unpredictable, and results vary by broker, spread, and market conditions. We provide tools, not guarantees.

Yes, we'd be happy to assist you!

We can advise you on the best settings for your account or create custom presets tailored to your needs. Additionally, we offer a one-time free installation service using AnyDesk for remote setup.

Please note, however, that we cannot provide advice on how to make money with any of our products.

Absolutely. Once you purchase, the EA is yours to use on unlimited live and demo accounts—no restrictions.

You can run it on multiple brokers, VPS servers, or trading accounts simultaneously.

There are no license limits or activation keys. Buy once, use everywhere.

After successful payment, your product will be available for download instantly in the following ways:

- Displayed on the screen immediately after checkout.

- Emailed to the address you provided during purchase.

- Stored in your account if you created one at checkout, where you can access it anytime.

Please note, in rare cases (about 1% of high-value premium products), orders may be held for manual review to prevent fraud.

If you don’t see a download link, contact us for assistance.

Yes, absolutely.

We do not sell fake products, and our customer reviews, along with our pricing, reflect the quality and authenticity of what we offer.

Related Products

High-quality products exclusive to CheaperForex at the lowest prices.

-

DowGold Hedging Scalper EA MT5 – 100% Verified

Rated 5.00 out of 5$1,999.00Original price was: $1,999.00.$1,099.00Current price is: $1,099.00. -

Boring Pips EA MT4 Version 4.4

Rated 0 out of 5$599.00Original price was: $599.00.$169.95Current price is: $169.95. -

Nas100 Scalping EA MT4

Rated 0 out of 5$100.00Original price was: $100.00.$29.95Current price is: $29.95. -

Quantix EA MT4

Rated 0 out of 5$1,000.00Original price was: $1,000.00.$199.95Current price is: $199.95.

Why Traders Trust Us

- ⭐ We are rated excellent on Trustpilot

- 🏆 In business since 2019

- ⚡ Free and fast product updates

- 🚫 Instant access – no 'group buys' hassle

- 🔄 7-day refund policy for product errors

- 🖥️ We can install it for you using UltraViewer

- 💬 Responsive support team

- 🔒 Pay with cards, Apple Pay, GPay, or crypto

🛟 Support & Community

Live Chat

Click to message us on Telegram @CheaperForex

Join Channel

Stay updated by joining our free Telegram channel.