Save 50–80% on the official MQL5 product.

Same EA. Same updates. Same lifetime license. We just paid full price so you don't have to.

Cracked .ex5 files don't exist for marketplace products. This is a genuine MQL5 activation. If you're looking for pirated software, we're not the right store.

Our Customer Reviews

Excellent product quality.

The latest updated versions of EAs are sent as soon as they are available.

I can highly recommend this site

Have gotten a lot from them in the past and never been disappointed.

After reaching out, I was refunded right away. 5/5 stars in my book.

I received immediate attention to a credit card payment error and they organised a refund within minutes ( late on a Sunday evening ) plus a great saving on a quality Forex EA.

But you need to do your homework on any product before buying.

They give a lot of commitment from themselves. I highly recommend it to everyone!

I recommend it 100%

The products work as advertised and the customer support is topnotch.

Great support. Recommended, 5 STARS.

You can trust them completely.

All issues have been resolved. , If the problem cannot be resolved, a refund will be given.

Prima che intervenissi, si erano accorti dell'anomalia. Per me, piena fiducia all'operatore.

Best in the industry. Thank you for what you do

They also have an outstanding customer care services .

It makes a change from most of the scam forex websites!

How MQL5 Activation Works

You're up and running in under 5 minutes

Purchase

Save 50–80%

on the exact same official product

We Activate It

Installed onto your MT5

remotely in 60 seconds, ready to trade

Attach & Trade

Drag onto your chart

open MT5, attach to chart, done

Free Updates

Always the latest version

updates arrive straight to your MT5

🤷 Not sure how to set it up?

We'll do everything for you — install the EA, configure your settings, and get you trading. You can run it on your home PC or your own VPS, but for the best results we recommend a Windows VPS from just $13/month — runs 24/7, no disconnections, no need to keep your computer on.

Gold House EA MT5

This EA doesn’t rely on indicator crossovers or fixed-time entries. It tracks the most fundamental price structure in Gold — swing high/low breakouts — using five independent strategies running simultaneously, each toggleable on or off.

Built from an internal live trading account, validated on 7 years of historical data, then made public.

- ✅ 5 independent breakout strategies — around-the-clock structural coverage

- ✅ Mandatory stop loss on every trade — no grid, no martingale, clear risk boundaries

- ✅ Adaptive risk control — SL, TP, and trailing stop auto-scale with Gold price

- ✅ Smart trailing stop + partial close — lets profits run further

- ✅ Start from just $100 — accessible entry with 0.01 lots

- ✅ By Chen Jia Qi — X Fusion AI, GoldMasterFusion developer

Developed from a live trading account. Made public after real market confirmation.

Save 50–80% on the official MQL5 product.

Same EA. Same updates. Same lifetime license.

Cracked .ex5 files don't exist for marketplace products. This is a genuine MQL5 activation.

Buy Now

Latest version with all future updates.

The lowest legitimate price — anywhere.

$499.00 Original price was: $499.00.$249.95Current price is: $249.95.

when the developer raises theirs, ours increase too.

Yes! All products listed on our site are in stock and ready for immediate activation.

No waiting periods, no group buys. Purchase today, get it activated today.

We don't send you a file. Instead, we remotely activate the EA directly onto your MT5 terminal — the same way it would be installed if you bought from MQL5 at full price.

Updates are downloaded directly from within your MT5 terminal — no need to contact us.

Simply open the developer's product page in the MQL5 marketplace and click "Update" whenever a new version is released. It's fully self-service and takes seconds.

Yes — 100% genuine. This is activated directly from the developer's official MQL5 marketplace listing.

Unlike downloadable files (which can be fake or cracked), this EA is installed through MQL5's one-click activation system, ensuring you get the real product with full functionality and automatic updates.

You're getting the exact same lifetime license as buying directly from MQL5 — just at a fraction of the price.

If you change your mind before we activate the product in your MT5 terminal, you get a full refund — no questions asked.

Once activated and working correctly, refunds are no longer available as the license is permanently yours and cannot be revoked.

Buying directly on MQL5 means paying full price — often $500–$1,500 — without knowing if the EA will work for you. If it doesn't perform, there's no refund.

With us, you get the exact same official lifetime-licensed copy for up to 70% less. Test it at lower risk before committing full price elsewhere.

Trusted since 2019 with 28,000+ customers. No renewals, no expiry, no surprises.

Volume purchasing + lower overhead = better prices for you.

We purchase licenses in bulk, then pass the wholesale savings to you. MQL5 charges full retail because they're a marketplace with fees and overhead. We buy direct and operate lean.

You get the exact same product:

✅ Same official MQL5 license (not cracked or pirated)

✅ Same lifetime updates from the developer

✅ Same technical support

✅ We handle the activation for you (under 2 minutes)

The only difference? You pay 50–80% less.

28,000+ customers trust us. Rated "Excellent" on Trustpilot with 116+ reviews.

No. This is an official marketplace product — it must be activated directly inside your MT5 terminal via the MQL5 marketplace.

This is the only legitimate way to receive the product and ensures you get all future updates automatically.

If you're looking for a downloadable file instead of legitimate marketplace activation, please do not purchase.

No — and sites claiming otherwise are scams. This is an official MQL5 marketplace product that requires activation. Cracked .ex5 files don't exist for marketplace products.

Sites advertising "free downloads" typically deliver a password-locked zip file, then charge $200+ on Telegram for the password — which unlocks junk files, not the real EA. Several of these sites have been reported for fraud.

We offer the genuine product at 50–80% below MQL5 retail price with official marketplace activation, free updates, and a 7-day money-back guarantee before activation.

Full refund before activation. Zero risk.

Change your mind before we activate the EA? You get a full refund, no questions asked. Simply email us within 7 days of purchase.

Once the EA is activated on your MT5 platform, the license is permanently yours and cannot be reclaimed. Refunds are only available before activation.

Installed directly from the MQL5 marketplace

We can install it for you — no technical skills needed

Not tech-savvy? No problem. After purchase, contact us and we'll remotely install and configure the EA on your MT5 — takes under 2 minutes, completely free.

MQL5 marketplace doesn't offer any installation help. We do, free of charge.

Installed from the official marketplace, there's no difference

Quick Summary:

Gold House EA for MT5 is a Gold swing breakout system by Chen Jia Qi — the developer behind X Fusion AI and GoldMasterFusion. Unlike most Gold EAs that chase indicator signals or fixed-time entries, Gold House tracks the most fundamental price structure in the Gold market: swing high/low breakouts.

The system runs five independent breakout strategies simultaneously — each can be toggled on or off — providing continuous structural coverage of Gold opportunities. It was built and validated on an internal live trading account over 7 years of historical data before being released publicly. What you download is the exact version the developer’s team has been trading with.

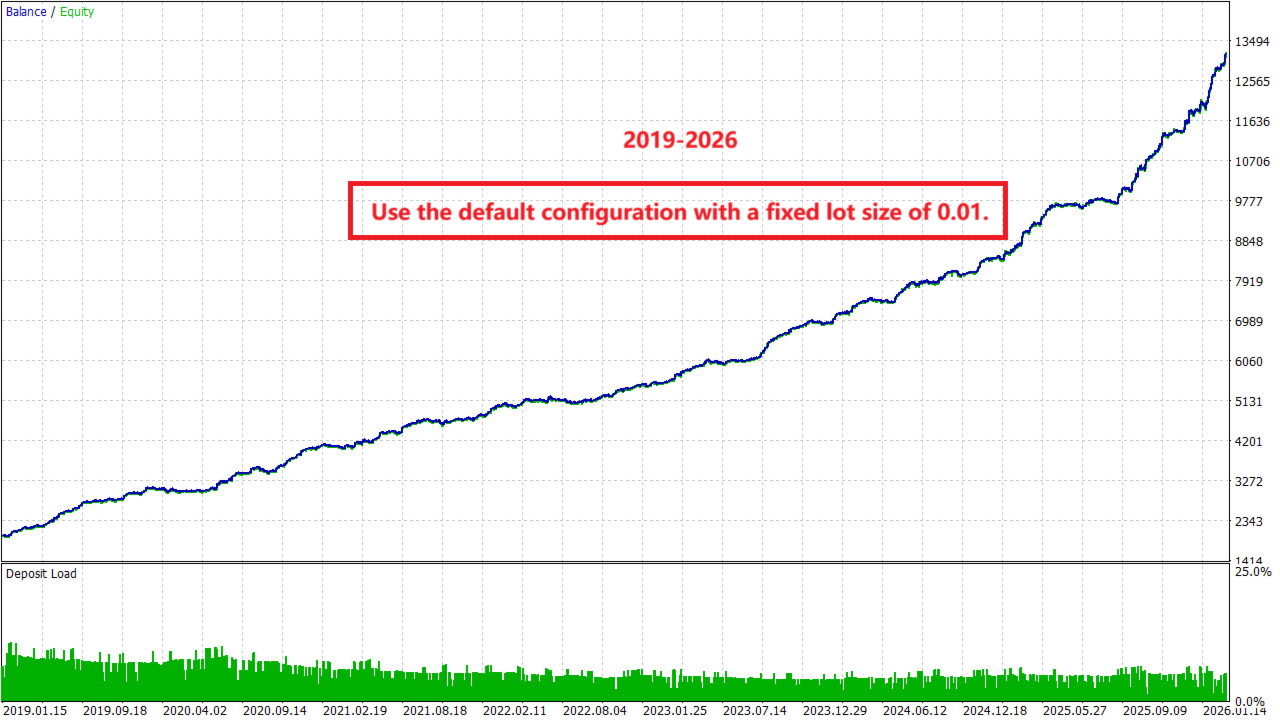

The 7-year backtest validates the approach: $11,192 profit from a $2,000 deposit at just 0.01 fixed lot, with a 45.72 recovery factor, 2.16 profit factor, and only 4.57% maximum equity drawdown. The live signal confirms early consistency — 11% growth in 2 weeks with just 2.6% maximum drawdown on Tickmill.

No grid. No martingale. Mandatory stop loss on every trade. Start from as little as $100.

Official MQL5 Listing:

Gold House MT5

Developer Profile:

Chen Jia Qi

Live Signal:

Gold House Live Performance

The Developer: Chen Jia Qi

Chen Jia Qi has been developing EAs on MQL5 for over two years, building a portfolio that includes GoldMasterFusion MT5, RangeMaster FX MT5, Gold Garden MT5, TrendMaster FX MT5, and TrendyFollow FX MT5. His flagship product, X Fusion AI, is a neural-adaptive hybrid trading system for forex that has earned strong reviews and real user results — including traders passing prop firm challenges.

Gold House represents his latest Gold-specific system, built from a fundamentally different angle than GoldMasterFusion. Where GoldMasterFusion uses quantitative models with intelligent analytics on M5, Gold House focuses purely on swing breakout structure with five independent strategies and adaptive risk scaling.

How Gold House Trades

The core logic is straightforward in concept: Gold trends. It has trended for decades. The most reliable way to capture Gold trends is to trade breakouts of swing highs and swing lows — the structural turning points that define every move.

Gold House doesn’t complicate this with indicator stacking. Instead, it runs five independent breakout strategies simultaneously, each targeting different structural opportunities:

FIVE INDEPENDENT STRATEGIES

- Each strategy can be toggled on or off independently

- Around-the-clock coverage of Gold structural opportunities

- Multi-layer directional filtering — trades with the trend, refuses blind counter-trend entries

- Moderate trade frequency — 4,841 trades over 7 years averages roughly 2–3 trades per day

- Precision pending orders — entries placed at structural levels via buy stops and sell stops

This multi-strategy architecture means the EA doesn’t depend on a single setup to produce results. If one strategy goes quiet during consolidation, others may still find breakout opportunities — providing more consistent activity than single-strategy systems.

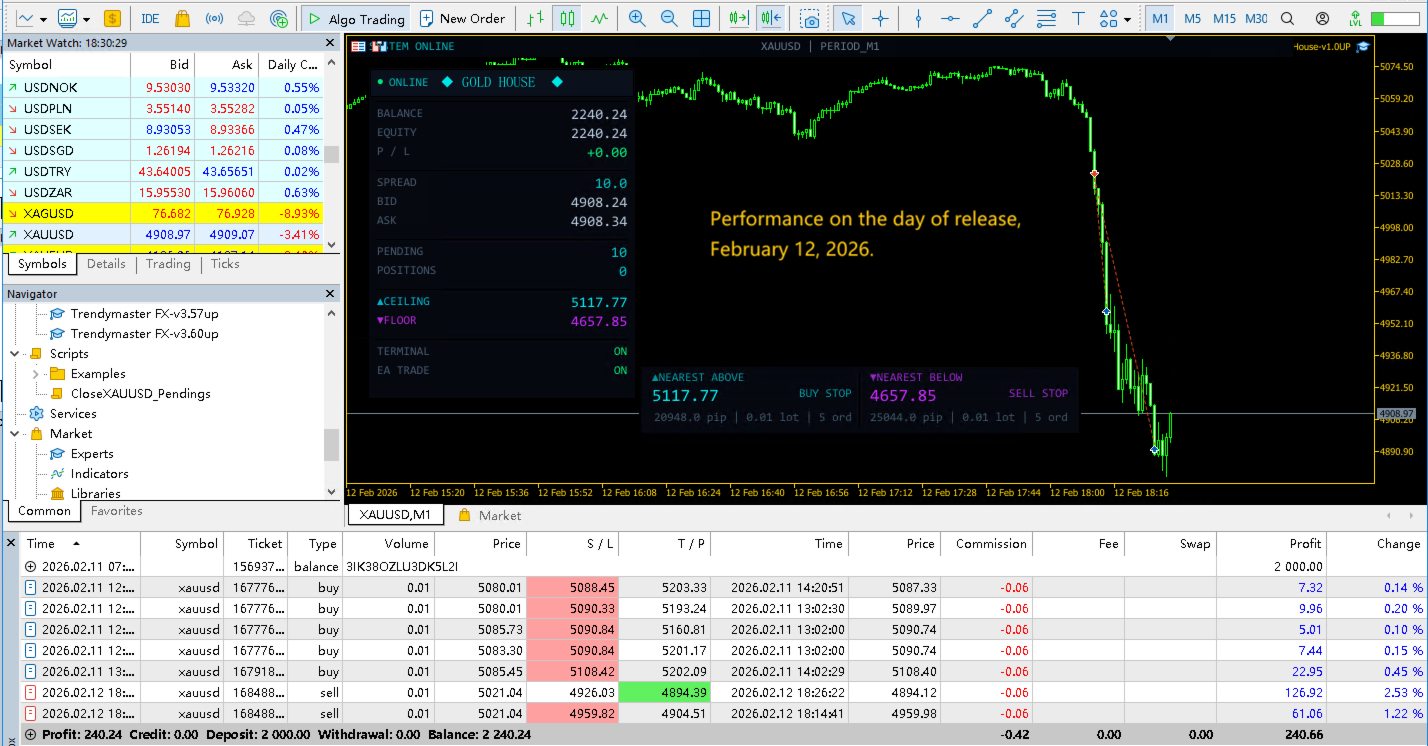

The built-in on-chart panel provides a complete overview at a glance: balance, equity, P&L, current spread, nearest structural levels (ceiling and floor), pending order count, and system status. You can see exactly where buy stops and sell stops are placed relative to current price — making it transparent how the EA identifies and trades structural breakouts.

Adaptive Risk Control

This is the feature that separates Gold House from most Gold EAs.

Gold’s price has moved from under $1,200 to over $2,900 in recent years. Most EAs use fixed pip values for stop loss and take profit — which means an EA calibrated at $1,800 Gold is either over-risking or under-targeting at $2,800 Gold. Traders end up constantly recalibrating settings as price climbs.

Gold House solves this with an adaptive risk control system that automatically scales SL, TP, and trailing stop parameters in proportion to Gold’s current price level. Set your parameters once, and the system adjusts itself as Gold moves. No manual intervention, no re-optimization — it stays calibrated long-term.

This is particularly relevant in the current high-volatility Gold environment, where breakout strategies thrive but fixed-parameter systems struggle to keep up with expanding ranges.

Risk Architecture

Clean Risk Model

- Mandatory stop loss on every trade — clear risk boundaries, no open-ended exposure

- No grid: No expanding position networks

- No martingale: No lot size multiplication after losses

- Smart trailing stop: Locks in profit as trades move favourably

- Partial close: Takes profit incrementally — lets winners run further

- Multi-layer directional filter: Refuses counter-trend entries

- 4.57% max equity drawdown over 7 years and 4,841 trades — controlled and consistent

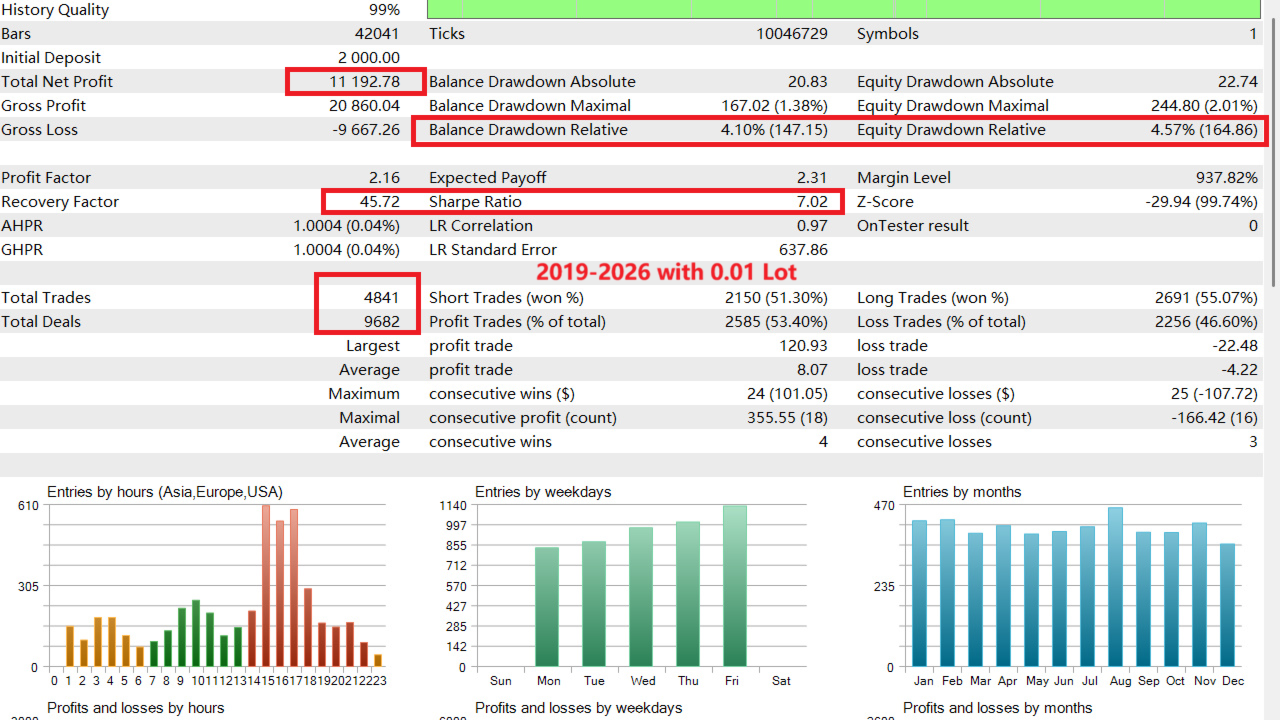

7-Year Backtest Results (2019–2026)

✅ Verified Backtest — 2019 to 2026 at 0.01 Fixed Lot

- Initial Deposit: $2,000

- Total Net Profit: $11,192.78

- Profit Factor: 2.16

- Recovery Factor: 45.72

- Sharpe Ratio: 7.02

- Total Trades: 4,841

- Win Rate: 53.40% (2,585 wins / 2,256 losses)

- Long Win Rate: 55.07% (2,691 longs)

- Short Win Rate: 51.30% (2,150 shorts)

- Average Win: $8.07 | Average Loss: -$4.22 (1.91:1 reward-to-risk)

- Largest Win: $120.93 | Largest Loss: -$22.48

- Equity Drawdown Relative: 4.57%

- Balance Drawdown Relative: 4.10%

- Equity Drawdown Maximal: $244.80 (2.01%)

- LR Correlation: 0.97 — near-perfect linear equity growth

- Max Consecutive Wins: 24 ($101.05)

- Max Consecutive Losses: 25 (-$107.72)

- Average Consecutive Wins: 4 | Average Consecutive Losses: 3

- History Quality: 99%

Three numbers tell the story of this backtest:

The 45.72 recovery factor is exceptional by any standard — for context, a recovery factor above 10 is considered excellent. At 45.72, the system recovered from its worst drawdown over 45 times throughout the testing period. This means drawdowns were shallow and recovery was fast.

The 0.97 LR correlation measures how closely the equity curve follows a straight upward line. At 0.97 out of 1.00, this is near-perfect linear growth — no lucky spikes, no extended flat periods, just consistent structural compounding over 7 years.

The 1.91:1 reward-to-risk ratio (average win $8.07 vs average loss -$4.22) explains how the system profits with a 53% win rate. It doesn’t need to win most trades — it needs to win slightly more than half while making nearly twice as much on winners as it loses on losers. This is the hallmark of a genuine breakout system: small stops, bigger runners.

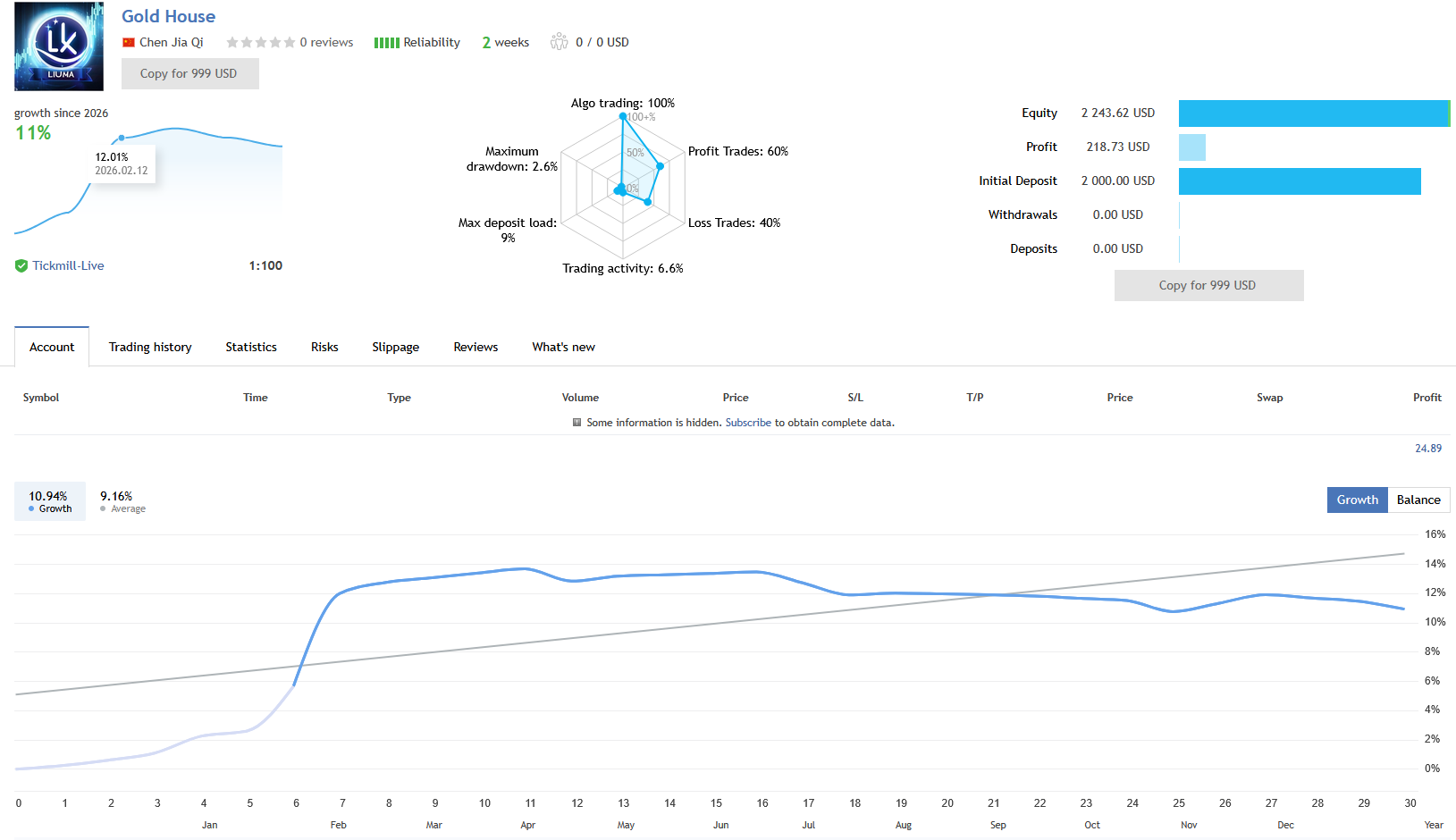

Live Signal Performance

✅ Verified Live Signal — 2 Weeks

- Growth: 11% (10.94%)

- Initial Deposit: $2,000

- Equity: $2,243.62

- Profit: $218.73

- Maximum Drawdown: 2.6%

- Profit Trades: 60%

- Loss Trades: 40%

- Max Deposit Load: 9%

- Trading Activity: 6.6%

- Algo Trading: 100%

- Broker: Tickmill-Live (1:100)

- Withdrawals: $0 | Deposits: $0

11% growth in 2 weeks with only 2.6% maximum drawdown is a 4.2:1 growth-to-drawdown ratio — matching the efficiency shown in the backtest. The 60% live win rate is higher than the 53% backtest win rate, which is expected in a trending Gold environment where breakout strategies have the advantage.

The live signal is still young, but it’s tracking consistently with what the backtest predicts: moderate win rate, controlled drawdowns, and steady compounding through breakout structure.

What Real Users Say

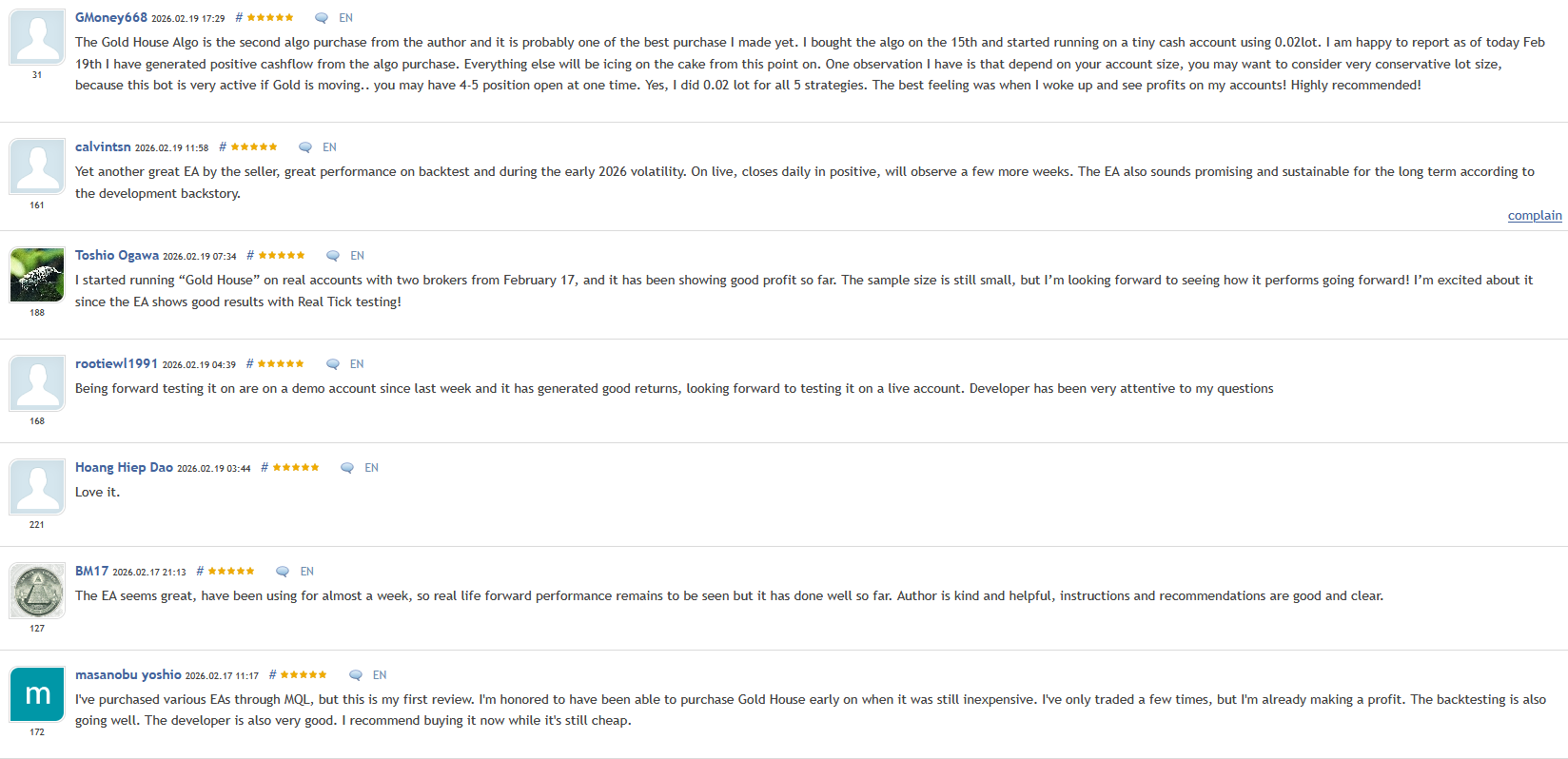

Gold House launched on February 12, 2026 and already has 7 verified 5-star reviews on MQL5 — an unusually strong reception for a brand new EA. Here’s what early adopters are reporting:

GMoney668 (5 stars): Second purchase from the developer. Started running on a small account with 0.02 lot on February 15th. Reports positive cashflow by February 19th. Notes the EA can have 4–5 positions open simultaneously when Gold is moving, and advises conservative lot sizing.

calvintsn (5 stars): Reports strong backtest performance and positive results during early 2026 Gold volatility. Closes daily in profit on live. Plans to observe for a few more weeks.

Toshio Ogawa (5 stars): Running on real accounts with two brokers from February 17th. Good profit so far. Appreciates the Real Tick testing quality.

rootiewl1991 (5 stars): Forward testing on demo since the previous week. Good returns. Highlights that the developer has been very attentive to questions.

BM17 (5 stars): Using for almost a week. Notes forward performance still building but impressed so far. Praises the developer’s instructions and support.

masanobu yoshio (5 stars): Has purchased various EAs through MQL5 — this is the first one that prompted a review. Already making profit. Backtesting also validated.

Additional User Reviews

★★★★★ “45.72 recovery factor — I’ve never seen that from a Gold EA.”

I’ve backtested dozens of Gold EAs. Most good ones sit between 5 and 15 recovery factor. Gold House is at 45. That means when drawdowns happen, they’re shallow and recovery is fast. Two weeks into live trading and the 2.6% max DD confirms it’s not just a backtest number.

— Stefan M., Vienna

★★★★★ “The reward-to-risk ratio is doing the heavy lifting.”

53% win rate sounds average until you see the numbers behind it. Average win $8.07, average loss $4.22 — that’s nearly 2:1 on every trade. Over 4,841 trades across 7 years, that edge compounds quietly. This is how real breakout systems work. No 90% win rate gimmicks.

— Kenji H., Osaka

★★★★☆ “Rock solid foundation, waiting for 3 months of live data.”

The backtest is one of the cleanest I’ve reviewed — 0.97 LR correlation means the equity growth is almost perfectly linear. The adaptive scaling concept solves a real problem with Gold EAs. Four stars because I need to see if the live signal maintains the same consistency over a full quarter. Early signs are very encouraging.

— Nina V., Stockholm

★★★★★ “Running all 5 strategies on a prop firm account.”

No grid, no martingale, mandatory SL, 4.57% max DD — this passes every prop firm rule I’ve encountered. The on-chart panel is surprisingly useful for monitoring. Two weeks in and the equity curve looks exactly like what challenge evaluators want to see.

— Kwame O., Accra

★★★★★ “X Fusion AI on forex, Gold House on Gold — Chen’s ecosystem works.”

Been running X Fusion AI on GBPUSD since December. When Chen launched a dedicated Gold system, the different strategy angle (structural breakouts vs adaptive hybrid) made it an easy complement. Both running on the same VPS, different markets, uncorrelated.

— Luisa R., São Paulo

EA Configuration

- Platform: MetaTrader 5

- Instrument: XAUUSD (Gold) exclusively

- Timeframe: Any — just attach to chart

- Minimum Deposit: $100 / 0.01 lot

- Recommended Deposit: $1,000+

- Optimal Deposit: $2,000+

- Broker: Low spread ECN — Gold spread within 25 points

- VPS: Recommended for stable 24/5 operation

- Grid/Martingale: None — mandatory stop loss on every trade

- Limited Copies: Sold in limited quantities

- On-Chart Panel: Real-time strategy and position monitoring

Also From Chen Jia Qi

X Fusion AI EA MT5

Chen Jia Qi’s flagship forex system — a neural-adaptive hybrid trading system that adjusts its logic based on whether the market is trending, ranging, or volatile. 76% win rate with 4.37 profit factor over 10 years of backtesting. Users have reported passing prop firm challenges with it, and live signals show consistent results on IC Markets. If you want Gold-specific breakout trading, Gold House is the pick. If you want adaptive forex trading on pairs like GBPUSD, X Fusion AI is the one.

Our Assessment

Evaluation based on 7-year backtest data, live signal performance, verified user reviews, and developer track record:

What We Found:

- Recovery Factor: 45.72 — among the highest we’ve ever seen. Drawdowns are shallow and recovery is fast

- Equity Growth: 0.97 LR correlation — near-perfect linear growth over 7 years, no spikes or extended flat periods

- Drawdown: 4.57% max equity DD over 4,841 trades — extremely controlled for a Gold EA

- Risk-Reward: 53% win rate with 1.91:1 average win/loss ratio — genuine breakout edge, not inflated win rate

- Live Signal: 11% growth in 2 weeks with 2.6% max DD — 4.2:1 growth-to-drawdown ratio tracks backtest consistency

- Adaptive Scaling: SL/TP auto-scale with Gold price — solves the recalibration problem that plagues most Gold EAs

- Risk Model: No grid, no martingale, mandatory SL — clean and prop firm compatible

- User Reception: 7 verified 5-star reviews in the first week — strong early confidence from real buyers

- Developer: Chen Jia Qi — X Fusion AI creator, active community, responsive to user questions

- Origin: Built from internal live account — developer trades the same system they’re selling

- Note: Live signal is only 2 weeks old. While the backtest data is outstanding and early live results match, a longer live track record will add further confidence

- Overall: Gold House delivers some of the most impressive risk-adjusted numbers we’ve seen from a Gold EA. A 45.72 recovery factor and 0.97 LR correlation over 7 years, combined with a clean risk model and accessible $100 minimum, make this a standout product. The developer’s track record with X Fusion AI adds real credibility. We’ll be watching the live signal closely as it matures

Who Should Use This EA?

Gold House is ideal for traders who:

- Want structural Gold trading — breakouts of swing highs and lows, not indicator noise

- Need adaptive risk management — auto-scaling as Gold price changes, no manual recalibration

- Reject grid and martingale — mandatory stop loss on every position

- Want multiple strategies from one EA — five independent strategies with individual toggle control

- Value risk-adjusted performance — 45.72 recovery factor and 4.57% max DD over 4,841 trades

- Have a smaller starting capital — $100 minimum is genuinely accessible

NOT for traders who:

- Need years of proven live trading history before committing

- Expect 80%+ win rates (this system wins 53% but profits through superior reward-to-risk)

- Trade instruments other than XAUUSD

- Use high-spread standard accounts (ECN with sub-25 point Gold spread required)

Risk Disclaimer

Past performance does not guarantee future results. Gold does not always experience intense volatility — consolidation periods of 1–3 months are normal. Please test thoroughly on a demo account before going live. All trading involves risk. Do not trade with funds you cannot afford to lose.

What Do You Receive?

– Gold House EA for MT5 – Latest Version

– Default optimized settings (ready to trade)

– Free lifetime updates

FAQs

Frequently Asked Questions

What is Gold House EA?

Gold House is a Gold swing breakout trading system for MetaTrader 5, developed by Chen Jia Qi. It runs five independent breakout strategies simultaneously — each targeting different structural swing high/low opportunities in XAUUSD. The system features adaptive risk control that auto-scales stop loss, take profit, and trailing stop parameters as Gold’s price changes. No grid, no martingale, mandatory stop loss on every trade.

What are the five strategies?

Gold House runs five independent breakout strategies that can each be toggled on or off. Together they provide around-the-clock structural coverage of Gold opportunities. Each targets different swing breakout patterns with multi-layer directional filtering to ensure trades align with the prevailing trend. The developer provides recommended parameter sets for each strategy via private message after purchase.

How does the adaptive risk control work?

As Gold’s price changes over time (from $2,000 to $2,500 to $3,000+), the EA automatically scales its stop loss, take profit, and trailing stop values in proportion. This means you set your parameters once and the system stays calibrated long-term — no need to manually recalibrate when Gold moves to new price levels. Most EAs use fixed pip values that become outdated as Gold trends higher.

Does it use grid or martingale?

No. Gold House uses mandatory stop loss on every trade with no grid positioning and no martingale lot multiplication. The risk model includes smart trailing stops and partial closes to manage winning trades, and multi-layer directional filtering to avoid counter-trend entries.

What is the minimum deposit?

$100 minimum with 0.01 lot trading. $1,000 recommended. $2,000+ optimal. A low-spread ECN broker with Gold spread within 25 points is required — wider spreads will reduce performance.

What timeframe should I use?

Any timeframe — just attach the EA to a Gold chart. The system handles timeframe analysis internally. Simply open an XAUUSD chart on any timeframe, attach Gold House, and it runs.

Is there a live signal?

Yes. A verified live signal is available at mql5.com/en/signals/2359124. The signal launched February 12, 2026 and is still in its early stages. We’ll update performance information as the track record develops.

Was it developed from a live account?

Yes. The developer states that Gold House was built and validated on their team’s internal live trading account. It was developed on 7 years of historical data, then confirmed through real market performance before being made public. The version available for purchase is the same version running on the developer’s own money.

Who is the developer?

Chen Jia Qi (MQL5 username: walter2008) — a developer with over two years on MQL5 and a portfolio including X Fusion AI, GoldMasterFusion MT5, RangeMaster FX MT5, Gold Garden MT5, TrendMaster FX MT5, and TrendyFollow FX MT5. His flagship product X Fusion AI has earned strong reviews and real user results. He maintains a community channel on MQL5 at mql5.com/en/channels/tendmaster.

How is this different from GoldMasterFusion?

Both are Gold EAs by Chen Jia Qi, but they use fundamentally different approaches. GoldMasterFusion combines quantitative trading models with intelligent analytics on the M5 timeframe. Gold House focuses purely on swing breakout structure with five independent strategies and adaptive risk scaling. They target different aspects of Gold’s price behaviour and could potentially complement each other.

Is it prop firm compatible?

Yes. No grid, no martingale, mandatory stop loss on every trade, and multi-layer directional filtering make it suitable for prop firm challenge and funded accounts. The adaptive risk control and smart trailing stop with partial close produce the kind of steady equity curves that prop firm evaluators look for.

Do I need a VPS?

Recommended but not strictly required. A VPS ensures the EA runs continuously 24/5 without interruption from power outages, internet issues, or computer restarts. Since Gold House uses pending orders placed at structural levels, stable connectivity helps ensure orders are properly managed.

What broker should I use?

A true ECN broker with Gold spread within 25 points. The developer recommends IC Markets and IC Trading. Higher spreads will reduce the effectiveness of the breakout entries and tighten the profit window on each trade.

Are there any reviews yet?

Gold House has a 5-star rating on MQL5 with 2 reviews and 69 purchases in its first month — indicating strong early adoption. As the product matures, more detailed reviews will follow. The developer’s previous products (X Fusion AI, GoldMasterFusion) have extensive review histories that demonstrate his track record.

What does the on-chart panel show?

Gold House includes a built-in monitoring panel displayed directly on the chart. It shows real-time system status including strategy activity, current positions, risk levels, and trade management — giving you a clear overview of what the EA is doing without checking the journal or trade history.

Can I turn individual strategies on or off?

Yes. Each of the five breakout strategies can be independently toggled on or off through the EA settings. This lets you customise the system to your preferences — run all five for maximum coverage, or select specific strategies based on your risk appetite and testing results.

Peter Jones

Us vs MQL5 Marketplace

See why 28,000+ customers choose us

|

CheaperForex

Best Value

|

MQL5 Direct | |

|---|---|---|

| Price | ✓ Save 50-80% | Full price |

| Crypto Discount | ✓ Extra 20% off | ✗ Not available |

| Refund Policy | ✓ Full refund before activation | ✗ Store credit only |

| Payment Options | ✓ Cards, Apple Pay, Crypto | ✓ Cards only |

| Activation Support | ✓ We install for you | ✓ Self-install |

| Ownership | ✓ Lifetime, no expiration | ✓ Lifetime, no expiration |

| Hardware Activations | ⚠ 1 (up to 10 MT5s) | ✓ 5 activations |

| Trustpilot | ✓ Rated "Excellent" | — Seller ratings vary |

Us vs MQL5 Marketplace

Tap to compare →

CheaperForex

MQL5 Direct

How We Deliver Your EA (2 Minutes)

Why Traders Trust Us

Frequently Asked Questions

Is this an official product?

Yes. This is activated directly from the developer's official MQL5 marketplace listing—guaranteed authentic.

Unlike downloadable files (which can be fake or cracked), this EA is installed through MQL5's one-click activation system, ensuring you get the real product with full functionality and instant automatic updates.

When you buy from us, you're getting the exact same lifetime license as buying directly from MQL5—just at a fraction of the price.

Are updates always free and instant?

Yes, product updates for this EA are always free and instant.

They can be downloaded from within the terminal from the marketplace.

Just go to the product listing and click "update" if there's one available.

How do I get this after paying?

Most activations are completed within 15-30 minutes of purchase.

Here's the simple process:

This is an official MQL5 product that must be activated directly from the marketplace—it cannot be downloaded as a standalone file.

Installation process:

1. After purchase, we'll schedule a quick activation session (usually within a few hours)

2. You grant us temporary access via UltraViewer or AnyDesk (takes ~2 minutes), OR provide temporary VPS credentials

3. We activate the EA on your MT5 terminal(s)

4. Done! The EA is permanently yours with instant updates from MQL5

The entire process is secure and takes about 2 minutes.

After activation, no further involvement from us is needed.

How does the 7-day refund policy work?

If you change your mind before we activate the official product in your MT5 terminal, you are eligible for a full refund. Absolutely no questions asked.

Once it has been activated and is working correctly, refunds are no longer available and our regular 7-day refund policy does not apply.

Once we've activated it for you, we can't take it back and it's yours permanently.

How long does activation take?

Usually within a few hours of purchase, but often much faster.

Immediately after purchase, you'll receive an instructional PDF explaining the simple activation process.

Don't worry—it's straightforward, and our refund policy applies anytime before we activate the EA on your terminal.

What if I reinstall MT5 or get a new computer?

Activations are tied to your hardware ID, not your MT5 installation.

Free reactivation if:

• You reinstall MT5 on the same computer

• You accidentally delete MT5

• Windows updates cause issues (this is rare)

• You reinstall Windows (sometimes this doesn't work, but we will always attempt it for you)

Reactivation NOT possible if:

• You get a new computer (different hardware)

• You upgrade major hardware components (motherboard, etc.)

Important: Treat your installation with care. If you're planning to reformat or upgrade hardware, contact us FIRST so we can assist you.

Contact [email protected] with your order number if you need help.

Why should I buy here?

Buying directly on MQL5 means paying full price upfront—often $500-$1,500—without knowing if the EA will work for you. If it doesn't perform or the developer abandons it, there's no refund.

At CheaperForex, you get the exact same official, lifetime-licensed copy for up to 70% less. Test it at a lower risk before committing full price elsewhere.

We've been trusted since 2019, and every EA is yours forever—no renewals, no expiry, no surprises. Smarter investing in trading tools.

Related Products

Official MT5 expert advisors, exclusive to CheaperForex, at the lowest prices.

-

Golden Hen EA MT5

Rated 0 out of 5$799.00Original price was: $799.00.$399.95Current price is: $399.95. -

Quantum Queen MT5 EA

Rated 0 out of 5$1,549.99Original price was: $1,549.99.$699.95Current price is: $699.95. -

Quantum Emperor EA MT5

Rated 0 out of 5$799.00Original price was: $799.00.$399.95Current price is: $399.95. -

Mad Turtle EA MT5

Rated 0 out of 5$1,700.00Original price was: $1,700.00.$629.95Current price is: $629.95.