- Official Product

- Instant Download

- 7-Day Money-Back Guarantee*

- Instant Download

- 7-Day Refund Policy*

Sale!

What's Included

Our Customer Reviews

Excellent product quality.

The latest updated versions of EAs are sent as soon as they are available.

I can highly recommend this site

Have gotten a lot from them in the past and never been disappointed.

After reaching out, I was refunded right away. 5/5 stars in my book.

I received immediate attention to a credit card payment error and they organised a refund within minutes ( late on a Sunday evening ) plus a great saving on a quality Forex EA.

But you need to do your homework on any product before buying.

They give a lot of commitment from themselves. I highly recommend it to everyone!

I recommend it 100%

The products work as advertised and the customer support is topnotch.

Great support. Recommended, 5 STARS.

You can trust them completely.

All issues have been resolved. , If the problem cannot be resolved, a refund will be given.

Prima che intervenissi, si erano accorti dell'anomalia. Per me, piena fiducia all'operatore.

Best in the industry. Thank you for what you do

They also have an outstanding customer care services .

It makes a change from most of the scam forex websites!

GridSync Pro EA MT4

GridSync Pro EA for MT4 is a non-martingale grid trading system developed by Thushara Dissanayake.

It maintains continuous pending order grids in both directions with intelligent risk controls — daily profit/loss limits, 50% retracement recovery, trailing stops, and session filters to protect capital during volatile conditions.

- ✅ Non-martingale — fixed lot sizes, no exponential blowup risk

- ✅ 50% retracement recovery — closes losers at profit without full reversal

- ✅ Daily profit targets & loss limits auto-stop trading

- ✅ Professional dashboard with one-click manual overrides

- ✅ Session filters avoid high-impact news volatility

Grid trading with actual risk management.

Instant Download

The lowest legitimate price — anywhere.

7-day full refund in the rare event of problems.

$1,249.00 Original price was: $1,249.00.$299.95Current price is: $299.95.

If your EA isn't profitable after 30 days of proper use, we'll exchange it for another product of equal or lesser value. No questions asked.

Applies to products $150+. Requires proof of proper installation and use per documentation. One exchange per customer.

What's Included

Quick Summary:

GridSync Pro EA for MT4 is a non-martingale grid trading system developed by Thushara Dissanayake.

Unlike traditional grid EAs that multiply lot sizes until accounts blow, GridSync Pro maintains fixed position sizing while building continuous pending order grids that capture price movements in both directions. The system’s 50% retracement recovery feature closes underwater positions at profit when price reverses just halfway — eliminating the need for full retracement that destroys most grid traders.

Built-in daily profit targets automatically stop trading once goals are hit, while loss limits protect against runaway drawdowns. Session filters let you avoid high-volatility news periods. The professional on-chart dashboard provides real-time P/L tracking with one-click manual overrides when you need to intervene.

Official MQL5 Listing:

GridSync Pro EA MT4

Developer Profile:

Thushara Dissanayake

What GridSync Pro Is Designed To Do

The EA automates risk-controlled grid trading without martingale:

- Grid Construction — Builds continuous pending orders (stop or limit) in both directions

- Gap Filling — Systematically captures price movements in ranging and trending markets

- 50% Recovery — Closes losing positions at profit when price reverses just halfway

- Daily Controls — Stops trading when profit targets or loss limits are hit

- Session Filters — Avoids high-impact news periods and overnight gaps

The philosophy: capture grid profits while eliminating the two biggest grid killers — martingale blowups and overtrading.

How the Strategy Works

The EA follows a structured approach to grid trading:

Step 1: Build the Grid Network

The EA places pending orders at fixed intervals above and below current price:

- Initial Distance: First orders placed 4 pips from entry (adjustable)

- Grid Step: Subsequent orders spaced 3 pips apart (adjustable)

- Grid Density: 2+ orders per side (adjustable)

- Order Types: Stop orders, limit orders, or hybrid approach

Step 2: Capture Price Movements

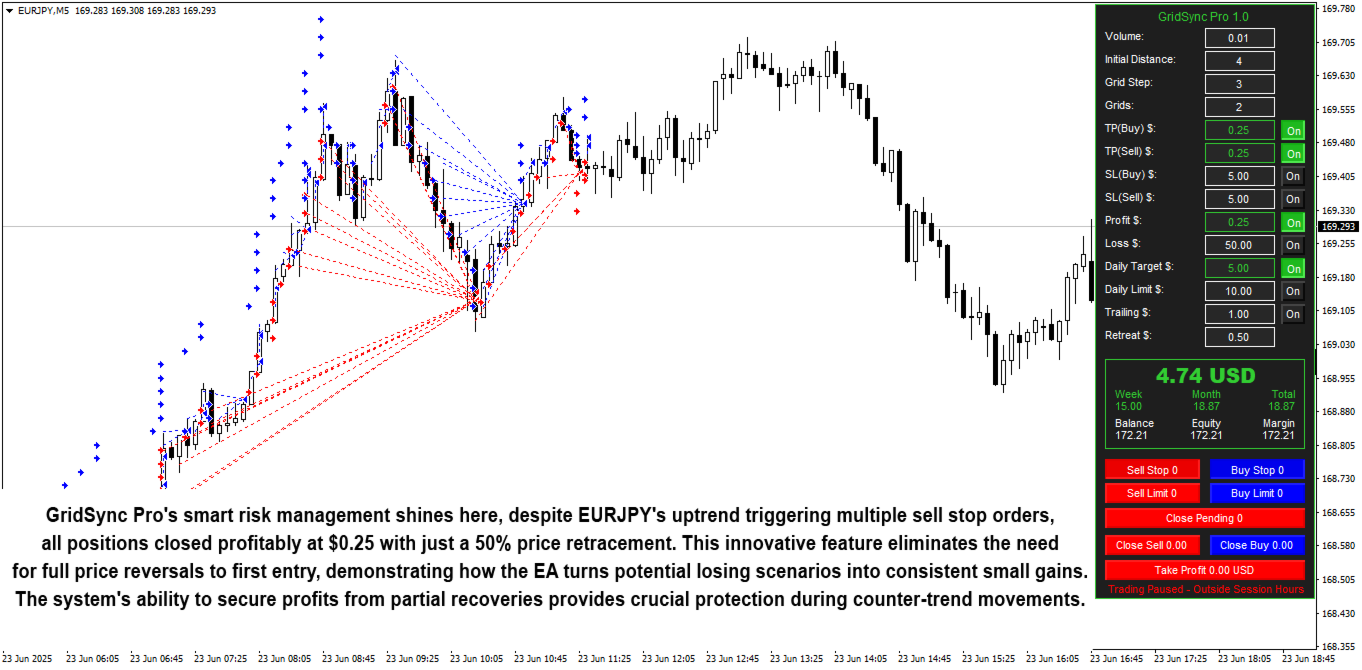

As price moves through the grid, orders trigger and close at take profit. The system profits from both ranging markets (price oscillating through grid) and trending markets (partial recovery on retracements).

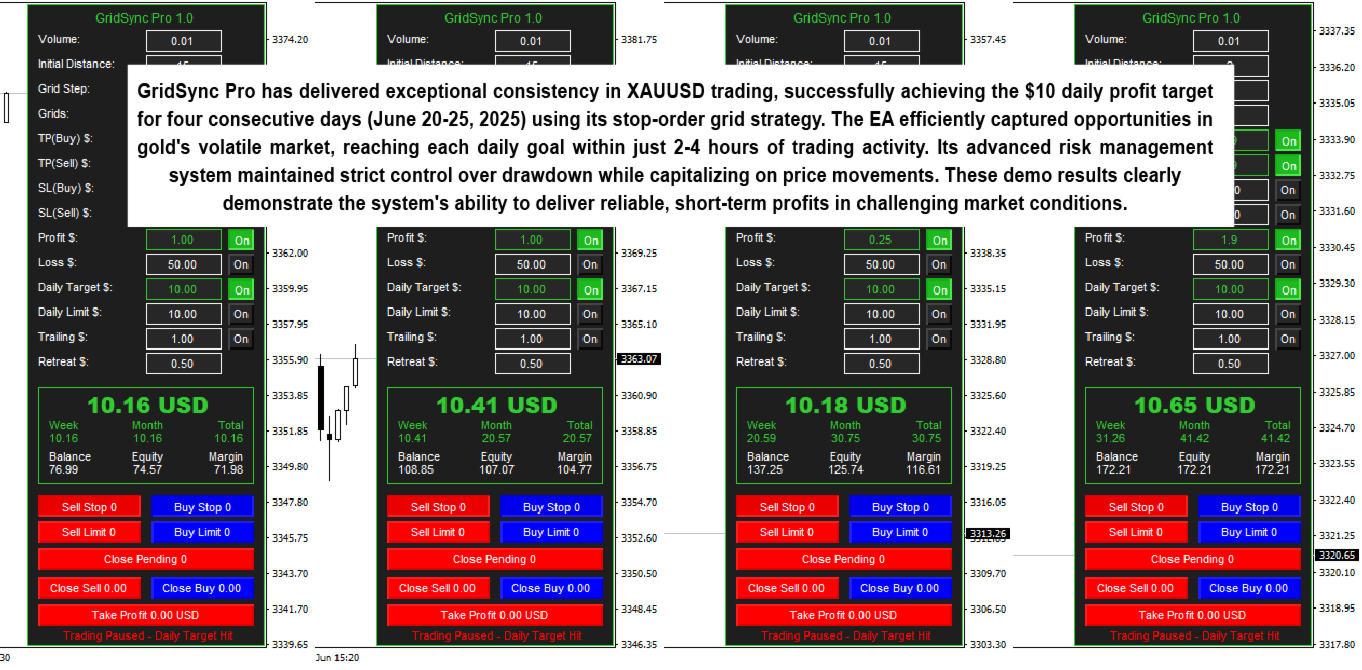

Step 3: 50% Retracement Recovery

When positions move against you, traditional grids require full price reversal to close at profit. GridSync Pro’s recovery logic closes underwater positions when price reverses just 50% of the move — locking in small gains without waiting for full retracement that may never come.

Step 4: Daily Risk Controls

- Daily Profit Target: Trading stops when daily goal is hit (e.g., $5, $10, $15)

- Daily Loss Limit: Trading stops before drawdown exceeds threshold

- Session Filters: Avoid volatile periods by restricting trading hours

- Trailing Stops: Lock in gains during strong moves

The 50% Retracement Recovery Feature

This is GridSync Pro’s key differentiator from standard grid EAs.

Traditional grid systems require price to fully retrace to your original entry before closing losing positions at profit. If you enter a sell at 1.3000 and price runs to 1.3100, you need price to return all the way to 1.3000 (or below) to exit profitably. During strong trends, this full retracement never comes — and accounts blow.

GridSync Pro’s recovery logic works differently. Using the same example: if price runs 100 pips against you to 1.3100 and then reverses just 50 pips back to 1.3050, the system recognizes this partial recovery and closes the position at a small profit. You capture the reversal without needing full retracement.

This feature turns potential losing scenarios into consistent small gains — the foundation of sustainable grid trading.

Key Features

Non-Martingale Architecture

Fixed lot sizes throughout the grid cycle. No exponential position increases. No doubling down until account destruction. The approach traditional grid traders wish they had from the start.

Flexible Grid Configuration

- FirstOrderDistance: 4 pips default (adjustable)

- GridStepSize: 3 pips default (adjustable)

- GridOrdersPerSide: 2 orders default (adjustable)

- Order Types: Stop orders, limit orders, or hybrid

Advanced Risk Controls

- TakeProfit: $0.25 per trade default (adjustable)

- StopLoss: $5 per trade default (adjustable)

- DailyProfitTarget: $5 default — stops trading when hit

- DailyLossLimit: $10 default — protects against runaway drawdown

Smart Trade Management

- Trailing Stops: TrailStart $1, TrailRetreat $0.50 (optional)

- Equity Auto-Shutdown: Stops if equity drops below threshold

- Session Filters: Restrict trading to specific hours

- Magic Number Tracking: Run multiple instances on different pairs

Professional Dashboard

Real-time on-chart panel showing:

- Current balance, equity, margin

- Daily, weekly, monthly P/L tracking

- Active grid status and pending orders

- One-click manual override buttons

Best Instruments for GridSync Pro

The EA performs optimally on instruments with consistent volatility and tight spreads:

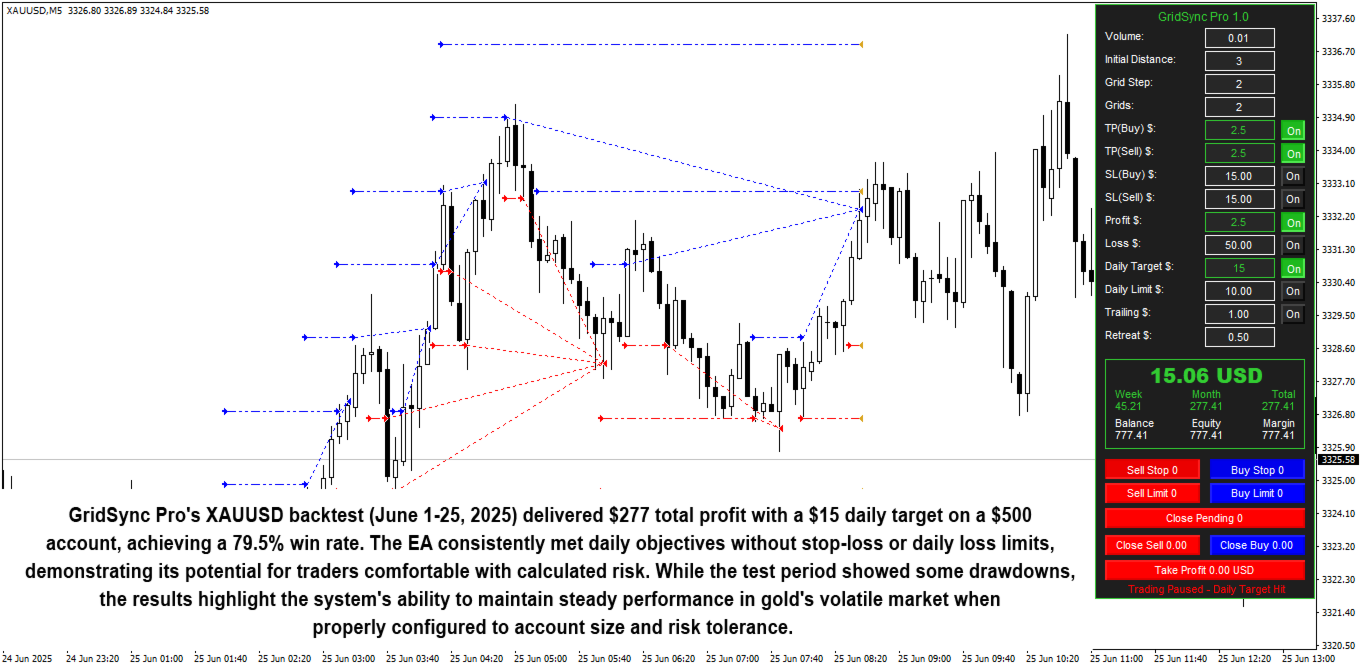

Gold (XAUUSD)

GridSync Pro’s primary testing ground. Gold’s intraday volatility creates frequent grid triggers, while the 50% recovery feature handles the inevitable retracements. The backtest below shows $277 profit on a $500 account over 25 days with 79.5% win rate.

Forex Majors

- EURUSD — Tight spreads, predictable ranging behavior

- GBPUSD — Higher volatility, larger grid captures

- USDJPY — Clean price action for grid systems

Bitcoin (BTCUSD)

For brokers offering crypto CFDs, BTCUSD’s volatility suits grid strategies when properly configured with wider step sizes.

Who Should Use This EA?

This tool is ideal for:

- Grid trading enthusiasts — Who want the strategy without martingale risk

- Gold scalpers — Capitalizing on XAUUSD intraday volatility

- Multi-pair traders — Running parallel grids across Forex and commodities

- Risk-conscious automated traders — Utilizing daily profit caps and loss limits

- Part-time traders — Who want hands-off execution with built-in controls

Technical Requirements

- Platform: MetaTrader 4

- Instruments: XAUUSD, BTCUSD, EURUSD, GBPUSD, USDJPY (recommended)

- Timeframe: Works across all timeframes

- Account Type: ECN preferred for tight spreads

- Minimum Deposit: $100+ recommended for 0.01 lot sizing

- VPS: Recommended for continuous grid monitoring

Quick Setup Guide

- Install the EA file into your MT4

Expertsfolder. - Restart MT4 and enable AutoTrading.

- Attach the EA to your chosen chart (XAUUSD, EURUSD, etc.).

- Configure grid parameters — step size, order density, order type.

- Set risk controls — TP, SL, daily profit target, daily loss limit.

- Enable session filters if avoiding specific trading hours.

- Enable trailing stops if desired (optional).

- Start with conservative settings — 0.01 lots, $0.25 TP.

- Test on demo for 2-3 weeks before live trading.

User Reviews

★★★★★ “Finally a grid EA that doesn’t blow accounts.”

I’ve lost money on three different grid EAs before — all martingale-based. GridSync Pro’s fixed lot sizing and daily loss limits saved me. The 50% recovery feature is genius. Running it on XAUUSD with conservative settings and seeing steady daily targets hit.

— Robert M., Chicago

★★★★★ “The daily profit target is everything.”

What I love is the EA stops trading when it hits the daily target. No overtrading, no giving back profits. I set $10/day on gold, it usually hits within a few hours, then I’m done. Consistent income without watching charts all day.

— Sandra K., Toronto

★★★★☆ “Great for ranging markets, needs patience in trends.”

Works beautifully when price oscillates. During strong trends, the 50% recovery feature does its job but you need patience. Not a get-rich-quick EA — it grinds out consistent small gains. Exactly what I wanted after blowing accounts on aggressive systems.

— Michael T., Sydney

★★★★★ “Dashboard makes all the difference.”

The on-chart panel showing real-time P/L and manual override buttons is professional-grade. I can see exactly what’s happening and intervene if needed. Most grid EAs are black boxes — this one is transparent.

— Elena V., London

★★★★★ “Session filters saved me during NFP.”

I forgot to disable trading before Non-Farm Payrolls once. The session filter I’d configured stopped trading automatically before the news. Avoided what would have been a disaster. Small feature, huge value.

— David L., Singapore

Our Assessment

Transparent evaluation based on feature review:

What We Found:

- Strategy: Non-martingale grid with fixed lot sizing and continuous pending orders

- Key Innovation: 50% retracement recovery — closes losers at profit without full reversal

- Risk Management: Daily profit targets, loss limits, trailing stops, equity shutdown

- Session Control: Time filters avoid high-volatility news periods

- Dashboard: Professional on-chart panel with real-time P/L and manual overrides

- Best Instruments: XAUUSD, EURUSD, GBPUSD — tight spreads, consistent volatility

- Best Suited For: Traders wanting grid profits without martingale blowup risk

- Approach: Conservative settings recommended — 0.01 lots, small daily targets

- Watch Out For: Strong one-way trends require patience; recovery feature handles but takes time

- Overall: The most sensible grid EA we’ve seen — actual risk controls instead of pray-and-hope

Understanding Grid Trading Risks

Grid trading is not risk-free. Understanding the mechanics helps set realistic expectations:

Why Most Grid EAs Fail

Traditional grid EAs use martingale — doubling lot sizes on losing positions. In ranging markets, this works beautifully. In strong trends, lot sizes compound exponentially until margin calls. GridSync Pro eliminates this by maintaining fixed position sizes.

The Trend Risk

Extended one-way moves challenge all grid systems. GridSync Pro’s 50% recovery feature mitigates this by closing losers at profit during partial retracements, but strong trends still require patience. The daily loss limit prevents catastrophic drawdowns.

The Spread Factor

Grid profitability depends heavily on spreads. Each grid cycle must overcome entry/exit spread costs. ECN brokers with tight spreads significantly improve results.

Capital Requirements

Grid trading requires sufficient capital to hold multiple positions. Conservative lot sizing (0.01) on a $500+ account provides breathing room for the strategy to work.

Conclusion

GridSync Pro EA for MT4 brings professional risk management to grid trading.

For traders who appreciate grid mechanics but have been burned by martingale blowups, GridSync Pro offers a sensible alternative. Fixed lot sizes eliminate exponential position growth. Daily profit targets stop overtrading. Daily loss limits prevent catastrophic drawdowns. And the 50% retracement recovery feature solves the classic grid problem of waiting for full reversals that never come.

The results from the images speak to the approach: consistent daily targets hit within hours, disciplined session control, and transparent dashboard monitoring. This isn’t promising 1000% monthly returns — it’s grinding out sustainable daily profits with actual risk controls.

Grid trading isn’t for everyone. But for those who understand and accept the strategy, GridSync Pro implements it more responsibly than any grid EA we’ve reviewed.

What Do You Receive?

– GridSync Pro EA for MT4 – Latest Version

– Free lifetime updates

– Fully unlocked for unlimited brokers and accounts

– Delivered by email and allocated to your user account dashboard

FAQs

What is grid trading?

A strategy that places pending orders at fixed intervals above and below current price. As price moves through the grid, orders trigger and close at take profit. The system profits from price oscillation without predicting direction.

What makes GridSync Pro different from other grid EAs?

Non-martingale architecture (fixed lot sizes, no exponential blowup), 50% retracement recovery (closes losers at profit without full reversal), and daily profit/loss controls that stop trading automatically.

What is the 50% retracement recovery feature?

Traditional grids require full price reversal to close losing positions profitably. GridSync Pro closes underwater positions when price reverses just 50% of the move — capturing partial recoveries instead of waiting for full retracements that may never come.

Does it use martingale?

No. Lot sizes remain fixed throughout the grid cycle. No doubling, no exponential position increases, no account-destroying multiplication.

What are the daily profit targets and loss limits?

Configurable thresholds that automatically stop trading. Default: $5 daily profit target, $10 daily loss limit. When either is hit, the EA stops opening new positions for the day.

What pairs work best?

XAUUSD (Gold) — primary testing instrument with excellent results. EURUSD, GBPUSD, USDJPY — Forex majors with tight spreads. BTCUSD — for brokers offering crypto with wider grid steps.

What order types are available?

Stop orders (triggered when price reaches level), limit orders (triggered at better prices), or hybrid approaches. Choose based on your trading style and market conditions.

Can I adjust the grid spacing?

Yes. FirstOrderDistance (default 4 pips), GridStepSize (default 3 pips), and GridOrdersPerSide (default 2) are all configurable.

What are the session filters?

Time-based controls that restrict trading to specific hours. Use them to avoid high-volatility news periods, overnight gaps, or sessions that don’t suit your pairs.

What’s the recommended starting capital?

$500+ for 0.01 lot sizing. Grid trading requires capital to hold multiple positions. Conservative lot sizing provides breathing room for the strategy.

Does the EA include trailing stops?

Yes. Optional trailing stops with configurable TrailStart ($1 default) and TrailRetreat ($0.50 default) to lock in gains during strong moves.

What does the dashboard show?

Real-time balance, equity, margin, daily/weekly/monthly P/L, active grid status, pending orders, and one-click manual override buttons for closing positions.

Is a VPS required?

Recommended for continuous grid monitoring. Missing price movements due to disconnection means missing grid triggers.

What’s the recommended testing period?

2-3 weeks on demo before live trading. Test different grid configurations, daily targets, and instruments to find optimal settings for your broker.

Reviewed by Our Trader

Peter Jones

Pre-Purchase FAQs

Are updates always free?

Yes, all updates are completely free—you'll never pay twice.

We receive updates from developers and upload them to your account when they're available. Please be patient, as we're managing hundreds of products at discounted prices. More popular products are updated more frequently.

All versions are stored in your account for easy access.

What's your refund policy?

We offer a 7-day technical guarantee. If the EA fails to attach to your chart due to verified errors we can replicate, we'll issue a full refund.

However, we cannot refund based on trading performance or profit expectations—forex markets are unpredictable, and results vary by broker, spread, and market conditions. We provide tools, not guarantees.

I need assistance installing this?

Yes, we'd be happy to assist you!

We can advise you on the best settings for your account or create custom presets tailored to your needs. Additionally, we offer a one-time free installation service using AnyDesk for remote setup.

Please note, however, that we cannot provide advice on how to make money with any of our products.

Can I use this on multiple accounts?

Absolutely. Once you purchase, the EA is yours to use on unlimited live and demo accounts—no restrictions.

You can run it on multiple brokers, VPS servers, or trading accounts simultaneously.

There are no license limits or activation keys. Buy once, use everywhere.

How do I download after payment?

After successful payment, your product will be available for download instantly:

- Displayed on the screen immediately after checkout

- Emailed to the address you provided during purchase

- Stored in your account if you created one at checkout

In rare cases (about 1% of high-value premium products), orders may be held for manual review to prevent fraud. If you don't see a download link, contact us for assistance.

Is this an original product?

Yes, absolutely.

We do not sell fake products, and our customer reviews, along with our pricing, reflect the quality and authenticity of what we offer.

Why Traders Trust Us

Related Products

Powerful expert advisors, exclusive to CheaperForex, at the lowest prices.

-

NASDAQ Magnet X Turbo EA MT4

Rated 0 out of 5$699.00Original price was: $699.00.$169.95Current price is: $169.95. -

Lutos V3 Multicurrency EA MT4

Rated 0 out of 5$1,000.00Original price was: $1,000.00.$179.95Current price is: $179.95. -

Magnat EA MT4 V1.5 – Official & Latest Version

Rated 0 out of 5$9,000.00Original price was: $9,000.00.$199.95Current price is: $199.95. -

BitBull EA MT4 V2.20 – 68% Gain, 4% Drawdown

Rated 0 out of 5$590.00Original price was: $590.00.$149.95Current price is: $149.95.