- Official Product

- Instant Download

- 7-Day Money-Back Guarantee*

- Instant Download

- 7-Day Refund Policy*

Sale!

What's Included

Our Customer Reviews

Excellent product quality.

The latest updated versions of EAs are sent as soon as they are available.

I can highly recommend this site

Have gotten a lot from them in the past and never been disappointed.

After reaching out, I was refunded right away. 5/5 stars in my book.

I received immediate attention to a credit card payment error and they organised a refund within minutes ( late on a Sunday evening ) plus a great saving on a quality Forex EA.

But you need to do your homework on any product before buying.

They give a lot of commitment from themselves. I highly recommend it to everyone!

I recommend it 100%

The products work as advertised and the customer support is topnotch.

Great support. Recommended, 5 STARS.

You can trust them completely.

All issues have been resolved. , If the problem cannot be resolved, a refund will be given.

Prima che intervenissi, si erano accorti dell'anomalia. Per me, piena fiducia all'operatore.

Best in the industry. Thank you for what you do

They also have an outstanding customer care services .

It makes a change from most of the scam forex websites!

Quantum Matrix AI EA MT4

It uses matrix-layered grid groups with mirror-balancing logic across forex, gold, indices, and cryptocurrencies — featuring daily profit targets, Fibonacci-based spacing, and intelligent basket management.

- ✅ Multi-pair compatible — forex, gold, indices, crypto

- ✅ Matrix group engine with individual TP logic per group

- ✅ Mirror-balancing for buy/sell exposure management

- ✅ Daily profit targets with automatic reset

- ✅ Professional on-chart control panel

Structured grid trading with daily compounding targets.

Instant Download

The lowest legitimate price — anywhere.

7-day full refund in the rare event of problems.

$799.00 Original price was: $799.00.$249.95Current price is: $249.95.

If your EA isn't profitable after 30 days of proper use, we'll exchange it for another product of equal or lesser value. No questions asked.

Applies to products $150+. Requires proof of proper installation and use per documentation. One exchange per customer.

What's Included

Quick Summary:

Quantum Matrix AI EA for MT4 is a multi-pair adaptive grid system developed by Hassane Zibara.

Unlike single-instrument EAs, Quantum Matrix AI is designed to operate across forex pairs, gold, indices, and cryptocurrencies using a matrix-layered grid approach with Fibonacci-based spacing, mirror-balancing logic, and daily profit targets.

The system uses Matrix Groups — controlled grid sequences where each group has its own take-profit logic and restarts automatically after closing. A mirror-balancing engine manages buy/sell exposure to maintain more stable equity curves. The on-chart panel provides full control with real-time monitoring of baskets, targets, and daily progress.

The developer’s philosophy centers on daily compounding: targeting consistent small gains that compound over time rather than chasing large individual trades.

Official MQL5 Listing:

Quantum Matrix AI EA MT4

Developer Profile:

Hassane Zibara

What Quantum Matrix AI Is Designed To Do

Quantum Matrix AI operates on a structured grid philosophy with daily profit targets:

- Multi-Pair Operation — Works on forex, gold, indices, and cryptocurrencies

- Matrix Group Engine — Opens smart grid groups with individual TP logic

- Mirror-Balancing — Manages buy/sell exposure for equity curve stability

- Daily Targets — Aims for consistent daily gains that compound over time

- Adaptive Spacing — Fibonacci-based grid spacing adjusts to market conditions

The core idea: structured, repeatable daily gains that compound into long-term growth.

Key Features

Matrix-Layered Grid System

The EA uses “Matrix Groups” — controlled grid sequences rather than unlimited position accumulation:

- You control how many grid groups can activate (e.g., 3 groups)

- Each group has its own take-profit logic

- Groups restart automatically after closing

- Fibonacci-based step spacing (FIB 400/47 default)

Mirror-Balancing Engine

Instead of pure directional trading, the system balances buy/sell exposure:

- Manages both buy and sell baskets simultaneously

- Aims for more stable equity curves

- Reduces exposure to single-direction moves

Daily Profit Target System

The EA operates on a daily compounding philosophy:

- Sets daily profit targets based on account balance

- Tracks progress in real-time on the panel

- “Target crushed. Matrix locked. Repeat tomorrow” — resets daily

- Designed for consistent small gains over time

Professional On-Chart Control Panel

Full trading control directly on chart:

Panel features:

- Account Section — Balance, equity, free margin

- Matrix Section — Levels, step/spread, TP/SL settings

- Buy/Sell Baskets — Orders, lots, average price, TP/SL for each direction

- Daily Progress — Base balance, live P/L, target, percentage, closed profit

- Control Buttons — BUY:ON/OFF, SELL:ON/OFF, Close BUY, Close SELL, Pause, CloseAll, Reset

Multi-Market Compatibility

Works across multiple asset classes:

- Major and minor forex pairs

- Gold (XAUUSD) and silver

- Indices (US30, NAS100, etc.)

- Cryptocurrencies (BTCUSD, etc.)

- Energies

Six Internal Strategies

Multiple strategy modules work together:

- When one strategy is inactive, others may be active

- Adaptive to different market conditions

- Coordinated through the matrix engine

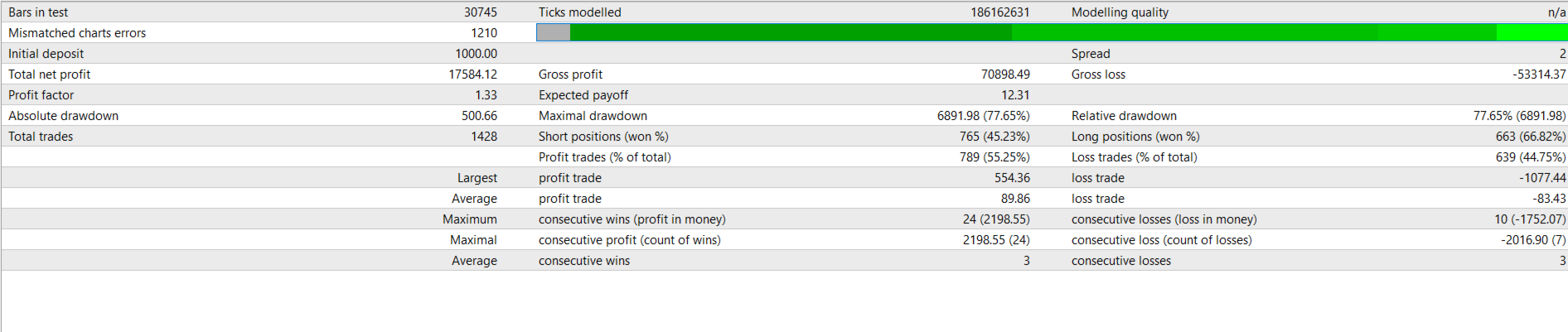

Backtest Performance

XAUUSD H1 backtest results:

- Initial deposit: $1,000

- Total net profit: $17,584.12

- Profit factor: 1.33

- Win rate: 55.25%

- Total trades: 1,428

- Longs won: 66.82%

- Shorts won: 45.23%

- Average profit trade: $89.86

- Max consecutive wins: 24

- Average consecutive wins: 3

Important Risk Note:

The backtest shows significant drawdown periods (visible in the equity curve dips). Grid-based systems can experience substantial drawdowns during extended directional moves. This is inherent to the strategy type. Appropriate capital and conservative settings are essential.

The Daily Compounding Philosophy

The developer targets approximately 2% daily growth under optimal conditions. The mathematical illustration:

- Starting balance: $1,000

- Daily target: 2%

- Compounded over 355 trading days → $1,000,000+

Important: This is a mathematical illustration of compounding power, not a guarantee. Actual results depend on market conditions, settings, and risk management. The 2% daily target is an aim, not a promise.

Technical Requirements

- Platform: MetaTrader 4

- Instruments: Forex, Gold, Indices, Crypto

- Timeframe: M1–H4 (fully adaptive)

- Minimum deposit: $1,000

- Recommended leverage: 1:500

- Account type: ECN/Raw/Low-spread, Hedging enabled

- VPS: Required for 24/5 operation

- Recommended brokers: IC Markets, Pepperstone, RoboForex, Exness, Eightcap

Quick Setup Guide

- Install the EA file into your MT4

Expertsfolder. - Restart MT4 and enable AutoTrading.

- Attach Quantum Matrix AI to your chosen chart (any timeframe).

- Configure your preferred risk level and matrix group settings.

- Set daily profit target appropriate for your account.

- Use the on-chart panel to enable/disable BUY and SELL directions.

- Run on a VPS for 24/5 uninterrupted operation.

- Monitor daily progress through the panel’s tracking display.

User Reviews

★★★★★ “The matrix group concept is smart.”

Instead of unlimited grid positions, you control how many groups can open. Each group closes at its own TP and restarts. Much more controlled than typical grid systems. The daily target tracking keeps everything focused.

— Marcus T., Frankfurt

★★★★☆ “Works well, but respect the drawdown.”

Made consistent daily gains for weeks. Then gold moved 400 pips against me and drawdown hit hard. Recovered eventually, but learned to use conservative settings. The system works — just size appropriately.

— Chen W., Singapore

★★★★★ “Multi-pair capability is excellent.”

Running it on gold, EURUSD, and US30 simultaneously. The mirror-balancing helps smooth the equity curve. Different pairs hit their targets at different times, which creates more consistent daily results overall.

— Sarah K., London

★★★★★ “The control panel is professional.”

Everything you need right on the chart. Can pause trading, close specific directions, see daily progress. The “Target crushed” message when the day’s goal is hit is satisfying. Real control over the automation.

— Paolo R., Milan

★★★★☆ “Good concept, requires adequate capital.”

Started with minimum deposit and settings were too aggressive for my risk tolerance. Increased capital and reduced grid levels — now running smoothly. This isn’t a small-account EA.

— James H., Toronto

Our Assessment

Transparent evaluation based on backtest analysis and feature review:

What We Found:

- Strategy Type: Adaptive grid with matrix groups — more controlled than unlimited grids

- Multi-Pair: Genuine multi-market compatibility across forex, metals, indices, crypto

- Mirror-Balancing: Buy/sell exposure management for equity curve smoothing

- Daily Targets: Compounding philosophy with daily profit goals and tracking

- Control Panel: Professional interface with full trading control on-chart

- Drawdown Risk: Grid systems can experience significant drawdowns during extended moves — appropriate capital essential

- Capital Requirement: $1,000 minimum, but more recommended for conservative grid operation

- Best Suited For: Traders who understand grid mechanics and have adequate capital buffer

- Watch Out For: Don’t underestimate drawdown potential — size conservatively

- Overall: Well-structured grid system with intelligent controls, but requires respect for inherent grid risks

Conclusion

Quantum Matrix AI EA for MT4 brings structure and control to grid-based trading through its matrix group system, mirror-balancing, and daily profit targets.

The matrix group approach is the key differentiator — instead of unlimited position accumulation, you control how many grid groups can activate, each with its own TP logic. The mirror-balancing engine manages buy/sell exposure for more stable equity curves. And the daily target system provides clear goals with compounding potential.

The multi-pair capability means you can run it across forex, gold, indices, and crypto from a single installation. The professional on-chart panel gives you full control: pause trading, close specific directions, track daily progress, and monitor basket status in real-time.

Grid trading carries inherent drawdown risk during extended directional moves. This is true of all grid systems, and Quantum Matrix AI is no exception. Use appropriate capital, conservative settings, and understand that drawdowns are part of the strategy. For traders who accept these dynamics and want structured grid trading with intelligent controls, Quantum Matrix AI delivers a professional solution.

What Do You Receive?

– Quantum Matrix AI EA for MT4 – Latest Version

– Free lifetime updates

– Fully unlocked for unlimited brokers and accounts

– Delivered by email and allocated to your user account dashboard

FAQs

What is the matrix group system?

Instead of unlimited grid positions, the EA uses “Matrix Groups” — controlled grid sequences where you set the maximum number of groups. Each group has its own take-profit logic and restarts automatically after closing.

What pairs does it work on?

Forex pairs, gold, indices, and cryptocurrencies. The EA is designed for multi-market operation with the same logic adapting to different instruments.

What is mirror-balancing?

The system manages both buy and sell baskets, balancing exposure between directions to maintain more stable equity curves rather than being exposed to single-direction moves.

Is this a martingale system?

The developer states it uses “risk-managed compounding” rather than martingale gambling. Lot sizing evolves based on account growth with controlled grid groups. However, like all grid systems, drawdowns can occur during extended directional moves.

What’s the 2% daily target?

The EA aims for approximately 2% daily growth under optimal conditions. This is a target, not a guarantee. The developer uses this to illustrate compounding potential — actual results vary by market conditions.

What’s the minimum deposit?

$1,000 minimum. However, more capital is recommended for conservative settings and to handle grid drawdowns safely.

What leverage is recommended?

1:500 recommended. Higher leverage provides more margin for grid positions during drawdown periods.

What timeframe should I use?

The EA is fully adaptive from M1 to H4. Attach to any timeframe — the internal logic adjusts accordingly.

What does the on-chart panel show?

Account info (balance, equity, free margin), matrix settings (levels, step/spread, TP/SL), buy/sell basket status, daily progress tracking (base, live P/L, target, percentage), and control buttons for trading management.

Can I control buy and sell separately?

Yes. The panel includes BUY:ON/OFF and SELL:ON/OFF buttons, plus Close BUY and Close SELL options to manage each direction independently.

Is a VPS required?

Required for 24/5 operation. Grid systems need continuous monitoring to manage positions and hit daily targets.

What brokers work best?

ECN/Raw/Low-spread brokers with hedging enabled: IC Markets, Pepperstone, RoboForex, Exness (Raw), Eightcap ECN, or similar.

Reviewed by Our Trader

Peter Jones

Pre-Purchase FAQs

Are updates always free?

Yes, all updates are completely free—you'll never pay twice.

We receive updates from developers and upload them to your account when they're available. Please be patient, as we're managing hundreds of products at discounted prices. More popular products are updated more frequently.

All versions are stored in your account for easy access.

What's your refund policy?

We offer a 7-day technical guarantee. If the EA fails to attach to your chart due to verified errors we can replicate, we'll issue a full refund.

However, we cannot refund based on trading performance or profit expectations—forex markets are unpredictable, and results vary by broker, spread, and market conditions. We provide tools, not guarantees.

I need assistance installing this?

Yes, we'd be happy to assist you!

We can advise you on the best settings for your account or create custom presets tailored to your needs. Additionally, we offer a one-time free installation service using AnyDesk for remote setup.

Please note, however, that we cannot provide advice on how to make money with any of our products.

Can I use this on multiple accounts?

Absolutely. Once you purchase, the EA is yours to use on unlimited live and demo accounts—no restrictions.

You can run it on multiple brokers, VPS servers, or trading accounts simultaneously.

There are no license limits or activation keys. Buy once, use everywhere.

How do I download after payment?

After successful payment, your product will be available for download instantly:

- Displayed on the screen immediately after checkout

- Emailed to the address you provided during purchase

- Stored in your account if you created one at checkout

In rare cases (about 1% of high-value premium products), orders may be held for manual review to prevent fraud. If you don't see a download link, contact us for assistance.

Is this an original product?

Yes, absolutely.

We do not sell fake products, and our customer reviews, along with our pricing, reflect the quality and authenticity of what we offer.

Why Traders Trust Us

Related Products

Powerful expert advisors, exclusive to CheaperForex, at the lowest prices.

-

EvoTrade EA MT4 Version 1.5

Rated 0 out of 5$799.00Original price was: $799.00.$169.95Current price is: $169.95. -

US30 Magnet X Turbo EA MT4

Rated 0 out of 5$699.00Original price was: $699.00.$149.95Current price is: $149.95. -

Boring Pips EA MT4 Version 4.4

Rated 0 out of 5$399.00Original price was: $399.00.$149.95Current price is: $149.95. -

JorgeAi Oceania PreciseStrategy EA MT4 – 500% Growth

Rated 0 out of 5$2,000.00Original price was: $2,000.00.$249.95Current price is: $249.95.